Articles

Eurozone: Solvency of banks continues to improve – BNP Paribas

18917 December 31, 2018 16:33 FXStreet Market News

Thomas Humblot, analyst at BNP Paribas, suggests that the European Union’s major banks have continued to strengthen their solvency and have improved their ability to absorb a large-scale financial shock and to resist its economic consequences on their own.

Key Quotes

“The CET1 ratios of the EU’s major banks are higher than they were during the EBA’s previous stress tests, both at the starting and end points of the shock, even though the shock itself was more severe.”

“There were significant discrepancies between the results of the various banks. The results highlighted the banks’ differing sensitivity to the adverse scenario, related in particular to their business mix and/or their international exposure.”

Gold consolidates in a range, just below 6-month tops

18916 December 31, 2018 16:03 FXStreet Market News

• US-China trade optimism prompts some long-unwinding trade on Monday.

• Expectations of a dovish Fed/global growth concerns helped limit downside.

Gold was seen oscillating in a narrow trading band and remained within striking distance of over six-month tops set on Friday.

The precious metal now seems to have entered a bullish consolidation phase, especially after this month’s strong up-move of nearly 5% and amid relatively thin liquidity conditions.

The US President Donald Trump sent positive signals to ease US-China trade tensions, which eventually dented the precious metal’s safe-haven status during the Asian session on Monday.

The downtick, however, turned out to be rather shallow amid a fragile sentiment surrounding the US Dollar, which has been one of the key factors behind the recent upsurge to the highest level since June 19.

Expectations of a dovish Fed next year, along with a partial US government shutdown kept the USD bulls on the defensive and continued benefitting the dollar-denominated commodity.

This coupled with concerns over a global economic slowdown should further collaborate towards limiting any meaningful corrective slide ahead of this week’s important release of the keenly watched US NFP report.

Technical levels to watch

On a sustained move beyond $1282 level, the commodity is likely to accelerate the up-move towards $1290 horizontal zone before eventually darting towards reclaiming the $1300 round figure mark. On the flip side, the $1276-74 region now seems to act as immediate support, which if broken might drag the metal further towards $1270 level en-route $1265 support area.

Russia: Are sanctions effective? – Commerzbank

18915 December 31, 2018 15:53 FXStreet Market News

Tatha Ghose, analyst at Commerzbank, suggests that the impact of western sanctions on Russia since 2014 has been a controversial topic as several commentators, including Russian officials, claim that sanctions have been futile – that life goes on much the same in Russia.

Key Quotes

“These commentators point to the healthy capital adequacy of financial institutions whose access to capital markets was barred, or the increased profitability of systemic oil and gas and other exporters, which received a windfall from the weaker ruble. Because so many opposing forces act on individual sectors and institutions, the net impact can be confusing, especially because this period also happened to coincide with an abrupt downward shift in the oil price.”

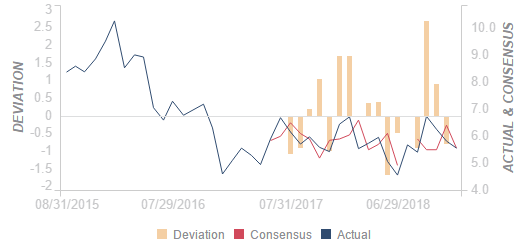

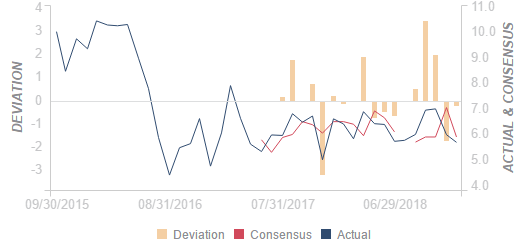

“Russia’s economic performance experienced a discrete turning point around 2014. Until before the Crimea sanctions, Russia was by and large outperforming the world average as well as its major neighbour (the euro zone).”

