Articles

IC Markets Global – Europe Fundamental Forecast | 16 January 2026

425392 January 16, 2026 16:39 ICMarkets Market News

IC Markets Global – Europe Fundamental Forecast | 16 January 2026

What happened in the Asia session?

Asia’s session reflected cautious trading with yen strength from intervention rhetoric and inflation stability overshadowing tech sector weakness from China policies, alongside commodity volatility; yen crosses, U.S. chip stocks, oil, and gold saw outsized impacts amid broader USD firmness.

What does it mean for the Europe & US sessions?

Focus on U.S. bank earnings pre-market from firms like PNC, State Street, M&T Bank, Regions Financial, and Wit, which could signal economic resilience. Watch the U.S. Dollar Index near 99.35 and any FX reactions to recent data. European traders eye ongoing tariff and U.S. fiscal concerns impacting euro area stability, per the ECB’s prior review.

The Dollar Index (DXY)

Key news events today

No major news event

What can we expect from DXY today?

The US Dollar wobbled near a DXY of 99, undermined by a DOJ probe into Fed Chair Powell that sparked safe-haven buying in gold and yen, alongside soft US jobs data and cautious inflation outlooks ahead of CPI. Bearish technicals and eroding rate differentials pointed to further downside risks toward 98 unless upcoming data surprises to the upside.

Central Bank Notes:

- The Federal Open Market Committee (FOMC) is widely expected to lower the federal funds rate target range by 25 basis points to 3.50%–3.75% at its December 9–10, 2025, meeting, marking the third consecutive cut after the October reduction to 3.75%–4.00%

- The Committee continues to pursue maximum employment and 2% inflation goals, with the labour market showing further softening as the unemployment rate rose to 4.4% in September 2025 amid modest job gains.

- Officials note persistent downside risks to growth alongside resilient activity, with inflation easing to 3.0% year-over-year CPI in September but remaining elevated due to tariff effects; core PCE stands at around 2.8% as of October.

- Economic activity grew at a 3.8% annualised pace in Q2 2025, according to revised estimates. However, Q3 and Q4 are expected to face headwinds from trade tensions, fiscal restraint, and data disruptions, such as the government shutdown.

- September’s Summary of Economic Projections forecasts 2025 unemployment at a median of 4.5%, with PCE inflation near 3.0% and core PCE at 3.1%, signalling a gradual disinflation path. Updates expected on December 10 may adjust for higher unemployment and lower growth.

- The Committee maintained its data-dependent approach, noting a softening labour market and inflation above the 2% target, while deciding to lower the federal funds rate target range by 25 basis points to 3.50%-3.75%. Dissent persisted, with multiple members opposing the cut or advocating for a hold, reflecting divisions similar to recent meetings.

- The FOMC confirmed the conclusion of its quantitative tightening program effective December 1, 2025, with Treasury rolloff caps at $5 billion per month and agency MBS caps at $35 billion per month to ensure ample reserves and market stability.

- The next meeting is scheduled for 27 to 28 January 2026.

Next 24 Hours Bias

Weak Bullish

Gold (XAU)

Key news events today

No major news event

What can we expect from Gold today?

Gold prices remain elevated near record highs, trading around $4,609 per ounce amid ongoing safe-haven demand driven by geopolitical tensions and economic uncertainties. Recent sessions saw spot gold surge to peaks above $4,640 earlier in the week, fueled by softer U.S. inflation data boosting Fed rate cut expectations.

Next 24 Hours Bias

Weak Bullish

The Euro (EUR)

Key news events today

No major news event

What can we expect from EUR today?

The Euro experienced downward pressure, trading around 1.1606-1.163 against the US dollar, marking a modest daily decline of about 0.02% and a one-month weakening of roughly 1.15% amid a strengthening dollar. This movement reflects investor caution over diverging monetary policies, with the ECB holding key rates steady at its early January meeting.

Central Bank Notes:

- The Governing Council of the ECB kept the three key interest rates unchanged at its 4–5 January 2026 meeting, maintaining the main refinancing rate at 2.15%, the marginal lending facility at 2.40% and the deposit facility at 2.00%. This decision aligns with the assessment that the current stance supports medium-term price stability, as inflation edges below the 2% target while growth shows resilience amid balanced risks. Markets and commentary indicate value in holding steady, with no fixed path ahead given uncertainties in data.

- Price dynamics remain stable near target levels. Headline HICP inflation stood at 2.1% in November 2025, with projections for 1.9% in 2026 driven by base effects from energy and easing non-energy components. Services inflation persists somewhat elevated but trends toward moderation, alongside contained food pressures.

- December 2025 Eurosystem staff projections confirm headline inflation at 2.1% for 2025, declining to 1.9% in 2026 and 1.8% in 2027 before nearing 2% in 2028. Downside risks from soft producer prices and anchored expectations offset potential upsides from geopolitics or fiscal measures.

- Euro area GDP growth remains resilient at subdued levels, with Q3 2025 at 0.3% qoq and forecasts around 1.2-1.4% for 2025-2027. Surveys signal stabilization, bolstered by public investment and external demand against softer private spending.

- The labour market stays tight overall, with unemployment steady at 6.4% through October 2025, near historic lows and solid participation. Real incomes support consumption as inflation eases, with credit conditions aiding gradual household and firm expansion.

- Business sentiment reflects caution over US policy, trade tensions, and tariffs, tempered by easing supply chains and a competitive euro. Export sectors gain a modest lift, while domestic drivers like investment build momentum.

- The Governing Council will continue to make data-dependent decisions meeting by meeting, assessing inflation outlook, underlying trends, and transmission. Both hikes and cuts remain possible based on data, avoiding preset paths amid uncertainties.

- Balance sheet normalisation proceeds steadily, with APP and PEPP portfolios shrinking post-reinvestment halts, at a pace deemed suitable without market strain.

The next meeting is on 4 to 5 February 2026

Next 24 Hours Bias

Weak Bearish

The Swiss Franc (CHF)

Key news events today

No major news event

What can we expect from CHF today?

The Swiss Franc maintains firmness around 0.80 per USD, buoyed by safe-haven flows amid U.S. dollar risks and a stable SNB outlook, with traders eyeing upcoming U.S. CPI data for further direction. No major intraday events specific to today have emerged, but the currency’s recent rally underscores its appeal in uncertain markets.

Central Bank Notes:

- At its 11 December 2025 monetary policy assessment, the Swiss National Bank (SNB) is widely expected to leave the policy rate unchanged at 0%, extending the pause that began in September as the Governing Board judges that current settings are sufficient to keep inflation near, but still below, its target while avoiding an unnecessary move into negative rates.

- Recent data show that the tentative rebound in Swiss inflation has stalled, with headline CPI easing from 0.1% year‑on‑year in October to 0.0% in November and core inflation slipping to about 0.4%, reinforcing the view that underlying price pressures remain very weak and that deflation risks, while contained, have not fully disappeared.

- The SNB’s conditional inflation forecast is likely to remain close to the September projections, with inflation still seen averaging roughly 0.2% in 2025, 0.5% in 2026, and 0.7% in 2027 under an unchanged policy rate path, though the latest CPI prints argue for a slightly lower near‑term profile and keep open the option of renewed easing if activity or prices weaken further.

- The global backdrop has deteriorated further, as continuing U.S. tariff actions and softer external demand weigh on world trade, while uncertainty in key European and U.S. markets for Swiss exports persists, leaving the SNB cautious about the growth outlook despite Switzerland’s relatively resilient domestic demand.

- Business and labour-market sentiment in export‑oriented manufacturing remains subdued, with firms reporting pressure on margins from the still‑strong franc and softer foreign orders, although the broader economy is still expected to grow at around 1–1.5% in 2025 and unemployment only drifting up gradually from low levels.

- The SNB continues to stress its willingness to act if deflation risks re‑emerge, reiterating that it can ease policy through renewed rate cuts or targeted foreign‑exchange intervention if necessary, while also highlighting its commitment to transparent communication, including the publication of detailed minutes from recent assessments and ongoing dialogue with international partners on FX policy

The next meeting is on 19 March 2026.

Next 24 Hours Bias

Strong Bullish

The Pound (GBP)

Key news events today

BOE Gov Bailey Speaks (10:00 am GMT)

What can we expect from GBP today?

The pound remained range-bound near $1.3443, down slightly on the day but up 0.15% monthly, as traders digested mixed UK growth signals against a resilient dollar fueled by strong US data; weekly forecasts point to a corrective bounce before downside risks, with BoE caution and Fed uncertainties providing near-term support.

Central Bank Notes:

- The Bank of England’s Monetary Policy Committee (MPC) will meet on 18 December 2025, with the current Bank Rate standing at 4.00 per cent after being held in a close 5–4 vote at the 5 November meeting. Market pricing and analyst commentary point to a high risk of a 25‑basis‑point cut to 3.75 per cent, but this remains conditional on incoming inflation and labour‑market data, so the December note should be treated as pre‑decision guidance rather than an ex‑post summary.

- The BoE is expected to leave its quantitative tightening (QT) framework broadly unchanged through year‑end, maintaining the lower reduction pace in gilt holdings that was set earlier in 2025. Official communications still characterise the existing QT path as consistent with a restrictive stance, with policymakers stressing that balance‑sheet reduction will remain gradual and sensitive to market‑liquidity conditions.

- Headline CPI inflation eased to 3.6 per cent year‑on‑year in October 2025, down from 3.8 per cent in September, helped by softer energy and goods prices, though it remains almost twice the 2 per cent target. Underlying inflation pressures, particularly in services, have continued to moderate only slowly, so the MPC’s central projection still envisages inflation moving closer to, but not yet reaching, 3 per cent over the course of 2026, contingent on further normalisation in energy and wage dynamics.

