Articles

IC Markets Asia Fundamental Forecast | 10 October 2025

422123 October 10, 2025 15:00 ICMarkets Market News

IC Markets Asia Fundamental Forecast | 10 October 2025

What happened in the U.S. session?

The U.S. session was characterized by low volatility in the absence of economic data, with equities, bond yields, gold, and the dollar fluctuating in response to monetary policy commentary and earnings updates, while the government shutdown remained the foremost sentiment risk. The latest overnight U.S. session saw muted financial news developments due to the ongoing government shutdown, which has delayed key macroeconomic data releases and contributed to heightened market uncertainty.

What does it mean for the Asia Session?

Asian stock markets may open weaker, reflecting a global pullback and profit-taking mood. Key data from China, Canada, and the U.S. will set the tone for global risk sentiment. Dollar strength, softer commodities, and focus on consumer metrics are central for Friday trading. Major data include China’s New Loans report, Canadian labor market figures, and important U.S. consumer sentiment indicators. Market sentiment is cautious after a stall in the U.S. stock rally, and Asian equities may open lower.

The Dollar Index (DXY)

Key news events today

Prelim UoM consumer sentiment (2:00 pm GMT)

Prelim UoM inflation expectations (2:00 pm GMT)

What can we expect from DXY today?

Dollar weakness dominates today’s narrative, with policy uncertainty, shaky jobs data, and poor sentiment fueling expectations for further depreciation into late October 2025. The US Dollar Index (DXY) is hovering near 99, a slight recovery from recent lows, but still down by 3.38% over the past year and showing signs of broader weakness through October.

Central Bank Notes:

- The Federal Open Market Committee (FOMC) voted, by majority, to lower the federal funds rate target range by 25 basis points to 4.00%–4.25% at its September 16–17, 2025, meeting, marking the first policy rate adjustment since December 2024 after five consecutive holds.

- The Committee maintained its long-term objective of achieving maximum employment and 2% inflation, acknowledging recent labor market softening and continued tariff-driven price pressures.

- Policymakers expressed elevated concern about downside risks to growth, citing a stalling labor market, modest job creation, and an unemployment rate drifting up toward 4.4%. At the same time, inflation remains above target, with CPI at 3.2% and core inflation at 3.1% as of August 2025; higher energy and food prices, largely attributable to tariffs, continue to weigh on headline measures.

- Although economic activity expanded at a moderate pace in the third quarter, the growth outlook has weakened. Q3 GDP growth is estimated near 1.0% (annualized), with full-year 2025 GDP growth guidance revised to 1.2%, reflecting slowing household consumption and tighter financial conditions.

- In the updated Summary of Economic Projections, the unemployment rate is projected to average 4.5% for the year, with headline PCE inflation revised up slightly to 3.1% for 2025. The Committee anticipates core PCE inflation to remain stubborn, requiring sustained vigilance and a flexible approach to risk management.

- The Committee reiterated its data-dependent approach and openness to further adjustments should employment or inflation deviate meaningfully from current forecasts. Several members dissented, either advocating a larger 50-basis-point cut or preferring no adjustment at this meeting, revealing heightened divergence within the Committee.

- Balance sheet reduction continues at a measured pace. The monthly Treasury redemption cap remains at $5B and the agency MBS cap at $35B, as the Board aims to support orderly market conditions in the face of evolving global and domestic uncertainty.

- The next meeting is scheduled for 28 to 29 October 2025.

Next 24 Hours Bias

Medium Bullish

Gold (XAU)

Key news events today

Prelim UoM consumer sentiment (2:00 pm GMT)

Prelim UoM inflation expectations (2:00 pm GMT)

What can we expect from Gold today?

Gold remains in a historically strong uptrend, consolidating after breaking all-time highs, supported by global demand and monetary factors despite recent profit-taking and easing tensions in geopolitical hotspots. Gold surged to record highs above $4,000/oz this week, but has seen a modest pullback as the market digests recent gains and global risk sentiment shifts slightly.

Next 24 Hours Bias

Strong Bullish

The Australian Dollar (AUD)

Key news events today

No major news event

What can we expect from AUD today?

The Australian Dollar remains under moderate pressure, but resilient inflation expectations and a cautious RBA provide underlying support. Key technical levels could see volatility increase if broken, with upcoming US and Australian data releases likely driving the next move for AUD/USD. The AUD experienced some depreciation this week, trading around 0.6550 to 0.6585 against the US Dollar after a recent dip to monthly lows, largely influenced by US dollar strength amid US government policy uncertainty and persistent inflation risk.

Central Bank Notes:

- The RBA held its cash rate steady at 3.60% at its October meeting on 29–30 September 2025, marking a second consecutive pause after August’s 25 basis point cut. The move affirms the Bank’s data-dependent approach as inflation trends within the target range.

- Inflation indicators remained stable through September, with headline CPI likely anchoring near 2.2%—comfortably within the 2–3% band. Insurance and housing costs remain sticky but are increasingly offset by moderation in discretionary goods.

- Trimmed mean inflation is estimated at around 2.8%, signaling underlying pressures remain contained. The Board continues to flag food and energy price volatility as short-term risks, though the broader disinflation narrative holds.

- Global conditions remain a source of uncertainty. U.S. policy expectations and uneven growth in China continue to weigh on commodities, even as trade disruptions have eased marginally since mid-year.

- Domestic growth shows resilience in the housing and services sectors, though manufacturing remains subdued. Household incomes have stabilized, but consumption remains only modest, capped by high borrowing costs.

- The labor market maintains relative tightness, though job growth has slowed notably since the first half of the year. Underutilization has ticked higher, but overall employment conditions remain supportive.

- Wage growth is plateauing, reflecting softer labor demand. Weak productivity continues to keep unit labor costs elevated, underscoring a medium-term concern highlighted repeatedly by the RBA.

- Household consumption prospects remain fragile. The combination of high rents and weak discretionary appetite suggests risks of a consumer-led slowdown in Q4 if confidence fails to rebound.

- The Board reiterated that subdued household spending poses risks to business sentiment and may dampen investment and job creation in the coming quarters.

- Monetary policy remains mildly restrictive. The RBA balanced confidence in inflation progress with caution around global and domestic demand risks, keeping further adjustments conditional on incoming data.

- The Bank reaffirmed its dual commitment to price stability and full employment, noting its readiness to act should conditions shift markedly.

- The next meeting is on 5 to 6 November 2025.

Next 24 Hours Bias

Weak Bearish

The Kiwi Dollar (NZD)

Key news events today

No major news event

What can we expect from NZD today?

The NZD remains weak after a surprise RBNZ rate cut and dovish tone, with market sentiment cautious and the risk of further downside if economic data do not improve. The NZD is likely to remain under pressure as the RBNZ has left the door open to more rate cuts, especially if domestic and global data continue to disappoint. Market participants are watching for upcoming New Zealand inflation and labor market data for further policy clues.

Central Bank Notes:

- The Monetary Policy Committee (MPC) agreed to cut the Official Cash Rate (OCR) by 25 basis points to 3.00% on 20 August 2025, marking a three-year low and continuing the easing cycle after July’s pause. The vote was split 4-2, with two members advocating a 50-basis-point cut, highlighting diverging views within the Committee.

- Policymakers indicated that significant uncertainty and a stalling economic recovery prompted this move, leaving the door open for further rate cuts later in the year, with a possible trough around 2.5% by December.

- Annual consumer price index inflation rose to 2.7% in the June quarter and is expected to reach 3% for the September quarter—at the upper end of the MPC’s 1 to 3% target band—but medium-term expectations remain anchored near the 2% midpoint.

- Despite the near-term uptick, headline inflation is projected to return toward 2% by mid-2026, as tradables inflation pressures ease and significant spare capacity continues to dampen domestic price momentum.

- Domestic financial conditions are broadly aligning with MPC expectations, as lower wholesale rates have translated into reduced borrowing costs for households. However, declining consumption and investment demand, higher unemployment, and subdued wage growth reflect ongoing economic slack.

- GDP growth stalled in the second quarter of 2025, contrasting with earlier projections. High-frequency indicators point to continued weakness driven by rising prices for essentials, weakening household savings, and constrained business lending.

- The MPC cautioned that ongoing global tariff uncertainties and policy shifts, especially recent changes in US trade regulations, could amplify market volatility and present both upside and downside risks to New Zealand’s recovery.

- Subject to medium-term inflation pressures continuing to ease as projected, the MPC signaled scope for further OCR cuts, possibly down to 2.5% by year-end, consistent with the latest Monetary Policy Statement outlook.

- The next meeting is on 22 October 2025.

