177 | +3.107% | 2 Setups

10:02 today will be less trading .. as i have some other stuff to do and got out of bed quite late as well (again)

Divergence data

Positive: JPY

Negative: NZD, USD, EUR

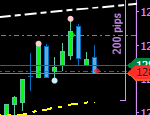

10:31 Short USDSGD and Long GOLD (both just scalp trades with small setup bias)

10:41 Closing USDSGD Short gaining 0.253%

10:55 Hedging GOLD (although this looks like a bad place to place a hedge)

11:12 Reversed the GOLD Hedge to Long.

but honestly, i’m not so sure this was a wise choice of action, as EURUSD still falling.

11:33 Reversing again on GOLD to enable the hedge, Gaining another 0.32%

11:40 DXY Update

11:42 turned out correct, it as a bad idea.

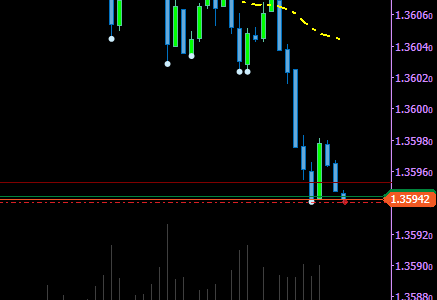

11:51 EURUSD at vWap .. let’s hope the bounce there will move gold more up, so I can get out of it without too much harm.

12:02 Hedging again GOLD .. leave it till price move elsewhere,

USDJPY unclear and EURUSD on the vWap as well.

it still looks like it’s going more UP .. but a swing down on a Volatility spike would be too expensive, due to the fact that the position is far too big.

14:01 used the Volatility of the Frankfurt bell to close out all trades. that caused a large profit on GOLD

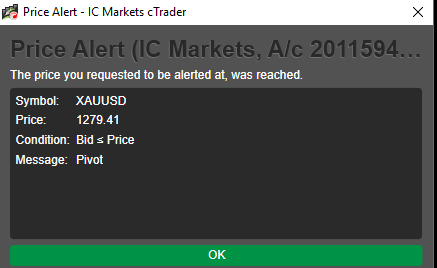

14:12 I wrote in the chatroom about 30 minutes ago we may see the Pivot as well and guess what just happened?

that would have doubled the gain, but if removing hedges by reversing positions is double the risk, so no gambling!

keep in Mind FOMO KILLS !!

Total Today: +3.107%