Articles

Yearn.Finance Price Analysis: YFI/USD touches $38,000 after yet another breakout

67836 August 31, 2020 22:26 FXStreet Market News

- YFI price is currently around $36,000 after a slight rejection from $38,855.

- Bulls are riding the 12-EMA on the 4-hour chart and looking for yet another leg up.

Yearn.Finance has been one of the best-performing assets in the past week reaching $1 billion market capitalization after just weeks of trading. At this point, it’s remarkably difficult to predict the top of YFI as FOMO continues pushing the digital asset up.

YFI/USD 4-hour chart

The 4-hour chart is currently in a strong uptrend defending the 12-EMA and looking for another leg up with some resistance at $36,860 and the all-time high at $38,855. For support, bulls can use $30,000 and $29,689 as well as the last low of $26,900. Anything below this level would represent a downtrend and a clear shift in favor of the bears.

Full ArticleEUR/USD: To 1.25, USD/JPY: to 100 in the next year – SocGen

67834 August 31, 2020 22:17 Forexlive Latest News Market News

New forecasts from Societe General

“Our updated forecasts reflect our concern that EUR/USD in

particular, has gone too far too fast, but it seems clear to us that we

are at the start of a multi-year period of dollar decline, from very

elevated levels,” SocGen notes.

“The yen still can’t fall far

and is doing its job: ready to rally if global equities correct, doing

little while they go up…A sterling short squeeze has dragged EUR/GBP

below 0.90 but we doubt it can hold here for long, even if the outlook

is still for the real trade-weighted index to bump along the bottom,”

SocGen adds.

Full Article

S&P 500 Index posts small losses near 3,500 following last week’s impressive rally

67832 August 31, 2020 22:12 FXStreet Market News

- Wall Street’s main indexes started the week on a mixed note.

- S&P 500 Index struggles to push higher above 3,500.

- Energy shares underperform in early trade on Monday.

The S&P 500 Index, which gained 3.25% last week, opened flat on Monday and was last seen posting small daily losses at 3,501. Meanwhile, the Dow Jones Industrial Average is down 0.57% on the day at 28,487 and the Nasdaq Composite is gaining 0.45% at 12,050.

In August, the S&P 500 is up more than 7% and profit-taking on the last day of the month could make it difficult for Wall Street’s main indexes to continue to push higher.

Among the 11 major S&P 500 sectors, the Utilities Index is up 0.5% in the early trade. On the other hand, the Energy Index is down 1.85%. Meanwhile, the rate-sensitive Financials Index is losing around 1% pressured by a 1.5% decline in the 10-year US Treasury bond yield.

There won’t be any significant macroeconomic data releases from the US in the remainder of the day and the market action is likely to remain choppy.

S&P 500 chart (daily)

Full ArticleRBA Preview: Five major banks expectations

67831 August 31, 2020 22:09 FXStreet Market News

The Reserve Bank of Australia (RBA) will announce its Interest Rate Decision on 1 September at 04:30 GMT. The market consensus is for the RBA to stay on hold and as we get closer to the release time, here are the expectations forecast by the economists and researchers of five major banks regarding the upcoming central bank’s meeting.

More – RBA Preview: No changes to leave AUD/USD at 0.74 – TDS

Standard Chartered

“We expect the RBA to keep the policy cash rate at the floor of 0.25% at its September meeting. The central bank announced a slew of policy measures in an intermeeting announcement in mid-March, reducing the policy cash rate to the 0.25% floor, and announcing QE, yield curve control (YCC) and a term funding facility. The RBA’s YCC has worked well in anchoring 3Y interest rates; it restarted bond purchases in August, to provide further monetary easing after the re-imposition of lockdowns in Melbourne. We believe the hurdle for further rate cuts or a modification of YCC is high; the success of its YCC measures would enable the RBA to stay on the sidelines in the near-term.”

Westpac

“The RBA is expected to keep policy settings unchanged at its September meeting. The Bank is providing support to the economy through a range of stimulus policies and will continue to do so for the foreseeable future. The key elements have been: 1) lowering the cash rate to 0.25%; 2) targeting the 3-year government bond rate at 0.25%; 3) market operations, as needed, to provide ample liquidity to the banking system; 4) a Term Funding Facility for the banking system providing 3-year funding at 0.25%; and 5) Setting the rate paid on Exchange Settlement balances at the RBA at 10bps. Persistently poor economic outcomes – growth well below trend, high unemployment, and inflation below the bank’s 2–3% target – mean the RBA will need to maintain these policies for an extended period and may come under pressure to do more in the future. For now, though the bank is of the view that monetary policy is doing ‘what it can’.”