- UK economic activity remains weak heading into the December meeting, with the labour market showing further signs of slackening. The unemployment rate has risen toward just above 5 per cent on the latest three‑month figures to October, while overall regular pay growth has slowed to around the mid‑4 per cent range, reinforcing the view that domestic cost pressures are gradually easing.

- External conditions continue to cloud the outlook, with fragile global growth and fluctuating commodity prices contributing to bouts of financial‑market volatility. The MPC has highlighted that renewed global energy or food price shocks could temporarily slow the pace of disinflation, but such risks are currently judged unlikely to derail the medium‑term downward trajectory for inflation if domestic demand stays subdued.

- The balance of risks around the inflation outlook remains finely poised. Downside risks are linked to persistently weak domestic demand and rising unemployment, while upside risks come from still‑elevated inflation expectations, sticky services inflation, and the possibility that structural changes in the labour market leave less slack than conventional indicators suggest.

- Overall, the MPC’s stance going into December is restrictive but increasingly open to a gradual easing cycle, with any rate cuts expected to be measured and data‑dependent. Policymakers have reiterated that the Bank Rate will need to stay in restrictive territory until they are confident inflation is on a sustainable path back to the 2 per cent target, and they have signalled that the profile of cuts, once started, is likely to be shallow rather than rapid.

- The next meeting is on 5 February 2026.

Next 24 Hours Bias

Weak Bullish

The Canadian Dollar (CAD)

Key news events today

No major news event

What can we expect from CAD today?

The Canadian Dollar (CAD) showed mild weakness amid ongoing USD strength and pressures from falling oil prices, a key commodity driver for Canada. USD/CAD traded around 1.3893-1.3919, up slightly from recent sessions, reflecting a 0.07-0.1% gain for the USD as investors digested mixed Canadian economic data, like rising unemployment and cautious Bank of Canada rate cut expectations.

Central Bank Notes:

- The Governing Council left the target for the overnight rate unchanged at 2.25% at its 10 December 2025 meeting, in line with market expectations and signalling that the earlier easing cycle has likely concluded. The Bank noted that while global tariff tensions and trade uncertainty persist, the external backdrop has stabilised somewhat, reducing the need for additional insurance cuts even as world trade remains fragile.

- The Council acknowledged that uncertainty around U.S. trade policy and tariffs continues to weigh on business sentiment, but recent data show Canadian manufacturing and goods exports holding up better than anticipated. Surveys cited by the Bank suggest export order books have stopped deteriorating, with firms reporting some rebuilding of backlogs despite still‑cautious capital spending plans.

- Canada’s economy rebounded more strongly than expected in the third quarter, with real GDP expanding at an annualised pace of about 2.6% after a 1.8% contraction in Q2, largely on the back of higher crude exports and government spending. Monthly data show output rising 0.2% in September, though flash estimates point to a softer start to Q4 as some sectors give back earlier gains.

- Service sector activity has firmed, with indicators showing the services PMI back above the 50 threshold and broadening gains in business and professional services. However, consumer-facing categories remain mixed, as still‑elevated price levels and only modest real income growth keep a lid on discretionary spending even as tourism and technology‑related services expand.

- Housing markets have continued to stabilise, with national resale activity and prices edging higher through the autumn alongside the earlier decline in borrowing costs. The Bank noted that while some major urban centres are seeing renewed price pressures, tighter underwriting standards and still‑high affordability constraints are expected to cap the pace of any rebound.

- Headline CPI inflation eased to 2.2% year over year in October and is estimated to have remained near that rate in November, keeping it slightly above the 2% target but comfortably within the 1%–3% control range. Core measures have drifted lower, with CPI‑median and CPI‑trim around 3% or below, reinforcing the assessment that underlying price pressures are gradually moderating even as gasoline and some shelter components remain volatile.

- The Governing Council reiterated that the current policy rate is “about the right level” to keep inflation close to target while supporting the economy through a period of structural adjustment, and it signalled a shift away from near‑term easing expectations. While the Bank did not rule out future adjustments, officials stressed that, barring a material downside surprise to growth or inflation, further rate cuts are unlikely before 2026. Attention is now focused on the durability of the recovery and the evolution of core inflation.

- The next meeting is on 28 January 2026.

Next 24 Hours Bias

Medium Bearish

Oil

Key news events today

No major news event

What can we expect from Oil today?

Oil prices steadied after a sharp 4.6% drop the previous day, marking the biggest decline since June, driven by reduced fears of US military action against Iran. West Texas Intermediate (WTI) hovered near $59 per barrel, while Brent remained below $64, as Israeli Prime Minister Benjamin Netanyahu urged President Donald Trump to postpone any Iran strike amid ongoing protests there, easing supply disruption concerns.

Next 24 Hours Bias

Medium Bearish

The post IC Markets Global – Europe Fundamental Forecast | 16 January 2026 first appeared on IC Markets | Official Blog.

Friday 16th January 2026: Technical Outlook and Review

425372 January 16, 2026 16:14 ICMarkets Market News

DXY (U.S. Dollar Index):

Potential Direction: Bullish

Overall momentum of the chart: Bearish

The price could see a short-term pullback toward the pivot before rising again toward the 1st resistance.

Pivot: 99.23

Supporting reasons: Identified as a pullback support, where renewed buying pressure could emerge to push the price higher.

1st support: 98.73

Supporting reasons: Identified as an overlap support, indicating a potential area where the price could again stabilize.

1st resistance: 99.79

Supporting reasons: Identified as an overlap resistance, indicating a potential area that could halt any further upward movement

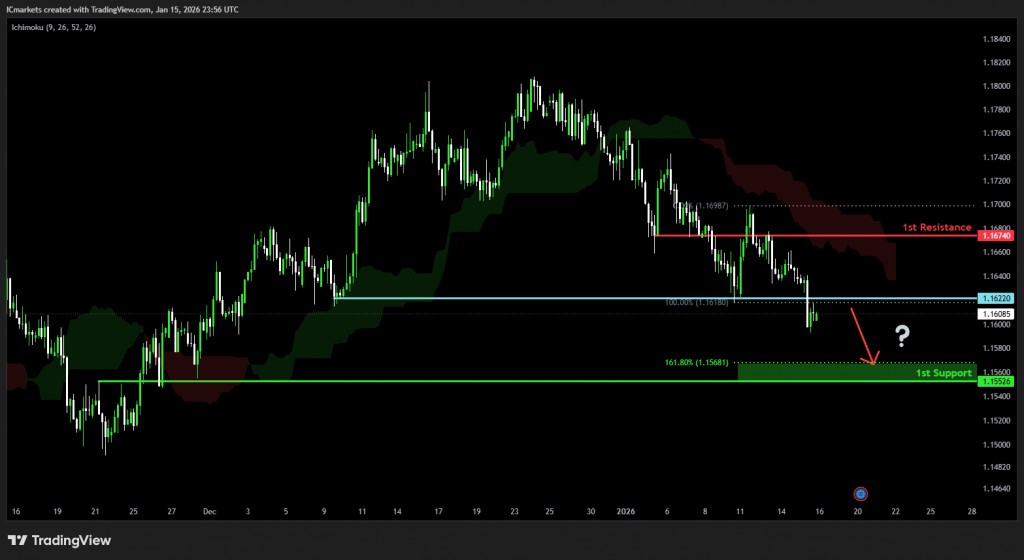

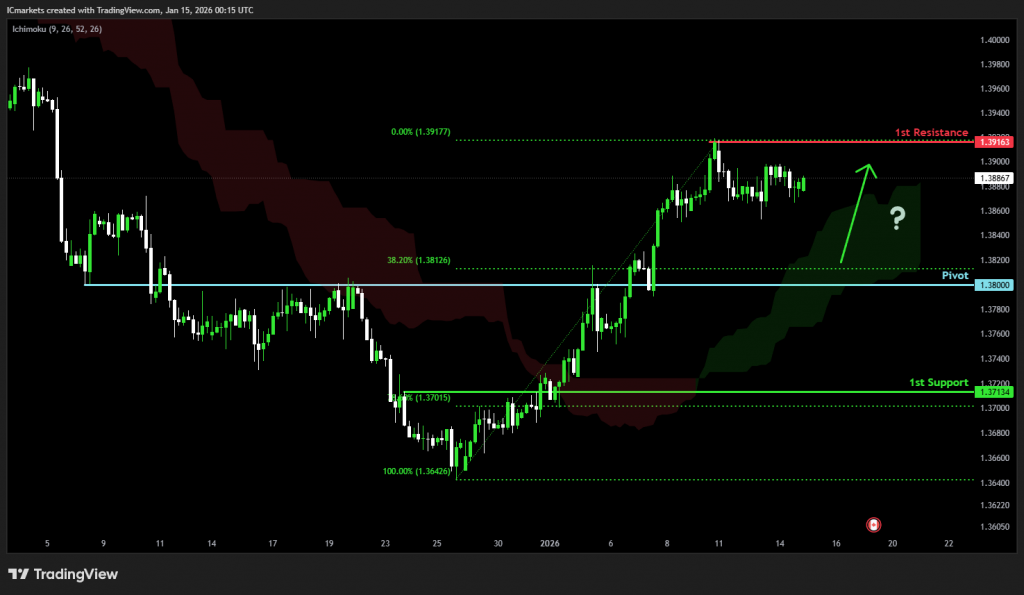

EUR/USD:

Potential Direction: Bearish

Overall momentum of the chart: Bearish

The price has already reacted off the pivot and may continue its bearish move toward the 1st support.