Next 24 Hours Bias

Medium Bearish

The Japanese Yen (JPY)

Key news events today

No major news event

What can we expect from JPY today?

The yen continues to face downside pressure after Japan’s political transition and the market’s anticipation of slower BoJ tightening. The short-term trend for USD/JPY remains bullish unless key support levels are broken, with further volatility likely around today’s key US data releases. This decline is largely attributed to political shifts, as fiscal expansion expectations rise with the election of Sanae Takaichi as leader of Japan’s ruling party and likely next Prime Minister. Markets are betting that her policies could delay Bank of Japan (BoJ) rate hikes, weakening the yen further.

Central Bank Notes:

- The Policy Board of the Bank of Japan decided on 17 September, by a unanimous vote, to set the following guidelines for money market operations for the inter-meeting period:

- The Bank will encourage the uncollateralized overnight call rate to remain at around 0.5%.

- The BOJ will continue its gradual reduction of monthly outright purchases of Japanese Government Bonds (JGBs). The scheduled amount of long-term government bond purchases remains unchanged from the prior decision, with a quarterly reduction pace of about ¥400 billion through March 2026 and about ¥200 billion per quarter from April to June 2026 onward, aiming for a purchase level near ¥2 trillion in January to March 2027.

- Japan’s economy continues to show a moderate recovery, with household consumption supported by rising incomes, although corporate activity has softened somewhat. Overseas economies remain on a moderate growth path, with the impact of global trade policies still weighing on Japan’s export and industrial production outlook.

- On the price front, the year-on-year rate of change in consumer prices (excluding fresh food) remains in the mid-3% range. Inflationary pressures remain broad-based, with persistent cost-push factors in food and energy, alongside solid wage pass-through. However, input cost pressures from past import surges are showing early signs of easing.

- Short-term inflation momentum may moderate as cost-push effects diminish, though rent increases and service-related price gains tied to labor shortages are likely to provide support. Inflation expectations among firms and households continue a gradual upward drift.

- Looking ahead, the economy is projected to grow at a slower-than-trend pace in the near term due to external demand softness and cautious corporate investment plans. However, accommodative financial conditions and steady increases in real labor income are expected to underpin domestic demand.

- In the medium term, as overseas economies recover and global trade stabilizes, Japan’s growth potential is likely to improve. With persistent labor market tightness and rising medium- to long-term inflation expectations, core inflation is projected to remain on a gradual upward trend, converging toward the 2% price stability target in the latter half of the projection horizon.

- The next meeting is scheduled for 30 to 31 October 2025.

Next 24 Hours Bias

Medium Bearish

Oil

Key news events today

No major news event

What can we expect from Oil today?

Oil prices have declined sharply today, Friday, October 10, 2025, reflecting easing geopolitical tensions and a bearish short-term trend. West Texas Intermediate (WTI) is trading near $62 per barrel and Brent crude near $65, with both benchmarks posting losses following peace developments in the Middle East and persistent global oversupply concerns.

Next 24 Hours Bias

Medium Bearish

The post IC Markets Asia Fundamental Forecast | 10 October 2025 first appeared on IC Markets | Official Blog.

Friday 10th October 2025: Asian Markets Decline Amid U.S. Shutdown Concerns and Weak Wall Street Cues

422122 October 10, 2025 15:00 ICMarkets Market News

Global Markets:

- Asian Stock Markets : Nikkei up 1.56%, Shanghai Composite up 1.24%, Hang Seng down 0.03% ASX up 0.19%

- Commodities : Gold at $4,050.90 (-0.58%), Silver at $48.20 (1.37%), Brent Oil at $65.9 (-0.74%), WTI Oil at $62.19 (-0.74%)

- Rates : US 10-year yield at 4.125, UK 10-year yield at 4.7150, Germany 10-year yield at 2.6769

News & Data:

- (USD) Natural Gas Storage 80B to 76B expected

Markets Update:

Asian stock markets are trading mostly lower on Friday, following weak cues from Wall Street overnight as optimism over interest rate cuts faded amid concerns about the prolonged U.S. government shutdown, now in its ninth day. The economic toll of the shutdown appears to be weighing on sentiment. Asian markets had closed mostly higher on Thursday.

US Fed Governor Michael Barr said the central bank should move “cautiously” given persistent uncertainty and inflation risks, while Chair Jerome Powell offered no new guidance. New York Fed President John Williams also indicated support for another rate cut before the next policy meeting.

In Australia, the S&P/ASX 200 slipped 0.03 percent to 8,966.80, dragged by mining and energy losses, though financials and tech stocks provided some cushion. BHP and Rio Tinto dropped over 1 percent, while Fortescue declined similarly. Commonwealth Bank gained nearly 1 percent. The Aussie dollar traded at $0.656.

Japan’s Nikkei 225 fell 1.01 percent to 48,087.75, pressured by exporters and financials. Sony and Mitsubishi UFJ lost over 2 percent, while Fast Retailing surged almost 6 percent. Producer prices rose 0.3 percent in September, beating expectations.

Elsewhere, markets in China, Hong Kong, and Malaysia were lower, while South Korea gained 1.3 percent post-holidays. On Wall Street, the Nasdaq slipped 0.1 percent, the S&P 500 fell 0.3 percent, and oil prices dropped 1.76 percent to $61.45 per barrel.

Upcoming Events:

- 12:30 PM GMT – CAD Employment Change

- 12:30 PM GMT – CAD Unemployment Rate

The post Friday 10th October 2025: Asian Markets Decline Amid U.S. Shutdown Concerns and Weak Wall Street Cues first appeared on IC Markets | Official Blog.

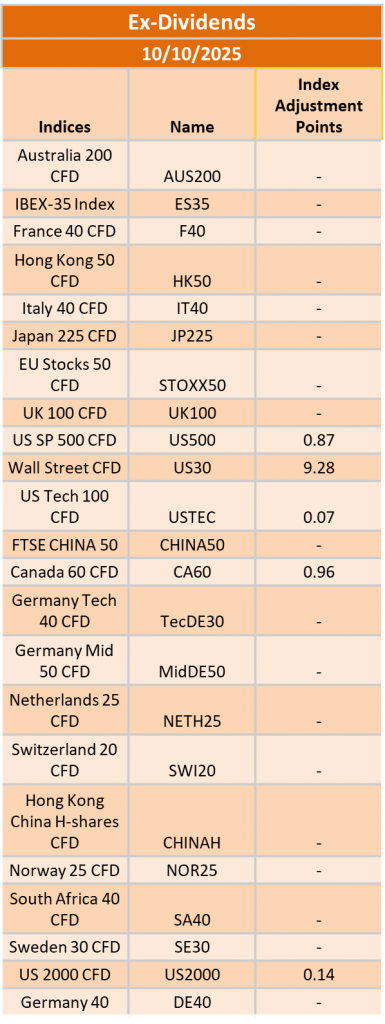

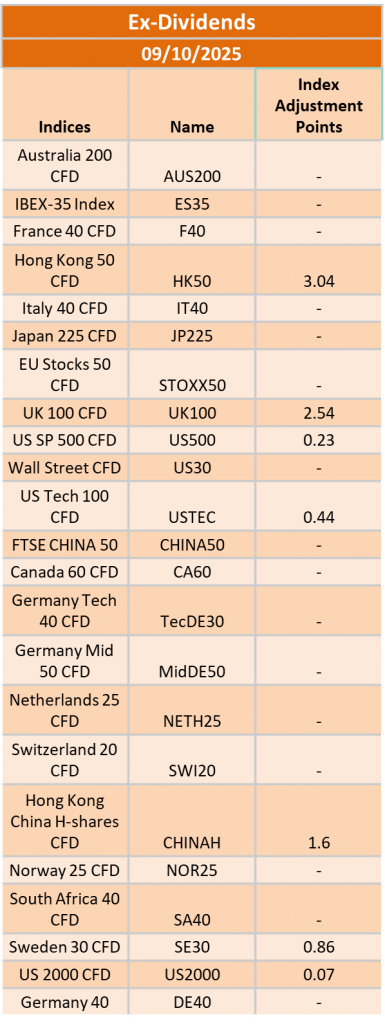

Ex-Dividend 10/10/2025

422115 October 10, 2025 10:39 ICMarkets Market News

The post Ex-Dividend 10/10/2025 first appeared on IC Markets | Official Blog.