ING

“We expect the RBA meeting to be – in line with market expectations – a relatively unremarkable event as we expect no change to the cash rate target of 0.25%. The Bank is likely in a good spot in terms of the monetary stimulus that has already been deployed to assist the fiscal efforts against the pandemic shock. The fall-out of the lockdown in Victoria will likely be in focus and Governor Lowe may once again highlight the serious economic damage for the whole country. The lack of hard data to back any policy shift suggests a wait-and-see approach should prevail, but more downbeat comments on the economic recovery prospects may deliver a short-lived negative impact on AUD.”

TDS

“The RBA Meeting should pass without any major surprises. The Bank is likely to assert that uncertainties remain high especially in light of the Covid-19 developments in Victoria. The RBA noted the downturn is not as severe as earlier expected and a recovery is underway in most of Australia. We expect the RBA to indicate this still remains the case.”

Citibank

“Citi’s cash rate forecast: 0.25%. We expect the statement to point to heightened uncertainty and downside risks, particularly in relation to the Melbourne lockdown. We also expect the RRBA to increase its bond purchases for the first time since May.”

Full ArticleGold Price Analysis: XAU/USD moves back above $1970 level, closer to session tops

67827 August 31, 2020 21:56 FXStreet Market News

- Sustained USD selling bias extended some support to the dollar-denominated commodity.

- A turnaround in the risk sentiment provided a modest lift to the safe-haven precious metal.

- The uptick lacked any strong follow-through, warranting some caution for bullish traders.

Gold reversed an intraday dip to the $1954 area and might now be headed back towards the top end of its daily trading range.

The selling bias around the US dollar remained unabated on the first day of a new trading week. This, in turn, was seen as a key factor that extended some support to the dollar-denominated commodity and helped limit the early downtick.

The early optimism over better-than-expected Chinese PMI prints for August faded rather quickly. This was evident from a sharp turnaround in the global risk sentiment, which further underpinned the precious metal’s safe-haven status.

The anti-risk flow was reinforced by a modest intraday pullback in the US Treasury bond yields. This comes on the back of the Fed Chair Jerome Powell’s dovish comments last week and further benefitted the non-yielding yellow metal.

Despite the supporting factors, the uptick lacked any strong follow-through and warrants some caution for bullish traders. This makes it prudent to wait for a sustained strength beyond the $1976-77 supply zone before positioning for any further positive move.

Technical levels to watch

Full ArticleFed’s Clarida: Yield curve control is not something we are about to deploy

67826 August 31, 2020 21:56 FXStreet Market News

Regarding the possible deployment of yield curve control, Federal Reserve’s Vice Chairman Richard Clarida said that it was in the tool kit but reiterated that it wasn’t something that they were looking at at the moment. “There’s potentially a place for it but it is most robustly a complement to forward guidance and large scale asset purchase programs,” Clarida explained.

Additional takeaways

“We believe in many circumstances it would be appropriate to aim for a modest overshoot to show inflation can operate on both sides of the goal.”

“We don’t think this is the time to revisit the history of 2%.”

“FOMC will continue to survey participants’ views on long-run growth and employment four times a year.”

“Fed did achieve 2% inflation as recently as two years ago.”

“Likely that discussion of other tools will now resume with the conclusion of framework review.”

“Threshold-based guidance is in the tool kit and potentially has a role.”

“I would image we will be returning to a discussion of our guidance.”

“Inflation expectations are critical to policy but they are unobserved.”

“International factors are crucial and are very relevant to the discussion.”

“There is global downward pressure on riskless rates.”

“There are very powerful global disinflationary forces.”

Market reaction

The US Dollar Index edged slightly higher in the last minutes and turned flat on the day near 92.30.

Full ArticleReserve Bank of Australia Preview: A dovish stance won’t be a shock

67824 August 31, 2020 21:49 FXStreet Market News

- The RBA is expected to maintain its monetary policy unchanged, the focus will be on growth.

- Victoria’s lockdown will likely result in a steeper contraction in Q3.

