US Initial Jobless Claims Preview: The recovery’s slow lane

- First time unemployment claims expected to fall to 843,000 from 860,000.

- Continuing claims to drop to 12.339 million from 12.628 million.

- Rate of decline has slowed dramatically from April and May.

- Powell and Munchin request more economic support from Congress.

- Dollar will benefit from improving average claims figures.

The slow improvement in jobless claims is expected to bring filings to the lowest level since their explosion in March heralded the onset of the COVID-19 pandemic in the US.

New requests for unemployment insurance benefits are projected to fall to 843,000 in the September 18 week from 860,000 previously. Continuing claims are expected to decrease to 12.339 million from 12.628 million.

From the 6.867 million peak on March 27 claims fell 41.5% to 3.867 million by the end of April. May saw another 40.3% plunge from 3.176 million to 1.897 million. Since then the improvement has slowed dramatically, 10.1% in June, 9.1% in July and 8.9% in August.

If the 843,000 forecast for the week of September 18 is accurate the three weeks of this month will have produced a 5.6% decline.

Though the total decrease from the March top to last week’s 860,000 of almost 90%, 87.5% to be precise, is impressive in absolute terms, the current total is still greater than any single week on record prior to the COVID-19 pandemic.

These statistics encapsulate the dilemma for government policy makers. Has the economy reached a point where the natural regenerative powers of the private sector can be left in charge of the recovery? The answer from the Federal Reserve and the Treasury has been a resounding no.

Fed and Treasury ask for stimulus

In quarterly testimony required by the Cares Act, Federal Reserve Chairman Jerome Powell and Treasury Secretary Steven Mnuchin said before the House Financial Service Committee that although the economy is rebounding from the lockdown induced recession, more government help is needed.

Powell told the representatives on Tuesday that the economy was “healing.” Mnuchin, the chief White House negotiator with House Democrats said that the country was in the “midst of the fastest economic recovery from any crisis in history.”

The Fed Chairman noted that despite the improvement in the labor market only about half of the 22 million jobs lost in March and April have been recovered.

US GDP

American GDP contracted at a 31.7% annual pace in the second quarter, by far the fastest and steepest drop in US economic history. The rebound appears to be equally impressive. According to the Atlanta Fed GDPNow estimate on September 17 growth in the third quarter was running at 32%.

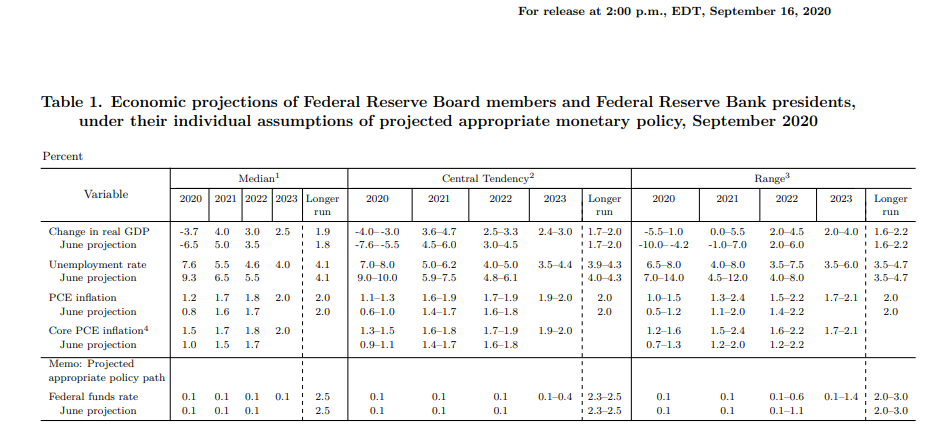

Federal Reserve projections for 2020 issued at the September 16 FOMC meeting show the economy contracting at 3.7% instead of the 6.5% decline posited in June.

Election politics

Election politics

Additional stimulus has become entangled in the politics of the looming presidential election. Democrats are pushing for a large $2 trillion package while Republicans and the administration support a smaller bill aimed at specific industries like airlines and hospitality that remain crippled and that encourages people to return to work.

When federal supplemental unemployment benefits of $600 a week expired at the end of July the two sides were unable to agree on an extension and President Trump continued the payments by executive order though at a lower level.

Paramount for both parties with just six weeks before the election is the impact a new stimulus bill would have on the electorate. Neither side will agree to any provision that it perceives aids the opposition.

Though the leadership of both parties and the administration have said they are willing to compromise the likelihood of a deal diminishes as the election closes in.

Conclusion: Markets and the dollar

Equity markets had anticipated another round of stimulus and the recent sharp declines were at least partially due to that disappointment.

The dollar’s modest rebound over the last several sessions has been fostered by the rising COVID-19 counts in a number of EU countries and the realization that the Fed’s extension of zero rates through the end of 2023 changes very little in the central bank comparison. No other bank is going to increase policy rates.

Over the next year the US economy will in all probability grow faster than its rivals. Jobless claims have been the main cautionary data point in the recovery. With the dollar already moving towards improvement a lower claims reports would give added logic for buying the greenback.