GBP/USD Forecast: Bulls dominate, despite coronavirus concerns

GBP/USD Current price: 1.3671

- The UK Parliament backed the post-Brexit trade deal with the EU.

- UK´s record coronavirus contagions forced the government to announce tougher measures.

- GBP/USD is technically bullish in the near-term, needs to break above 1.3710 to extend rally.

The British Pound is the strongest currency, with GBP/USD poised to close 2020 at its highest in over two years. The pair traded as high as 1.3685, now hovering in the 1.3670 price zone, as the UK parliament ratified the post-Brexit trade deal with the EU.

On Wednesday, the United Kingdom announced tougher restrictive measures amid record contagions in the country. The Midlands, North East, parts of the North West and parts of the South West are among those escalated to tier four. News that the government approved the emergency use of the AstraZeneca vaccine partially overshadowed the discouraging covid-related headlines.

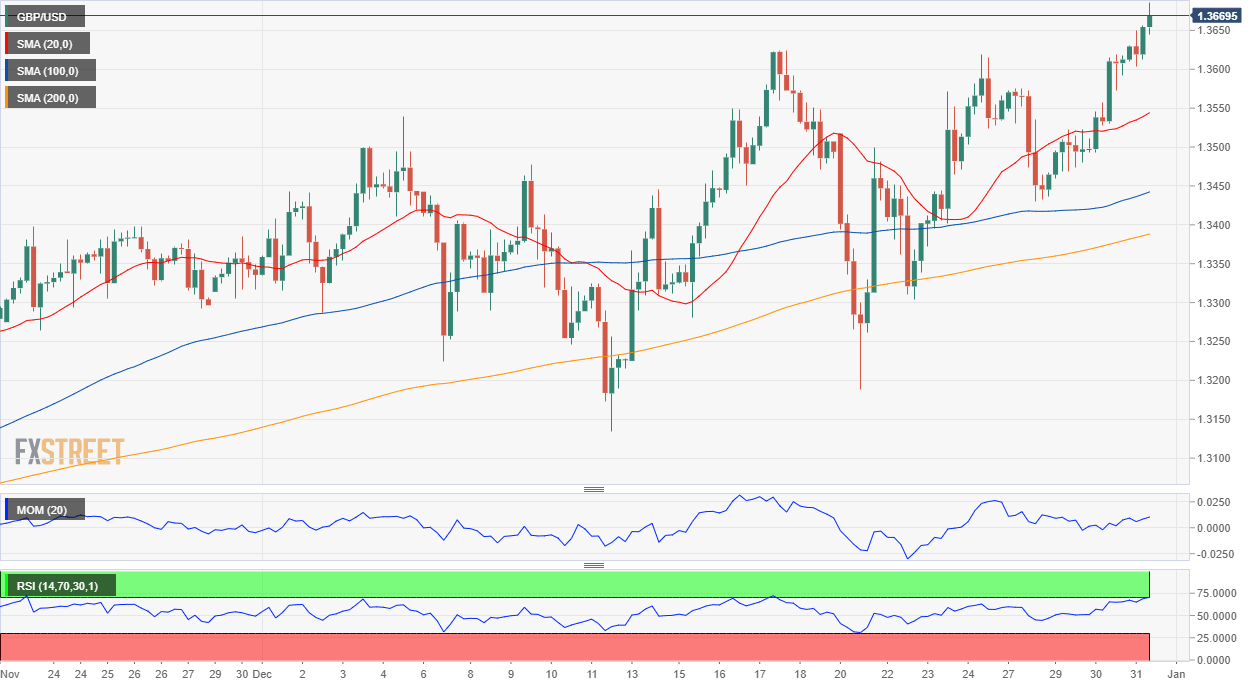

GBP/USD short-term technical outlook

The GBP/USD pair is pressuring daily highs and nearing the 1.3700 figure, without signs of bullish exhaustion. The broad dollar’s weakness adds to the bullish case of the pair. In the near-term, and according to the 4-hour chart, the risk remains skewed to the upside, despite overbought readings. The pair has continued to advance above bullish moving averages while technical indicators continue to grind higher. Another leg north is to be expected on a break above 1.3710, the immediate resistance level.

Support levels: 13625 1.3570 1.3515

Resistance levels: 1.3710 1.3755 1.3800