“After the sanctions, however, there has been steady underperformance. Per capita GDP dropped from nearly 70% of the euro zone average towards 55% within a matter of years.”

Global growth and tighter policy to keep risk assets under pressure near term – Danske Bank

18914 December 31, 2018 15:33 FXStreet Market News

Economists at Danske Bank expect the global expansion to continue but at a slower pace in coming years in light of a maturing global business cycle, but macro data have disappointed lately, raising growth concerns and weighing on risk assets.

Key Quotes

“Our quantitative business-cycle model now signals that the global economy is likely to remain in the so-called ‘red quadrant’ (cyclical downturn phase) for longer. This is not usually an attractive environment for FX carry trades. However, there is a risk of a ‘tail wagging the dog’ effect, i.e. when sentiments indicators stabilise, so might confidence indicators and growth. Thus selective carry may be attractive.”

“We note that FX carry trades tend to perform in the so-called ‘blue quadrant’ (recovery) and suffer in ‘red’. Still, this year, the G10 carry space has performed relatively well, due mainly to a strong dollar performance.”

“We reckon that, in absence of a more severe deterioration of risk appetite, G10 carry could continue to do well in the coming months on the back on continued USD support – even if our fundamental view is that USD overvaluation should eventually reverse.”

USD/CAD sticking to highs above 1.3600 heading into 2019

18913 December 31, 2018 15:03 FXStreet Market News

- Oil markets have hampered the CAD.

- New Year’s trading promises a rush of fresh liquidity in the latter half of the week.

USD/CAD is trading steadily near 1.3630 as traders buckle down for rollover into 2019 and Tuesday’s market holiday, with broader market volumes grinding to a halt as investors set up for the second off-day this holiday season.

Crude oil continues to see play towards the downside, leaving the Canadian Loonie exposed to further downside, with the commodity-linked CAD giving up steady ground to the Greenback with the USD/CAD pairing climbing for three straight months.

The pair remains latched onto near-term highs, threatening to plug into the major 1.3700 handle and 2017’s peak heading into the new year.

USD/CAD Technical Levels

USD/CAD

Overview:

Today Last Price: 1.363

Today Daily change: -30 pips

Today Daily change %: -0.220%

Today Daily Open: 1.366

Trends:

Previous Daily SMA20: 1.3472

Previous Daily SMA50: 1.3295

Previous Daily SMA100: 1.3155

Previous Daily SMA200: 1.306

Levels:

Previous Daily High: 1.3662

Previous Daily Low: 1.3594

Previous Weekly High: 1.4134

Previous Weekly Low: 1.3564

Previous Monthly High: 1.336

Previous Monthly Low: 1.3048

Previous Daily Fibonacci 38.2%: 1.3636

Previous Daily Fibonacci 61.8%: 1.362

Previous Daily Pivot Point S1: 1.3616

Previous Daily Pivot Point S2: 1.3572

Previous Daily Pivot Point S3: 1.3549

Previous Daily Pivot Point R1: 1.3683

Previous Daily Pivot Point R2: 1.3706

Previous Daily Pivot Point R3: 1.375

USD/JPY sticks to modest recovery gains but lacks follow-through

18912 December 31, 2018 14:53 FXStreet Market News

• Trump’s optimistic trade-related comments weigh on JPY’s safe-haven status.

• The partial US government shutdown kept the USD bulls on the defensive.

• Global growth concerns further collaborate towards capping any strong up-move.

The USD/JPY pair held on to its mildly positive tone, albeit struggled to build on the recovery move further beyond mid-110.00s.

The pair caught some bids at the start of a new trading week and recovered a part of Friday’s fall back closer to over 4-month lows. The US President Donald Trump’s optimistic comments on Sunday increased the likelihood of a possible trade deal with China and eventually dented the Japanese Yen’s safe-haven status.

This coupled with a modest US Dollar uptick, boosted by Friday’s better-than-expected Chicago PMI and mostly in line pending home sales, remained supportive of the attempted rebound, though a combination of factors kept a lid on any strong follow-through.

