Articles

Colombia National Jobless Rate increased to 20.2% in July from previous 19.8%

67851 August 31, 2020 23:45 FXStreet Market News

After spending the second half of the previous week under modest bearish pressure, crude oil prices started the new week on a strong footing. As of writing, the barrel of West Texas Intermediate (WTI) was trading near $43.50, gaining 1.25% on a daily basis.

Full ArticleIt’s the best August for markets since 1986

67849 August 31, 2020 23:33 Forexlive Latest News Market News

Records continue to be broken

European stocks have slipped to end the month but the overall picture in August has been remarkably strong. Generally, August is a soft month for equities but not this year as asset prices everywhere have surged.

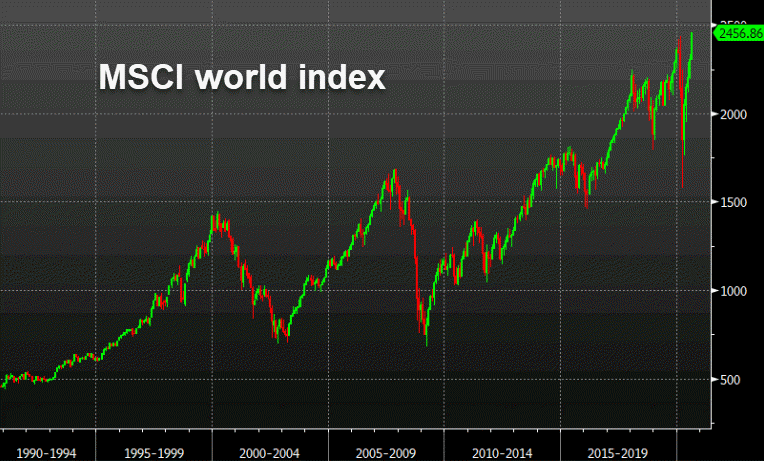

The MSCI World Index of developed markets is up 6.6% this year in the largest August rally since 1986. The All-World index that also includes emerging markets is in its best August since records began in 1988.

On the month:

- S&P 500 +6.8%

- Stoxx 50 +3.7%

- FTSE 100 +1.1%

- CAC 40 +4.1%

- DAX +5.2%

- Nikkei +6.6%

- Hang Seng +2.4%

Full Article

Coronavirus update UK: 1,406 new coronavirus infections confirmed on Monday

67848 August 31, 2020 23:26 FXStreet Market News

There were 1,496 new confirmed coronavirus infections in the UK as of Monday morning, the UK government data showed. This reading followed Sunday’s increase of 1,715.

Further details of the daily report revealed that the total number of fatalities within 28 days of testing positive for COVID-19 rose by 2 to 41,501.

Market reaction

These figures don’t seem to be having a significant impact on the British pound’s performance against its rivals. The GBP/USD pair, which touched a fresh 2020 high of 1.3396 earlier in the day, was last seen gaining 0.2% on the day at 1.3376.

Full ArticleUSD/JPY advances above 106.00 despite broad USD weakness

67847 August 31, 2020 23:17 FXStreet Market News

- USD/JPY continues to erase last week’s losses on Monday.

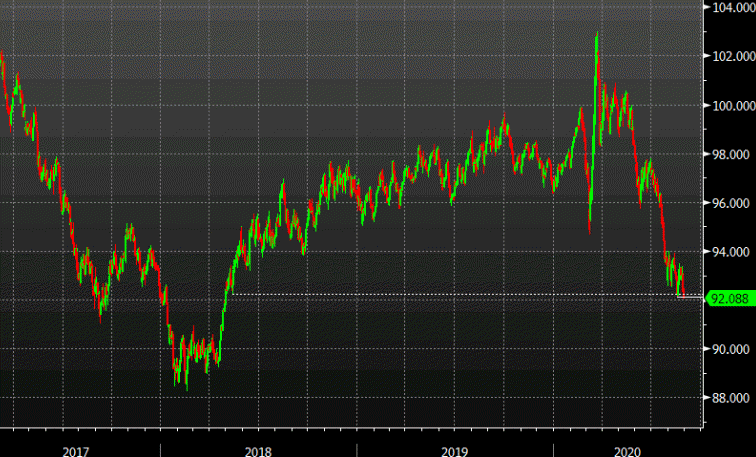

- US Dollar Index slumps to lowest level since April 2018.

- JPY struggles to find demand amid risk flows.

The USD/JPY pair extended its daily advance during the early trading hours of the American session and touched a fresh daily high of 106.10. As of writing, the pair, which lost more than 100 pips on Friday after Japanese Prime Minister Shinzo Abe announced his resignation, was trading near 106.00, gaining 0.6% on a daily basis.