General Market Analysis – 9/10/25

422085 October 9, 2025 16:00 ICMarkets Market News

US Stocks Push Higher After Fed Minutes – Nasdaq up 1.1%

US tech stocks pushed higher in trading again yesterday as investors shrugged off concerns over the ongoing government shutdown and less dovish-than-expected FOMC Meeting Minutes. The Dow closed flat at 46,601; however, the more heavily tech-weighted S&P and Nasdaq both hit new record levels, the S&P up 0.58% to 6,753 and the Nasdaq up 1.12% to 23,043. Treasury yields finished close to flat after the Fed minutes and a tepid 10-year auction, the 2-year closing up 1.5 basis points at 3.578% and the 10-year finishing down 0.4 of a basis point at 4.119%. The dollar gained ground again against the majors, most notably against the Japanese yen, the DXY up 0.28% on the day to 98.85. Oil prices also pushed back higher, Brent up 1.04% to $66.12 and WTI up 1.05% to $62.38 a barrel. Gold again powered to fresh record levels, smashing through the $4,000 mark to close up 1.50% at $4,043.01 an ounce.

Gold Shines Again – Smashes Through $4,000

Gold pushed higher yet again in trading yesterday, with the $4,000 barrier providing little resistance in the relentless push higher of the world’s favourite precious metal. It has now gained around 16% since it broke through the previous record high at $3,500 in early September and shows very little sign of losing momentum. Global market uncertainty has been attributed to aiding this meteoric rise in the last few weeks; however, that normally comes hand in hand with a stock market drop, and that is not the case with major US indices—the S&P and the Nasdaq both reporting record closes overnight. Traders will continue to look for levels to buy in the current environment, with breaks of daily highs seeming to work on an almost daily basis at the moment and any pullbacks being well supported. Trendline support now comes in around the $3,910 level, with stronger support below at $3,845. While it is a brave player that looks to short gold, there are some thinking that the move is overdone and we could see a correction in the coming days, especially with the dollar gaining ground against other products.

Quiet Calendar Day but More Moves Expected

It’s another quiet macroeconomic calendar day ahead for investors today; however, the market is expecting to see plenty of volatility across markets, with any geopolitical updates likely to hold sway. The Asian session does see the return of Chinese markets to the game after a long week off, and traders are expecting to see some strong moves as they adjust to what has been a lively week in global financial products. The London session sees the release of the ECB’s Monetary Policy Meeting Accounts; however, most traders are expecting geopolitical updates to have a greater impact on the euro. Once again, it is unlikely that we will see the weekly update on US Unemployment Claims in the New York session with the government shutdown ongoing; however, we do hear from Fed Chair Jerome Powell, which is almost guaranteed to move markets—especially coming on the back of yesterday’s Meeting Minutes. Fed members Michelle Bowman and Michael Barr are also scheduled to speak, but expect the Chairman’s comments to dominate.

The post General Market Analysis – 9/10/25 first appeared on IC Markets | Official Blog.

Thursday 9th October 2025: Technical Outlook and Review

422076 October 9, 2025 15:39 ICMarkets Market News

DXY (U.S. Dollar Index):

Potential Direction: Bullish

Overall momentum of the chart: Bearish

The price could continue to make a bullish rise toward the 1st resistance

Pivot: 97.99

Supporting reasons: Identified as a pullback support, where renewed buying pressure could emerge to push the price higher.

1st support: 97.49

Supporting reasons: Identified as an overlap support, indicating a potential area where the price could again stabilize.

1st resistance: 99.28

Supporting reasons: Identified as a pullback resistance that aligns with the 161.8% Fibonacci extension and the 78.6% Fibonacci retracement, indicating a potential area that could halt any further upward movement

EUR/USD:

Potential Direction: Bearish

Overall momentum of the chart: Bullish

The price could see a short-term pullback toward the pivot before continuing its bearish move down toward the 1st support.

Pivot: 1.1691

Supporting reasons: Identified as a pullback resistance, where selling pressures could intensify and potentially cap any upward retracement.

1st support: 1.1586

Supporting reasons: Identified as an overlap support that aligns closely with the 127.2% Fibonacci extension, indicating a potential level where the price could stabilize once again.

1st resistance: 1.1773

Supporting reasons: Identified as an overlap resistance, indicating a potential level that could cap further upward movement.

EUR/JPY:

Potential Direction: Bullish

Overall momentum of the chart: Bullish

The price could make a short-term pullback toward the pivot before rising again toward the 1st resistance

Pivot: 176.23

Supporting reasons: Identified as a pullback support, where renewed buying pressure could emerge to push the price higher.

1st support: 174.99

Supporting reasons: Identified as an overlap support, indicating a potential area where the price could again stabilize.

1st resistance: 177.75

Supporting reasons: Identified as a resistance that is supported by the 200% Fibonacci extension, indicating a potential level that could cap further upward movement.

EUR/GBP:

Potential Direction: Bearish

Overall momentum of the chart: Bullish

The price could see a short-term pullback toward the pivot before continuing its bearish move down toward the 1st support.

Pivot: 0.8693

Supporting reasons: Identified as an overlap resistance, where selling pressures could intensify and potentially cap any upward retracement.

1st support: 0.8664

Supporting reasons: Identified as an overlap support that aligns with the 161.8% Fibonacci extension, indicating a potential area where the price could stabilize once more.

1st resistance: 0.8725

Supporting reasons: Identified as an overlap resistance, indicating a potential level that could cap further upward movement.

GBP/USD:

Potential Direction: Bearish

Overall momentum of the chart: Bearish

The price could see a short-term pullback toward the pivot before continuing its bearish move down toward the 1st support.

Pivot: 1.3434

Supporting reasons: Identified as an overlap resistance, where selling pressures could intensify and potentially cap any upward retracement.

1st support: 1.3314

Supporting reasons: Identified as a pullback support, indicating a potential area where the price could stabilize once more.

1st resistance: 1.3513

Supporting reasons: Identified as a swing high resistance, indicating a potential level that could halt further upward movement.

GBP/JPY:

Potential Direction: Bullish

Overall momentum of the chart: Bullish

The price could make a short-term pullback toward the pivot before rising again toward the 1st resistance

Pivot: 201.15

Supporting reasons: Identified as an overlap support, where renewed buying pressure could emerge to push the price higher.

1st support: 197.99

Supporting reasons: Identified as a swing low support, indicating a potential level where the price could stabilize once more.

1st resistance: 206.01

Supporting reasons: Identified as a pullback resistance, indicating a potential level that could halt further upward movement.

USD/CHF:

Potential Direction: Bullish

Overall momentum of the chart: Bullish

The price could make a short-term pullback toward the pivot before rising again toward the 1st resistance

Pivot: 0.7981

Supporting reasons: Identified as a pullback support, where renewed buying pressure could emerge to push the price higher.

1st support: 0.7923

Supporting reasons: Identified as an overlap support, indicating a potential area where the price could again stabilize.

1st resistance: 0.8067

Supporting reasons: Identified as a multi-swing high resistance that aligns with the 161.8% Fibonacci extension, indicating a potential level that could cap further upward movement.

USD/JPY:

Potential Direction: Bullish

Overall momentum of the chart: Bullish

The price could make a short-term pullback toward the pivot before rising again toward the 1st resistance

Pivot: 150.91

Supporting reasons: This level is identified as a pullback support and a prior breakout zone. After a strong bullish impulse above this area, a retest could invite renewed buying interest.

1st support: 149.82

Supporting reasons: Identified as a pullback support, indicating a strong area where buyers might return, and the price could stabilize once again.

1st resistance: 153.98

Supporting reasons: Identified as a pullback resistance. Marked as the 161.8%Fibonacci extension. This is a significant resistance that could cap further upward movement and coincide with profit-taking zones for bullish positions

USD/CAD:

Potential Direction: Bullish

Overall momentum of the chart: Bearish

The price could fall toward the pivot and make a bullish bounce off toward the 1st resistance.

Pivot: 1.3927

Supporting reasons: Identified as a pullback support, indicating a potential area where buying interest could pick up.

1st support: 1.3880

Supporting reasons: Identified as a pullback support that aligns closely with the 38.2% Fibonacci retracement, indicating a key level where the price could stabilize once more.

1st resistance: 1.3987

Supporting reasons: Identified as a swing high resistance, making it a possible target for bullish advances and a level where some sellers could return to cap gains

AUD/USD:

Potential Direction: Bearish

Overall momentum of the chart: Bullish

The price could see a short-term pullback toward the pivot before continuing its bearish move down toward the 1st support.

Pivot: 0.6590

Supporting reasons: Identified as an intermediate pullback zone where any brief bullish recovery could find resistance before resuming the bearish trend.