Pivot: 1.1622

Supporting reasons: Identified as a pullback resistance, where selling pressures could intensify and potentially cap any upward retracement.

1st support: 1.1552

Supporting reasons: Identified as an overlap support that aligns with the 161.8% Fibonacci extension, indicating a potential level where the price could stabilize once again.

1st resistance: 1.1674

Supporting reasons: Identified as an overlap resistance, indicating a potential level that could cap further upward movement.

EUR/JPY:

Potential Direction: Bullish

Overall momentum of the chart: Bullish

The price could see a short-term pullback toward the pivot before rising again toward the 1st resistance.

Pivot: 183.55

Supporting reasons: Identified as a pullback support that aligns with the 61.8% Fibonacci retracement, where renewed buying pressure could emerge to push the price higher.

1st support: 182.54

Supporting reasons: Identified as swing low support, indicating a potential area where the price could again stabilize.

1st resistance: 185.53

Supporting reasons: Identified as a swing high resistance, indicating a potential level that could cap further upward movement.

EUR/GBP:

Potential Direction: Bearish

Overall momentum of the chart: Bullish

The price could see a short-term pullback toward the pivot before continuing its bearish move down toward the 1st support.

Pivot: 0.8690

Supporting reasons: Identified as a swing high resistance, where selling pressures could intensify and potentially cap any upward retracement.

1st support: 0.8651

Supporting reasons: Identified as a multi-swing low support, indicating a potential area where the price could stabilize once more.

1st resistance: 0.8706

Supporting reasons: Identified as an overlap resistance that aligns with the 61.8% Fibonacci retracement, indicating a potential level that could cap further upward movement.

GBP/USD:

Potential Direction: Bearish

Overall momentum of the chart: Bullish

The price has already reacted off the pivot and may continue its bearish move toward the 1st support.

Pivot: 1.3392

Supporting reasons: Identified as an overlap resistance, where selling pressures could intensify and potentially cap any upward retracement.

1st support: 1.3260

Supporting reasons: Identified as a pullback support that aligns with the 61.8% Fibonacci retracement, indicating a potential area where the price could stabilize once more.

1st resistance: 1.3489

Supporting reasons: Identified as an overlap resistance, indicating a potential level that could halt further upward movement.

GBP/JPY:

Potential Direction: Bullish

Overall momentum of the chart: Bullish

The price could see a short-term pullback toward the pivot before rising again toward the 1st resistance.

Pivot: 211.94

Supporting reasons: Identified as a pullback support that aligns with the 61.8% Fibonacci retracement, where renewed buying pressure could emerge to push the price higher.

1st support: 210.30

Supporting reasons: Identified as a multi-swing low support, indicating a potential level where the price could stabilize once more.

1st resistance: 214.29

Supporting reasons: Identified as a swing high resistance, indicating a potential level that could halt further upward movement.

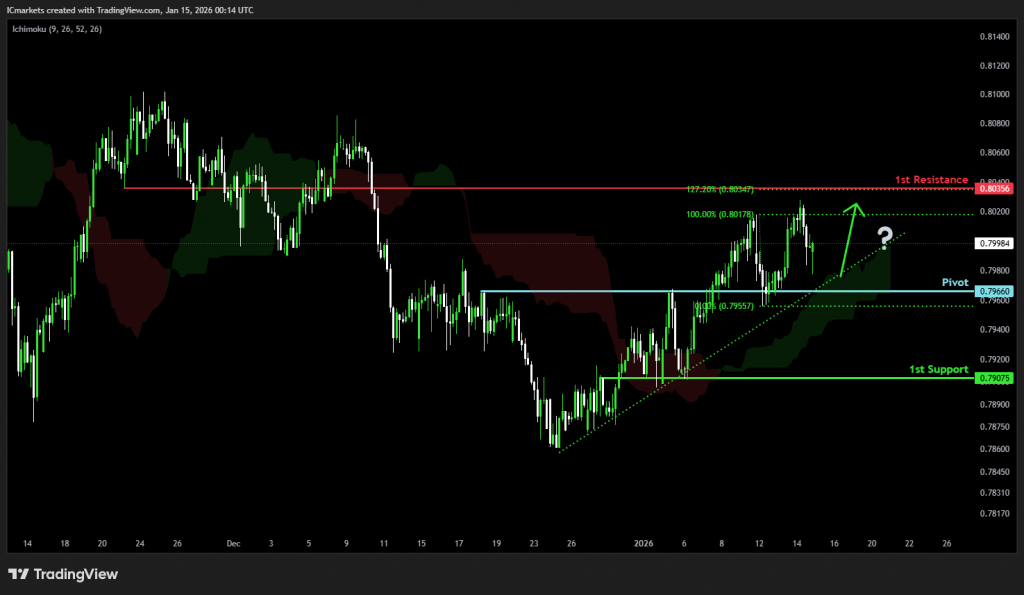

USD/CHF:

Potential Direction: Bullish

Overall momentum of the chart: Bearish

The price has already bounced off the pivot and may continue its bullish move toward the 1st resistance

Pivot: 0.8013

Supporting reasons: Identified as an overlap support, where renewed buying pressure could emerge to push the price higher.

1st support: 0.7966

Supporting reasons: Identified as an overlap support, indicating a potential level where the price could stabilize once again.

1st resistance: 0.8065

Supporting reasons: Identified as a multi swing high resistance that aligns with the 161.8% Fibonacci extension, indicating a potential level that could cap further upward movement.

USD/JPY:

Potential Direction: Bullish

Overall momentum of the chart: Bullish

The price could see a short-term pullback toward the pivot before rising again toward the 1st resistance.

Pivot: 157.87

Supporting reasons: Identified as a pullback support, where renewed buying pressure could emerge to push the price higher.

1st support: 156.84

Supporting reasons: Identified as an overlap support, indicating a strong area where buyers might return, and the price could stabilize once again.

1st resistance: 160.09

Supporting reasons: Identified as a resistance that is supported by the 161.8% Fibonacci extension. This level represents the next key area where upward movement could be capped amid increased selling pressure

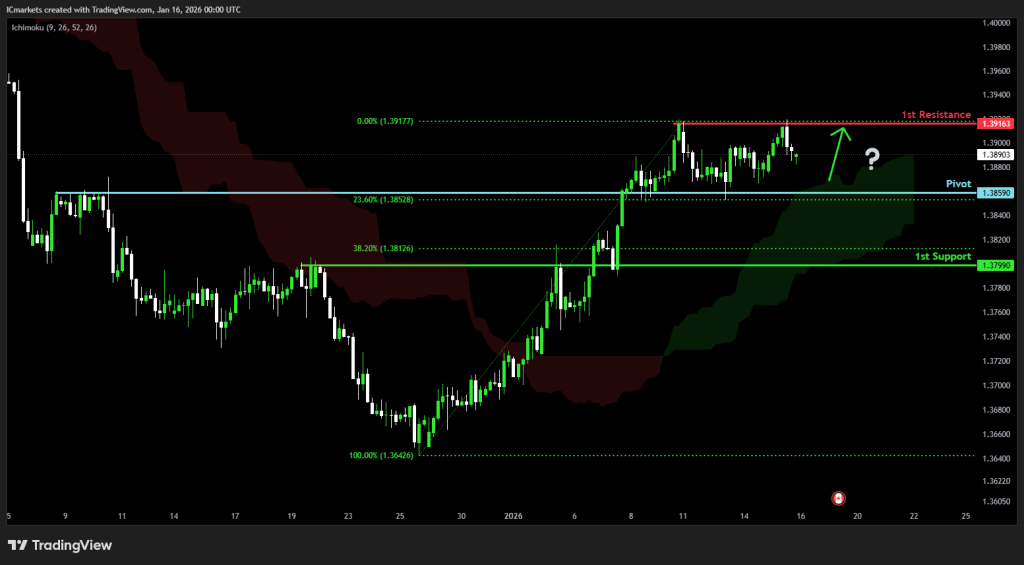

USD/CAD:

Potential Direction: Bullish

Overall momentum of the chart: Bearish

The price could see a short-term pullback toward the pivot before rising again toward the 1st resistance.

Pivot: 1.3859

Supporting reasons: Identified as an overlap support that aligns with the 23.6% Fibonacci retracement, where renewed buying pressure could emerge to push the price higher.

1st support: 1.3799

Supporting reasons: Identified as an overlap support that aligns with the 38.2% Fibonacci retracement, indicating a key level where the price could stabilize once more.

1st resistance: 1.3916

Supporting reasons: Identified as a swing high resistance, making it a possible target for bullish advances and a level where some sellers could return to cap gains

AUD/USD:

Potential Direction: Bearish

Overall momentum of the chart: Bullish

The price could see a short-term pullback toward the pivot before continuing its bearish move down toward the 1st support.

Pivot: 0.6722

Supporting reasons: Identified as an overlap resistance, where selling pressures could intensify and potentially cap any upward retracement.

1st support: 0.6661

Supporting reasons: Identified as an overlap support that aligns with the 61.8% Fibonacci retracement, this area has provided strong support historically and may attract buying interest for a potential short-term bounce

1st resistance: 0.6766

Supporting reasons: Identified as a swing high resistance, indicating a potential area that could halt any further upward movement.

NZD/USD

Potential Direction: Bearish

Overall momentum of the chart: Bullish

The price could see a short-term pullback toward the pivot before continuing its bearish move down toward the 1st support.

Pivot: 0.5770

Supporting reasons: Identified as an overlap resistance, where selling pressures could intensify and potentially cap any upward retracement.

1st support: 0.5690

Supporting reasons: Identified as a pullback support, this area has provided strong support historically and may attract buying interest for a potential short-term bounce

1st resistance: 0.5796

Supporting reasons: Identified as an overlap resistance, indicating a potential area that could halt any further upward movement.

