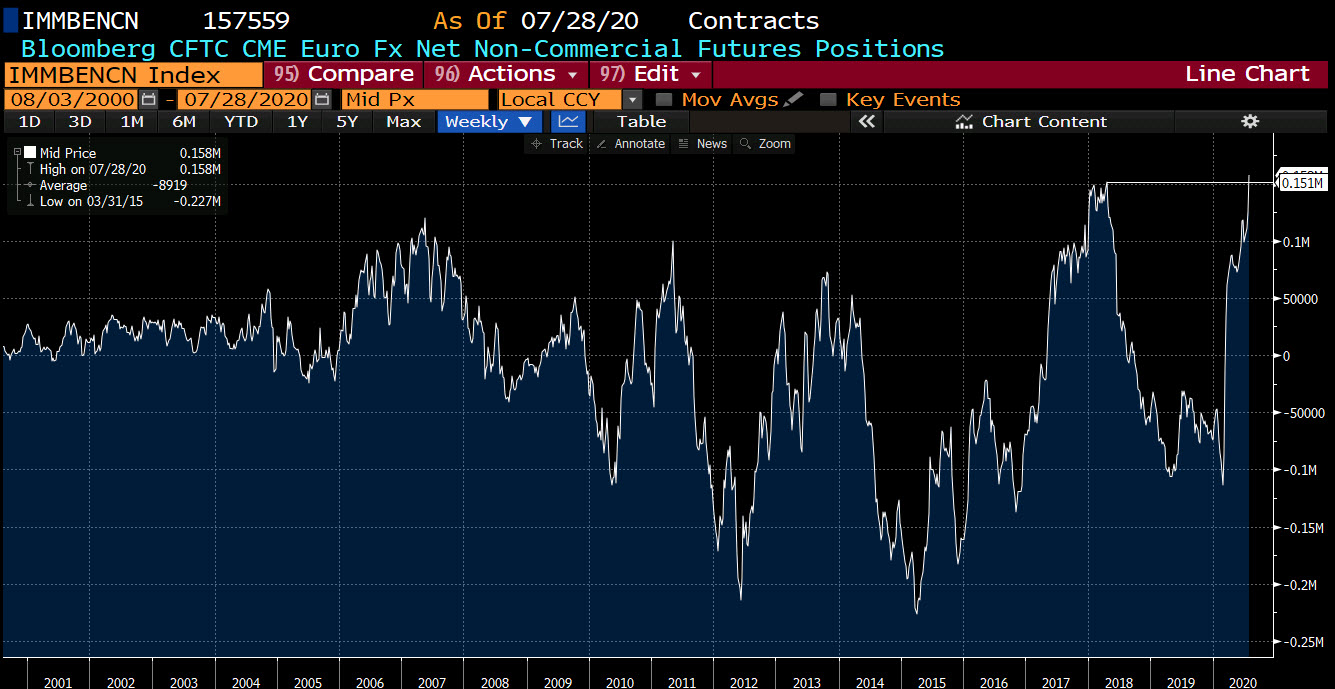

CFTC commitments of traders: EUR longs spike by 32K to a record long level

Read full post at forexlive.com

Read full post at forexlive.com

Weekly FX speculative positioning data from the CFTC

- EUR long 157K vs 125K long last week. Longs increased by 32K

- GBP short 25K vs 15K short last week. Shorts increased by 10K

- JPY long 29K vs 19K long last week. Longs increased by 10K

- CHF long 8K vs 7K long last week. Longs increase by 1K

- AUD -5Kvs 0K long last week. Shorts increased by 5K

- NZD short 1K vs 2K last week. NZD switches from long to short. 3K change

- CAD short 13k vs 17K short last week. Shorts trimmed by 4K

The EUR longs spiked up by 32K to 157K in the current week to a record high for long positions. The move higher is corresponding to higher EURUSD prices. The price of the EURUSD has been up for 6 consecutive weeks. The long position started to move more to the upside during the May 19 week when the position was at 72K.