1st support: 0.6543

Supporting reasons: Identified as a pullback support, this area has provided strong support historically and may attract buying interest for a potential short-term bounce

1st resistance: 0.6624

Supporting reasons: Identified as an overlap resistance near the 61.8% Fibonacci retracement, this level could cap upside potential in the current bearish structure.

NZD/USD

Potential Direction: Bearish

Overall momentum of the chart: Bullish

The price could see a short-term pullback toward the pivot before continuing its bearish move down toward the 1st support.

Pivot: 0.5801

Supporting reasons: Identified as a pullback resistance that aligns with the 61.8% Fibonacci retracement, where selling pressures could intensify and potentially cap any upward retracement.

1st support: 0.5763

Supporting reasons: Identified as a pullback support, this area has provided strong support historically and may attract buying interest for a potential short-term bounce

1st resistance: 0.5845

Supporting reasons: Identified as a pullback resistance that aligns closely with the 38.2% Fibonacci retracement, indicating a potential area that could halt any further upward movement.

US30 (DJIA):

Potential Direction: Bullish

Overall momentum of the chart: Bullish

The price has already bounced off the pivot and could continue to make a bullish move toward the 1st resistance.

Pivot: 46,439.34

Supporting reasons: Identified as an overlap support, indicating a potential area where buying interest could pick up.

1st support: 45,125.00

Supporting reasons: Identified as an overlap support, suggesting a potential area where the price could stabilize once again.

1st resistance: 47,061.00

Supporting reasons: Identified as a swing high resistance, indicating a potential area that could halt any further upward movement.

DE40 (DAX):

Potential Direction: Bullish

Overall momentum of the chart: Bullish

The price could make a short-term pullback toward the pivot before rising again toward the 1st resistance

Pivot: 24,511.06

Supporting reasons: Identified as a pullback support, indicating a potential area where buying interest could pick up

1st support: 23,927.36

Supporting reasons: Identified as a pullback support, indicating a key level where the price could stabilize once more.

1st resistance: 25,322.73

Supporting reasons: Identified as a resistance that is supported by the 161.8% Fibonacci extensino, indicating a potential area that could halt any further upward movement.

US500 (S&P 500):

Potential Direction: Bullish

Overall momentum of the chart: Bullish

The price could make a short-term pullback toward the pivot before rising again toward the 1st resistance

Pivot: 6,697.28

Supporting reasons: Identified as an overlap support, where renewed buying pressure could emerge to push the price higher.

1st support: 6,632.04

Supporting reasons: Identified as an overlap support, indicating a potential level where the price could stabilize once again.

1st resistance: 6,776.73

Supporting reasons: Identified as a resistance that is supported by the 161.8% Fibonacci extension, indicating a potential area that could halt any further upward movement.

BTC/USD (Bitcoin):

Potential Direction: Bearish

Overall momentum of the chart: Bullish

The price could see a short-term pullback toward the pivot before continuing its bearish move down toward the 1st support.

Pivot: 124,139.15

Supporting reasons: Identified as a pullback resistance that aligns with the 61.8% Fibonacci retracement, where selling pressures could intensify and potentially cap any upward retracement.

1st support: 119,294.96

Supporting reasons: Identified as a pullback support that aligns with the 38.2% Fibonacci retracement, indicating a potential level where the price could stabilize once more.

1st resistance: 126,282.29

Supporting reasons: Identified as a swing high resistance that aligns with the 161.8% Fibonacci projection, indicating a potential area that could halt any further upward movement.

ETH/USD (Ethereum):

Potential Direction: Bearish

Overall momentum of the chart: Bullish

The price could see a short-term pullback toward the pivot before continuing its bearish move down toward the 1st support.

Pivot: 4,607.50

Supporting reasons: Identified as a pullback resistance that aligns with the 61.8% Fibonacci retracement, where selling pressures could intensify and potentially cap any upward retracement.

1st support: 4,429.49

Supporting reasons: Identified as a pullback support that aligns with the 38.2% Fibonacci retracement, indicating a potential level where the price could stabilize once more.

1st resistance: 4,762.59

Supporting reasons: Identified as a swing high resistance, indicating a potential area that could halt any further upward movement.

WTI/USD (Oil):

Potential Direction: Bullish

Overall momentum of the chart: Bullish

The price could make a short-term pullback toward the pivot before rising again toward the 1st resistance

Pivot: 62.15

Supporting reasons: Identified as a pullback support, where renewed buying pressure could emerge to push the price higher.

1st support: 60.61

Supporting reasons: Identified as a swing low support, indicating a key level where the price could stabilize once more.

1st resistance: 63.15

Supporting reasons: Identified as a pullback resistance, indicating a potential area that could halt any further upward movement.

XAU/USD (GOLD):

Potential Direction: Bullish

Overall momentum of the chart: Bullish

The price could fall toward the pivot and make a bullish rise toward the 1st resistance.

Pivot: 3,894.93

Supporting reasons: Identified as a pullback support that aligns closely with the 61.8% Fibonacci retracement, indicating a potential area where buying interest could pick up.

1st support: 3,790.67

Supporting reasons: Identified as a pullback support, indicating a key level where the price could stabilize once more.

1st resistance: 4055.52

Supporting reasons: Identified as a swing high resistance that aligns with the 127.2% Fibonacci extension, indicating a potential area that could halt any further upward movement.

The accuracy, completeness and timeliness of the information contained on this site cannot be guaranteed. IC Markets does not warranty, guarantee or make any representations, or assume any liability regarding financial results based on the use of the information in the site.

News, views, opinions, recommendations and other information obtained from sources outside of www.icmarkets.com, used in this site are believed to be reliable, but we cannot guarantee their accuracy or completeness. All such information is subject to change at any time without notice. IC Markets assumes no responsibility for the content of any linked site.

The fact that such links may exist does not indicate approval or endorsement of any material contained on any linked site. IC Markets is not liable for any harm caused by the transmission, through accessing the services or information on this site, of a computer virus, or other computer code or programming device that might be used to access, delete, damage, disable, disrupt or otherwise impede in any manner, the operation of the site or of any user’s software, hardware, data or property.

The post Thursday 9th October 2025: Technical Outlook and Review first appeared on IC Markets | Official Blog.

IC Markets Asia Fundamental Forecast | 09 October 2025

422075 October 9, 2025 15:39 ICMarkets Market News

IC Markets Asia Fundamental Forecast | 09 October 2025

What happened in the U.S. session?

The U.S. session was dominated by dovish Fed signals and geopolitical uncertainty, driving a relief rally in risk assets, new records for gold, a stronger dollar, and surges in tech stocks and Bitcoin. During the latest U.S. session overnight, key financial headlines centered around the release of the Federal Reserve’s FOMC Meeting Minutes, surging gold prices hitting fresh record highs, a strong U.S. dollar, and upbeat performance for U.S. equities, especially technology stocks.

What does it mean for the Asia Session?

Asian traders are recommended to monitor central bank outcomes, macro data releases, US news flow, and sector events closely for potential volatility and directional cues on Thursday, October 9, 2025. Asian traders are recommended to monitor central bank outcomes, macro data releases, US news flow, and sector events closely for potential volatility and directional cues on Thursday, October 9, 2025.

The Dollar Index (DXY)

Key news events today

Fed Chair Powell speaks (12:30 pm GMT)

Unemployment claims (Tentative)

What can we expect from DXY today?

The US Dollar is experiencing significant strength on October 9, 2025, driven by a combination of dovish central bank policies from major global peers, ongoing political uncertainty abroad, and safe-haven demand amid the US government shutdown. While the Fed remains on a gradual easing path, the relative weakness of other major currencies and delayed economic data releases are providing substantial support for dollar strength. Key focus remains on Powell’s upcoming speech and resolution of the government shutdown, both of which could influence the dollar’s trajectory in the coming days.

Central Bank Notes:

- The Federal Open Market Committee (FOMC) voted, by majority, to lower the federal funds rate target range by 25 basis points to 4.00%–4.25% at its September 16–17, 2025, meeting, marking the first policy rate adjustment since December 2024 after five consecutive holds.

- The Committee maintained its long-term objective of achieving maximum employment and 2% inflation, acknowledging recent labor market softening and continued tariff-driven price pressures.

- Policymakers expressed elevated concern about downside risks to growth, citing a stalling labor market, modest job creation, and an unemployment rate drifting up toward 4.4%. At the same time, inflation remains above target, with CPI at 3.2% and core inflation at 3.1% as of August 2025; higher energy and food prices, largely attributable to tariffs, continue to weigh on headline measures.

- Although economic activity expanded at a moderate pace in the third quarter, the growth outlook has weakened. Q3 GDP growth is estimated near 1.0% (annualized), with full-year 2025 GDP growth guidance revised to 1.2%, reflecting slowing household consumption and tighter financial conditions.