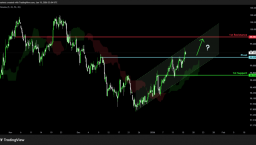

US30 (DJIA):

Potential Direction: Bullish

Overall momentum of the chart: Bullish

The price could see a short-term pullback toward the pivot before rising again toward the 1st resistance.

Pivot: 48,844.50

Supporting reasons: Identified as a pullback support, where renewed buying pressure could emerge to push the price higher.

1st support: 48,330.52

Supporting reasons: Identified as an overlap support, suggesting a potential area where the price could stabilize once again.

1st resistance: 49,617.45

Supporting reasons: Identified as a multi-swing high resistance, indicating a potential area that could halt any further upward movement.

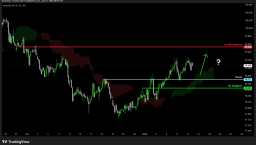

DE40 (DAX):

Potential Direction: Bullish

Overall momentum of the chart: Bullish

The price could see a short-term pullback toward the pivot before rising again toward the 1st resistance.

Pivot: 24,687.00

Supporting reasons: Identified as a pullback support, where renewed buying pressure could emerge to push the price higher.

1st support: 24,203.80

Supporting reasons: Identified as an overlap support, indicating a key level where the price could stabilize once more.

1st resistance: 25,501.92

Supporting reasons: Identified as a resistance that is supported by the 161.8% Fibonacci extension, indicating a potential area that could halt any further upward movement.

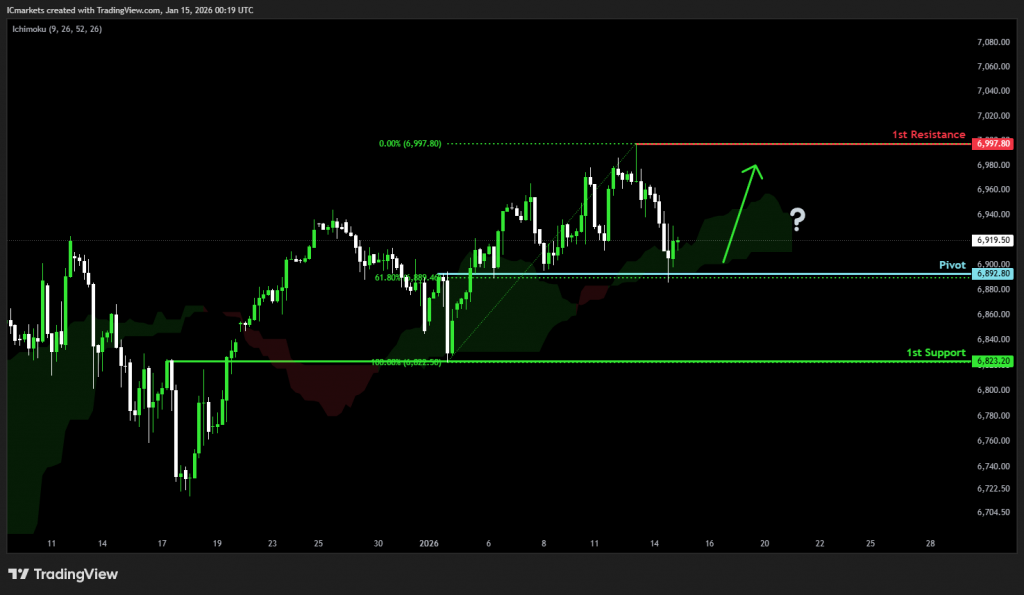

US500 (S&P 500):

Potential Direction: Bullish

Overall momentum of the chart: Bullish

The price has already bounced off the pivot and may continue its bullish move toward the 1st resistance

Pivot: 6,892.80

Supporting reasons: Identified as an overlap support that aligns with the 61.8% Fibonacci retracement, where renewed buying pressure could emerge to push the price higher.

1st support: 6,823.20

Supporting reasons: Identified as an overlap support, indicating a potential level where the price could stabilize once again.

1st resistance: 6,997.80

Supporting reasons: Identified as a swing high resistance, indicating a potential area that could halt any further upward movement.

BTC/USD (Bitcoin):

Potential Direction: Bullish

Overall momentum of the chart: Bearish

The price could see a short-term pullback toward the pivot before rising again toward the 1st resistance.

Pivot: 94,194.50

Supporting reasons: Identified as a pullback support, where renewed buying pressure could emerge to push the price higher.

1st support: 91,670.00

Supporting reasons: Identified as an overlap support, indicating a potential level where the price could stabilize once more.

1st resistance: 98,880.63

Supporting reasons: Identified as a pullback resistance that aligns with the 161.8% Fibonacci extension, indicating a potential area that could halt any further upward movement.

ETH/USD (Ethereum):

Potential Direction: Bullish

Overall momentum of the chart: Bullish

The price could see a short-term pullback toward the pivot before rising again toward the 1st resistance.

Pivot: 3,192.74

Supporting reasons: Identified as a pullback support that aligns with the 61.8% Fibonacci retracement, where renewed buying pressure could emerge to push the price higher.

1st support: 3,051.82

Supporting reasons: Identified as an overlap support, indicating a potential level where the price could stabilize once more.

1st resistance: 3,403.56

Supporting reasons: Identified as an overlap resistance, indicating a potential area that could halt any further upward movement.

WTI/USD (Oil):

Potential Direction: Bullish

Overall momentum of the chart: Bullish

The price has already bounced off the pivot and may continue its bullish move toward the 1st resistance

Pivot: 60.26

Supporting reasons: Identified as a pullback support, where renewed buying pressure could emerge to push the price higher.

1st support: 56.69

Supporting reasons: Identified as an overlap support, indicating a key level where the price could stabilize once more.

1st resistance: 62.16

Supporting reasons: Identified as a swing high resistance that aligns with the 161.8% Fibonacci projection, indicating a potential area that could halt any further upward movement.

XAU/USD (GOLD):

Potential Direction: Bullish

Overall momentum of the chart: Bullish

The price could see a short-term pullback toward the pivot before rising again toward the 1st resistance.

Pivot: 4,549.86

Supporting reasons: Identified as a pullback support that aligns with the 38.2% Fibonacci retracement, where renewed buying pressure could emerge to push the price higher.

1st support: 4,500.59

Supporting reasons: Identified as a pullback support that aligns with the 61.8% Fibonacci retracement, indicating a key level where the price could stabilize once more.

1st resistance: 4,641.78

Supporting reasons: Identified as a swing high resistance, indicating a potential area that could halt any further upward movement.

The accuracy, completeness and timeliness of the information contained on this site cannot be guaranteed. IC Markets Global does not warranty, guarantee or make any representations, or assume any liability regarding financial results based on the use of the information in the site.

News, views, opinions, recommendations and other information obtained from sources outside of www.icmarkets.com, used in this site are believed to be reliable, but we cannot guarantee their accuracy or completeness. All such information is subject to change at any time without notice. IC Markets Global assumes no responsibility for the content of any linked site.

The fact that such links may exist does not indicate approval or endorsement of any material contained on any linked site. IC Markets Global is not liable for any harm caused by the transmission, through accessing the services or information on this site, of a computer virus, or other computer code or programming device that might be used to access, delete, damage, disable, disrupt or otherwise impede in any manner, the operation of the site or of any user’s software, hardware, data or property.

The post Friday 16th January 2026: Technical Outlook and Review first appeared on IC Markets | Official Blog.

IC Markets Global – Asia Fundamental Forecast | 16 January 2026

425371 January 16, 2026 16:14 ICMarkets Market News

IC Markets Global – Asia Fundamental Forecast | 16 January 2026

What happened in the U.S. session?

Robust U.S. labor and manufacturing data, combined with upbeat bank and TSMC earnings, propelled a Wall Street rebound, lifting major stock indexes and the dollar while pressuring safe-havens like gold amid de-escalating Iran tensions; energy stocks dipped slightly as oil tumbled.

What does it mean for the Asia Session?

Asian traders face a data-light local calendar but pivotal US jobless claims and industrial production releases that could sway risk appetite, compounded by Thursday’s commodity selloff and yen pressures; expect choppy opens in Nikkei/Hang Seng, with oil/gold volatility tied to supply dynamics and gold eyeing support near $4,235 before potential rebounds.

The Dollar Index (DXY)

Key news events today

No major news event

What can we expect from DXY today?

The dollar trimmed intraday gains to trade near 99.35 late in the session, as Fed rate-hold bets grew but political jitters overshadowed positive jobs revisions. Overall weekly forecasts remained cautious, with low directional volatility in majors.

Central Bank Notes:

- The Federal Open Market Committee (FOMC) is widely expected to lower the federal funds rate target range by 25 basis points to 3.50%–3.75% at its December 9–10, 2025, meeting, marking the third consecutive cut after the October reduction to 3.75%–4.00%

- The Committee continues to pursue maximum employment and 2% inflation goals, with the labor market showing further softening as the unemployment rate rose to 4.4% in September 2025 amid modest job gains.

- Officials note persistent downside risks to growth alongside resilient activity, with inflation easing to 3.0% year-over-year CPI in September but remaining elevated due to tariff effects; core PCE stands at around 2.8% as of October.

- Economic activity grew at a 3.8% annualized pace in Q2 2025 per revised estimates, though Q3 and Q4 face headwinds from trade tensions, fiscal restraint, and data disruptions like the government shutdown.

- September’s Summary of Economic Projections forecasts 2025 unemployment at a median of 4.5%, with PCE inflation near 3.0% and core PCE at 3.1%, signaling a gradual disinflation path. Updates expected on December 10 may adjust for higher unemployment and lower growth.

