Euro clings to gains above 1.1000, Dollar remains side-lined

- Euro extends the upside to the vicinity of 1.1040 against the US Dollar.

- Stocks in Europe reverse the initial optimism on Monday.

- EUR/USD looks to consolidate the breakout of the 1.1000 mark.

- EMU Flash headline Inflation Rate extends its downward trend in July.

- Germany’s Retail Sales contract 1.6% YoY in June.

The Euro (EUR) is continuing to maintain its recovery against the US Dollar (USD) that began on Friday, which is causing EUR/USD to extend its upward trend after breaking through the important 1.1000 level at the start of the week.

The pair regained momentum after hitting a low of around 1.0940 on Friday as the Greenback was undergoing a corrective move.

Currently, both US and European yields are trading with uncertainty as investors continue digesting last week’s interest rate decisions by the Federal Reserve and the European Central Bank (ECB).

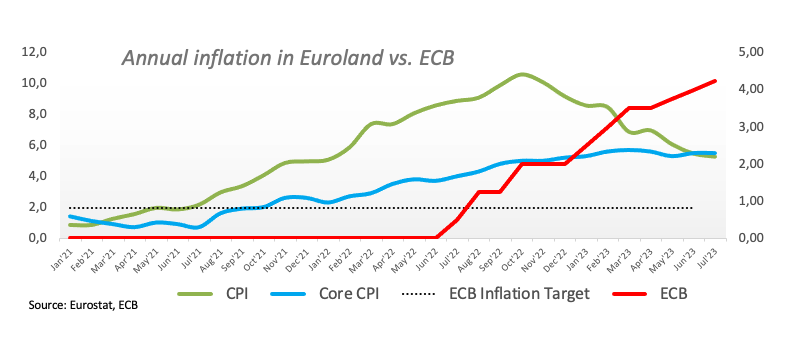

Regarding the ECB, President Christine Lagarde has indicated that the central bank is keeping an “open-minded” approach to the upcoming September meeting and emphasized that the future rate decisions will depend on economic data. Similarly, Fed Chair Jerome Powell has reiterated multiple times that the Fed’s decisions on rates will be data-dependent at the FOMC event on July 26.

In terms of speculative positioning, the net longs in EUR have remained relatively unchanged in the week ending July 25, according to CFTC, which was prior to the FOMC and ECB gatherings. During this time, spot had retreated from yearly highs around 1.1275 (July 18) to the low 1.1000s.

In the Eurozone, Germany’s Retail Sales declined by 1.6% YoY in June, and the Italian Q2 GDP Growth Rate was lower than expected, with a QoQ contraction of 0.3% and YoY expansion of 0.6%. Additionally, preliminary inflation figures in the Euro area show that the Core CPI rose more than anticipated – by 5.5% YoY in July and 5.3% YoY for headline CPI. Finally, the flash Q2 GDP Growth Rate for the bloc shows that the economy expanded by 0.3% QoQ and 0.6% YoY.

There are no significant data releases scheduled in the US docket for Monday.

Daily digest market movers: Euro poised to some consolidation near term

- The EUR picks up pace above the 1.1000 mark vs. the USD.

- The USD Index treads water around 101.70 on Monday.

- EMU flash GDP figures surprise to the upside in Q2.

- Core inflation in the euro area remains sticky.

- US, German yields trade without direction across all maturities.

- The Italian economy is expected to have contracted slightly in Q2.

- Markets’ attention is expected to be on the US labour market this week.

Technical Analysis: Euro looks supported near 1.0940

EUR/USD manages to gather some impulse and extend the bounce off recent lows north of the 1.1000 hurdle so far on Monday.

If bears regain the upper hand, EUR/USD should put the weekly low of 1.0943 (July 28) to the test ahead of a probable move to the transitory 55-day and 100-day SMAs at 1.0908 and 1.0906, respectively. The loss of this region could open the door to a potential visit to the July low of 1.0833 (July 6) ahead of the key 200-day SMA at 1.0723 and the May low of 1.0635 (May 31). South from here emerges the March low of 1.0516 (March 15) before the 2023 low of 1.0481 (January 6).

On the other hand, occasional bullish attempts could motivate the pair to initially dispute the weekly top at 1.1149 (July 27). Above this level the downside pressure could mitigate somewhat and encourage the pair to test the 2023 high at 1.1275 (July 18). Once this level is cleared, there are no resistance levels of significance until the 2022 peak of 1.1495 (February 10), which is closely followed by the round level of 1.1500.

Furthermore, the constructive view of EUR/USD appears unchanged as long as the pair trades above the key 200-day SMA.

German economy FAQs

The German economy has a significant impact on the Euro due to its status as the largest economy within the Eurozone. Germany’s economic performance, its GDP, employment, and inflation, can greatly influence the overall stability and confidence in the Euro. As Germany’s economy strengthens, it can bolster the Euro’s value, while the opposite is true if it weakens. Overall, the German economy plays a crucial role in shaping the Euro’s strength and perception in global markets.

Germany is the largest economy in the Eurozone and therefore an influential actor in the region. During the Eurozone sovereign debt crisis in 2009-12, Germany was pivotal in setting up various stability funds to bail out debtor countries. It took a leadership role in the implementation of the ‘Fiscal Compact’ following the crisis – a set of more stringent rules to manage member states’ finances and punish ‘debt sinners’. Germany spearheaded a culture of ‘Financial Stability’ and the German economic model has been widely used as a blueprint for economic growth by fellow Eurozone members.

Bunds are bonds issued by the German government. Like all bonds they pay holders a regular interest payment, or coupon, followed by the full value of the loan, or principal, at maturity. Because Germany has the largest economy in the Eurozone, Bunds are used as a benchmark for other European government bonds. Long-term Bunds are viewed as a solid, risk-free investment as they are backed by the full faith and credit of the German nation. For this reason they are treated as a safe-haven by investors – gaining in value in times of crisis, whilst falling during periods of prosperity.

German Bund Yields measure the annual return an investor can expect from holding German government bonds, or Bunds. Like other bonds, Bunds pay holders interest at regular intervals, called the ‘coupon’, followed by the full value of the bond at maturity. Whilst the coupon is fixed, the Yield varies as it takes into account changes in the bond’s price, and it is therefore considered a more accurate reflection of return. A decline in the bund’s price raises the coupon as a percentage of the loan, resulting in a higher Yield and vice versa for a rise. This explains why Bund Yields move inversely to prices.

The Bundesbank is the central bank of Germany. It plays a key role in implementing monetary policy within Germany, and central banks in the region more broadly. Its goal is price stability, or keeping inflation low and predictable. It is responsible for ensuring the smooth operation of payment systems in Germany and participates in the oversight of financial institutions. The Bundesbank has a reputation for being conservative, prioritizing the fight against inflation over economic growth. It has been influential in the setup and policy of the European Central Bank (ECB).