Australia’s Unemployment Rate increases to 3.8% in March vs. 3.9 % expected

Australia’s Unemployment Rate rose to 3.8% in March, compared with the expectations of 3.9% and the previous figure of 3.7%, according to the official data released by the Australian Bureau of Statistics (ABS) on Thursday.

Furthermore, the Australian Employment Change arrived at -6.6K in March from 116.5K in February, compared with the consensus forecast of 7.2K.

The participation rate in Australia decreased to 66.6% in March, compared to 66.7% in February. Meanwhile, Full-Time Employment increased by 27.9K to 9,853,800 people in the same period from 79.4K in the previous reading. The Part-Time Employment decreased by 6.6K to 4,406,100 people in March versus 117.6K prior, below the market consensus of a rise of 7.2K.

Bjorn Jarvis, ABS head of labour statistics, said with the key highlights noted below.

“With employment falling by around 7,000 people and the number of unemployed rising by 21,000 people, the unemployment rate rose to 3.8 per cent.”

“The labour market remained relatively tight in March, with an employment-to-population ratio and participation rate still close to their record highs in November 2023. While they have both fallen by 0.4 percentage points since then, they continue to be much higher than their pre-pandemic levels.”

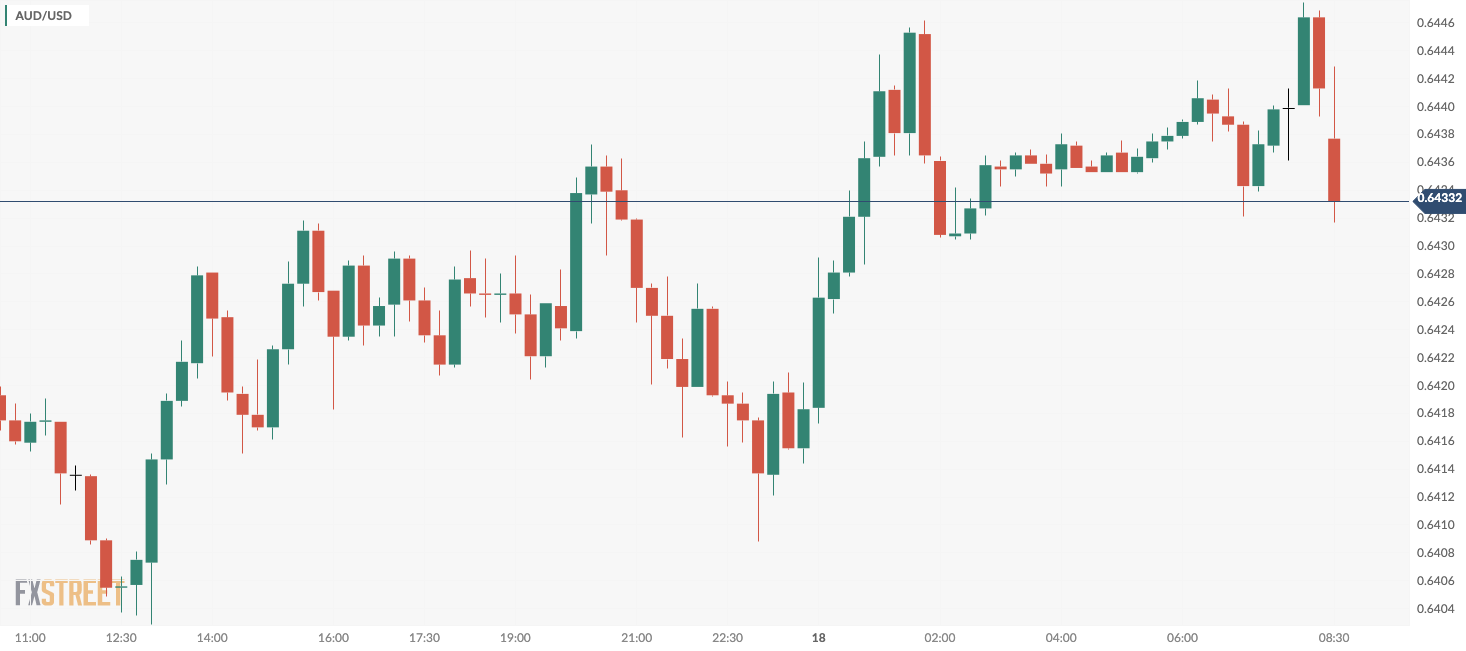

AUD/USD reaction to the Australia Employment report

The Australian Dollar attracts some sellers in an immediate reaction to the Australia Employment report. The AUD/USD pair is trading at 0.6433, losing 0.02% on the day.