- In the updated Summary of Economic Projections, the unemployment rate is projected to average 4.5% for the year, with headline PCE inflation revised up slightly to 3.1% for 2025. The Committee anticipates core PCE inflation to remain stubborn, requiring sustained vigilance and a flexible approach to risk management.

- The Committee reiterated its data-dependent approach and openness to further adjustments should employment or inflation deviate meaningfully from current forecasts. Several members dissented, either advocating a larger 50-basis-point cut or preferring no adjustment at this meeting, revealing heightened divergence within the Committee.

- Balance sheet reduction continues at a measured pace. The monthly Treasury redemption cap remains at $5B and the agency MBS cap at $35B, as the Board aims to support orderly market conditions in the face of evolving global and domestic uncertainty.

- The next meeting is scheduled for 28 to 29 October 2025.

Next 24 Hours Bias

Medium Bullish

Gold (XAU)

Key news events today

Fed Chair Powell speaks (12:30 pm GMT)

Unemployment claims (Tentative)

What can we expect from Gold today?

Gold’s breakthrough above $4,000 represents a historic milestone driven by a confluence of factors, including US government dysfunction, aggressive Federal Reserve easing expectations, global political instability, and continued central bank accumulation. While technical indicators suggest the market may be due for consolidation, the fundamental drivers supporting higher prices remain intact. With analysts projecting further gains toward $4,200-$4,900 over the coming months, gold’s role as the premier safe-haven asset appears more entrenched than ever in an increasingly uncertain global environment.

Next 24 Hours Bias

Strong Bullish

The Australian Dollar (AUD)

Key news events today

RBA Gov Bullock speaks (10:00 pm GMT)

What can we expect from AUD today?

The Australian Dollar (AUD) has experienced mild volatility today, with movements shaped by ongoing US political uncertainty, recent Reserve Bank of New Zealand (RBNZ) policy decisions, and market reactions to inflation data and US Federal Reserve expectations. The AUD/USD pair traded around the 0.6600 region, showing attempts to recover from recent lows, but the broader trend remains under bearish pressure with resistance near 0.6605 and potential decline targets below 0.6525 if selling resumes.

Central Bank Notes:

- The RBA held its cash rate steady at 3.60% at its October meeting on 29–30 September 2025, marking a second consecutive pause after August’s 25 basis point cut. The move affirms the Bank’s data-dependent approach as inflation trends within the target range.

- Inflation indicators remained stable through September, with headline CPI likely anchoring near 2.2%—comfortably within the 2–3% band. Insurance and housing costs remain sticky but are increasingly offset by moderation in discretionary goods.

- Trimmed mean inflation is estimated at around 2.8%, signaling underlying pressures remain contained. The Board continues to flag food and energy price volatility as short-term risks, though the broader disinflation narrative holds.

- Global conditions remain a source of uncertainty. U.S. policy expectations and uneven growth in China continue to weigh on commodities, even as trade disruptions have eased marginally since mid-year.

- Domestic growth shows resilience in the housing and services sectors, though manufacturing remains subdued. Household incomes have stabilized, but consumption remains only modest, capped by high borrowing costs.

- The labor market maintains relative tightness, though job growth has slowed notably since the first half of the year. Underutilization has ticked higher, but overall employment conditions remain supportive.

- Wage growth is plateauing, reflecting softer labour demand. Weak productivity continues to keep unit labour costs elevated, underscoring a medium-term concern highlighted repeatedly by the RBA.

- Household consumption prospects remain fragile. The combination of high rents and weak discretionary appetite suggests risks of a consumer-led slowdown in Q4 if confidence fails to rebound.

- The Board reiterated that subdued household spending poses risks to business sentiment and may dampen investment and job creation in the coming quarters.

- Monetary policy remains mildly restrictive. The RBA balanced confidence in inflation progress with caution around global and domestic demand risks, keeping further adjustments conditional on incoming data.

- The Bank reaffirmed its dual commitment to price stability and full employment, noting its readiness to act should conditions shift markedly.

- The next meeting is on 5 to 6 November 2025.

Next 24 Hours Bias

Weak Bearish

The Kiwi Dollar (NZD)

Key news events today

Official cash rate (1:00 am GMT)

RBNZ rate statement (1:00 am GMT)

What can we expect from NZD today?

The New Zealand Dollar saw major developments on October 9, 2025, following a surprise rate cut by the Reserve Bank of New Zealand (RBNZ). The Kiwi plunged to a six-month low as markets reacted to the central bank’s aggressive monetary policy shift. The NZD/USD currency pair dropped as much as 1% before partially rebounding, with traders digesting signals of deeper easing ahead.

Central Bank Notes:

- The Monetary Policy Committee (MPC) agreed to cut the Official Cash Rate (OCR) by 25 basis points to 3.00% on 20 August 2025, marking a three-year low and continuing the easing cycle after July’s pause. The vote was split 4-2, with two members advocating a 50-basis-point cut, highlighting diverging views within the Committee.

- Policymakers indicated that significant uncertainty and a stalling economic recovery prompted this move, leaving the door open for further rate cuts later in the year, with a possible trough around 2.5% by December.

- Annual consumer price index inflation rose to 2.7% in the June quarter and is expected to reach 3% for the September quarter—at the upper end of the MPC’s 1 to 3% target band—but medium-term expectations remain anchored near the 2% midpoint.

- Despite the near-term uptick, headline inflation is projected to return toward 2% by mid-2026, as tradables inflation pressures ease and significant spare capacity continues to dampen domestic price momentum.

- Domestic financial conditions are broadly aligning with MPC expectations, as lower wholesale rates have translated into reduced borrowing costs for households. However, declining consumption and investment demand, higher unemployment, and subdued wage growth reflect ongoing economic slack.

- GDP growth stalled in the second quarter of 2025, contrasting with earlier projections. High-frequency indicators point to continued weakness driven by rising prices for essentials, weakening household savings, and constrained business lending.

- The MPC cautioned that ongoing global tariff uncertainties and policy shifts, especially recent changes in US trade regulations, could amplify market volatility and present both upside and downside risks to New Zealand’s recovery.

- Subject to medium-term inflation pressures continuing to ease as projected, the MPC signaled scope for further OCR cuts, possibly down to 2.5% by year-end, consistent with the latest Monetary Policy Statement outlook.

- The next meeting is on 22 October 2025.

Next 24 Hours Bias

Medium Bearish

The Japanese Yen (JPY)

Key news events today

No major news event

What can we expect from JPY today?

The Japanese Yen faces significant downward pressure today, driven by fiscal policy concerns, political uncertainty, and soft economic data, with markets closely watching upcoming BOJ moves and government coalition negotiations for signs of potential reversal or stabilization. The Japanese Yen weakened further today, reaching its lowest levels against the US dollar since mid-February, largely due to fiscal concerns and political uncertainty following the ruling LDP’s leadership change. USD/JPY traded near 152.69—up over 3% this week and marking the Yen’s worst monthly performance in almost a year.

Central Bank Notes:

- The Policy Board of the Bank of Japan decided on 17 September, by a unanimous vote, to set the following guidelines for money market operations for the inter-meeting period:

- The Bank will encourage the uncollateralized overnight call rate to remain at around 0.5%.

- The BOJ will continue its gradual reduction of monthly outright purchases of Japanese Government Bonds (JGBs). The scheduled amount of long-term government bond purchases remains unchanged from the prior decision, with a quarterly reduction pace of about ¥400 billion through March 2026 and about ¥200 billion per quarter from April to June 2026 onward, aiming for a purchase level near ¥2 trillion in January to March 2027.

- Japan’s economy continues to show a moderate recovery, with household consumption supported by rising incomes, although corporate activity has softened somewhat. Overseas economies remain on a moderate growth path, with the impact of global trade policies still weighing on Japan’s export and industrial production outlook.

- On the price front, the year-on-year rate of change in consumer prices (excluding fresh food) remains in the mid-3% range. Inflationary pressures remain broad-based, with persistent cost-push factors in food and energy, alongside solid wage pass-through. However, input cost pressures from past import surges are showing early signs of easing.

- Short-term inflation momentum may moderate as cost-push effects diminish, though rent increases and service-related price gains tied to labor shortages are likely to provide support. Inflation expectations among firms and households continue a gradual upward drift.

- Looking ahead, the economy is projected to grow at a slower-than-trend pace in the near term due to external demand softness and cautious corporate investment plans. However, accommodative financial conditions and steady increases in real labor income are expected to underpin domestic demand.