The risk-on market environment on Monday seems to be making it difficult for the safe-haven JPY to find demand. Heightened optimism for an effective coronavirus treatment following the US Food and Drug Administration’s decision to fast-track vaccine approval if benefits outweigh the risks allows the market mood to remain upbeat at the start of the week.

Although the S&P 500 trades flat on the day a little above 3,500, the Nasdaq Composite hit a new all-time high above 12,000 on Monday.

USD selloff continues

On the other hand, the broad-based selling pressure surrounding the greenback seems to be capping the pair’s upside for the time being. After losing nearly 1% last week, the US Dollar Index (DXY) slumped to its lowest level in more than two years at 91.99 on Monday. In the absence of significant fundamental drivers, the USD remains under pressure following the Fed’s shift in policy strategy.

Commenting on the Fed’s decision to target average inflation, “we believe in many circumstances it would be appropriate to aim for a modest overshoot to show inflation can operate on both sides of the goal,” Federal Reserve’s Vice Chairman Richard Clarida explained earlier in the day.

Technical levels to watch for

Full ArticleUSD/CAD tumbles to fresh seven-month lows under 1.3050 as DXY falls to lowest in two years

67846 August 31, 2020 23:17 FXStreet Market News

- USD/CAD extends slide, eyes 1.3000 and December lows at 1.2950.

- DXY about to test 92.00, trading at the lowest since April 2018.

The USD/CAD is falling for the fifth day in a row and during the American session accelerated the decline. The pair dropped to 1.3021, reaching the lowest level since January 2020. As of writing, it trades at 1.3035/40, down 50 pips for the day.

The key driver in the USD/CAD slide continues to be USD weakness. The greenback lost key levels last week after the Federal Reserve announces its new framework.

The US Dollar Index (DXY) is falling 0.35%, trading slightly above 92.00, at the lowest level in two years. Despite losing ground in the G10 space, the greenback is rising versus most emerging market currencies, showing that an improvement in risk appetite is not driving price action.

Technical levels

On the flip side, a consolidation below 1.3025 in USD/CAD would expose the 1.3000 area and below attention would turn to 1.2945/50 (December 2019 / January 2020 lows). Resistance levels are now seen at 1.3075, 1.3130 (Aug 19, 24 & 26 low) and 1.3165. The short-term bearish bias will likely remain intact while below the downtrend line seen today at 1.3150.

Full ArticleDollar slumps into the London fix

67843 August 31, 2020 23:02 Forexlive Latest News Market News

Dollar at the lows of the day

The dollar is being hit particularly hard at the moment into the London fix. The Dollar Index is at its lowest since 2018.

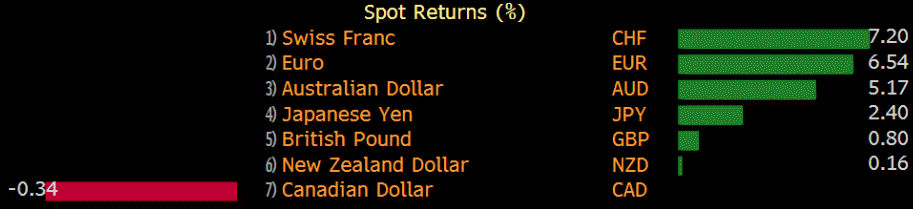

The lone bright spot for the dollar today is against the yen but other wise it’s a miserable day.

Year-to-date, the Canadian dollar is now the only major currency that isn’t in positive territory vs USD and it’s not far from flipping.

ISM Manufacturing PMI Preview: Why only a leap can stop the dollar’s decline

67842 August 31, 2020 23:02 FXStreet Market News

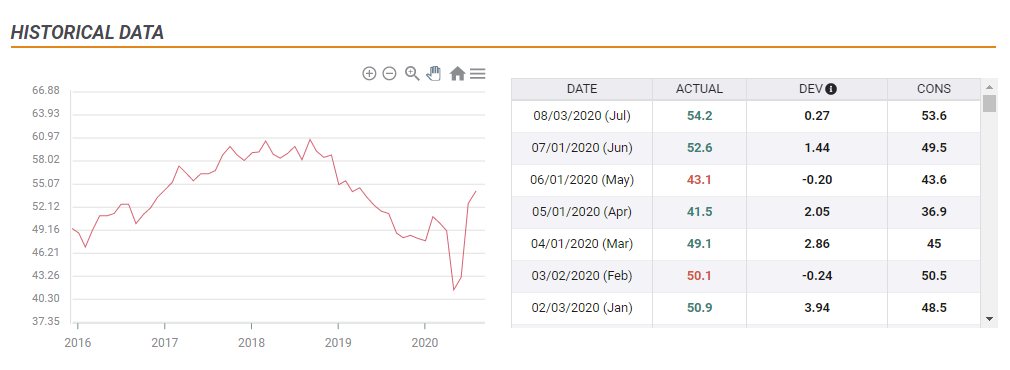

- The ISM Manufacturing PMI is set to continue reflecting moderate growth.

