Articles

ECB will stick to its plans – Nordea Markets

16810 November 30, 2018 19:53 FXStreet Market News

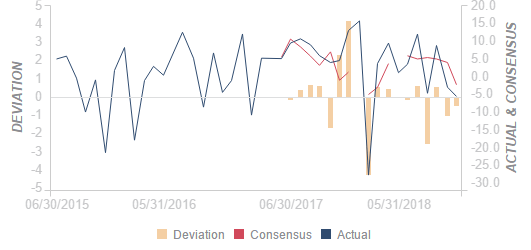

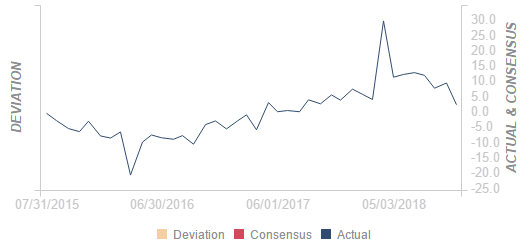

Tuuli Koivu, research analyst at Nordea Markets, suggests that in the ECB’s is likely to revise downwards its growth outlook and inflation projections in its forthcoming release of macroeconomic projections in December.

Key Quotes

“It is certain that. The data surprises since the September meeting have been negative and even more importantly, the Euro-area outlook has weakened due to the increased uncertainty in the global and political environment.”

“However, we do not expect the ECB to give up on its firm belief that the higher wage increases will finally push up consumer prices in the Euro area. One part of the reasoning is that although the November numbers were weaker than expected, most of the downside surprise came from the German package holidays and the ECB is likely to look through that type of data points. Thus, we expect the ECB core inflation profile to continue to be rising in the coming years.”

“This implies that the ECB can stick to its plans to stop the net asset purchases at the end of this year. However, the continuous negative surprises have clearly increased risks that the rate hikes are further delayed. Our expectation still is that the first rate hike will come in December 2019 but that forecast assumes that the political challenges related mainly to Italy, Brexit and trade war do not worsen.”

Eurozone: Pull back in inflation – ING

16807 November 30, 2018 18:53 FXStreet Market News

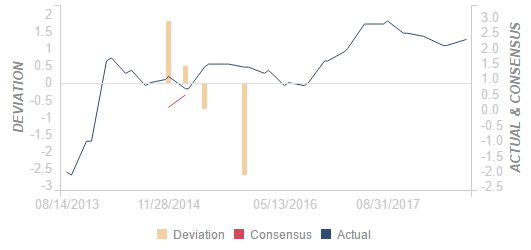

Bert Colijn, Senior Economist at ING, notes that the Eurozone’s core inflation has dipped back to 1% and it will add to discussion about the ECBs path to normalising rates.

Key Quotes

“The drop in the oil price was much larger than the slide in inflation suggests, mainly caused by logistical problems that hindered supply in Germany and Netherlands for example, but also by higher taxes. The logistical issues are likely to fade out, which suggests that the inflation rate will continue to fall modestly over the coming months.”

“Softer headline inflation for the beginning of 2019 is largely expected, but the degree to which inflation will drop will be key for the ECB to determine when to hike. For now, the ECB maintains its forward guidance of a rate hike after the summer of next year, but if economic conditions continue to slow sluggishness, the question is if that will be maintained.”

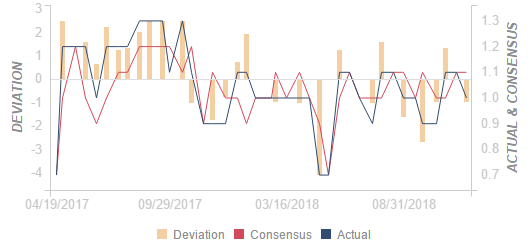

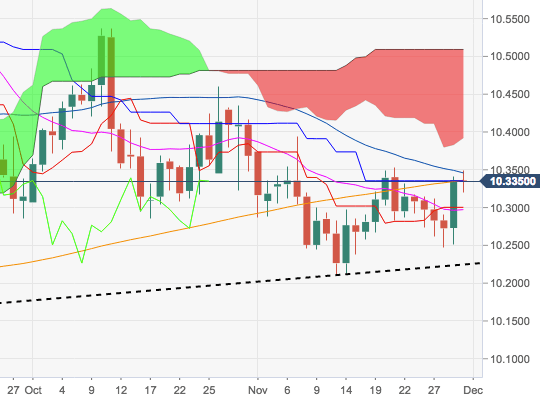

EUR/SEK Technical Analysis: The cross is eroding the 200-day SMA at 10.3374. Targets recent tops around 10.3500

16806 November 30, 2018 18:33 FXStreet Market News

- EUR/SEK is alternating gains with losses in the upper end of the weekly range in the 10.3300 region, where is located the key 200-day SMA.

- Recently, poor data in the Scandinavian economy weighed on SEK and pushed the cross to multi-day peaks near the immediate target at/above 10.3500.

- Further upside is still probable while above the 6-month support line, today at 10.2200, coincident with recent lows near 10.2000.

- Volatility around SEK is expected to come from domestic politics and the likely rate hike by the Riksbank at some point by year-end or early 2019.

