ForexLive European FX news wrap: Dollar uninspired as month-end approaches

Read full post at forexlive.com

Read full post at forexlive.com

Forex news from the European trading session – 30 November 2020

Headlines:

Markets:

- CAD leads, AUD lags on the day

- European equities mixed; E-minis flat

- US 10-year yields up 1.6 bps to 0.854%

- Gold down 1.1% to $1,768.91

- WTI down 0.9% to $45.11

- Bitcoin up 10.6% to $18,815

It was mostly a quiet session with a few data points to move thing along, as well as Brexit headlines reaffirming that negotiations are still ongoing in London.

Risk appetite was mostly tepid but equities have recovered from a bit of a pullback earlier in the day, with US futures keeping closer to flat levels with Nasdaq futures holding slight gains while European equities are more mixed now after a softer start.

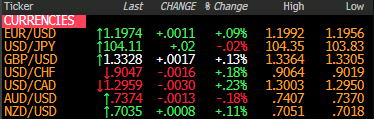

The dollar was uninspired as it trades a little lower with month-end in focus today, as EUR/USD holds slightly higher and nudging towards a test of 1.2000.

GBP/USD was more choppy, bouncing in between its key hourly moving averages as the pound consolidates between 1.3300 and 1.3400 awaiting more Brexit clues.

Elsewhere, the loonie also gained some slight ground as oil pared some of its earlier losses on the session having been down by 2% earlier to $44.50 only to recover towards $45.11 currently as we look towards the start of the OPEC ministerial meeting.

The aussie keeps softer as 0.7400 remains an elusive target for buyers so far today.

Meanwhile, gold continues to be pressured upon a break below $1,800 and its 200-day moving average at the end of last week as the yellow metal is down another 1%.