Gold Weekly Forecast: Strength of $2,300 support is an encouraging sign for bulls

- Gold fell sharply on Monday but recovered a portion of its losses in the second half of the week.

- XAU/USD remains technically bullish despite closing the week in the red.

- The Fed’s monetary policy announcements and US jobs data could impact Gold’s valuation next week.

Gold (XAU/USD) price started the week under heavy bearish pressure and registered its largest one-day loss of the year on Monday. The pair managed to stage a rebound in the second half of the week but closed in negative territory. The US Federal Reserve’s (Fed) monetary policy announcements and April labor market data from the US could drive XAU/USD’s action next week.

Gold managed to hold above $2,300 following Monday’s sharp drop

Gold turned south at the beginning of the week as geopolitical tensions eased following a relatively quiet weekend in terms of news regarding the Iran-Israel conflict. After benefiting from safe-haven flows and registering impressive gains for the past few weeks, the overdue correction took place on Monday and XAU/USD fell 2.7% on a daily basis. The pair continued to stretch lower and touched its weakest level in over two weeks near $2,290 early Tuesday. As the US Dollar (USD) came under selling pressure after disappointing US PMI data releases, however, Gold recovered above $2,300 and closed the day virtually unchanged.

S&P Global Composite PMI in the US declined to 50.9 in April’s flash estimate from 52.1 in March. This reading showed a loss of growth momentum in the private sector’s business activity. Additionally, the underlying details of the report pointed to softening input inflation, further weighing on the USD. Assessing PMI surveys’ findings, “the deterioration of demand and cooling of the labor market fed through to lower price pressures, as April saw a welcome easing in rates of increase for selling prices for both goods and services,” said Chris Williamson, Chief Business Economist at S&P Global Market Intelligence.

On Wednesday, the USD held resilient against its rivals after the US Census Bureau reported that Durable Goods Orders rose 2.6% to $238.4 billion in March. In turn, Gold struggled to gather recovery momentum.

The US Bureau of Economic Analysis’ (BEA) reported on Thursday that the US Gross Domestic Product (GDP) expanded at an annualized rate of 1.6% (first estimate) in the first quarter. This reading followed the 3.4% growth registered in the last quarter of 2023 and missed the market forecast for an expansion of 2.5% by a wide margin. As a result, the USD continued to weaken, allowing XAU/USD to end the day in positive territory. Gold’s recovery, however, remained capped as the GDP report also showed that the GDP Price Index, also known as the GDP price deflator, climbed to 3.1% from 1.7%, highlighting a stronger impact of inflation on GDP growth.

On Friday, the BEA announced that the core Personal Consumption Expenditures (PCE) Price Index rose 2.8% on a yearly basis in March. This reading matched February’s increase and came in above the market expectation of 2.6%. The USD preserved its strength and made it difficult for XAU/USD to extend its recovery haeding into the weekend.

Gold investors’ focus shifts to Fed decision, US data

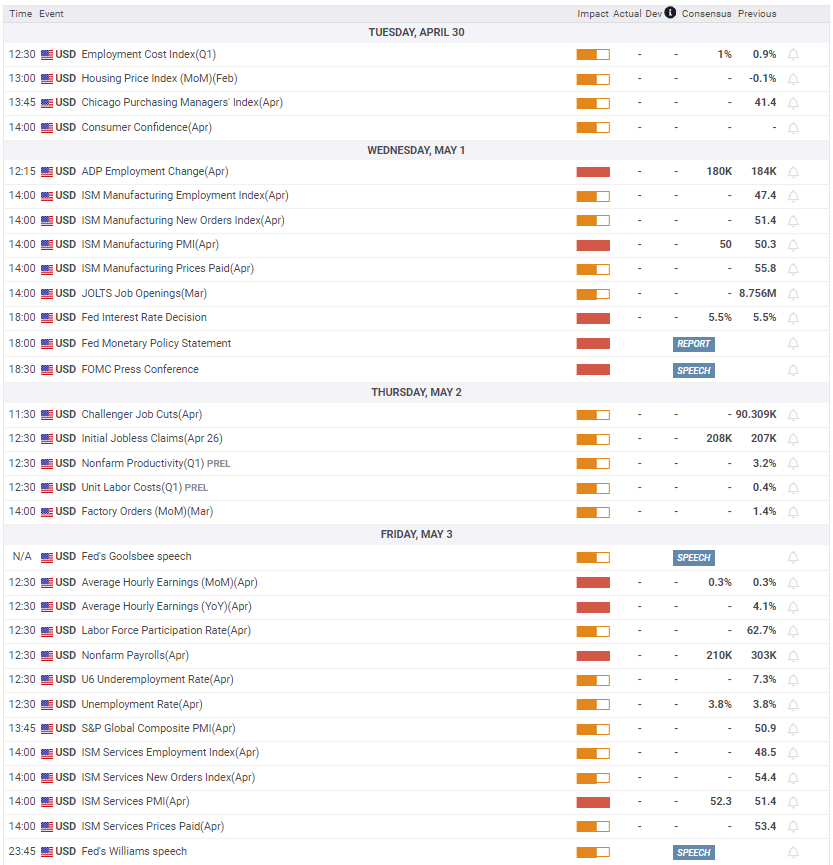

The Fed will announce monetary policy decisions on Wednesday. Markets expect the US central bank to leave the policy rate unchanged at 5.25%-5.5%. According to the CME FedWatch Tool, the probability of the Fed opting for another policy hold in June stands at around 90%. The Fed is unlikely to offer any fresh hints on the timing of the policy pivot in its statement.