EUR/SEK daily chart

EUR/SEK

Overview:

Today Last Price: 10.3339

Today Daily change: -23 pips

Today Daily change %: -0.0223%

Today Daily Open: 10.3362

Trends:

Previous Daily SMA20: 10.2949

Previous Daily SMA50: 10.3419

Previous Daily SMA100: 10.3867

Previous Daily SMA200: 10.3312

Levels:

Previous Daily High: 10.3405

Previous Daily Low: 10.2506

Previous Weekly High: 10.3507

Previous Weekly Low: 10.2676

Previous Monthly High: 10.5375

Previous Monthly Low: 10.2863

Previous Daily Fibonacci 38.2%: 10.3062

Previous Daily Fibonacci 61.8%: 10.2849

Previous Daily Pivot Point S1: 10.2777

Previous Daily Pivot Point S2: 10.2192

Previous Daily Pivot Point S3: 10.1878

Previous Daily Pivot Point R1: 10.3676

Previous Daily Pivot Point R2: 10.399

Previous Daily Pivot Point R3: 10.4575

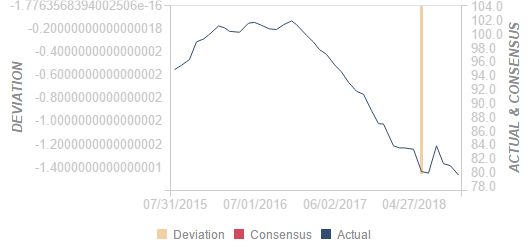

GBP/USD fades a spike beyond 1.2800 handle, back near daily lows

16804 November 30, 2018 17:53 FXStreet Market News

• The latest leg of a sudden pickup lacked any catalyst and quickly ran out of steam.

• Persistent Brexit uncertainties continue to dent sentiment surrounding the GBP.

• A modest USD uptick further collaborated towards capping any meaningful up-move.

The GBP/USD pair faded a knee-jerk spike to levels beyond the 1.2800 handle and quickly retreated to the lower end of its daily trading range.

After consolidating in a range through the Asian/early European session, the pair picked up the pace in the last hour and jumped an intraday high level of 1.2810.

The up-move lacked any obvious catalyst but coincided with the news that the UK trade secretary Liam Fox has urged MPs to vote for Theresa May’s controversial EU withdrawal plan.

However, investors seemed convinced that the UK PM Theresa May will fail to get the Brexit deal past parliament, which eventually kept a lid on any runaway rally for the British Pound.

The pair has now retreated back to the 1.2780 region, the lower end of its daily trading range, and was further weighed down by a modest US Dollar uptick, which remained supported by Thursday’s FOMC meeting minutes.

The latest FOMC meeting minutes reaffirmed prospects for another rate hike in December and largely offset Wednesday’s dovish sounding comments by the Fed Chair Jerome Powell and eventually extended some support to the greenback.

In absence of any major market moving economic releases from the UK, the incoming Brexit-related headlines might continue to drive sentiment surrounding the British Pound and infuse some volatility around the major.

Later during the early North-American session, a scheduled speech by New York Fed President John Williams and the release of Chicago PMI might also help traders grab some short-term opportunities on the last trading day of the week.

Technical levels to watch

Immediate support is pegged near the 1.2760 zone and is followed by the 1.2725 level, below which the pair is likely to break through the 1.2700 handle retest yearly lows, around the 1.2665-60 region. On the flip side, any attempted move back above the 1.2800 handle now seems to confront resistance near the 1.2825 region, which is closely followed overnight swing highs, around mid-1.2800s.

US Dollar Index clings to gains near 96.80

16803 November 30, 2018 17:33 FXStreet Market News

- The index is up smalls in the 96.80 region.

- Yields of the US 10-year note navigate lows around 3.02%.

- FOMC’s Williams is due to speak, Chicago PMI next on tap.

The US Dollar Index (DXY), which gauges the greenback vs. its main rivals, is trading within a sideline theme around the 96.80 region.

US Dollar Index looks to trade, G20

After two consecutive daily pullbacks, the index is now attempting a small rebound to the 96.80 area amidst lower US yields and a cautious approach ahead of the Trump-Xi meeting at the G20 gathering.

Nothing new from the FOMC minutes on Thursday, where the Committee reinforced the now data-dependent stance from the Federal Reserve. The minutes also left intact the likeliness of a fourth rate hike at the December meeting, while market consensus started to debate the possibility of 1-3 rate hikes next year.

In the data space, NY Fed J.Williams (permanent voter, centrist) is due to speak while the Chicago PMI is only scheduled in the US calendar.

US Dollar Index relevant levels

As of writing the index is gaining 0.07% at 96.84 facing the next hurdle at 97.53 (high Nov.28) seconded by 97.69 (2018 high Nov.12) and then 97.87 (61.8% Fibo retracement of the 2017-2018 drop). On the other hand, a break below 96.62 (low Nov.29) would open the door to 96.32 (low Nov.22) and finally 96.04 (low Nov.20).

Turkish central bank Governor: Monetary policy tools will be used effectively

16799 November 30, 2018 16:53 FXStreet Market News

Reuters reports the latest comments by the Central Bank of the Republic of Turkey (CBRT) Governor, with the key headlines found below.

Closely monitoring factors that affect inflation.

Monetary policy tools will be used effectively.

Inflation seen nearing targets gradually.