291 | +3.162% | 2 Setups

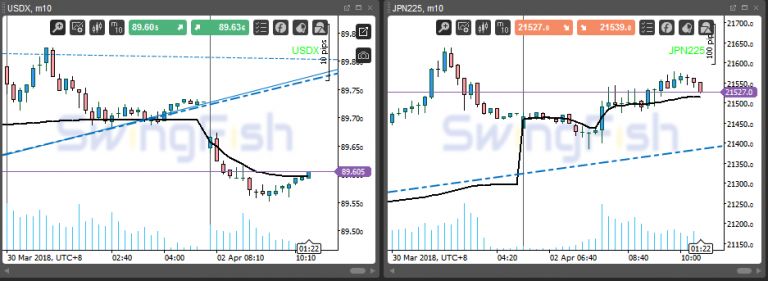

Happy Easter Monday, Volatility is quite interesting, but no direction has pointed out yet. still holding the Hedge from Easter Friday.

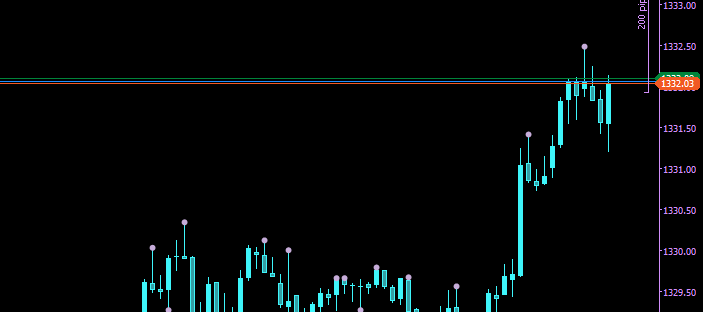

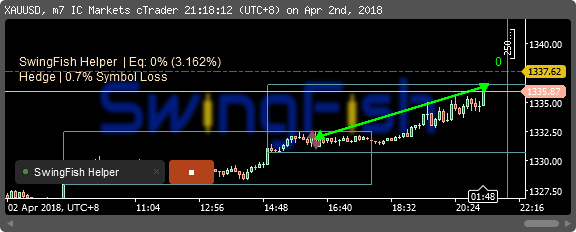

resolving the hedge ended in a total disaster, however, GOLD did finally pointing out a direction. this trade lasted serval hours as volatility is still very thin, but in the end, it paid for the Hedge-loss and added a nice 3.16% to the account.

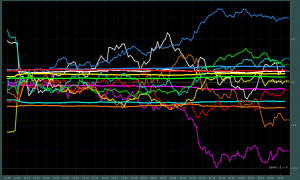

Currency Data:

- Positive: GBP

- Negative: NZD, AUD

- Neutral: USD, CAD, CHF, NZD, USD

- Pair(s) to Watch: -divergence data too thin-

- Asia Session Events: Caixin Manufacturing PMI [CNH], Markit Manufacturing PMI [EUR]

- Bank Holiday: Easter Monday (almost everywhere)

09:40 looks like we are in a bullish day, but I will wait a little bit to have that play out. (this could turn really easy)

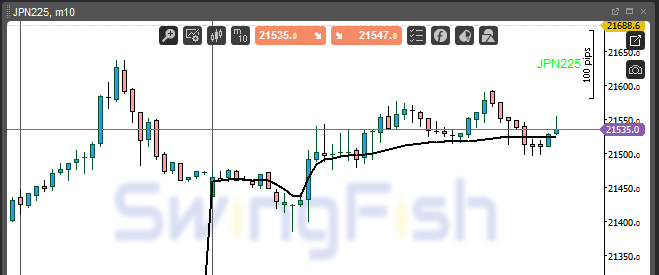

10:45 Reverse Friday-Hedge to Buy on USDJPY

11:25 TP1 was reached, but did not exit, that likely turned out to be a mistake as the Nikkei has trouble staying above the vWap

15:57 closing USDJPY Buy Trades (leaving sell trades open)

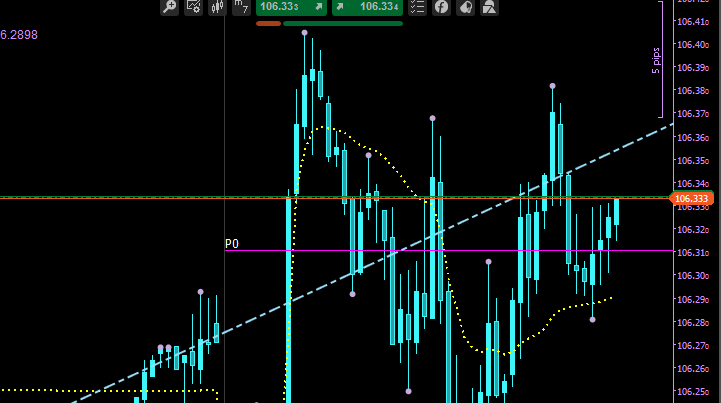

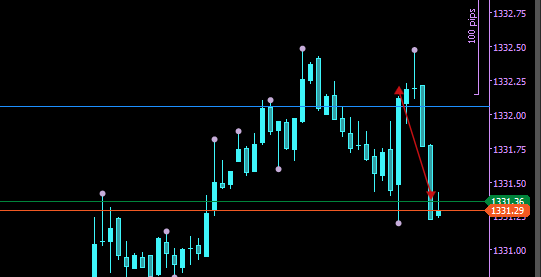

16:18 Buy GOLD [1335.9]

16:26 momentum died quickly, closing GOLD buy with a 0.092% loss.

16:29 re-Buy GOLD

17:10 going to the pool, this is just going nowhere …

21:16 closing all trades with a nice gain.

Total Today: +3.162%