- In the medium term, as overseas economies recover and global trade stabilizes, Japan’s growth potential is likely to improve. With persistent labor market tightness and rising medium- to long-term inflation expectations, core inflation is projected to remain on a gradual upward trend, converging toward the 2% price stability target in the latter half of the projection horizon.

- The next meeting is scheduled for 30 to 31 October 2025.

Next 24 Hours Bias

Medium Bearish

Oil

Key news events today

No major news event

What can we expect from Oil today?

Geopolitical uncertainty, especially Russia-Ukraine tensions, and US production growth are providing mixed sentiment in the market, but prices remain supported in the short term.OPEC+ output decisions and US inventory reports are central to market moves, with traders monitoring supply glut risks and demand recovery signals. Oil markets are slightly bullish due to supply-side restrictions and resilient demand, though abundant US production and inventory builds may limit further gains in the coming months.

Next 24 Hours Bias

Medium Bearish

The post IC Markets Asia Fundamental Forecast | 09 October 2025 first appeared on IC Markets | Official Blog.

Thursday 9th October 2025: Asian Markets Mixed Amid Fed Rate Cut Optimism and Lingering U.S. Shutdown Uncertainty

422074 October 9, 2025 15:14 ICMarkets Market News

Global Markets:

- Asian Stock Markets : Nikkei up 1.56%, Shanghai Composite up 1.24%, Hang Seng down 0.03% ASX up 0.19%

- Commodities : Gold at $4,050.90 (-0.58%), Silver at $48.20 (1.37%), Brent Oil at $65.9 (-0.74%), WTI Oil at $62.19 (-0.74%)

- Rates : US 10-year yield at 4.125, UK 10-year yield at 4.7150, Germany 10-year yield at 2.6769

News & Data:

- (USD) Crude Oil Inventories 3.7M to 0.4M expected

Markets Update:

Asian markets traded mixed on Thursday, mirroring the positive cues from Wall Street overnight, as optimism grew over the outlook for U.S. interest rates. Minutes from the Federal Reserve’s September meeting indicated support for further policy easing this year, though some members favored caution given tightening financial conditions. The prolonged U.S. government shutdown, now in its eighth day, along with global political and trade uncertainties, has clouded the economic outlook and delayed key U.S. data releases such as payrolls and inflation. Despite this, markets are pricing in a 92.5% probability of a 25-basis-point rate cut at the Fed’s October 28–29 meeting, according to CME Group’s FedWatch Tool.

In Australia, the S&P/ASX 200 climbed 0.20% to 8,965.70, rebounding from three days of losses amid strength in mining and energy stocks. BHP gained over 2%, while Rio Tinto and Fortescue rose more than 1% each. Tech and financial shares were mixed.

Japan’s Nikkei 225 surged 1.41% to 48,405.93, driven by gains in SoftBank, Fast Retailing, and chipmakers, offsetting weakness in automakers like Toyota and Honda.

Elsewhere, China, Malaysia, Taiwan, and Indonesia advanced, while Hong Kong, Singapore, and New Zealand edged lower. On Wall Street, the Nasdaq jumped 1.1% and the S&P 500 gained 0.6%, while oil prices rose for a third straight session.

Upcoming Events:

- Tentative GMT – USD Unemployment Claims

The post Thursday 9th October 2025: Asian Markets Mixed Amid Fed Rate Cut Optimism and Lingering U.S. Shutdown Uncertainty first appeared on IC Markets | Official Blog.

IC Markets Europe Fundamental Forecast | 09 October 2025

422073 October 9, 2025 15:14 ICMarkets Market News

IC Markets Europe Fundamental Forecast | 09 October 2025

What happened in the Asia session?

Asian risk assets generally benefited from a combination of positive earnings, geopolitics, and a tech-driven rally, while commodities like oil and gold reacted mostly to easing tensions in the Middle East and solid economic prints in China. During today’s Asia session, the most notable financial news developments included a broad recovery in Asian equities, a significant pullback in oil prices, and fresh highs in technology-linked stocks driven by global optimism around artificial intelligence. Key macroeconomic data out of China and Japan, as well as geopolitical relief in the Middle East, played pivotal roles in shaping market sentiment.

What does it mean for the Europe & US sessions?

The key financial news and macroeconomic data releases are a mix of major central bank speeches, high-impact economic data from China, and ongoing themes impacting European and U.S. markets. Traders should monitor the following developments as the European and U.S. sessions begin. Traders should stay alert for headlines from these events and speeches, as they are likely to drive intraday volatility across FX, commodities, and equities globally.

The Dollar Index (DXY)

Key news events today

Fed Chair Powell speaks (12:30 pm GMT)

What can we expect from DXY today?

The consensus among traders and analysts is for the dollar to retain strength in the near term, barring unexpected dovish signals from Chair Powell or major shifts in US economic data once releases resume. Public expectations point toward at least one interest rate cut before year-end, with Powell’s speech today poised to offer valuable guidance for currency markets.

Central Bank Notes:

- The Federal Open Market Committee (FOMC) voted, by majority, to lower the federal funds rate target range by 25 basis points to 4.00%–4.25% at its September 16–17, 2025, meeting, marking the first policy rate adjustment since December 2024 after five consecutive holds.

- The Committee maintained its long-term objective of achieving maximum employment and 2% inflation, acknowledging recent labor market softening and continued tariff-driven price pressures.

- Policymakers expressed elevated concern about downside risks to growth, citing a stalling labor market, modest job creation, and an unemployment rate drifting up toward 4.4%. At the same time, inflation remains above target, with CPI at 3.2% and core inflation at 3.1% as of August 2025; higher energy and food prices, largely attributable to tariffs, continue to weigh on headline measures.

- Although economic activity expanded at a moderate pace in the third quarter, the growth outlook has weakened. Q3 GDP growth is estimated near 1.0% (annualized), with full-year 2025 GDP growth guidance revised to 1.2%, reflecting slowing household consumption and tighter financial conditions.

- In the updated Summary of Economic Projections, the unemployment rate is projected to average 4.5% for the year, with headline PCE inflation revised up slightly to 3.1% for 2025. The Committee anticipates core PCE inflation to remain stubborn, requiring sustained vigilance and a flexible approach to risk management.

- The Committee reiterated its data-dependent approach and openness to further adjustments should employment or inflation deviate meaningfully from current forecasts. Several members dissented, either advocating a larger 50-basis-point cut or preferring no adjustment at this meeting, revealing heightened divergence within the Committee.

- Balance sheet reduction continues at a measured pace. The monthly Treasury redemption cap remains at $5B and the agency MBS cap at $35B, as the Board aims to support orderly market conditions in the face of evolving global and domestic uncertainty

- The next meeting is scheduled for 28 to 29 October 2025.

Next 24 Hours Bias

Medium Bullish

Gold (XAU)

Key news events today

Fed Chair Powell speaks (12:30 pm GMT)

What can we expect from Gold today?

Gold is experiencing a historic surge, breaking through the $4,000 per ounce barrier due to a confluence of geopolitical tensions, Fed rate cut anticipations, and inflation concerns. Indian gold prices reflect this global trend with steady local gains boosted by seasonal and currency factors. Although some short-term profit-taking is occurring, the overall outlook for gold remains bullish amid prevailing economic and geopolitical uncertainties.

Next 24 Hours Bias

Strong Bullish

The Euro (EUR)

Key news events today

No major news event

What can we expect from EUR today?

The euro today is under mild bearish pressure, with political and central bank developments contributing to market caution. Technical factors and economic data may influence short-term recovery if key supports hold. The EUR/USD exchange rate stands at around 1.1644, up 0.12% from the previous session but reflecting a weaker position over the past month.

Central Bank Notes:

- The Governing Council kept the three key ECB interest rates unchanged at its meeting on September 11, 2025. The main refinancing rate remains at 2.15%, the marginal lending facility at 2.40%, and the deposit facility at 2.00%. These levels have been maintained after the cuts earlier in 2025, reflecting the Council’s confidence that the current stance is consistent with the price stability mandate.

- Evidence that inflation is running close to the ECB’s medium-term target of 2% supported the decision to hold rates steady. Domestic price pressures are easing as wage growth continues to moderate, and financing conditions remain accommodative. Policymakers reaffirmed a data-dependent, meeting-by-meeting approach to further policy moves, with no pre-commitment to a predetermined path amid ongoing global and domestic risks.

- Eurosystem staff projections foresee headline inflation averaging 2.0% for 2025, 1.8% for 2026, and 2.0% in 2027. The 2025 and 2026 forecasts reflect a downward revision, primarily on lower energy costs and exchange rate effects, even as food inflation remains persistent. Core inflation (excluding energy and food) is expected at 2.0% for 2026 and 2027, with only minor changes since prior rounds.

