EUR/USD: Bears don’t give up and push for more

- EUR/USD breaks below the 0.9900 mark to new lows.

- The dollar remains well bid ahead of the FOMC event on Wednesday.

- EMU Flash inflation rose more than expected in October.

The single currency remains mired in the negative territory and drags EUR/USD to fresh multi-session lows in the sub-0.9900 region at the beginning of the week.

EUR/USD weaker on USD-recovery

EUR/USD accelerates its losses on Monday and breaches the key support at 0.9900 the figure, that is more than 2 cents down from last week’s monthly highs just below the 1.0100 barrier (October 27).

Indeed, the continuation of the strong recovery in the greenback keeps undermining the sentiment around the euro and favours extra decline in the pair, as investors get ready for the FOMC gathering on Wednesday, which will be the salient event of the week.

The daily drop in the pair comes in tandem with the small rebound in the German 10-year bund yields, which add to Friday’s bounce beyond 2.10% at the same time.

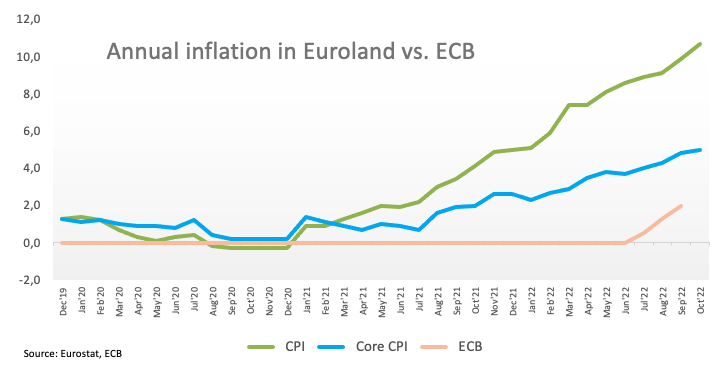

In the euro docket, advanced inflation figures in the euro area now see the CPI rising more than expected 10.7% in the year to October, while the Core CPI is seen gaining 5.0% from a year earlier.

Still in the Euroland, the economy is predicted to expand 0.2% QoQ in Q3 and 2.1% on a yearly basis, according to preliminary results. In the first turn, German Retail Sales contracted 0.9% in September vs. the same month of 2021.

What to look for around EUR

EUR/USD extends a leg lower and breaks below the 0.9900 mark against the backdrop of persistent dollar strength on Monday.

In the meantime, price action around the European currency is expected to closely follow dollar dynamics, geopolitical concerns and the Fed-ECB divergence. The resurgence of speculation around a potential Fed’s pivot seems to have removed some strength from the latter, however.

Furthermore, the increasing speculation of a potential recession in the region – which looks propped up by dwindling sentiment gauges as well as an incipient slowdown in some fundamentals – adds to the fragile sentiment around the euro in the longer run.

Key events in the euro area this week: Germany Retail Sales, EMU Flash Q3 GDP Growth Rate, Inflation Rate (Monday) – Germany Balance of Trade, Unemployment Change, Unemployment Rate, Final Manufacturing PMI, EMU Final Manufacturing PMI (Wednesday) – EMU Unemployment Rate (Thursday) – EMU/Germany Final Services PMI, ECB Lagarde (Friday).

Eminent issues on the back boiler: Continuation of the ECB hiking cycle vs. increasing recession risks. Impact of the war in Ukraine and the persistent energy crunch on the region’s growth prospects and inflation outlook.

EUR/USD levels to watch

So far, the pair is retreating 0.66% at 0.9899 and the breakdown of 0.9888 (weekly low October 31) would target 0.9704 (weekly low October 21) en route to 0.9631 (monthly low October 13). On the upside, there is an initial hurdle at 1.0093 (monthly high October 27) followed by 1.0197 (monthly high September 12) and finally 1.0368 (monthly high August 10).