- The Committee maintained its data-dependent approach, noting a softening labor market and inflation above the 2% target, while deciding to lower the federal funds rate target range by 25 basis points to 3.50%-3.75%. Dissent persisted, with multiple members opposing the cut or advocating for a hold, reflecting divisions similar to recent meetings.

- The FOMC confirmed the conclusion of its quantitative tightening program effective December 1, 2025, with Treasury rolloff caps at $5 billion per month and agency MBS caps at $35 billion per month to ensure ample reserves and market stability.

- The next meeting is scheduled for 27 to 28 January 2026.

Next 24 Hours Bias

Medium Bearish

Gold (XAU)

Key news events today

No major news event

What can we expect from Gold today?

Gold maintains bullish momentum near record levels despite minor pullbacks, supported by softer US jobless claims at 198K and improving Philly Fed data, though Friday’s focus shifts to political developments with limited macro releases.

Next 24 Hours Bias

Strong Bullish

The Australian Dollar (AUD)

Key news events today

No major news event

What can we expect from AUD today?

The AUD began 2026 robustly, hitting 15-month highs before pulling back nearly 1 cent amid trimmed RBA rate hike expectations and US uncertainties like Fed subpoenas, yet maintains upside potential above its 200-day SMA toward 0.6766, supported by commodities and risk sentiment watch domestic jobs data, and China risks next.

Central Bank Notes:

- The Reserve Bank of Australia held its cash rate steady at 3.60% at the November 2025 policy meeting, adopting a cautious tone amid a surprise uptick in inflation data for the September quarter. This marks the fourth consecutive pause since the 25 basis point cut in August. The Board attributed some of the inflation rise to temporary factors like higher petrol prices and council rates, but noted signs of more persistent pressures from consumer demand.

- Policymakers emphasized vigilance on inflation, with trimmed mean inflation expected to remain elevated in the near term before nearing the 2–3% target midpoint by mid-2027. Recent data showed underlying inflation staying above target until at least the second half of 2026, prompting upward revisions to forecasts. Capacity pressures are seen as slightly more pronounced than previously assessed, delaying any easing.

- Headline CPI for the September quarter exceeded expectations, driven partly by temporary items, while underlying measures signal ongoing stickiness. The shift to monthly CPI reporting, with the first full edition in November 2025, will enhance real-time inflation monitoring. Housing and services remain resilient contributors to price pressures.

- Domestic demand shows firmness in services alongside below-trend growth elsewhere, with capacity pressures not expected to ease significantly. The labor market is gradually softening, with unemployment projected to stabilize around 4.4%, though wage growth and productivity dynamics keep unit labor costs a concern. Household spending faces headwinds from high borrowing costs.

- Global risks include geopolitical tensions and commodity volatility, set against modestly revised-up world growth outlooks. The Board describes its policy as mildly restrictive and data-dependent, balancing inflation control with employment goals. No rate hike was considered despite the inflation surprise.

- Monetary policy remains mildly restrictive to address lingering price stability risks amid household and global vulnerabilities. Communications reaffirm the dual mandate of 2–3% inflation and full employment, with readiness to adjust based on incoming data.

- Market expectations point to the cash rate holding through early 2026, with a possible modest cut to 3.3% mid-year if inflation eases as forecast. The new monthly CPI data will be key for timely insights.

- Monetary policy remains mildly restrictive, balancing progress on price stability against vulnerabilities in household demand and global outlook. Board communications reaffirm a dual mandate: price stability and full employment, while underscoring readiness to respond should risks materialize sharply.

- Analysts generally expect the cash rate to remain at current levels through early 2026, with only modest cuts possible later in the year if inflation moderates. The new monthly CPI release (first full edition Nov 2025) will be watched closely for timely signals on price trends.

- The next meeting is on 2 to 3 February 2026.

Next 24 Hours Bias

Medium Bullish

The Kiwi Dollar (NZD)

Key news events today

No major news event

What can we expect from NZD today?

The New Zealand Dollar traded in a tight range near 0.5740 amid thin specific news, extending a bearish weekly bias with forecasts eyeing a correction to 0.5755 before potential drops below 0.5375, as RBNZ’s steady 2.25% rate tempers hike hopes despite US Dollar softness from Fed worries.

Central Bank Notes:

- The Monetary Policy Committee (MPC) left the Official Cash Rate (OCR) unchanged at 2.25% at its 26 November 2025 meeting, following the widely anticipated 25-basis-point reduction from 2.50%, and signaled that policy is now firmly in stimulatory territory while keeping the option of further easing on the table if needed.

- The decision was again reached by consensus, with members judging that the cumulative 325 basis points of easing over the past year warranted a period of assessment, even as several emphasized a willingness to cut further should incoming data point to a more protracted downturn or renewed disinflationary pressures.

- Headline consumer price inflation is projected to hover near 3% in late 2025 before gradually easing toward the 2% midpoint of the 1–3% target band through 2026, supported by contained inflation expectations around 2.3% over the two-year horizon and an expected pickup in spare capacity.

- The MPC noted that domestic demand remains subdued but shows tentative signs of stabilisation, with softer household spending and construction only partially offset by improving services activity; nevertheless, policymakers still expect services inflation to ease as wage growth moderates and the labour market loosens further over the coming year.

- Financial conditions continue to ease as wholesale and retail borrowing rates reprice to the lower OCR, contributing to gradually rising mortgage approvals and improving housing-related sentiment, although broader business credit growth remains patchy and sensitive to uncertainty about the durability of the recovery.

- Recent data confirm that GDP momentum is weak but not deteriorating as sharply as earlier in 2025, with high-frequency indicators pointing to a shallow recovery from a low base and ongoing headwinds from elevated living costs and fragile confidence weighing on discretionary consumption and investment.

- The MPC reiterated that external risks remain skewed to the downside, particularly from softer Chinese demand and uncertainty around United States trade policy, but noted that a lower New Zealand dollar continues to provide some offset via improved export competitiveness and support for tradables inflation.

- Looking ahead to early 2026, the Committee maintained a mild easing bias, indicating that a further cut toward 2.00–2.10% cannot be ruled out if activity fails to gain traction or if inflation undershoots projections, but current forecasts envisage the OCR remaining near 2.25% for an extended period, provided inflation converges toward target and the recovery proceeds broadly as expected.

- The next meeting is on 18 February 2026.

Next 24 Hours Bias

Medium Bearish

The Japanese Yen (JPY)

Key news events today

No major news event

What can we expect from JPY today?

The Japanese yen steadied around 158.50 per dollar after hitting an 18-month low near 159.45, pressured by Prime Minister Sanae Takaichi’s snap election plans for February and fears of fiscal loosening that could stall Bank of Japan rate hikes. Verbal warnings from officials curbed further slides, while BoJ policymakers increasingly eye the currency’s role in inflation ahead of their January 22-23 meeting.

Central Bank Notes:

- The Policy Board of the Bank of Japan will meet on 18–19 December with markets almost fully pricing a 25-basis-point hike, which would raise the short-term policy rate from 0.50% to around 0.75%, as the bank moves further away from its ultra-loose stance while stressing that any tightening will remain gradual and data-dependent.

- The BOJ is expected to continue guiding the uncollateralized overnight call rate in a narrow band around the new policy rate, near 0.75%, while signaling that the pace and timing of any additional hikes will depend on how past increases affect bank lending, corporate financing conditions, and overall economic activity.

- The quarterly path of JGB purchases remains on a pre-announced, gradual taper: outright purchases are being reduced by about ¥400 billion per quarter through March 2026, then by roughly ¥200 billion per quarter from April to June 2026, with the bank still aiming for JGB purchases to settle near ¥2 trillion in Q1 2027 and retaining flexibility to adjust the pace if market functioning or yield volatility deteriorate.

- Japan’s economy has softened in the near term, with Q3 2025 GDP contracting at an annualized rate of approximately 2.3%, as weaker residential investment and external demand weighed on activity. Meanwhile, business sentiment in manufacturing has recently improved to a roughly four-year high.

- Core consumer inflation (excluding fresh food) accelerated to around 3.0% year-on-year in October, up from 2.9% in September and remaining above the BOJ’s 2% target, while the “core-core” measure excluding both fresh food and energy rose to about 3.1%, underscoring persistent underlying price pressures.

- In the very near term, some input-cost pressures are easing as earlier import price surges fade, but services inflation linked to labor shortages, along with steady wage gains, continues to support broader price momentum; firms’ and households’ medium-term inflation expectations remain anchored slightly above 2%, keeping short-term inflation risks tilted to the upside.

- For the coming quarters, the BOJ assesses that real growth will likely run below potential as the economy digests tighter financial conditions and past yen depreciation. However, accommodative real rates, positive real wage growth, and improving corporate sentiment are expected to help sustain a modest recovery in private consumption and business investment.

- Over the medium term, as overseas demand stabilizes and domestic labor markets remain tight, the BOJ expects wage settlements and inflation expectations to keep core inflation on a gradual upward trajectory around or slightly above 2%, providing room for further cautious rate normalization as long as financial conditions remain supportive and the recovery is not derailed.

- The next meeting is scheduled for 22 to 23 January 2026.

Next 24 Hours Bias

Medium Bearish

Oil

Key news events today

No major news event

What can we expect from Oil today?

Oil prices experienced downward pressure amid easing geopolitical tensions and global oversupply dynamics. In Ghana, fuel prices at pumps declined marginally starting that day, with petrol dropping 1.26-2.30% to around GHC 11.75 per liter, driven by falling international refined product prices despite a slight crude uptick and cedi strength.