Market sentiment remained fragile over looming concerns of slowing global growth, while a partial US government shutdown held investors from placing any aggressive USD bullish bets amid relatively thin liquidity conditions and absent relevant market moving economic releases on New Year’s Eve.

Technical levels to watch

USD/JPY

Overview:

Today Last Price: 110.39

Today Daily change: 18 pips

Today Daily change %: 0.163%

Today Daily Open: 110.21

Trends:

Previous Daily SMA20: 112.27

Previous Daily SMA50: 112.78

Previous Daily SMA100: 112.38

Previous Daily SMA200: 111.01

Levels:

Previous Daily High: 111.07

Previous Daily Low: 110.16

Previous Weekly High: 111.41

Previous Weekly Low: 110

Previous Monthly High: 114.25

Previous Monthly Low: 112.3

Previous Daily Fibonacci 38.2%: 110.5

Previous Daily Fibonacci 61.8%: 110.72

Previous Daily Pivot Point S1: 109.89

Previous Daily Pivot Point S2: 109.56

Previous Daily Pivot Point S3: 108.97

Previous Daily Pivot Point R1: 110.8

Previous Daily Pivot Point R2: 111.39

Previous Daily Pivot Point R3: 111.72

UK MPs set to delay Brexit if May’s Brexit deal fails – UK’s Telegraph

18907 December 31, 2018 13:53 FXStreet Market News

According to initial reporting by the UK’s Telegraph, Tory and Labour MPs have a plan to delay the final Brexit date by “several months” if Prime Minister Theresa May’s Brexit withdrawal agreement fails a parliamentary vote, in a bid to undermine PM May’s bid to ‘bleed the clock’ on Brexit in an effort to force no voters into her camp by withholding the key vote until too close to Brexit day to allow naysayers time to scrape together a new plan.

Key quotes

Cross-party talks have been under way for several weeks to ensure the 29 March date is put back – probably until July at the latest – if the government does not push for a delay itself. It is also understood that cabinet ministers have discussed the option of a delay with senior backbench MPs in both the main parties and that Downing Street is considering scenarios in which a delay might have to be requested from Brussels.

One senior Tory backbencher said: “I have had these discussions with ministers. They will not say so in public but of course the option of a delay has to be looked at in detail now. If we are determined to avoid a no deal, and the prime minister’s deal fails, we will have to ask to stop the clock, and that will give time for us to decide to go whatever way we decide thereafter.”

Any attempt to push back Brexit would anger hardline Brexiters in the European Research Group, led by Jacob Rees-Mogg. But most MPs think it would be supported by a majority in parliament to avoid a cliff-edge exit.

In the week before Christmas Starmer told the Commons: “I do agree that serious consideration needs to be given to the timetable now set by article 50, because by 14 January we will be just nine weeks away from the proposed date of leaving the EU. On any view, the government will then have to make a choice about what to do next. No plan B has ever been forthcoming.”

Labour is not, yet, officially calling for a delay but is biding its time to see what happens when parliament returns in the second week in January.

GBPUSD heads into the new year hobbled at 1.2700

18906 December 31, 2018 13:33 FXStreet Market News

- The Sterling’s sideways range is a nice reprieve after months of hard Brexit selling.

- 2019 promises to open with more selling as Brexit looks to remain a dramatic downside factor.

GBP/USD continues to play into the middle, firmly planted just south of the 1.2700 handle as apprehensive Cable traders see little reason to buy heading into the January Brexit gauntlet.

The Cable has been constrained below the 1.2700 zone for several weeks after Brexit ground to a halt for the holidays, but January’s upcoming action will see Pound traders continuing to get hammered, as a parliamentary no-confidence vote in Prime Minister Theresa May is expected in the coming weeks, as is a final vote on PM May’s current Brexit deal, which Mrs May pulled last-minute after it looked certain to fail.

