265 | +3.32% | 3 Setups

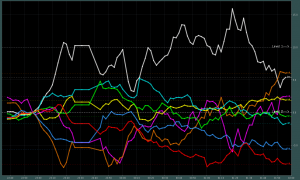

05:58 Good Monday Morning everyone, last Friday had very little to offer, so I thought the Asia Session this Monday may be the same kind of slow, but watching AUD and USD moving I may be wrong. keep in mind, divergence data is still very thin. Currency Data now:

Currency Data now:

- Positive: AUD, JPYÂ Â

- Negative: USD, GBP

- Neutral: EUR, CHF

- Pair(s) to Watch: AUDUSDÂ (Sell), GBPJPYÂ (Sell)

- Asia Session Events:Â PMI China & Japan

- Bank Holiday in Mexico

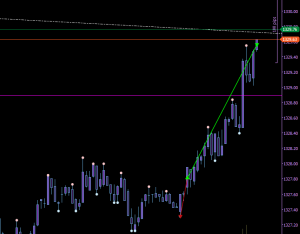

07:52 Buying GOLD

07:53 Price went quickly below, got me a hedge, which I immediately turned into a buy position.

09:05 Closing GOLD BUY as it reached the target, however, 1330.9 as an enhanced target may be possible (will not take this one)

09:18 1330.9 as TP2 was hit as well just a few minutes after (i did not take it, as I had an accident hedge and the setup was not so clear at it is now, so not going for TP2 is alright, expecting the price to fall afterward)

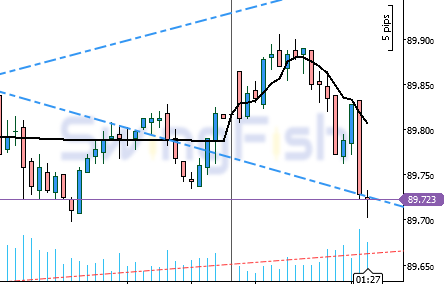

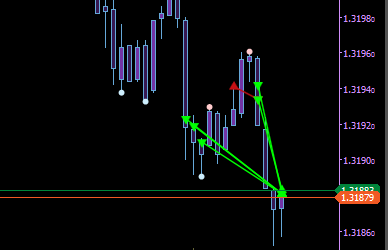

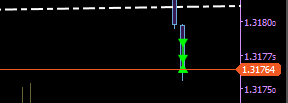

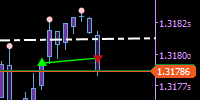

09:36 catching the falling knife on USDSGD for 1.31811

09:52 support on DXY holding, hedging USDSGD

10:12 exiting USDSGD Short early due to DXY hit the resistance line early gaining 1.506%

10:34 some small scalping the breakthrough ..exit early because we do expect a retest. gaining 0.611%

the way down is quite far which would be a massive trade, also DXY does support it.

target would be S2 1.31375

10:41 re Entering USDSGD Short for 1.31176

10:52 manually hedging USDSGD, Nikkei gaining strength and the way down for USD is too far, there may be something in the way i have not seen (yet) .. better play safe

11:14 close USDSGD hedge with a tiny gain

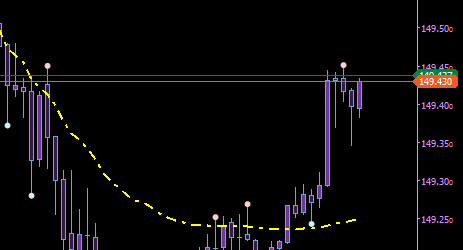

13:31 Buy GBPJPY for 149.66 and 149.757

13:34 releasing hedge on USDSGD for 1.31670

13:58 close USDSGD trades

14:01 original Target on USDSGD reached

14:03 reverse GBPJPY hedge

16:12 closing ALL GBPJPY Positions (almost at the channel top plus the Nikkei is getting weaker, not gonna risk it.

Total Today:+3.32%

Leave a Reply