Next 24 Hours Bias

Medium Bearish

The post IC Markets Global – Asia Fundamental Forecast | 16 January 2026 first appeared on IC Markets | Official Blog.

General Market Analysis – 16/01/26

425370 January 16, 2026 16:00 ICMarkets Market News

US Stocks Climb on Tech Optimism – Dow up 0.6%

Wall Street rebounded strongly overnight, led by technology stocks, after TSMC — the world’s largest producer of advanced AI chips — forecast robust growth into 2026. The Dow Jones rose 0.60% to close at 49,442, while the S&P 500 added 0.26% to 6,944 and the Nasdaq gained 0.25% to finish at 23,530. US Treasury yields moved higher following stronger-than-expected economic data, providing support to the US dollar. The 2-year Treasury yield climbed 5.5 basis points to 3.565%, while the 10-year yield rose 3.8 basis points to 4.170%. The stronger yield backdrop helped lift the US dollar index by 0.23% to 99.36. Commodity markets saw sharp moves, with oil prices tumbling after comments from President Trump eased concerns over potential US military action against Iran. Brent lost 3.94% to $63.89 per barrel, while WTI slumped 4.56% to $59.19. Gold also edged lower, slipping 0.25% to $4,616.15 as improved risk sentiment and higher yields weighed on demand, pulling prices back from recent record highs.

Earnings In Focus for US Stock Markets

US stock markets are focusing strongly on the first earnings reports to hit the newswires in 2026 in the coming weeks. Stellar earnings and projections throughout 2025 helped all three of the major US indices hit all-time highs in the last year, and they are still trading near those elevated levels. However, updates in the coming weeks could do a lot in determining where the indices head in the coming weeks and months. Major banks have kicked off the season this week with mixed results, but we will see a more diverse batch of companies in the coming weeks, with Netflix and Intel probably the pick of the bunch before we hit the full ‘Magnificent 7’ that dominated moves in the last year. In general, S&P 500 companies are expected to increase earnings by 15% in 2026, and any disappointments from already high valuations could see some sharp corrections in the market. However, for the moment, it has largely been a case of ‘carry on as 2025’ for the start of this year, and the bulls are still in control – how long that lasts could well be decided by earnings updates in this quarter.

Quiet Calendar Day to Close Out the Trading Week

Looking ahead, the macroeconomic calendar is relatively quiet today. However, markets are likely to remain sensitive to geopolitical headlines, with traders closely monitoring any developments that could impact risk sentiment across asset classes. The Asian session has very little in the way of scheduled events; however, focus remains strongly on Japanese markets and the potential for a snap election and its implications, with the yen remaining sensitive to any updates. The European session will see a strong focus on UK markets, with Bank of England Governor Andrew Bailey scheduled to speak midway through the day, while US markets will focus on updates from Fed members Susan Collins, Michelle Bowman, and Phillip Jefferson.

Explore all upcoming market events in the Economic Calendar.

The post General Market Analysis – 16/01/26 first appeared on IC Markets | Official Blog.

Friday 16th January 2026: Asian Markets Mostly Higher on Easing Geopolitical Tensions; Japan Underperforms

425369 January 16, 2026 16:00 ICMarkets Market News

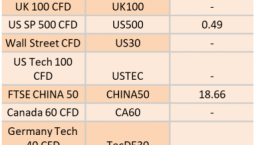

Global Markets:

- Asian Stock Markets : Nikkei down 0.28%, Shanghai Composite down 0.21%, Hang Seng down 0.23% ASX up 0.40%

- Commodities : Gold at $4,599.05 (-0.52%), Silver at $90.542 (-2.50%), Brent Oil at $63.21 (-0.32%), WTI Oil at $59.07 (-0.36%)

- Rates : US 10-year yield at 4.168, UK 10-year yield at 4.3920, Germany 10-year yield at 2.8177

News & Data:

- (USD) Unemployment Claims 198K to 215K expected

Markets Update:

Asian stock markets traded mostly higher on Friday, taking positive cues from Wall Street overnight amid easing geopolitical tensions surrounding a potential U.S.–Iran confrontation. Renewed optimism over AI-led growth also supported technology stocks. Asian markets had closed mixed in the previous session.

Sentiment was further aided by U.S. data showing an unexpected decline in first-time unemployment claims for the week ended January 10, helping to ease concerns over labor market strength.

Australian shares extended gains for a fifth straight session, with the benchmark S&P/ASX 200 hovering near the 8,900 level. Financial and technology stocks led advances, partially offset by weakness in energy and gold miners. Major miners showed mixed performance, while oil stocks declined alongside falling crude prices. Technology shares were broadly positive, with Appen surging after announcing the lapse of performance rights. The big four banks posted modest gains, while gold miners mostly traded lower. The Australian dollar was steady around $0.670.

In contrast, Japanese stocks declined, extending losses from the previous session despite upbeat global cues. The Nikkei 225 slipped amid weakness in exporters and financial stocks. Automakers and select technology shares moved lower, while gains were seen in some industrial and retail names. The yen traded in the lower 158 range against the U.S. dollar.

Elsewhere in Asia, South Korea and Taiwan posted strong gains, while China, Hong Kong, Singapore and New Zealand edged higher. Malaysia declined slightly, while Indonesia remained closed for a public holiday.

Overnight, U.S. markets ended higher, while European stocks closed mixed. Crude oil prices fell sharply as geopolitical risks eased.

Upcoming Events:

- 02:15 PM GMT – USD Industrial Production m/m

The post Friday 16th January 2026: Asian Markets Mostly Higher on Easing Geopolitical Tensions; Japan Underperforms first appeared on IC Markets | Official Blog.

General Market Analysis – 15/01/26

425365 January 16, 2026 12:00 ICMarkets Market News

US Stocks Hit as Tech Drops – Nasdaq down 1%

US equity markets closed lower in yesterday’s session, with stocks retreating as profit-taking weighed on technology shares and investors rotated into more defensive positioning. The S&P 500 fell 0.53% to 6,926, marking its first back-to-back daily losses of 2026, while the Nasdaq underperformed, sliding 1.00% to 23,471. The Dow Jones proved relatively resilient, easing just 0.09% to finish at 49,149. US Treasury yields moved lower after Core PPI data came in slightly weaker than expected. The 2-year Treasury yield fell 2.3 basis points to 3.510%, while the 10-year yield declined 4.7 basis points to 4.132%. The pullback in yields weighed modestly on the US dollar, with the DXY index edging down 0.04% to 99.09. In commodities, oil prices pushed lower as reports suggesting that civil unrest in Iran may be easing reduced geopolitical risk premiums. Brent fell 0.99% to $64.82 a barrel, while WTI declined 1.13% to $60.47. In contrast, precious metals continued to attract strong demand, with gold rising 0.87% to close at a fresh record of $4,626.58. Silver was the standout performer, surging more than 6% on the day as momentum and safe-haven flows remained firmly in place.

Silver Outshining Gold in Current Markets

Whilst gold has continued to trade in a similar vein in the first couple of weeks of the new year as it did in 2025, it has been hugely outdone by silver in the last few days. It has smashed through all-time highs on three separate occasions already this year and looks set to do so again today. A lot of column space had been given to gold’s rise in the last year, but given that silver was trading under $50/oz as recently as November 21 and is now trading above $92/oz, representing a 90% increase, many traders feel that they may have missed the boat. Traders are now looking for it to hit $100/oz in short order but are aware that some of the pullbacks can be significant, as liquidity is much thinner than its golden counterpart. We have seen daily falls of over 10% on some occasions in the recent move higher, so it’s not for the faint-hearted; however, for those that have hung in over the last couple of months, the rewards have been great. Short-term support is now at yesterday’s low of $86.85, with longer-term support on the daily trendline at $78.15, while resistance is at the recent high of $93.57.

Traders Anticipate Another Buy Day Ahead

Looking ahead, market participants will continue to monitor geopolitical developments, while attention will also turn to several key economic releases due later in the day. There is very little of note on the macroeconomic calendar in the Asian session again today; however, things should start to liven up when Europe comes in. UK GDP data (exp +0.1% m/m) is scheduled for release early in the London session alongside Industrial Production (exp +0.2% m/m) and Manufacturing Production (exp +0.4%) data, although the GDP numbers are expected to dominate. The US session features Weekly Unemployment Claims (exp 215k), the Empire State Manufacturing Index (exp 0.8), and the Philadelphia Fed Manufacturing Index (exp -1.6) data sets, all released early in the day, before we hear from more Fed speakers, including members Bostic, Barkin, Schmid, and Barr.

Explore all upcoming market events in the Economic Calendar.

The post General Market Analysis – 15/01/26 first appeared on IC Markets | Official Blog.

IC Markets Global – Asia Fundamental Forecast | 15 January 2026

425356 January 15, 2026 21:14 ICMarkets Market News

IC Markets Global – Asia Fundamental Forecast | 15 January 2026

What happened in the U.S. session?

Labor and manufacturing data releases jobless claims at 208K, Empire State at -3.9, and Philly Fed at -10.2 that met or approximated forecasts but underscored manufacturing weakness, eliciting limited immediate market moves, overshadowed by bank earnings misses in sentiment (e.g., JPM shares down 4%), Trump’s policy rhetoric, and steady inflation trends pointing to Fed patience on rates.

What does it mean for the Asia Session?

Ongoing yen weakness amid Japanese political developments, and broader market reactions to recent U.S. data when markets open on January 15, 2026. With U.S. CPI beating expectations and Trump’s tariff threats on Iran lifting oil prices, commodities remain volatile, while gold hits record highs above $4,580 an ounce due to safe-haven demand from Middle East unrest.

