When are the Eurozone flash CPIs and how could they affect EUR/USD?

Eurozone flash CPIs estimate overview

Eurostat will publish the Eurozone’s inflation first estimate for November at 1000 GMT today. Consumer prices are expected to tick down to 2.0% on a yearly basis while the core figures are also seen flat at 1.1% in the reported month.

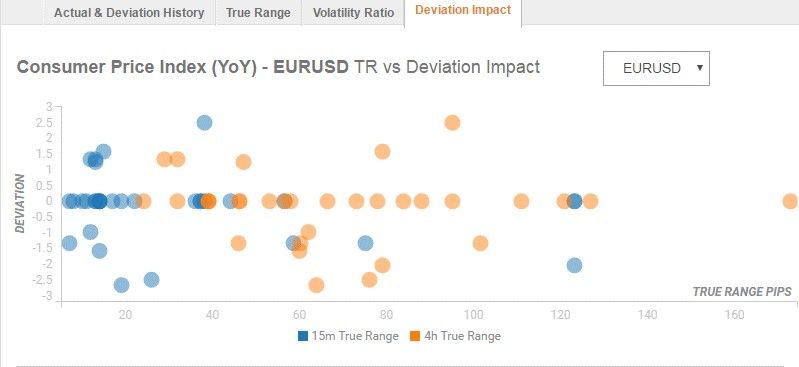

Deviation impact on EUR/USD

Readers can find FX Street’s proprietary deviation impact map of the event below. As observed the reaction is likely to remain confined between 10 and 40 pips in deviations up to 1.5 to -3, although in some cases, if notable enough, a deviation can fuel movements of up to 50 pips.

How could affect EUR/USD?

According to FXStreet’s Analyst Haresh Menghani, “from a technical perspective, the pair has been consolidating near 61.8% Fibonacci the 1.1500-1.1216 Nov. monthly decline and already seems to have found acceptance above 200-hour SMA. The set-up support prospects for an extension of the positive momentum towards a descending trend-line resistance, currently near the 1.1425-30 region, extending through highs set on Nov. 7, 19 & 20. A follow-through buying might trigger some additional short-covering and accelerate the up-move further towards reclaiming the key 1.1500 psychological mark.”

“On the flip side, the 200-hour SMA, currently near the 1.1365 region, now seems to protect the immediate downside, below which the pair is likely to head back towards 38.2% Fibonacci retracement level support near the 1.1325 region en-route the 1.1300 round figure mark,” Haresh adds.

Key Notes

Eurozone: November headline inflation likely to soften to 2.0% y/y – TDS

G20 meeting and Eurozone inflation amongst market movers today – Danske Bank

EUR futures: upside limited near term

About Eurozone flash CPIs estimate

The Euro Zone CPI released by the Eurostat captures the changes in the price of goods and services. The CPI is a significant way to measure changes in purchasing trends and inflation in the Euro Zone. Generally, a high reading anticipates a hawkish attitude which will be positive (or bullish) for the EUR, while a low reading is seen as negative (or bearish).