- Real GDP growth in the euro area is projected at 1.1% for 2025, 1.1% for 2026, and 1.4% for 2027. A robust first quarter—partly due to firms accelerating exports ahead of anticipated tariff hikes—cushioned a weaker outlook for the remainder of 2025. While business investment continues to face uncertainty from ongoing global trade disputes, especially with the US, government investment and infrastructure spending are expected to provide some support to the outlook.

- Rising real incomes and continued strength in the labor market boost household spending. Despite some fading tailwind from previous rate cuts, financing conditions remain broadly favorable and are expected to underpin the resilience of private consumption and investment against outside shocks. Moderating wage growth and profit margin adjustments are helping to absorb residual cost pressures.

- Rising real incomes and continued strength in the labor market boost household spending. Despite some fading tailwind from previous rate cuts, financing conditions remain broadly favorable and are expected to underpin the resilience of private consumption and investment against outside shocks. Moderating wage growth and profit margin adjustments are helping to absorb residual cost pressures.

- All future interest rate decisions will continue to be guided by the integrated assessment of economic and financial data, the inflation outlook, and underlying inflation dynamics, and the effectiveness of monetary policy transmission—without any pre-commitment to a specific future rate path.

- The ECB’s Asset Purchase Program (APP) and Pandemic Emergency Purchase Program (PEPP) portfolios are declining predictably, as maturities have ceased to be reinvested. Balance-sheet normalization continues in line with the ECB’s previously communicated schedule.

- The next meeting is on 29 to 30 October 2025

Next 24 Hours Bias

Weak Bullish

The Swiss Franc (CHF)

Key news events today

No major news event

What can we expect from CHF today?

The Swiss Franc is experiencing mild weakness versus the USD, driven by external pressures and stable SNB policies, but retains relative strength thanks to its safe-haven status and solid economic fundamentals.The latest news and developments for the Swiss Franc (CHF) show that the currency is trading around its lowest level in a month, at approximately 0.80 per USD, as global events and central bank policies influence its movements.

Central Bank Notes:

- The SNB maintained its key policy rate at 0% during its meeting on 25 September 2025, pausing a sequence of six consecutive rate cuts as inflation stabilized and the Swiss franc remained firm.

- Recent data showed a modest rebound in inflation, with Swiss consumer prices rising 0.2% year-on-year in August after staying above zero for three consecutive months; this helped alleviate fears of deflation that were mounting earlier in the year.

- The conditional inflation forecast remains broadly unchanged from June: headline inflation is expected to average 0.2% in 2025, 0.5% in 2026, and 0.7% in 2027. The risk of a negative rate move has diminished for now, but the SNB retains flexibility should inflationary pressures weaken again.

- The global economic outlook has deteriorated further, weighed down by heightened trade tensions—especially with the U.S.—and ongoing uncertainty in key Swiss export markets.

- Swiss GDP growth moderated in Q2 after a strong Q1 boosted by front-loaded U.S. exports. The SNB expects growth to slow and remain subdued, with forecasted GDP expansion between 1% and 1.5% in both 2025 and 2026.

- Labour market sentiment in the Swiss industrial sector has softened on concerns over export competitiveness and potential adjustments to production, but the overall growth outlook stays broadly unchanged

- The SNB reiterated its readiness to respond as needed if deflation risks re-emerge, emphasizing its commitment to medium-term price stability and a robust, transparent communication policy, with the introduction of more detailed monetary policy minutes beginning in October.

- The next meeting is on 11 December 2025.

Next 24 Hours Bias

Weak Bearish

The Pound (GBP)

Key news events today

No major news event

What can we expect from GBP today?

The pound is trading quietly and defensively today, with no UK-specific events expected to trigger major moves; attention remains on dollar trends, global risk appetite, and technical levels in GBP pairs. The British pound (GBP) is showing mixed performance and modest volatility, with its movements largely influenced by broader market sentiment and global rate trends rather than UK-specific macro events.

Central Bank Notes:

- The Bank of England’s Monetary Policy Committee (MPC) voted on 18 September 2025 by a majority (expected split likely 7–2 or 6–3) to hold the Bank Rate steady at 4.00%, following the August rate cut. Most members cited persistent inflation and mixed indicators on growth and employment, while a minority favored further easing due to the cooling labor market and subdued GDP growth.

- The Committee decided to decrease the pace of quantitative tightening, planning to reduce the stock of UK government bond purchases by £67.5 billion over the next 12 months instead of the prior £100 billion pace, with the gilt balance now standing near £558 billion. This reflects increased volatility in bond markets and a shift to a more gradual approach.

- Headline inflation rose unexpectedly to 3.8% in July and is projected at 4% for September, above the Bank’s 2% target. Price pressures are driven by regulated energy costs and ongoing food price increases. While previous disinflation has been substantial, core inflation remains elevated and sticky.

- The MPC expects headline inflation to remain above target through Q4, with a resumption of the downward trend projected for early 2026 as energy and regulated price pressures abate. The Committee remains watchful for signs of persistent inflation despite previous policy tightening.

- UK GDP growth is stagnant, with business and consumer activity subdued. Recent labor market data show rising unemployment rates (now at 4.7%) and stabilizing wage growth (holding near 5%), indicating slack but continued wage price pressure. The Committee remains cautious amid lackluster demand and soft survey sentiment.

- Pay growth and employment indicators have moderated further, alongside confirmation from business surveys that pay settlements are slowing. The Committee expects wage growth to decelerate significantly through Q4 and the rest of 2025.

- Global uncertainty persists due to volatile energy prices, supply chain disruptions linked to Middle East conflicts, and renewed trade tensions. The MPC remains vigilant in tracking transmission of external cost/wage shocks to UK inflation.

- Risks to inflation are considered two-sided. While subdued domestic growth and softening labor activity suggest scope for easing, persistent inflation requires caution. The MPC anticipates a slow, gradual reduction path in rates, continuing its data-dependent approach with careful adjustment as warranted by economic developments.

- The Committee’s bias remains toward maintaining a restrictive monetary policy stance until firmer evidence emerges that inflation will return sustainably to the 2% target. All future decisions will remain highly data dependent, with a strong emphasis on evolving demand, inflation expectations, costs, and labor market conditions.

- The next meeting is on 6 November 2025.

Next 24 Hours Bias

Weak Bearish

The Canadian Dollar (CAD)

Key news events today

No major news event

What can we expect from CAD today?

The Canadian Dollar is currently influenced by a mix of weaker domestic data, oil market volatility, and anticipation about North American monetary policy decisions, especially potential moves by the US Federal Reserve and Bank of Canada. The Canadian Dollar (CAD) is stable to slightly weaker against the US Dollar this morning, with recent trading in the 1.3938 to 1.395 range USD/CAD. Broader sentiment shows the CAD under pressure from softer domestic data and oil price fluctuations, while an expected rebound could occur if the US Federal Reserve cuts rates in the coming year.

Central Bank Notes:

- The Council cited continued U.S. tariff volatility and slow progress on trade negotiations as major contributors to ongoing uncertainty. While headline tariffs have not escalated further, the unpredictability of U.S. policy remains a significant risk for Canadian exports and business confidence.

- Uncertainty about U.S. trade policy and recurring tariff threats continued to weigh on growth prospects. The Bank flagged downside risks to the export sector, with survey data indicating ongoing hesitancy among manufacturers and exporters.

- After modest growth in Q1, Canada’s economy slipped into contraction, with GDP shrinking by 0.8% in Q2 and forecast to decrease again by 0.8% in Q3. Economic weakness has been most pronounced in manufacturing and goods-producing sectors affected by trade frictions and softer U.S. demand.

- Early estimates show that growth stabilized in September but remained well below the Bank’s 2% forecast for Q4. Manufacturing output has improved slightly—supported by a modest rebound in petroleum and mining activity—while consumer spending and retail sales were largely flat.

- Consumer spending remained subdued as households continued to limit discretionary purchases amid uncertainty and a slower job market. Housing activity stayed weak, despite earlier government efforts to boost affordability and modest gains in some real estate segments.

- Headline CPI inflation edged up to 1.9% in August, undershooting economist expectations but still showing emerging pressures from shelter and imported goods costs. Core inflation metrics were mixed, though price growth remains just below the Bank’s 2% target.

- The Governing Council reaffirmed its cautious approach, emphasizing that while further rate cuts are possible, the pace will hinge on the path of U.S. tariffs, domestic inflation dynamics, and signs of a sustainable recovery. The Bank remains vigilant against the risk of inflation falling below target in the face of economic slack.