- AUD/USD bullish and poised to break above 0.7400.

The Reserve Bank of Australia is having a monetary policy this Tuesday, September 1st. A bit too early in the month, and ahead of Australian Q2 GDP which will be out on Wednesday. The economy is expected to have contracted 6.0% in the three months to June, following a -0.3% reading in Q1.

Still, the central bank is expected to leave the monetary policy unchanged, keeping the cash rate at a record low of 0.25%. Policymakers are expected to keep conducting market operations to provide liquidity to the banking system. Lowe & Co. have pledged not to change rates “until progress is being made towards full employment, and it is confident that inflation will be sustainably within the 2–3% target band.”

Australia entering technical recession

The Australian economy was baring pretty well with the pandemic, until a second wave hit the country, leading to a lockdown in Victoria’s region. On average, the area represents 23% of the total GDP, which means that this latest lockdown will likely imply a steeper setback in growth in Q3.

Meanwhile, the RBA has estimated that the unemployment rate would likely approach 10% by the end of the year. According to the latest available data, the unemployment rate hit 7.5% in July, slightly better than the 7.8% expected, while the participation rate was up, somehow indicating that the sector is in better shape than previously estimated. Seems unlikely, however, that policymakers may change their cautious stance on employment. They could acknowledge that the country entered a technical recession. Overall, it seems that the central bank will offer a dovish statement, which will have a limited surprise factor.

AUD/USD possible scenarios

The AUD/USD pair trades firmly above the 0.7300 level, not far from the year high at 0.7380 reached at the beginning of the week. The advance was mostly backed by the broad dollar’s weakness, which persists. In this scenario, a mildly dovish RBA may result in a temporal setback in AUD/USD. However, bulls may take their chances at lower levels, once the dust settles.

The pair may turn bearish on a break below the 0.7300 level, but the RBA needs to be a dovish shock for that to happen. The central bank is not expected to be optimistic, but in the case the statement is perceived as positive, there’s room for an advance towards the 0.7400 level and beyond.

Full ArticleChainlink Market Update: LINK jumps into a DeFi boom bandwagon

67823 August 31, 2020 21:45 FXStreet Market News

- Chainlink regains ground after the initial sell-off to $16.00.

- The recovery is driven by a massive boom in the DeFi industry.

Chainlink has recovered after the sell-off to $16.00; however, it still has some way to go to the recent top of $17.74. At the time of writing, LINK/USD is changing hands at $16.51, down nearly 5% on a day-to-day basis and unchanged since the beginning of Monday. Chainlink is now the fifth-largest digital asset with the current market capitalization of $5.68 billion, while its average daily trading volume exceeds $1.5 billion.

Chainlink’s LINK more than doubled in value in August. The coin started the last summer month at $7.70 and hit the all-time high at $20.00 on August 21 before the downside correction pushed the price to $16.00. Chainlink is one of the beneficiaries of the boom in the decentralized finance (DeFi) industry as it provides the infrastructure for DeFi protocols.

Recently, the team purchased DECO, the solution for private oracles developed by Cornell University. According to the press release, the acquisition will allow the project to expand its functionality to DeFi industry.

DECO improves the HTTPS/TLS usage for data transmission across the internet. The solution has been developed by Dr. Ari Juels, the former Chief Scientist of RSA, who will join Chainlink Lab as its new Chief Scientist. Commenting the news, Chainlink’s co-founder Sergey Nazarov, said:

DECO’s ability to provide previously unavailable data security when transferring data over the internet, will greatly increase the private and premium data that becomes available for use by all Web 2.0 and Web 3.0 applications.

Basically, DECO will guaranty that the data remains private while it is transmitted via various channels from private and premium data sources. The solution ensures a high-security level due to advanced cryptography and zero-knowledge proofs technology.

LINK/USD: The technical picture

On the intraday charts, the local resistance for LINK/USD is created by 1-hour SMA50 at $16.70, followed by $17.00. A sustainable move above this area will allow for an extended recovery towards $17.40 created by the upper line of the 1-hour Bollinger Band and the weekend high of $17.74. On the downside, the local psychological support of $16.00 is followed by 1-hour SMA100 at $15.80 and 1-hour SMA200 at $15.40. Once this area is passed, $15.00 will come into focus.