- Dollar selling pressure remains significant after the Fed’s policy shift.

- Contracting employment could add pressure on the greenback.

The industrial sector remains on a recovery path – that what economists expect ISM’s Manufacturing Purchasing Managers’ Index to reflect in its August report. Nevertheless, that may be insufficient to halt the dollar’s decline.

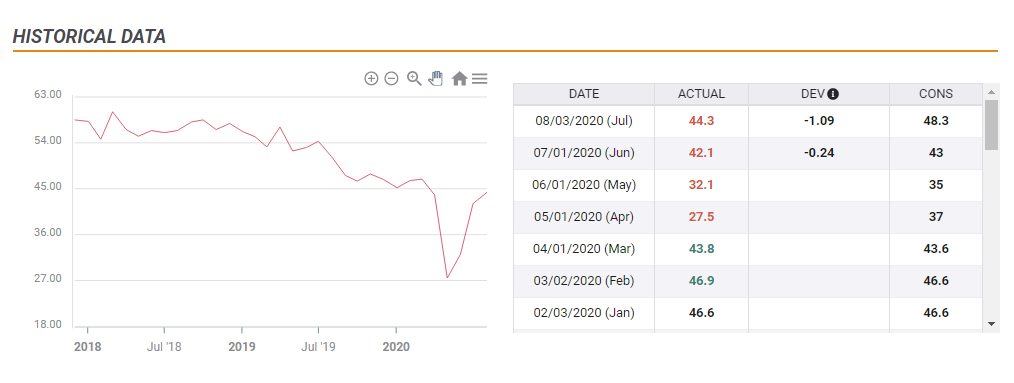

The forward-looking indicator is projected to edge up to 54.5 from 54.2 in July, comfortably above the 50-point threshold that separates expansion from contraction. That would be the third consecutive month of growth after sub-50 scores in March, April, and May, due to coronavirus. However, such a score would also be below a peak of around 60 in 2018.

Apart from serving as a snapshot of sentiment for the manufacturing sector, the survey is also eyed as a clue toward Friday’s jobs report. The Employment component of ISM’s publication is still estimated to fall short of expansion territory – scoring 48.3 points.

This gauge of hiring tumbled considerably more than the headline figure, bottoming at 27.5 in April. It made its way up swiftly but has fallen short of estimates in the past four publications.

Bearish dollar bias

If economists have now turned more pessimistic and the employment component surpasses 50, the dollar has room to rise. It would show that industrial employers are bullish and intend to expand their staff – not only restore jobs. Economists will probably revise their forecasts for Non-Farm Payrolls in that case.

Without a positive flip in hiring, the greenback would depend on the headline. A leap from 54.2 to a score closer to 60 would undoubtedly be upbeat and carry the dollar higher – yet that is highly unlikely.

There is a greater chance that the lapse of several government programs at the end of July has hurt the economy and likely hurt sentiment. The pace of the recovery has been slowing down in recent weeks according to jobless claims and other high-frequency data. A miss on the headline would be adverse for the greenback.

What can traders expect if figures are within estimates? In that case, the bias is against the dollar. The world’s reserve currency has been on the back foot since Federal Reserve Chairman Jerome Powell laid out a dovish policy shift. The Fed will prioritize reaching full employment even at the expense of higher inflation – implying lower rates.

While the change in the central bank’s policy has no immediate policy implications, it is having a substantial influence on markets. The prospects of lower rates for several years are weakening the dollar and the bottom is still out of sight.

Conclusion

The ISM Manufacturing PMI is projected to show overall growth but weak hiring in the industrial sector. Only a return to expansion in employment or a considerable surprise in the headline figure would boost the dollar – and such outcomes seem unlikely as the economy slows.

More Markets are Fed-dependent as ever, reaction to elections could surprise – Interview with Lior Cohen

Full ArticleRBA Preview: AUD/USD to break above 0.74 on a positive statement

67841 August 31, 2020 22:56 FXStreet Market News

The Reserve Bank of Australia (RBA) is having a monetary policy this Tuesday. It seems that the central bank will offer a dovish statement, which will have a limited surprise factor. Meanwhile, the aussie is bullish and poised to break above 0.7400, FXStreet’s Chief Analyst Valeria Bednarik reports.

More – RBA Preview: Five major banks expectations

Key quotes

“The RBA is expected to leave the monetary policy unchanged, keeping the cash rate at a record low of 0.25%. Policymakers are expected to keep conducting market operations to provide liquidity to the banking system.”

“The Australian economy was baring pretty well with the pandemic, until a second wave hit the country, leading to a lockdown in Victoria’s region. On average, the area represents 23% of the total GDP, which means that this latest lockdown will likely imply a steeper setback in growth in Q3.”

