GBP/USD Weekly Forecast: Pound Sterling recovers after two straight weeks of losses

- The Pound Sterling rebounded from five-month lows at 1.2300 against the US Dollar.

- The GBP/USD upturn is unlikely to last as the Fed rate decision and US Nonfarm Payrolls loom.

- The Pound Sterling needs acceptance above 1.2555 to sustain the recovery.

- The daily RSI still lurks below 50.00, warranting caution for GBP/USD buyers.

The Pound Sterling (GBP) rebounded firmly against the US Dollar (USD), with the GBP/USD pair snapping two weekly declines in a row.

Pound Sterling rebounds, but not out of the woods yet

Pound Sterling witnessed a negative start to the week despite the return of risk appetite on ebbing fears over a wider regional conflict in the Middle East. No official comments from Israel confirming Friday’s Israeli missiles strike on Iran and denial of further retaliatory measures by Iranian authorities calmed markets down.

It looked like the British Pound suffered from the dovish commentary delivered on Friday by Bank of England (BoE) Deputy Governor Dave Ramsden, who said that risks to persistence in domestic inflation pressures were receding, suggesting that a BoE policy pivot is inevitable later this year.

Thereafter, the tide turned in favor of the GBP/USD pair, allowing it to stage a solid comeback from a new five-month low of 1.2300. The retreat in the US Dollar from multi-month highs against its major currency counterparts was the main reason behind the pair’s turnaround.

Weak US macro data cast doubts on the country’s economic resilience, contributing to the US Dollar correction. S&P Global said on Tuesday that its preliminary US Composite PMI Output Index, which tracks the manufacturing and services sectors, fell to 50.9 in April from 52.1 in March. Both Manufacturing and Services PMI fell short of market expectations in April. Further, the US economy slowed in the first quarter, growing at an annualized rate of 1.6%, against expectations of a 2.5% expansion in the reported period.

Despite the discouraging economic performance, markets continued to price in the first US Federal Reserve (Fed) interest-rate cut in September, according to the CME Group’s FedWatch Tool. Meanwhile, the total easing expected this year would just be 40 basis points (bps), a sea change from about the 150 basis points of cuts priced in at the beginning of the year, per Reuters.

Sustained bets for a delayed Fed policy pivot lent support to the Greenback, but the upbeat US tech earnings-led risk environment also helped the higher-yielding Pound Sterling. Additionally, improving UK business activity in April aided the GBP/USD recovery. The S&P Global UK Composite Purchasing Managers’ Index for the services and manufacturing sectors jumped to an 11-month high of 54.0 in April from March’s 52.8.

On Friday, the data from the US showed that the core Personal Consumption Expenditures (PCE) Price Index rose 2.8% on a yearly basis in March. This reading came in above the market expectation of 2.6% and helped the USD hold its ground. In turn, GBP/USD struggled to build on its weekly gains heading into the weekend.

What to watch for in the Federal Reserve week

After a data-busy week in the United States, traders keenly await another eventful week, with the Fed policy decision likely to stand out.

The UK economic docket is once again relatively quiet data-wise, and therefore, the sentiment around the Fed rate expectations and the US Dollar price action will continue to drive the GBP/USD pair.

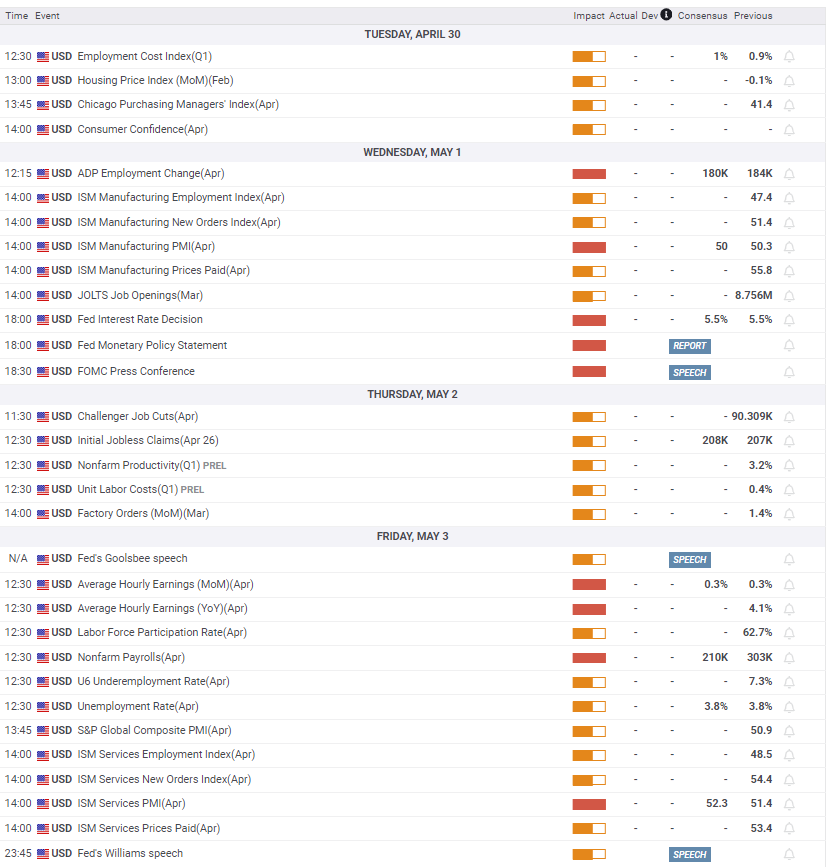

Monday is devoid of any top-tier data releases from both sides of the Atlantic. The focus, thus, shifts toward Tuesday’s quarterly release of the US Employment Cost Index for Q1 and the Conference Board Consumer Confidence data for April. China’s official Manufacturing and Non-Manufacturing PMI data will be also reported early Tuesday, which could have a reasonable impact on risk sentiment, eventually influencing the demand for the safe-haven US Dollar.

The economic calendar is busiest on Wednesday even though it’s a European market holiday. The US docket features the ADP Employment Change data, followed by the ISM Manufacturing PMI and JOLTS Job Openings data. However, the main event risk that day remains in the Fed interest rate decision and Chairman Jerome Powell’s press conference.

The US events are expected to spike the volatility around the US Dollar, impacting the currency pair.

On Thursday, traders will brace for another busy US calendar, filled with mid-tier data flow, including the weekly Jobless Claims, Preliminary Unit Labor Costs Index and Factory Orders data.

Finally, the US Nonfarm Payrolls data will hog the limelight on Friday. The ISM Services PMI and its sub-indices will be also closely-watched by market participants.

GBP/USD: Technical Outlook

Having bounced off from the key 1.2300 round level, GBP/USD ripped through several key supports, now turned resistances, to challenge the critical 200-day Simple Moving Average (SMA) at 1.2557.

A weekly closing above the 200-day SMA is required to build on the recovery momentum in the week ahead.

The main cause of concern for buyers, however, is that the 14-day Relative Strength Index (RSI) still lurks below the 50 level.

If Pound Sterling buyers face rejection at the abovementioned 200-day SMA of 1.2557, a retracement toward the initial support of the November 16 and 17 lows confluence at near 1.2375 will be retested.

A sustained move below the latter will expose the downside toward the November 14 low at 1.2266. Ahead of that, the five-month low of 1.2300 could rescue buyers.

On the flip side, a meaningful upside toward the 1.2630-1.2650 supply zone cannot be ruled out if the 200-day SMA is taken out decisively. That area is where the 50-day and 100-day SMAs hang around.

The next topside hurdle is seen at around the 1.2800 threshold.

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.