The Dollar Index (DXY)

Key news events today

Unemployment Claims (1:30 pm GMT)

Empire State Manufacturing Index (1:30 pm GMT)

Philly Fed Manufacturing Index (1:30 pm GMT)

What can we expect from DXY today?

The U.S. dollar maintained mild upward momentum with the index near 99.1, bolstered by safe-haven flows, global uncertainties, and awaited U.S. data like jobless claims and PPI that could influence Fed rate outlook; against peers, it held firm versus a recovering euro around 1.1645 and weaker yen at 156, though analysts noted risks of reversal amid Fed leadership speculation and mixed labor signals.

Central Bank Notes:

- The Federal Open Market Committee (FOMC) is widely expected to lower the federal funds rate target range by 25 basis points to 3.50%–3.75% at its December 9–10, 2025, meeting, marking the third consecutive cut after the October reduction to 3.75%–4.00%

- The Committee continues to pursue maximum employment and 2% inflation goals, with the labor market showing further softening as the unemployment rate rose to 4.4% in September 2025 amid modest job gains.

- Officials note persistent downside risks to growth alongside resilient activity, with inflation easing to 3.0% year-over-year CPI in September but remaining elevated due to tariff effects; core PCE stands at around 2.8% as of October.

- Economic activity grew at a 3.8% annualized pace in Q2 2025 per revised estimates, though Q3 and Q4 face headwinds from trade tensions, fiscal restraint, and data disruptions like the government shutdown.

- September’s Summary of Economic Projections forecasts 2025 unemployment at a median of 4.5%, with PCE inflation near 3.0% and core PCE at 3.1%, signaling a gradual disinflation path. Updates expected on December 10 may adjust for higher unemployment and lower growth.

- The Committee maintained its data-dependent approach, noting a softening labor market and inflation above the 2% target, while deciding to lower the federal funds rate target range by 25 basis points to 3.50%-3.75%. Dissent persisted, with multiple members opposing the cut or advocating for a hold, reflecting divisions similar to recent meetings.

- The FOMC confirmed the conclusion of its quantitative tightening program effective December 1, 2025, with Treasury rolloff caps at $5 billion per month and agency MBS caps at $35 billion per month to ensure ample reserves and market stability.

- The next meeting is scheduled for 27 to 28 January 2026.

Next 24 Hours Bias

Medium Bearish

Gold (XAU)

Key news events today

Unemployment Claims (1:30 pm GMT)

Empire State Manufacturing Index (1:30 pm GMT)

Philly Fed Manufacturing Index (1:30 pm GMT)

What can we expect from Gold today?

Gold prices reached new record highs around $4,630 per ounce, driven by escalating geopolitical tensions, including protests in Iran and the US arrest of Venezuelan leader Nicolás Maduro, alongside a criminal investigation into Federal Reserve Chairman Jerome Powell that weakened the US dollar.

Next 24 Hours Bias

Strong Bullish

The Australian Dollar (AUD)

Key news events today

No major news event

What can we expect from AUD today?

The Australian Dollar maintained strength around 0.67 against the USD, buoyed by a weakening US Dollar amid escalating political threats to Fed independence under President Trump, though gains were capped by softer Australian consumer confidence, cooling inflation signals, and reduced RBA hike bets following recent CPI data.

Central Bank Notes:

- The Reserve Bank of Australia held its cash rate steady at 3.60% at the November 2025 policy meeting, adopting a cautious tone amid a surprise uptick in inflation data for the September quarter. This marks the fourth consecutive pause since the 25 basis point cut in August. The Board attributed some of the inflation rise to temporary factors like higher petrol prices and council rates, but noted signs of more persistent pressures from consumer demand.

- Policymakers emphasized vigilance on inflation, with trimmed mean inflation expected to remain elevated in the near term before nearing the 2–3% target midpoint by mid-2027. Recent data showed underlying inflation staying above target until at least the second half of 2026, prompting upward revisions to forecasts. Capacity pressures are seen as slightly more pronounced than previously assessed, delaying any easing.

- Headline CPI for the September quarter exceeded expectations, driven partly by temporary items, while underlying measures signal ongoing stickiness. The shift to monthly CPI reporting, with the first full edition in November 2025, will enhance real-time inflation monitoring. Housing and services remain resilient contributors to price pressures.

- Domestic demand shows firmness in services alongside below-trend growth elsewhere, with capacity pressures not expected to ease significantly. The labor market is gradually softening, with unemployment projected to stabilize around 4.4%, though wage growth and productivity dynamics keep unit labor costs a concern. Household spending faces headwinds from high borrowing costs.

- Global risks include geopolitical tensions and commodity volatility, set against modestly revised-up world growth outlooks. The Board describes its policy as mildly restrictive and data-dependent, balancing inflation control with employment goals. No rate hike was considered despite the inflation surprise.

- Monetary policy remains mildly restrictive to address lingering price stability risks amid household and global vulnerabilities. Communications reaffirm the dual mandate of 2–3% inflation and full employment, with readiness to adjust based on incoming data.

- Market expectations point to the cash rate holding through early 2026, with a possible modest cut to 3.3% mid-year if inflation eases as forecast. The new monthly CPI data will be key for timely insights.

- Monetary policy remains mildly restrictive, balancing progress on price stability against vulnerabilities in household demand and global outlook. Board communications reaffirm a dual mandate: price stability and full employment, while underscoring readiness to respond should risks materialize sharply.

- Analysts generally expect the cash rate to remain at current levels through early 2026, with only modest cuts possible later in the year if inflation moderates. The new monthly CPI release (first full edition Nov 2025) will be watched closely for timely signals on price trends.

- The next meeting is on 2 to 3 February 2026.

Next 24 Hours Bias

Medium Bullish

The Kiwi Dollar (NZD)

Key news events today

No major news event

What can we expect from NZD today?

The New Zealand Dollar (NZD) showed modest gains against the US Dollar, trading around 0.5743-0.5745, up approximately 0.12-0.15% from the prior session, though it remains near multi-week lows amid low expectations for near-term Reserve Bank of New Zealand (RBNZ) rate hikes.

Central Bank Notes:

- The Monetary Policy Committee (MPC) left the Official Cash Rate (OCR) unchanged at 2.25% at its 26 November 2025 meeting, following the widely anticipated 25-basis-point reduction from 2.50%, and signaled that policy is now firmly in stimulatory territory while keeping the option of further easing on the table if needed.

- The decision was again reached by consensus, with members judging that the cumulative 325 basis points of easing over the past year warranted a period of assessment, even as several emphasized a willingness to cut further should incoming data point to a more protracted downturn or renewed disinflationary pressures.

- Headline consumer price inflation is projected to hover near 3% in late 2025 before gradually easing toward the 2% midpoint of the 1–3% target band through 2026, supported by contained inflation expectations around 2.3% over the two-year horizon and an expected pickup in spare capacity.

- The MPC noted that domestic demand remains subdued but shows tentative signs of stabilisation, with softer household spending and construction only partially offset by improving services activity; nevertheless, policymakers still expect services inflation to ease as wage growth moderates and the labour market loosens further over the coming year.

- Financial conditions continue to ease as wholesale and retail borrowing rates reprice to the lower OCR, contributing to gradually rising mortgage approvals and improving housing-related sentiment, although broader business credit growth remains patchy and sensitive to uncertainty about the durability of the recovery.

- Recent data confirm that GDP momentum is weak but not deteriorating as sharply as earlier in 2025, with high-frequency indicators pointing to a shallow recovery from a low base and ongoing headwinds from elevated living costs and fragile confidence weighing on discretionary consumption and investment.

- The MPC reiterated that external risks remain skewed to the downside, particularly from softer Chinese demand and uncertainty around United States trade policy, but noted that a lower New Zealand dollar continues to provide some offset via improved export competitiveness and support for tradables inflation.

- Looking ahead to early 2026, the Committee maintained a mild easing bias, indicating that a further cut toward 2.00–2.10% cannot be ruled out if activity fails to gain traction or if inflation undershoots projections, but current forecasts envisage the OCR remaining near 2.25% for an extended period, provided inflation converges toward target and the recovery proceeds broadly as expected.

- The next meeting is on 18 February 2026.

Next 24 Hours Bias

Medium Bearish

The Japanese Yen (JPY)

Key news events today

No major news event

What can we expect from JPY today?

The Japanese yen faced renewed selling pressure, with USD/JPY nearing 160 due to Prime Minister Takaichi’s potential snap election plans fueling bets on aggressive fiscal stimulus amid Bank of Japan rate hike uncertainty and Japan-China tensions, prompting official warnings of intervention risks despite a modest intraday rebound from 18-month lows around 159.45.

Central Bank Notes:

- The Policy Board of the Bank of Japan will meet on 18–19 December with markets almost fully pricing a 25-basis-point hike, which would raise the short-term policy rate from 0.50% to around 0.75%, as the bank moves further away from its ultra-loose stance while stressing that any tightening will remain gradual and data-dependent.

- The BOJ is expected to continue guiding the uncollateralized overnight call rate in a narrow band around the new policy rate, near 0.75%, while signaling that the pace and timing of any additional hikes will depend on how past increases affect bank lending, corporate financing conditions, and overall economic activity.

- The quarterly path of JGB purchases remains on a pre-announced, gradual taper: outright purchases are being reduced by about ¥400 billion per quarter through March 2026, then by roughly ¥200 billion per quarter from April to June 2026, with the bank still aiming for JGB purchases to settle near ¥2 trillion in Q1 2027 and retaining flexibility to adjust the pace if market functioning or yield volatility deteriorate.