“The AUD/USD pair trades firmly above the 0.7300 level, not far from the year high at 0.7380 reached at the beginning of the week. The advance was mostly backed by the broad dollar’s weakness, which persists. In this scenario, a mildly dovish RBA may result in a temporal setback in AUD/USD. However, bulls may take their chances at lower levels, once the dust settles.”

“The AUD/USD pair may turn bearish on a break below the 0.7300 level, but the RBA needs to be a dovish shock for that to happen. The central bank is not expected to be optimistic, but in the case the statement is perceived as positive, there’s room for an advance towards the 0.7400 level and beyond.”

Full ArticleUS: Dallas Fed Manufacturing Business Index improves from -3 to 8 in August

67840 August 31, 2020 22:40 FXStreet Market News

- Dallas Fed’s survey shows slight improvement in Texas’ manufacturing activity in August.

- US Dollar Index extends daily slide, closes in on 92.00.

The economic activity in Texas’ manufacturing sector expanded at a modest pace in August with the General Business Activity Index of the Federal Reserve Bank of Dallas’ Manufacturing Outlook Survey rising to 8 from -3 in July.

Further details of the publication revealed that the Manufacturing Output Index edged lower to 13.1 from 16.1 in July and the Company Outlook Index improved to 16.6 from 5.9.

“Expectations regarding future business activity remained universally positive in July, though some were less positive than last month,” the publication read. “The future production index slipped to 37.2, while the future general business activity index dropped nine points to 10.6.”

Market reaction

The US Dollar Index (DXY) largely ignored this data and continues to push lower. As of writing, the DXY was down 0.2% on the day at 92.11.

Full ArticleUnited States Dallas Fed Manufacturing Business Index increased to 8 in August from previous -3

67839 August 31, 2020 22:35 FXStreet Market News

After spending the second half of the previous week under modest bearish pressure, crude oil prices started the new week on a strong footing. As of writing, the barrel of West Texas Intermediate (WTI) was trading near $43.50, gaining 1.25% on a daily basis.

Full ArticleDallas Fed August manufacturing index +8.0 vs 0.0 expected

67838 August 31, 2020 22:33 Forexlive Latest News Market News

HIGH RISK WARNING: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives, experience level, and risk tolerance. You could lose some or all of your initial investment; do not invest money that you cannot afford to lose. Educate yourself on the risks associated with foreign exchange trading, and seek advice from an independent financial or tax advisor if you have any questions.

ADVISORY WARNING: FOREXLIVE™ provides references and links to selected blogs and other sources of economic and market information as an educational service to its clients and prospects and does not endorse the opinions or recommendations of the blogs or other sources of information. Clients and prospects are advised to carefully consider the opinions and analysis offered in the blogs or other information sources in the context of the client or prospect’s individual analysis and decision making. None of the blogs or other sources of information is to be considered as constituting a track record. Past performance is no guarantee of future results and FOREXLIVE™ specifically advises clients and prospects to carefully review all claims and representations made by advisors, bloggers, money managers and system vendors before investing any funds or opening an account with any Forex dealer. Any news, opinions, research, data, or other information contained within this website is provided as general market commentary and does not constitute investment or trading advice. FOREXLIVE™ expressly disclaims any liability for any lost principal or profits without limitation which may arise directly or indirectly from the use of or reliance on such information. As with all such advisory services, past results are never a guarantee of future results.

Full Article

GBP/USD Price Analysis: Consolidates in a range near mid-1.3300s, bullish bias remains

67837 August 31, 2020 22:33 FXStreet Market News

- GBP/USD struggled for a firm direction and was seen consolidating the recent gains to YTD tops.

- The set-up favours bullish traders and supports prospects for an extension of the upward trajectory.

The GBP/USD pair lacked any firm directional bias and seesawed between tepid gains/minor losses, through the early North American session. The pair was last seen trading around mid-1.3300s, nearly unchanged for the day.

Given Friday’s sustained move beyond the 1.3280-85 supply zone, the range-bound price action on the first day of a new week might still be categorized as a consolidation phase. Bullish technical indicators on 4-hourly/daily charts add credence to the constructive outlook.

This, in turn, favours bullish traders and supports prospects for additional gains amid sustained selling around the US dollar. However, RSI (14) on the mentioned chart remains on the verge of breaking into the overbought territory and warrant some caution for bullish traders.

That said, the pair seems poised to build on its recent strong upward trajectory and aim to reclaim the 1.3400 mark. Some follow-through buying will set the stage for a move towards the key 1.3500 psychological mark en-route December 2019 swing highs, around the 1.3515 level.

On the flip side, any meaningful dip will now be seen as an opportunity for bullish traders. This, in turn, should help limit the downside near the 1.3285-80 resistance breakpoint, which is closely followed by support near the 1.3270-65 region.

-637344809202500915.png)