Monday sees little action for the Cable on the economic calendar, and markets are set for the New Year’s shutdown, and the latter half of the trading week could see a fresh influx of volume as traders jostle for position in early 2019.

GBP/USD Levels to watch

Sideways action remains the key element of the Cable’s technical outlook, and as noted by FXStreet’s own Mario Blascak, PhD, technical indicators have worked themselves into middle ground as overall trend signals evaporate:

Technically, the GBP/USD is still moving sideways within a downward sloping trend while the currency pair remained capped in a one big figure trading range of 1.2660-1.2700 on a 1-hour chart. The technical oscillators including Momentum and the Relative Strength Index both dwell in the neutral territory. The Slow Stochastics made a bearish crossover just below the overbought territory. The holiday-thinned session is expected to see GBP/USD range-bound within 1.2600-1.2700.

AUD/USD lifted into 0.7060 on trade hopes

18905 December 31, 2018 13:03 FXStreet Market News

- AUD catching thin buying action on trade hopes.

- Overall markets remain subdued for holidays.

AUD/USD caught a mild bid heading through the year’s end trading window, rising to an intraday high of 0.7067 as investors begin to allow themselves a bit of hope for successful trade talks between the US and China.

Trump tweets from the weekend on China and trade

Though investors are looking confident heading into the break of 2019, little concrete evidence of progress on talks has yet to be seen, but the Antipodean is managing to build mild support regardless, climbing from the day’s opening lows near 0.7040, though the Aussie remains firmly buried within near-term consolidation as broader markets look set to take the New Years holiday off, and Pacific-Asia investors could see a rush of cash returning to the markets for the second half of the week.

AUD/USD Technical Levels

AUD/USD

Overview:

Today Last Price: 0.706

Today Daily change: 21 pips

Today Daily change %: 0.298%

Today Daily Open: 0.7039

Trends:

Previous Daily SMA20: 0.7163

Previous Daily SMA50: 0.7188

Previous Daily SMA100: 0.7196

Previous Daily SMA200: 0.736

Levels:

Previous Daily High: 0.707

Previous Daily Low: 0.7019

Previous Weekly High: 0.7078

Previous Weekly Low: 0.7014

Previous Monthly High: 0.7345

Previous Monthly Low: 0.7072

Previous Daily Fibonacci 38.2%: 0.7051

Previous Daily Fibonacci 61.8%: 0.7038

Previous Daily Pivot Point S1: 0.7015

Previous Daily Pivot Point S2: 0.6992

Previous Daily Pivot Point S3: 0.6964

Previous Daily Pivot Point R1: 0.7066

Previous Daily Pivot Point R2: 0.7094

Previous Daily Pivot Point R3: 0.7117

China: Debt problem continues – Commerzbank

18904 December 31, 2018 12:53 FXStreet Market News

Analysts at Commerzbank point out that China is sitting on a huge pile of debt which threatens to become an unsolvable problem.

Key Quotes

“China’s authorities have recognized the risk but are still missing a convincing and efficient approach to tackle the issue. With the help of, among other things, stricter regulation of the shadow banking sector, a reduction in explicit and implicit state guarantees and a gradual increase in financing costs, the Chinese authorities succeeded in stabilizing the debt level in 2016 and 2017.”

“The deleveraging campaign was to be continued in 2018 but instead the trade dispute with the U.S. provided a strong headwind for growth as a result of which China’s rulers have apparently fallen back into old patterns to support the economy: At the beginning of the year, the debt level increased again sharply. Debt of the government, households and companies outside the financial sector now amounts to more than 260% of GDP. This makes China the leader among the emerging markets.”

“And in our opinion, the resurgence of debt is likely to continue as the PBoC has shifted to a more accommodative monetary policy stance since Q2 2018 largely due to the economic slowdown and trade tensions. As China’s corporate debt has rebounded again, we would like to re-visit the corporate debt issue in this outlook as this will remain a crucial issue for the Chinese economy in 2019 and beyond.”