Gold Price Analysis: Nearing critical long-term support – Confluence Detector

Gold (XAU/USD) continues to suffer the echoes of on-hold central banks. This month, policymakers from around the world decided to maintain their monetary policies unchanged, against expectations of more pumping. In the meantime, risk-aversion triggered a dollar’s comeback, even against the safe-haven metal.

Spot gold trades around $1,891.20 a troy ounce, recovering from a daily low of 1,873, firmly bearish according to technical readings.

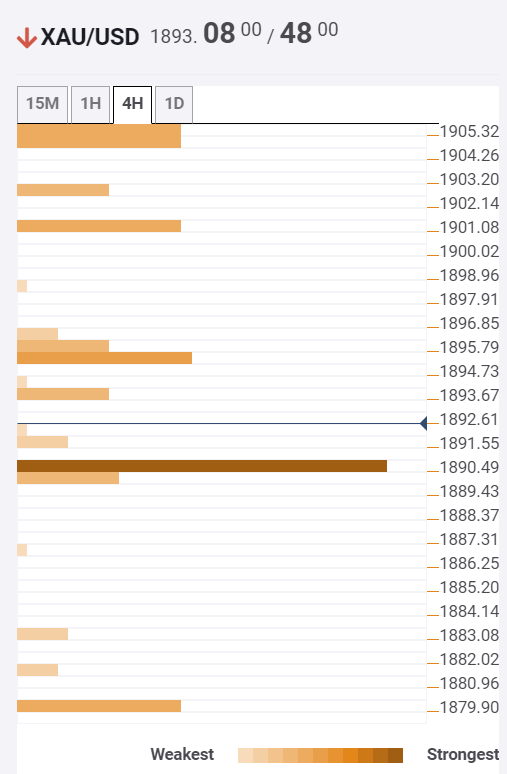

Meanwhile, the Technical Confluence Indicator shows that XAU/USD is barely holding above a strong support level at 1,890.50, as the metal has there the S3 of the weekly pivot point. Such sell-off indicates that the metal is oversold, but a break below it will be a game-changer for the trend, as bears will take full control once it stabilizes below it.

The most relevant resistance is the previous daily low at around 1,895, followed by congesting technical signs some $10.00 above this last. Still, chances of a bullish breakout are quite limited given the positive performance of global equities.