LINK/USD 1-hour chart

Full ArticleAUD/USD turns flat near 0.7370 ahead of RBA’s policy announcements

67822 August 31, 2020 21:45 FXStreet Market News

- AUD/USD pared early losses and turned flat near 0.7370.

- US Dollar Index continues to edge lower toward 92.00.

- RBA is widely expected to keep its policy rate unchanged.

The AUD/USD pair climbed to its highest level since December 2018 at 0.7382 during the Asian trading hours on Monday but struggled to preserve its bullish momentum. After retreating to 0.7340 area, however, the pair erased its losses and was last seen trading flat on the day at 0.7367.

Focus shifts to RBA

The broad-based USD weakness remains unabated at the start of the week. The US Dollar Index (DXY), which lost nearly 1% last week following the Fed’s policy shift, touched its lowest level in more than 10 days at 92.15 on Monday. Nevertheless, the lack of fundamental drivers doesn’t allow the DXY to make sharp movements in either direction.

During the early trading hours of the Asian session on Tuesday, the Reserve Bank of Australia (RBA) will publish its policy statement and announce its interest rate decision.

TD Securities analysts think that the RBA is likely to adopt a neutral stance with regards to policy outlook and expect AUD/USD to continue to move sideways 0.7400.

“The Bank is likely to indicate that the downturn has not been as bad as initially feared but for the recovery to be ‘uneven and bumpy’. We anticipate the Bank is likely to indicate it’s content with current policy settings,” analysts explained. “With the Victorian Premier indicating a roadmap to exit lockdown to be detailed on 6 Sep, this should be news the RBA would welcome, reinforcing no need for the RBA to shift its current stance.”

Technical levels to watch for

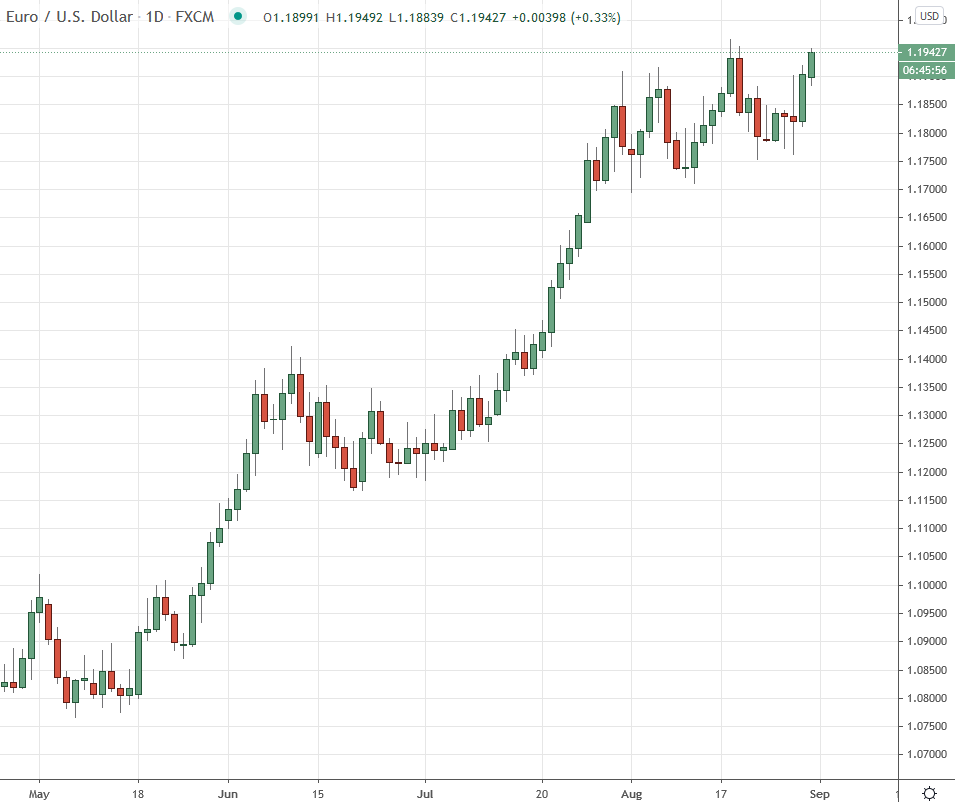

Full ArticleEUR/USD firmer near 1.1950 on USD-selling

67821 August 31, 2020 21:40 FXStreet Market News

- EUR/USD picks up extra pace and approaches 1.1950.