- The next meeting is on 29 October 2025.

Next 24 Hours Bias

Medium Bearish

Oil

Key news events today

No major news event

What can we expect from Oil today?

Oil prices fell sharply today as geopolitical tensions eased after a Gaza ceasefire deal, while rising US crude inventories added downward pressure. Experts forecast continued volatility, driven by supply-side factors and uncertainty around global demand growth. Oil prices declined primarily as a result of easing geopolitical tensions in the Middle East following the announcement of a preliminary peace agreement between Israel and Hamas. This development lowered the risk premium that had been supporting oil prices, leading investors to sell off holdings and pushing prices lower.

Next 24 Hours Bias

Weak Bearish

The post IC Markets Europe Fundamental Forecast | 09 October 2025 first appeared on IC Markets | Official Blog.

Ex-Dividend 9/10/2025

422040 October 8, 2025 17:39 ICMarkets Market News

The post Ex-Dividend 9/10/2025 first appeared on IC Markets | Official Blog.

IC Markets Europe Fundamental Forecast | 08 October 2025

422035 October 8, 2025 15:00 ICMarkets Market News

IC Markets Europe Fundamental Forecast | 08 October 2025

What happened in the Asia session?

Today’s Asia session was dominated by anticipation and reaction to central bank rate decisions, with the RBNZ’s expected cut weighing on NZD/USD and New Zealand equities. Japanese equities surged on the back of technology news and government stimulus hopes, while the yen weakened. Technology shares led the gains, and commodity markets saw gold strengthen alongside movements in sovereign debt markets.

What does it mean for the Europe & US sessions?

Traders should prepare for increased market movements during these release windows and monitor policy signals from central banks and ongoing geopolitical trade negotiations. The European and U.S. trading sessions begin include several high-impact central bank announcements, economic releases, and policy signals. The day is marked by major events that can drive volatility and influence trader sentiment across key markets

The Dollar Index (DXY)

Key news events today

FOMC meeting minutes (6:00 pm GMT)

What can we expect from DXY today?

The dollar is stable at four-week highs ahead of crucial FOMC minutes today, as markets wait for clarity on future rate cuts and watch the ongoing government shutdown. While short-term volatility is likely, the broader outlook remains for a gradual dollar weakening due to expected Fed easing and persistent risks to US fiscal stability.

Central Bank Notes:

- The Federal Open Market Committee (FOMC) voted, by majority, to lower the federal funds rate target range by 25 basis points to 4.00%–4.25% at its September 16–17, 2025, meeting, marking the first policy rate adjustment since December 2024 after five consecutive holds.

- The Committee maintained its long-term objective of achieving maximum employment and 2% inflation, acknowledging recent labor market softening and continued tariff-driven price pressures.

- Policymakers expressed elevated concern about downside risks to growth, citing a stalling labor market, modest job creation, and an unemployment rate drifting up toward 4.4%. At the same time, inflation remains above target, with CPI at 3.2% and core inflation at 3.1% as of August 2025; higher energy and food prices, largely attributable to tariffs, continue to weigh on headline measures.

- Although economic activity expanded at a moderate pace in the third quarter, the growth outlook has weakened. Q3 GDP growth is estimated near 1.0% (annualized), with full-year 2025 GDP growth guidance revised to 1.2%, reflecting slowing household consumption and tighter financial conditions.

- In the updated Summary of Economic Projections, the unemployment rate is projected to average 4.5% for the year, with headline PCE inflation revised up slightly to 3.1% for 2025. The Committee anticipates core PCE inflation to remain stubborn, requiring sustained vigilance and a flexible approach to risk management.

- The Committee reiterated its data-dependent approach and openness to further adjustments should employment or inflation deviate meaningfully from current forecasts. Several members dissented, either advocating a larger 50-basis-point cut or preferring no adjustment at this meeting, revealing heightened divergence within the Committee.

- Balance sheet reduction continues at a measured pace. The monthly Treasury redemption cap remains at $5B and the agency MBS cap at $35B, as the Board aims to support orderly market conditions in the face of evolving global and domestic uncertainty

- The next meeting is scheduled for 28 to 29 October 2025.

Next 24 Hours Bias

Medium Bullish

Gold (XAU)

Key news events today

FOMC meeting minutes (6:00 pm GMT)

What can we expect from Gold today?

Gold prices reached a historic milestone on, surging past the $4,000 per ounce mark for the first time due to intense safe-haven demand, geopolitical tensions, and expectations of further U.S. interest rate cuts. As of the latest trading, gold was quoted close to $3,985–$4,005 per ounce after briefly exceeding the psychological $4,000 threshold before some profit-taking set in. Gold’s rally is historic, but so is the current market and geopolitical uncertainty. The setup supports volatility, positional discipline, and continued focus on Fed policy and global headlines.

Next 24 Hours Bias

Strong Bullish

The Euro (EUR)

Key news events today

No major news event

What can we expect from EUR today?

The Euro is modestly higher today but faces a bearish technical environment and cautious sentiment due to political instability in Europe and potential U.S. fiscal disruptions. Volatility remains elevated as traders await critical U.S. economic data and developments from EU political leaders. The Euro has seen mild gains today, with EUR/USD trading around 1.1659, reflecting a modest 0.02% increase from the previous session. The currency is in a period of heightened volatility due to ongoing political and macroeconomic uncertainties in both Europe and the United States, with bearish sentiment dominating recent technical outlooks.

Central Bank Notes:

- The Governing Council kept the three key ECB interest rates unchanged at its meeting on September 11, 2025. The main refinancing rate remains at 2.15%, the marginal lending facility at 2.40%, and the deposit facility at 2.00%. These levels have been maintained after the cuts earlier in 2025, reflecting the Council’s confidence that the current stance is consistent with the price stability mandate.

- Evidence that inflation is running close to the ECB’s medium-term target of 2% supported the decision to hold rates steady. Domestic price pressures are easing as wage growth continues to moderate, and financing conditions remain accommodative. Policymakers reaffirmed a data-dependent, meeting-by-meeting approach to further policy moves, with no pre-commitment to a predetermined path amid ongoing global and domestic risks.

- Eurosystem staff projections foresee headline inflation averaging 2.0% for 2025, 1.8% for 2026, and 2.0% in 2027. The 2025 and 2026 forecasts reflect a downward revision, primarily on lower energy costs and exchange rate effects, even as food inflation remains persistent. Core inflation (excluding energy and food) is expected at 2.0% for 2026 and 2027, with only minor changes since prior rounds.

- Real GDP growth in the euro area is projected at 1.1% for 2025, 1.1% for 2026, and 1.4% for 2027. A robust first quarter—partly due to firms accelerating exports ahead of anticipated tariff hikes—cushioned a weaker outlook for the remainder of 2025. While business investment continues to face uncertainty from ongoing global trade disputes, especially with the US, government investment and infrastructure spending are expected to provide some support to the outlook..

- Rising real incomes and continued strength in the labor market boost household spending. Despite some fading tailwind from previous rate cuts, financing conditions remain broadly favorable and are expected to underpin the resilience of private consumption and investment against outside shocks. Moderating wage growth and profit margin adjustments are helping to absorb residual cost pressures.

- Rising real incomes and continued strength in the labor market boost household spending. Despite some fading tailwind from previous rate cuts, financing conditions remain broadly favorable and are expected to underpin the resilience of private consumption and investment against outside shocks. Moderating wage growth and profit margin adjustments are helping to absorb residual cost pressures.

- All future interest rate decisions will continue to be guided by the integrated assessment of economic and financial data, the inflation outlook, and underlying inflation dynamics, and the effectiveness of monetary policy transmission—without any pre-commitment to a specific future rate path.

- The ECB’s Asset Purchase Program (APP) and Pandemic Emergency Purchase Program (PEPP) portfolios are declining predictably, as maturities have ceased to be reinvested. Balance-sheet normalization continues in line with the ECB’s previously communicated schedule.

- The next meeting is on 29 to 30 October 2025

Next 24 Hours Bias

Weak Bullish

The Swiss Franc (CHF)

Key news events today

No major news event

What can we expect from CHF today?

The Swiss Franc continues to benefit from global safe-haven flows and cautious central bank policy, remaining strong despite modest short-term fluctuations. Low inflation and active management by the SNB are helping sustain CHF performance, especially as other central banks reconsider interventionist policies. The overall outlook for CHF is stable to strong, with analysts expecting the currency to trade near current levels through the quarter.

Central Bank Notes: