Articles

US stocks set for a small decline as a blockbuster month winds down

67817 August 31, 2020 21:21 Forexlive Latest News Market News

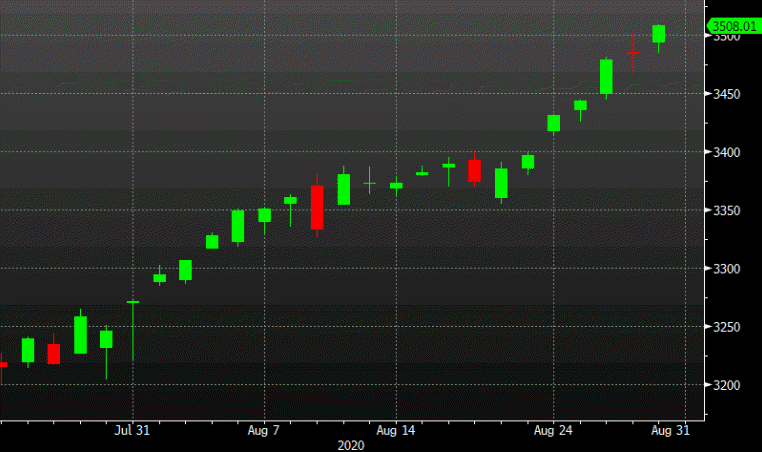

Stocks have been a one-way market

S&P 500 futures point to a 3 point decline after the open after Friday’s 23-point gain.

So far this month, there have only been four negative days for the S&P 500 (and two of those were less than 0.25%). If the index can score a win, that would put the percentage of days this month with gains at 82%.

The stocks to watch today are Tesla and Apple, which are both trading split-adjusted. TSLA jumped in the premarket initially but has given it all back.

Full Article

EUR/GBP holds steady above mid-0.8900s, moves little post-German CPI

67816 August 31, 2020 21:21 FXStreet Market News

- EUR/GBP witnessed some short-covering bounce and moved away from near two-month lows.

- A goodish pickup in demand for the shared currency was seen as a key factor behind the move.

- A subdued GBP price action did little to influence or hinder the pair’s intraday positive momentum.

The EUR/GBP cross added to its intraday gains and refreshed daily tops, around the 0.8965 region during the mid-European session.

The cross managed to find some support ahead of the 0.8900 mark and witnessed a short-covering bounce on the first day of a new trading week. The momentum assisted the EUR/GBP cross to erase the previous session’s slide to two-month lows and was sponsored by a goodish pickup in demand for the shared currency.

The offered tone surrounding the USD continued lending some support to the euro, which seemed rather unaffected by Monday’s softer German consumer inflation figures. According to the flash estimates, the headline German CPI unexpectedly fell 0.1% MoM in August and remained flat as compared to a year earlier.

On the other hand, the British pound was seen consolidating its recent strong gains against its American counterpart and did little to influence the EUR/GBP cross. The BoE Governor Andrew Bailey’s dovish comments on Friday turned out to be one of the key factors that kept the GBP bulls on the defensive.

Bailey said the UK central bank has more ammunition to support the economy from its coronavirus shock and also supported the possibility of negative interest rates. This comes amid concerns about the lack of progress in Brexit talks, which remained supportive of the EUR/GBP pair’s move back above mid-0.8900s.

The mentioned region coincides with 100-hour SMA and some follow-through buying should pave the way for additional gains. The EUR/GBP cross might then aim back to reclaim the key 0.9000 psychological mark, though the momentum runs the risk of fizzling out rather quickly.

Technical levels to watch

Full ArticleEthereum Price Analysis: ETH/USD reaches $437, inches away from a new 2020-high

67815 August 31, 2020 21:09 FXStreet Market News

- Ethereum price is currently around $437 after a notable breakout on August 30.

- Bulls are enjoying a free ride to the upside with very little resistance.

Ethereum suffered an extended consolidation period dropping even below $370 at one point. Eventually, bulls managed to hold a double bottom and bounce back up with a notable breakout above $400 and good continuation.

ETH/USD 1-hour chart

Bulls have been riding the 12-EMA since August 28 when the hourly chart flipped in favor of the buyers. There have been a few spikes down to the 26-EMA but they were defended. Currently, Ethereum price is way above both EMAs and will encounter very little resistance until the 2020-high at $447 and $450.

Full ArticleFed’s Clarida: Negative rates not seen as attractive policy for US

67814 August 31, 2020 21:09 FXStreet Market News

The Federal Reserve’s new framework is not a judgement that the previous strategy was ineffective but that low underlying interest rates, other changes to economy required a new approach, Federal Reserve’s Vice Chairman Richard Clarida said on Monday.

Additional takeaways

“Those changes meant US faced more risks of weak prices, higher unemployment in recessions.”

“By late in the last expansion data showed employment and wages could rise without inflation.”

“New language on employment means a low unemployment rate “by itself” and in the absence of inflation will not be a sufficient trigger for a rate hike.”

“New language keying Fed to shortfalls of employment a robust evolution in the Fed’s approach.”

“Change in employment language shows that macro models have been wrong and that rate hikes in the absence of inflation are difficult to justify.”

“Fed debate on new policy included a healthy range of views.”

“Fed policymakers broadly agreed that the economy had changed so much in recent years that the fed’s approach needed to change as well.”

“New goal of average 2% inflation over time represents aspiration and does not tether policy to any formula or rule.”

“Forward guidance and large scale asset purchases “have been and continue to be effective ways to support the economy.”

“Negative rates not seen as attractive policy for US.”

“Yield curve control seen providing only modest benefits assuming credible forward guidance and asset purchases.”

Yield curve control could be reassessed in the future if conditions change markedly.”

“Now that new strategy document has been ratified fed can study possible refinements to its quarterly dot plot projections with aim of deciding on any changes by end of the year.”

Market reaction

The US Dollar Index showed no reaction to these comments and was last seen losing 0.07% on the day at 92.23.

Full ArticleEUR/USD Forecast: Poised to challenge the 1.1965 year high

67810 August 31, 2020 21:05 FXStreet Market News

EUR/USD Current Price: 1.1936

- German August inflation missed the market’s expectations according to preliminary estimates.

- The sentiment improved during Asian trading hours, the dollar remains weak.

- EUR/USD bullish in the short-term and poised to challenge the year high.

The EUR/USD pair is up this Monday, trading not far below a daily high of 1.1940. Market players are optimistic amid upbeat Chinese data released at the beginning of the day, alongside news indicating that the country has given a local coronavirus vaccine an emergency approval and started using it.

The shared currency remains strong, despite the preliminary estimate of August German inflation missed expectations. The annual reading came in at -0.1%, while the monthly CPI printed at -0.2%. Ahead of Wall Street’s opening, Fed’s vice-chair Clarida is offering a speech, while the country will later publish the Dallas Fed Manufacturing Business Index for August, previously at -3.

EUR/USD short-term technical outlook

The greenback is only up against the JPY, mostly weak, which left the doors opened for fresh yearly highs in EUR/USD. The short-term picture is bullish, as, in the 4-hour chart, the pair is developing well above all of its moving averages. The 20 SMA is advancing above the 100 SMA, reflecting the increasing buying interest. Technical indicators, in the meantime, resumed their advances, maintaining their bullish slopes near overbought readings.

Support levels: 1.1905 1.1870 1.1825

Resistance levels: 1.1965 1.2010 1.2050

View Live Chart for the EUR/USD

Full ArticleChile Industrial Production (YoY) declined to -3.3% in July from previous -2.6%

67809 August 31, 2020 21:05 FXStreet Market News

After spending the second half of the previous week under modest bearish pressure, crude oil prices started the new week on a strong footing. As of writing, the barrel of West Texas Intermediate (WTI) was trading near $43.50, gaining 1.25% on a daily basis.

Full ArticleNikkei 225 closes higher by 1.12% at 23,139.76

67807 August 31, 2020 21:02 Forexlive Latest News Market News

Asian equities climb to start the week

But the mood has been slightly tempered with going into the closing stages, with gains losing steam a little. That said, the performance on the day is solid – especially for Japanese stocks after the beating last Friday due to Abe’s resignation.

The Hang Seng and Shanghai Composite are both up by 0.6% currently, while US futures are seen up by ~0.4% as we look towards European trading.

The yen is seen slightly weaker to start the week, with USD/JPY now up by 0.2% to 105.62 but gains remain more measured and sellers are still in near-term control.

Canada Industrial Product Price (MoM) meets expectations (0.7%) in July

67806 August 31, 2020 21:02 FXStreet Market News

After spending the second half of the previous week under modest bearish pressure, crude oil prices started the new week on a strong footing. As of writing, the barrel of West Texas Intermediate (WTI) was trading near $43.50, gaining 1.25% on a daily basis.

Full ArticleCanada Industrial Product Price (MoM) registered at 7% above expectations (0.7%) in July

67805 August 31, 2020 21:02 FXStreet Market News

After spending the second half of the previous week under modest bearish pressure, crude oil prices started the new week on a strong footing. As of writing, the barrel of West Texas Intermediate (WTI) was trading near $43.50, gaining 1.25% on a daily basis.

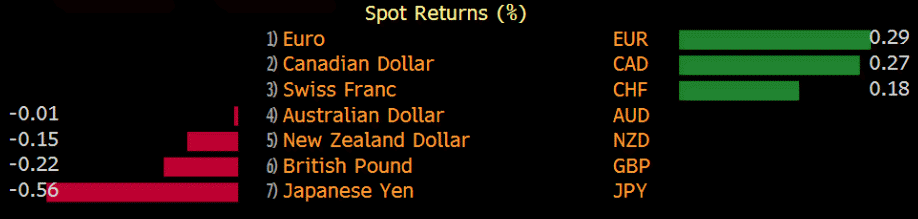

Full ArticleEuro and Canadian dollar top the leaderboard to start the day

67803 August 31, 2020 20:56 Forexlive Latest News Market News

Yen struggles

Warren Buffett’s investment into Japan isn’t giving any time of lift to the yen, which is struggling as August winds down.

At the top of the list are the euro and Canadian dollar. EUR/JPY is up 109 pips to 126.48.

It’s a big week for news and data that culminates in non-farm payrolls on Friday. We will get comments from the Fed vice-chair Clarida at the top of the hour.

Full Article

ECB’s Schnabel: Post-review ECB inflation aim should maintain a medium-term perspective

67802 August 31, 2020 20:45 FXStreet Market News

The European Central Bank (ECB) is “not too worried” over forex developments, Isabel Schnabel, Member of the Executive Board of the ECB, told Reuters on Monday.

Additional takeaways

“Eurozone economy performing according to ECB’s baseline forecast.”

“No need to adjust policy if the economy performs according to baseline; PEPP size appropriate in the current situation.”

“As the risk of fragmentation recedes, the need to deviate from the capital key is also reduced.”

“Post-review ECB inflation aim should maintain a medium-term perspective, must be simple to communicate.”

“Joint EU debt issuance on its own does not justify increase in PEPP.”

“Time has not yet come to adjust the tiering multiplier.”

“May have to revise plans to meet in person on September 10th.”

Market reaction

The EUR/USD edged slightly lower in the last minutes and was last seen gaining 0.25% on the day at 1.1932.

Full ArticleBitcoin Price Prediction: BTC/USD is poised for a short-term growth — Confluence Detector

67801 August 31, 2020 20:40 FXStreet Market News

- BTC/USD has been moving within a short-term bullish trend since August 27

- The technical picture implies that the upside momentum may gain traction.

Bitcoin (BTC) hit the intraday high at $11,713 and retreated below has settled above $11,700 on Monday. The first digital asset has been on recovery track from August 27, when it hit the recent bottom of $11,227. At the time of writing, BTC/USD is changing hands at $11,680, mostly unchanged both on a day-to-day basis and since the beginning of the day. Bitcoin’s dominance index dropped to 57.8% amid the strong growth of smaller cap coins.

BTC/USD 1-hour chart

On the intraday charts, BTC/USD has been moving within an upside-looking Bollinger Band with the local support created by its lower boundary and 1-hour SMA50 at $11,595. The short-term trend remains bullish as long as the price stays above this technical barrier. However, once it is broken, the sell-off may be extended to $11,500, which is reinforced by 1-hour SMA100. On the upside, a sustainable move above $11,700 is needed for the recovery to gain traction.

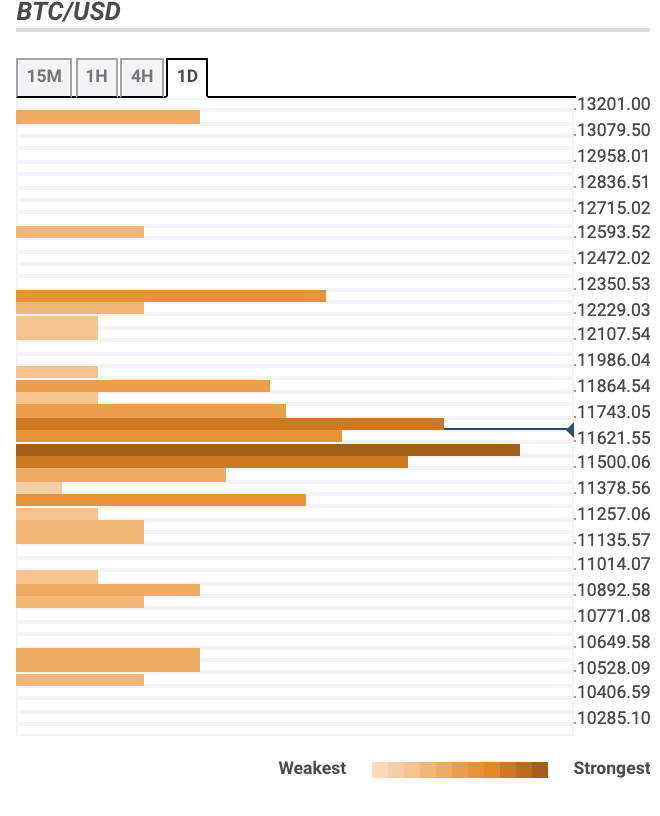

Bitcoin confluence levels

The vast majority of technical barriers are clustered both below the current price, which means the price may be better positioned for further recovery. Let’s have a closer look at support and resistance levels for BTC/USD.

Resistance levels

$11,700 – the middle lines of the 1-hour and daily Bollinger Bands, 23.6% Fibo retracement daily

$11,850 – the highest level of the previous week, Pivot Point 1-week Resistance 1

$12,300 – Pivot Point 1-month Resistance 1, 161.8% Fibo projection weekly

Support levels

$11,5000 – 1-hour SMA100 and SMA200, 4-hour SMA50, 61.8% Fibo retracement weekly, the middle line of the 4-hour Bollinger Band

$11,300 – 23.6% Fibo retracement weekly, 161.8% Fibo projection daily, Pivot POint 1-day Support 3

$11,000 – daily SMA50

-637344761215315630.png)

-637344742575968832.png)