In the post-meeting press conference, however, Fed Chairman Jerome Powell will most likely be asked about whether there is still a possibility of an interest-rate reduction in June. In case Powell doesn’t shut the door to a June cut, the initial reaction could trigger a sharp decline in the US Treasury bond yields and provide a boost to Gold. Following the March policy meeting, Powell noted that strong inflation numbers for January and February might have been caused by seasonal factors. Market participants will pay close attention to Powell’s comments about the inflation outlook as well. In case Powell adopts a concerning tone about the latest inflation developments, the USD could stay resilient against its rivals, limiting Gold’s upside. Finally, if Powell downplays the disappointing Q1 GDP reading, investors could see that as a hawkish tone and make it difficult for XAU/USD to gain traction.

On Friday, the US Bureau of Labor Statistics will release the April jobs report. A significant decline in Nonfarm Payrolls (NFP) growth, a reading close to 150,000, could trigger a USD sell-off with the immediate reaction. Even if that data doesn’t influence the June rate cut expectations in a significant way, it could still weigh heavily on the USD if investors lean toward a policy pivot in September. The CME FedWatch Tool shows markets are pricing in a nearly 40% probability of the Fed policy rate remaining unchanged in September. On the other hand, a stronger-than-forecast increase in NFP, especially if accompanied by a hot wage inflation print, could feed into expectations for a Fed inaction in September and trigger a sharp decline in XAU/USD ahead of the weekend.

Gold technical outlook

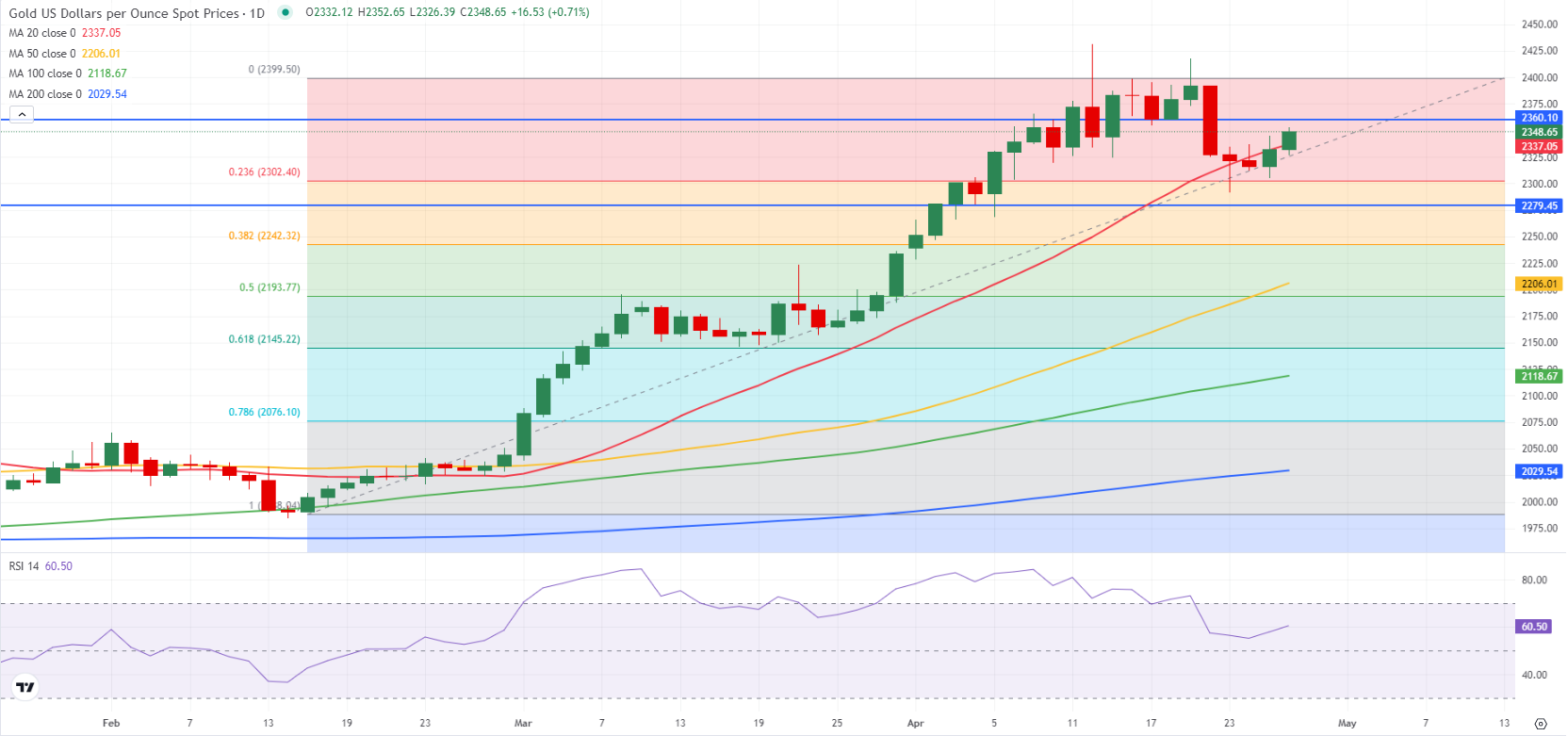

The Relative Strength Index (RSI) indicator on the daily chart climbed to 60 after falling toward 50 earlier in the week, suggesting the latest pullback was a correction rather than the beginning of a reversal. Additionally, Gold climbed back above the 20-day Simple Moving Average (SMA) after closing below this level on Wednesday, reflecting the sellers’ hesitancy.

On the upside, $2,360 (static level) aligns as interim resistance before $2,400 (static level, end-point of the latest uptrend) and $2,430 (all-time high set on April 12). On the other side,

$2,300 (Fibonacci 23.6% retracement of the recent uptrend movement since mid-February) aligns as strong support before $2,280 (static level) and $2,240 (Fibonacci 38.2% retracement).

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.