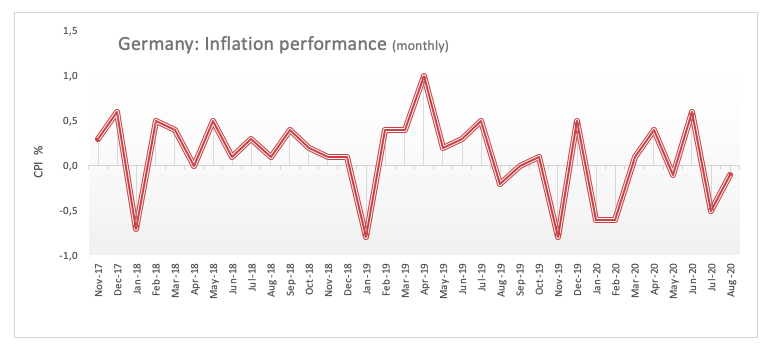

- German flash CPI came in at -0.1% MoM and 0.0% YoY.

- Fedspeak, Dallas fed index next on tap in the US calendar.

The upbeat tone in the European currency keeps pushing higher and lifts EUR/USD to the mid-1.1900s, or fresh daily highs, at the beginning of the week.

EUR/USD boosted by USD-weakness

EUR/USD is navigating the area of multi-day highs near 1.1950, starting the week on a positive note and always on the back of the generalized selling pressure hitting the greenback.

In the euro docket, German flash inflation figures measured by the CPI showed consumer prices are seen contracting 0.1% MoM and coming in flat on a year to August. Earlier, the Italian economy sunk nearly 13% QoQ during the second quarter and almost 18% on an annualized basis.

What to look for around EUR

EUR/USD broke above the multi-day rangebound theme last week and managed to regain the 1.19 mark and above, where it is now attempting to consolidate. The July-August rally, while largely triggered by broad-based dollar-selling and improved sentiment in the risk-associated universe, found extra sustain in auspicious results from domestic fundamentals – which have been in turn supporting further the view of a strong economic recovery following the coronavirus crisis – as well as US-China trade headlines. Also lending wings to the momentum around the euro appear the deal on the European Recovery Fund – which helped putting political fears within the bloc to rest (for now) – and the solid position of the current account in the region.

EUR/USD levels to watch

At the moment, the pair is up 0.29% at 1.1937 and a move above 1.1965 (2020 high Aug.18) would target 1.1996 (high May 14 2018) en route to 1.2032 (23.6% Fibo of the 2017-2018 rally). On the other hand, the next support is located at 1.1772 (weekly low Aug.26) seconded by 1.1754 (weekly low Aug.21) and finally 1.1695 (monthly low Aug.3).

Full ArticleEUR/USD poised to challenge the year high

67820 August 31, 2020 21:35 FXStreet Market News

The EUR/USD pair is up this Monday, trading not far below a daily high of 1.1940. The dollar remains weak as is only up against the JPY, which left the doors opened for fresh yearly highs in EUR/USD, FXStreet’s Chief Analyst Valeria Bednarik reports.

Key quotes

“Market players are optimistic amid upbeat Chinese data released at the beginning of the day, alongside news indicating that the country has given a local coronavirus vaccine an emergency approval and started using it.”

“The shared currency remains strong, despite the preliminary estimate of August German inflation missed expectations. The annual reading came in at -0.1%, while the monthly CPI printed at -0.2%. Ahead of Wall Street’s opening, Fed’s vice-chair Clarida is offering a speech, while the country will later publish the Dallas Fed Manufacturing Business Index for August, previously at -3.”

“The short-term picture is bullish, as, in the 4-hour chart, the pair is developing well above all of its moving averages. The 20 SMA is advancing above the 100 SMA, reflecting the increasing buying interest. Technical indicators, in the meantime, resumed their advances, maintaining their bullish slopes near overbought readings.”

Full ArticleS&P 500 edges lower at the open

67819 August 31, 2020 21:33 Forexlive Latest News Market News

No surprise

The S&P 500 is down 1 point to 3506 to start the week. There are several reports of brokerages down.

Shares of Apple and Tesla are slightly higher post-split. Those will be the ones to watch today.

Full Article

-637344806048859713.png)

-637344780072737250.png)