EUR/USD Forecast: Aiming for higher highs for the year

EUR/USD Current Price: 1.1982

- Equities struggle to post gains as investors wait for fresh clues.

- German inflation contracted by more than anticipated in November.

- EUR/USD is bullish in the near term, needs to break above 1.2011.

The EUR/USD pair advanced this Monday to 1.1991, its highest since September 1, when the pair established the year’s high at 1.2011. Speculative interest keeps selling the greenback while equities struggle to post some gains. Investors are cautious ahead of several first-tier events scheduled for this week, starting on Tuesday with a speech from the Federal Reserve’s head, Jerome Powell.

Germany published the preliminary estimate of November inflation, which came in worse than anticipated, falling by 0.3% YoY. The dismal announcement put a cap to EUR/USD advance. The US calendar includes October Pending Home Sales, the November Chicago Purchasing Managers’ Index, and the Dallas Fed Manufacturing Business Index for the same month.

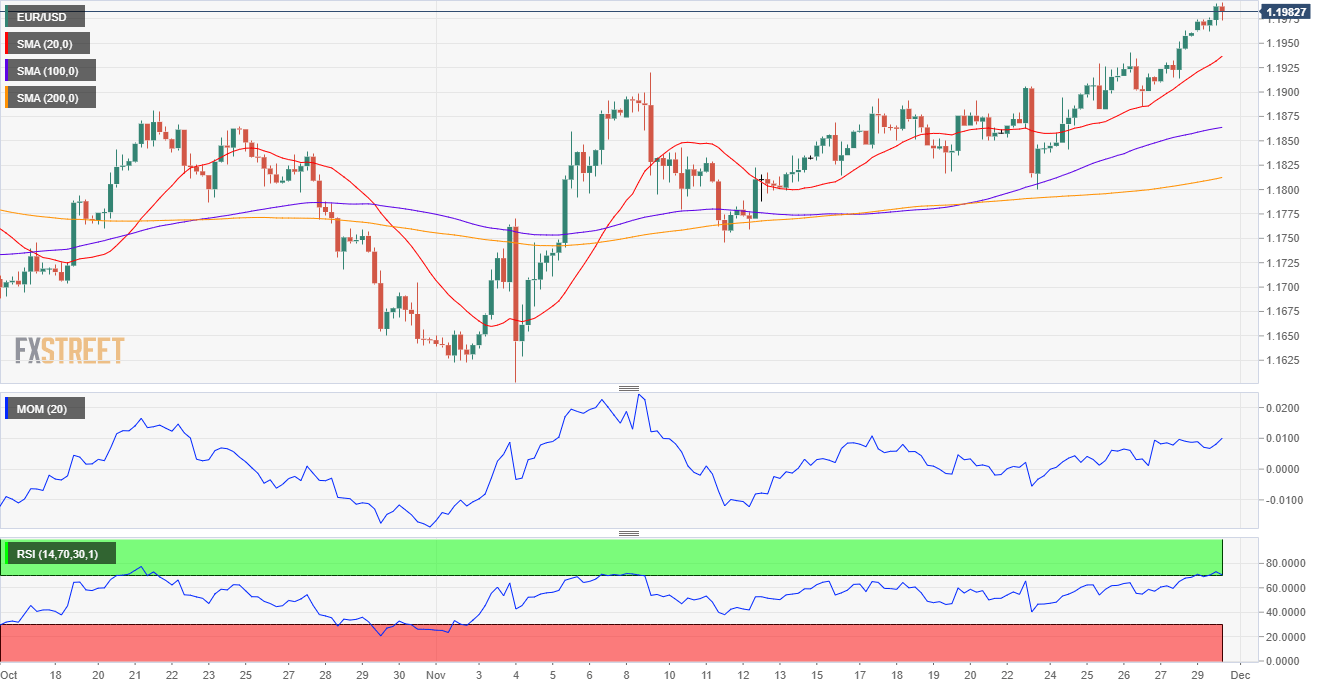

EUR/USD short-term technical outlook

The EUR/USD pair is trading near the mentioned daily high, consolidating gains and maintaining its bullish stance. The 4-hour chart shows that it further advanced beyond bullish moving averages, while technical indicators are neutral but within overbought readings. The European Central Bank has drawn a line in the sand on 1.2000 and is yet to be seen if the market will dare to challenge it. Meanwhile, and from a technical point of view, a steeper advance is to be expected on a break above 1.2011, this year´s high.

Support levels: 1.1960 1.1920 1.1880

Resistance levels: 1.2010 1.2050 1.2090

View Live Chart for the EUR/USD