US-DE 10-Yr Yield Spread Technical Analysis: spread could drop 10 bps in EUR-positive manner

The spread between the US and German (DE) 10-year bond yields fell to 248 basis points (bps) earlier today – the lowest level since Jan. 15 – and could slide further to the recent low of 239 bps, according to technical charts.

So, it seems safe to say that for EUR/USD, the path of least resistance is to the higher side.

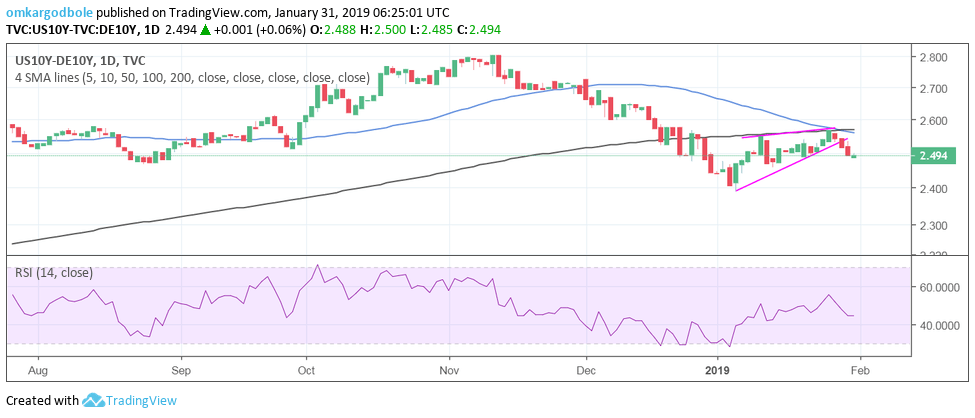

Daily chart

As seen above, the yield differential closed at 252 basis points on Tuesday, confirming a rising wedge breakdown. That pattern usually accelerates the preceding bearish trend.

Therefore, the yield spread could soon revisit the Jan. 4 low of 239 basis points. Supporting the bearish case is the below-50 reading on the 14-day relative strength index (RSI) and the death cross (bearish crossover between the 50- and 200-day moving averages).

Trend: bearish (positive for EUR/USD)