EUR/USD: Upside falters near 1.1850, looks to US data

- EUR/USD advances to fresh tops near 1.1850.

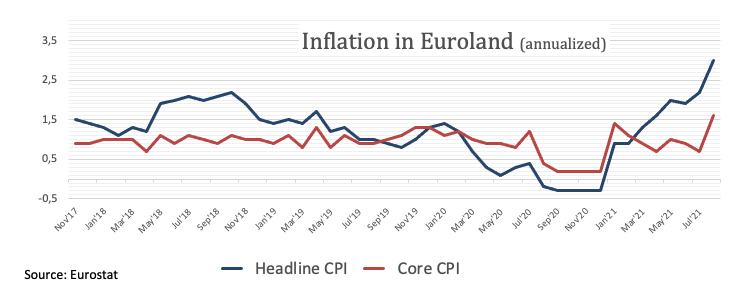

- EMU flash headline CPI climbed to a decade high at 3.0%.

- CB’s Consumer Confidence next of relevance in the US docket.

The sharp recovery in EUR/USD appears to have met a decent resistance near the 1.1850 level on Tuesday.

EUR/USD capped by 1.1850… for now

EUR/USD advances further north of the 1.1800 mark following Friday’s bullish “outside day” and Monday’s inconclusive price action. The move, however, faltered ahead of 1.1850 so far on Tuesday.

The pair trades in new multi-week tops on the back of the renewed offered stance in the greenback, as investors keep digesting Powell’s post-Jackson Hole statement and cautious message while month-end flows also add to the pessimism surrounding the buck.

Data results in the euro area also lend support to the single currency after the German Unemployment Rate edged lower to 5.5% in August and flash inflation figures in Euroland see the CPI rising to 3.0% YoY in August, levels last seen in 2011.

In the US data space, the House Price Index rose 1.7% MoM and house prices tracked by the S&P/Case-Shiller index rose 18.5% YoY, both prints for the month of June. Later, the Chicago PMI, the CB Consumer Confidence and the API report will close the daily calendar.

EUR/USD levels to watch

So far, spot is gaining 0.19% at 1.1819 and faces the next up barrier at 1.1845 (monthly high Aug.31) followed by 1.1908 (monthly high Jul.30) and finally 1.1954 (100-day SMA). On the downside, a break below 1.1663 (2021 low Aug.20) would target 1.1612 (monthly low Oct.20 2020) en route to 1.1602 (monthly low Nov.4 2020).