EUR/USD Forecast: Euro rejected at resistance, bears eye 1.1850 after US data boost

- EUR/USD has been drifting lower after eurozone inflation dropped.

- The dollar has received a boost from ADP’s upbeat US job figures.

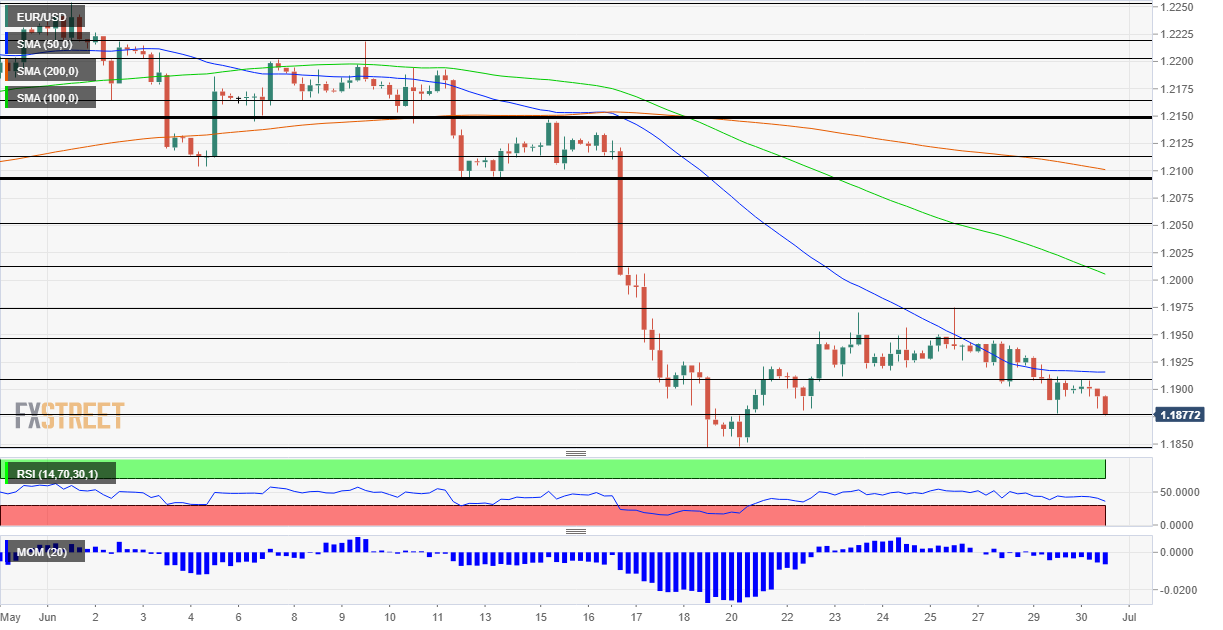

- Wednesday’s four-hour chart is painting a bearish picture.

One-two punch – EUR/USD has received a blow from mediocre eurozone data and from upbeat US figures and may extend its downfall.

Consumer prices rose by 1.9% YoY in June, according to the preliminary read, below 2% recorded in May. Underlying prices are at a meager 0.9%, also one-tenth of a percent lower. While these outcomes only met estimates rather than falling short, they will likely encourage the European Central Bank to maintain its dovish policy.

Moreover, the Delta variant is beginning to spread across the old continent, potentially wreaking havoc. It has yet to reach America’s shores.

Over in the US, ADP’s private-sector jobs report showed a gain of 692,000 positions, better than 600,000 estimates and with only a minor downward revision from last month. Back in May, the payroll firm overestimated American hiring in comparison to the official numbers, and by sticking to a high level, it raises expectations for Friday’s Nonfarm Payrolls.

Moreover, expectations for an end-of-month dollar downfall have proven wrong. The greenback gained substantial ground in June, and portfolio managers seem to be in no rush to unwind these positions.

Overall, fundamentals are pointing to additional falls for the currency pair.

EUR/USD Technical Analysis

Euro/dollar has been rejected at 1.1905, a level that has been capping in in the past few sessions. Downside momentum on the four-hour chart has intensified and that failure to break resistance also leaves the 50 Simple Moving Average as a cap on top of the currency pair.

Critical support awaits at June’s low of 1.1850, followed by 1.18 and 1.1760.

Resistance is at 1.1905, followed by 1.1950 and 1.1975.