- Japan’s economy has softened in the near term, with Q3 2025 GDP contracting at an annualized rate of approximately 2.3%, as weaker residential investment and external demand weighed on activity. Meanwhile, business sentiment in manufacturing has recently improved to a roughly four-year high.

- Core consumer inflation (excluding fresh food) accelerated to around 3.0% year-on-year in October, up from 2.9% in September and remaining above the BOJ’s 2% target, while the “core-core” measure excluding both fresh food and energy rose to about 3.1%, underscoring persistent underlying price pressures.

- In the very near term, some input-cost pressures are easing as earlier import price surges fade, but services inflation linked to labor shortages, along with steady wage gains, continues to support broader price momentum; firms’ and households’ medium-term inflation expectations remain anchored slightly above 2%, keeping short-term inflation risks tilted to the upside.

- For the coming quarters, the BOJ assesses that real growth will likely run below potential as the economy digests tighter financial conditions and past yen depreciation. However, accommodative real rates, positive real wage growth, and improving corporate sentiment are expected to help sustain a modest recovery in private consumption and business investment.

- Over the medium term, as overseas demand stabilizes and domestic labor markets remain tight, the BOJ expects wage settlements and inflation expectations to keep core inflation on a gradual upward trajectory around or slightly above 2%, providing room for further cautious rate normalization as long as financial conditions remain supportive and the recovery is not derailed.

- The next meeting is scheduled for 22 to 23 January 2026.

Next 24 Hours Bias

Strong Bearish

Oil

Key news events today

No major news event

What can we expect from Oil today?

Oil prices surged, driven by geopolitical tensions involving Iran and potential disruptions in the Strait of Hormuz, with WTI crude rising 1.21% to $61.89 per barrel and Brent gaining 1.34% to $66.35 per barrel. U.S. crude inventories unexpectedly increased by 3.39 million barrels, far above the anticipated draw, along with a significant gasoline stock build, yet prices held firm amid these supply concerns.

Next 24 Hours Bias

Weak Bullish

The post IC Markets Global – Asia Fundamental Forecast | 15 January 2026 first appeared on IC Markets | Official Blog.

Thursday 15th January 2026 : Asian Markets Slip Amid Geopolitical Tensions, Australia Defies Weak Global Cues

425355 January 15, 2026 21:00 ICMarkets Market News

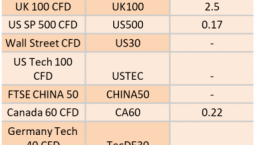

Global Markets:

- Asian Stock Markets : Nikkei down 0.96%, Shanghai Composite down 0.60%, Hang Seng down 0.53% ASX up 0.28%

- Commodities : Gold at $4,595.05 (-0.92%), Silver at $87.542 (-4.50%), Brent Oil at $64.21 (-3.32%), WTI Oil at $60.07 (-3.36%)

- Rates : US 10-year yield at 4.138, UK 10-year yield at 4.3430, Germany 10-year yield at 2.7816

News & Data:

- (USD) Core PPI m/m 0.0% to 0.2% expected

- (USD) Core Retail Sales m/m 0.5% to 0.4% expected

Markets Update:

Asian markets are trading mostly lower on Thursday, tracking broadly negative cues from Wall Street overnight amid rising global geopolitical concerns. Investor sentiment has been weighed by escalating tensions, including U.S. President Donald Trump’s remarks on Greenland, political unrest in Iran, and the ongoing Russia-Ukraine conflict. Some profit-taking has also emerged after the recent record rally in global equities, even as Asian markets closed mostly higher on Wednesday.

Australia is an exception, with shares trading modestly higher for a fourth session. The S&P/ASX 200 is hovering near the 8,850 level, supported by gains in mining stocks amid firmer gold and iron ore prices, while other sectors show mixed performance. Major miners are advancing, although oil stocks remain under pressure. The banking sector is mixed, and technology shares are uneven.

Japanese markets are significantly lower, snapping a three-session winning streak. The Nikkei 225 slipped below 53,850, dragged down by index heavyweights and technology stocks. Losses in SoftBank, semiconductor-related stocks, and select exporters outweighed gains in automakers and banks. Economic data showed Japan’s producer prices rose modestly in December, in line with expectations.

Elsewhere in Asia, markets such as New Zealand, China, Singapore, Malaysia, and Taiwan are lower, while Hong Kong, South Korea, and Indonesia are edging higher.

On Wall Street, stocks ended lower on Wednesday, led by a sharp decline in the Nasdaq. European markets were mixed, while crude oil prices jumped on supply concerns linked to potential U.S. intervention in Iran.

Upcoming Events:

- 01:30 PM GMT – USD Unemployment Claims

The post Thursday 15th January 2026 : Asian Markets Slip Amid Geopolitical Tensions, Australia Defies Weak Global Cues first appeared on IC Markets | Official Blog.

IC Markets Global – Europe Fundamental Forecast | 15 January 2026

425354 January 15, 2026 21:00 ICMarkets Market News

IC Markets Global – Europe Fundamental Forecast | 15 January 2026

What happened in the Asia session?

During the Asia session, markets digested Japan’s steady wholesale inflation data (CGPI ~2.4-3.8% YoY), official yen intervention threats driving USDJPY lower to 158.59, and China chip curbs pressuring tech stocks like Nvidia and Broadcom, while oil dropped on de-escalated Iran risks and gold hit records amid haven flows—impacting yen pairs, U.S. chip ADRs, and commodities most sharply amid mixed Hang Seng gains on China trade strength.

What does it mean for the Europe & US sessions?

Initial jobless claims and potential PPI updates, alongside European factory orders and ECB consumer surveys, as markets open amid recent Wall Street declines led by tech and banks. Gold and silver hit record highs before profit-taking pressured prices, while oil snapped a rally; watch yen strength on Japanese intervention warnings and Treasury gains from haven flows.

The Dollar Index (DXY)

Key news events today

Unemployment Claims (1:30 pm GMT)

Empire State Manufacturing Index (1:30 pm GMT)

Philly Fed Manufacturing Index (1:30 pm GMT)

What can we expect from DXY today?

The US dollar exhibited mild gains with the DXY at 99.1177, buoyed by steady inflation data and labour market anticipation, though forecasts point to USD/CHF declines post-correction and broader caution lingers over Fed independence amid political pressures; Asian demand highlights persistent safe-haven appeal despite 2025’s sharp losses.

Central Bank Notes:

- The Federal Open Market Committee (FOMC) is widely expected to lower the federal funds rate target range by 25 basis points to 3.50%–3.75% at its December 9–10, 2025, meeting, marking the third consecutive cut after the October reduction to 3.75%–4.00%

- The Committee continues to pursue maximum employment and 2% inflation goals, with the labour market showing further softening as the unemployment rate rose to 4.4% in September 2025 amid modest job gains.

- Officials note persistent downside risks to growth alongside resilient activity, with inflation easing to 3.0% year-over-year CPI in September but remaining elevated due to tariff effects; core PCE stands at around 2.8% as of October.

- Economic activity grew at a 3.8% annualised pace in Q2 2025, according to revised estimates. However, Q3 and Q4 are expected to face headwinds from trade tensions, fiscal restraint, and data disruptions, such as the government shutdown.

- September’s Summary of Economic Projections forecasts 2025 unemployment at a median of 4.5%, with PCE inflation near 3.0% and core PCE at 3.1%, signalling a gradual disinflation path. Updates expected on December 10 may adjust for higher unemployment and lower growth.

- The Committee maintained its data-dependent approach, noting a softening labour market and inflation above the 2% target, while deciding to lower the federal funds rate target range by 25 basis points to 3.50%-3.75%. Dissent persisted, with multiple members opposing the cut or advocating for a hold, reflecting divisions similar to recent meetings.

- The FOMC confirmed the conclusion of its quantitative tightening program effective December 1, 2025, with Treasury rolloff caps at $5 billion per month and agency MBS caps at $35 billion per month to ensure ample reserves and market stability.

- The next meeting is scheduled for 27 to 28 January 2026.

Next 24 Hours Bias

Medium Bullish

Gold (XAU)

Key news events today

Unemployment Claims (1:30 pm GMT)

Empire State Manufacturing Index (1:30 pm GMT)

Philly Fed Manufacturing Index (1:30 pm GMT)

What can we expect from Gold today?

Gold prices dipped modestly to around $4,615 per ounce in early trading, paring gains from a record $4,641 hit on January 14 amid escalating US-Iran tensions and safe-haven buying, though technical indicators signal a corrective pullback to rebuild bullish momentum toward potential new highs above $4,765 if support at $4,580 holds.

Next 24 Hours Bias

Strong Bullish

The Euro (EUR)

Key news events today

No major news event

What can we expect from EUR today?

The euro faces downward pressure today amid a strengthening US dollar, driven by delayed expectations for Federal Reserve rate cuts and ongoing tensions between President Trump and Fed Chair Powell. Goldman Sachs maintains a bullish outlook, forecasting EUR/USD to reach 1.22 by year-end due to factors like lower US rates and eurozone resilience.

Central Bank Notes:

- The Governing Council of the ECB kept the three key interest rates unchanged at its 4–5 January 2026 meeting, maintaining the main refinancing rate at 2.15%, the marginal lending facility at 2.40% and the deposit facility at 2.00%. This decision aligns with the assessment that the current stance supports medium-term price stability, as inflation edges below the 2% target while growth shows resilience amid balanced risks. Markets and commentary indicate value in holding steady, with no fixed path ahead given uncertainties in data.

- Price dynamics remain stable near target levels. Headline HICP inflation stood at 2.1% in November 2025, with projections for 1.9% in 2026 driven by base effects from energy and easing non-energy components. Services inflation persists somewhat elevated but trends toward moderation, alongside contained food pressures.