AUD/USD: 15-minutes chart

Australian Dollar price in the last 7 days

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies in the last 7 days. Australian Dollar was the weakest against the Swiss Franc.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | 0.66% | 0.63% | 0.55% | 1.03% | 0.83% | 0.94% | -0.28% | |

| EUR | -0.66% | -0.05% | -0.10% | 0.37% | 0.17% | 0.28% | -0.94% | |

| GBP | -0.63% | 0.02% | -0.08% | 0.40% | 0.18% | 0.31% | -0.91% | |

| CAD | -0.55% | 0.10% | 0.07% | 0.49% | 0.28% | 0.39% | -0.84% | |

| AUD | -1.04% | -0.39% | -0.40% | -0.48% | -0.20% | -0.08% | -1.31% | |

| JPY | -0.83% | -0.16% | -0.20% | -0.29% | 0.21% | 0.12% | -1.11% | |

| NZD | -0.95% | -0.28% | -0.32% | -0.39% | 0.08% | -0.12% | -1.26% | |

| CHF | 0.28% | 0.93% | 0.90% | 0.82% | 1.29% | 1.10% | 1.21% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

This section below was published at 20:30 GMT on Thursday as a preview of the Australia Employment report

- The Australian Unemployment Rate is expected to have ticked higher in March.

- Employment Change is foreseen losing momentum after the outstanding February figure.

- AUD/USD corrective advance may provide bears the chance to sell at higher levels.

Australia will publish its monthly employment report first thing Thursday. The Australian Bureau of Statistics (ABS) is expected to announce the country added measly 7.2K new positions in March after the outstanding 116.5K jobs created in February. The Unemployment Rate is foreseen at 3.9% after dropping to a six-month low of 3.7% in the previous month. In February, the trend unemployment rate remained at 3.8% for the sixth month in a row.

Australia reports the monthly Employment Change split into full-time and part-time positions. Generally speaking, full-time jobs imply working 38 hours per week or more and usually include additional benefits, but they mostly represent consistent income. On the other hand, part-time employment generally means higher hourly rates but lacks consistency and benefits. That’s why the economy prefers full-time jobs.

Scrutinizing the impressive February headline, Australia created 38.3K part-time roles and added a whopping 78.2K full-time ones. “The large increase in employment in February followed larger-than-usual numbers of people in December and January who had a job that they were waiting to start or to return to. This translated into a larger-than-usual flow of people into employment in February and even more so than February last year,” according to the official ABS report.

Australian unemployment rate expected to bounce back in March

Market analysts anticipate the Australian Unemployment Rate increased to 3.9% in March after declining to 3.7% in February. As mentioned before, the country is expected to have added 7.2K new jobs following 116.5K positions added in February.

The labor sector in Australia has remained relatively strong over the past few months, although, opposite to other major counterparts, the Reserve Bank of Australia (RBA) does not seem to care about whether the job market remains tight.

As widely anticipated, the RBA kept its policy rate unchanged for the third straight meeting at 4.35% when it met in March. For a change, policymakers scrapped any reference to possible further increases, pushing AUD/USD lower.

“If our forecasts come true, and I really hope we’re on that narrow path that Phil (Lowe – former RBA Governor) used to talk about, then we can slow the economy enough that it preserves a lot of the gains in employment and brings inflation down,” Governor Michele Bullock noted, following the central bank meeting. The Board is hopeful they will head into a soft landing as long as inflation remains subdued.

The Australian Bureau of Statistics (ABS) publishes the Consumer Price Index (CPI) quarterly. According to the latest release, the CPI rose 0.6% in the last quarter of 2023 and 4.1% in the 12 months to December 2023. The RBA’s inflation goal is between 2% and 3%.

It is worth mentioning that wage growth is reported separately. The ABS also offers a quarterly report, with the latest showing the seasonally adjusted Wage Price Index (WPI) rose 0.9% in the last quarter of 2023 and 4.2% over the year. At this point, wage growth continues to outstrip inflation, but it’s not something to care about today.

When will the Australian employment report be released, and how could it affect AUD/USD?

The ABS will publish the February employment report on Thursday. As previously stated, Australia is expected to have created 7.2K new jobs in March, while the Unemployment Rate is foreseen at 3.9%. The Participation Rate was reported at 66.7% in February.

The tepid job creation and the modest uptick in the Unemployment Rate should not be a problem for the RBA. A much stronger than-anticipated report, however, may be read as a delay in rate cuts. The market isn’t rushing to bet on it, which means the Aussie will likely take advantage against the US Dollar in such a scenario.

A poor outcome on the contrary, and given broad USD strength, AUD/USD may fall to fresh 2024 lows.

From a technical perspective, Valeria Bednarik, Chief Analyst at FXStreet, notes: “The AUD/USD pair set a fresh 2024 low on Tuesday at 0.6388, as broad US Dollar demand in a risk-averse environment dominates financial boards. The pair is up ahead of the announcement, but the advance seems corrective. Speculative interest is adjusting rate-cut expectations while digesting the latest Middle East developments. The modest improvement in sentiment is short of confirming fears are gone, which means the case for a lower low is alive and kicking.”

Bednarik adds: “AUD/USD is bearish, given that it is developing below all its moving averages in the daily chart. The 20 Simple Moving Average (SMA) heads firmly south below the 100 and 200 SMAs and over 100 pips above the current level, reflecting bears’ strength. Technical indicators recovered modestly from oversold readings but lack momentum enough to confirm an interim bottom. AUD/USD has near-term support at 0.6410, followed by the aforementioned 2024 low. Once below the latter, the slide could extend initially towards 0.6350, en route to 0.6315. On the contrary, immediate resistance can be found at 0.6470, followed by the 0.6530 pierce zone. It is worth adding that, once the dust settles and in the case of a bullish run, sellers may take their chances to keep the pair in the bearish path.”

Employment FAQs

Labor market conditions are a key element to assess the health of an economy and thus a key driver for currency valuation. High employment, or low unemployment, has positive implications for consumer spending and thus economic growth, boosting the value of the local currency. Moreover, a very tight labor market – a situation in which there is a shortage of workers to fill open positions – can also have implications on inflation levels and thus monetary policy as low labor supply and high demand leads to higher wages.

The pace at which salaries are growing in an economy is key for policymakers. High wage growth means that households have more money to spend, usually leading to price increases in consumer goods. In contrast to more volatile sources of inflation such as energy prices, wage growth is seen as a key component of underlying and persisting inflation as salary increases are unlikely to be undone. Central banks around the world pay close attention to wage growth data when deciding on monetary policy.

The weight that each central bank assigns to labor market conditions depends on its objectives. Some central banks explicitly have mandates related to the labor market beyond controlling inflation levels. The US Federal Reserve (Fed), for example, has the dual mandate of promoting maximum employment and stable prices. Meanwhile, the European Central Bank’s (ECB) sole mandate is to keep inflation under control. Still, and despite whatever mandates they have, labor market conditions are an important factor for policymakers given its significance as a gauge of the health of the economy and their direct relationship to inflation.

Economic Indicator

Unemployment Rate s.a.

The Unemployment Rate, released by the Australian Bureau of Statistics, is the number of unemployed workers divided by the total civilian labor force, expressed as a percentage. If the rate increases, it indicates a lack of expansion within the Australian labor market and a weakness within the Australian economy. A decrease in the figure is seen as bullish for the Australian Dollar (AUD), while an increase is seen as bearish.