Articles

EUR/GBP: Remains bid above 0.8800 – Commerzbank

16797 November 30, 2018 16:03 FXStreet Market News

According to Karen Jones, Analyst at Commerzbank, EUR/GBP is poised to challenge the recent highs of 0.8934/41 as the cross has continued to recover.

Key Quotes

“Above .8941 will put the July peak at .8960 back in the frame, followed by the early August and September highs at .9031/54. However given that we are currently pretty much mid-range – we have no strong bias.”

“The market stays bid near term while above the .8810/00 support. Slips should find support between the July low at .8799 and the November 12 high at .8774. Further support sits at the October trough at .8723.”

EUR/USD eases from tops near 1.1400 ahead of EMU CPI

16796 November 30, 2018 15:53 FXStreet Market News

- The pair came under pressure near the 1.1400 handle.

- The greenback appears sidelined around 96.80.

- German Retail Sales disappointed investors in October.

The single currency is now struggling for direction, motivating EUR/USD to retreat from overnight tops in the boundaries of 1.1400 the figure.

EUR/USD looks to data, G20

After two consecutive daily advances and two failed attempts to break above the critical 1.1400 the figure, the pair is now trading on a cautious tone while the greenback remains sidelined early in the European session.

In the meantime, investors’ attention has shifted once again to the US-China trade front and the imminent meeting between Trump and Xi Jinping at the G20 event in Argentina. In this regard, President Trump latest comments noted that a deal could be close.

In the data space, German Retail Sales came in below expectations in October, contracting 0.3% MoM and expanding 5.0% YoY. Later in the day, flash inflation figures in Euroland for the month of November will grab all the attention.

EUR/USD levels to watch

At the moment, the pair is losing 0.07% at 1.1385 facing the next support at 1.1267 (low Nov.28) followed by 1.1214 (2018 low Nov.12) and finally 1.1188 (61.8% Fibo of the 2017-2018 rally). On the flip side, a breakout of 1.1401 (high Nov.29) would target 1.1434 (high Nov.22) en route to 1.1473 (high Nov.20).

When are the Eurozone flash CPIs and how could they affect EUR/USD?

16795 November 30, 2018 15:33 FXStreet Market News

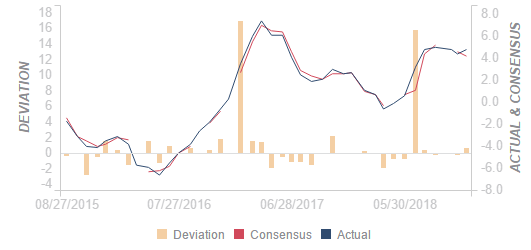

Eurozone flash CPIs estimate overview

Eurostat will publish the Eurozone’s inflation first estimate for November at 1000 GMT today. Consumer prices are expected to tick down to 2.0% on a yearly basis while the core figures are also seen flat at 1.1% in the reported month.

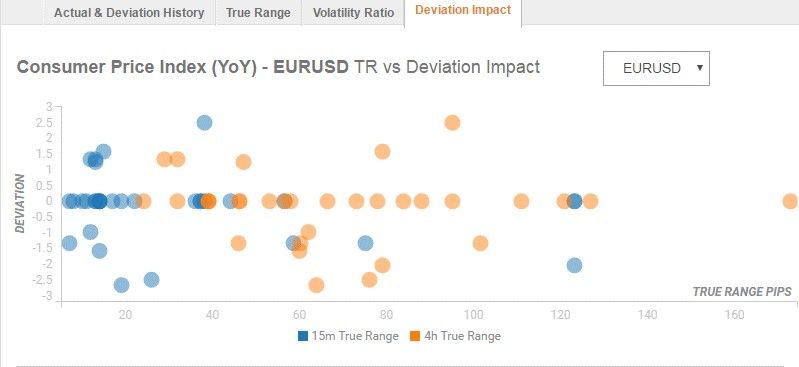

Deviation impact on EUR/USD

Readers can find FX Street’s proprietary deviation impact map of the event below. As observed the reaction is likely to remain confined between 10 and 40 pips in deviations up to 1.5 to -3, although in some cases, if notable enough, a deviation can fuel movements of up to 50 pips.

How could affect EUR/USD?

According to FXStreet’s Analyst Haresh Menghani, “from a technical perspective, the pair has been consolidating near 61.8% Fibonacci the 1.1500-1.1216 Nov. monthly decline and already seems to have found acceptance above 200-hour SMA. The set-up support prospects for an extension of the positive momentum towards a descending trend-line resistance, currently near the 1.1425-30 region, extending through highs set on Nov. 7, 19 & 20. A follow-through buying might trigger some additional short-covering and accelerate the up-move further towards reclaiming the key 1.1500 psychological mark.”

“On the flip side, the 200-hour SMA, currently near the 1.1365 region, now seems to protect the immediate downside, below which the pair is likely to head back towards 38.2% Fibonacci retracement level support near the 1.1325 region en-route the 1.1300 round figure mark,” Haresh adds.

Key Notes

Eurozone: November headline inflation likely to soften to 2.0% y/y – TDS

G20 meeting and Eurozone inflation amongst market movers today – Danske Bank

EUR futures: upside limited near term

About Eurozone flash CPIs estimate

The Euro Zone CPI released by the Eurostat captures the changes in the price of goods and services. The CPI is a significant way to measure changes in purchasing trends and inflation in the Euro Zone. Generally, a high reading anticipates a hawkish attitude which will be positive (or bullish) for the EUR, while a low reading is seen as negative (or bearish).

GBP/USD: At the bottom of its 4 month trading range – Commerzbank

16793 November 30, 2018 14:53 FXStreet Market News

Karen Jones, Analyst at Commerzbank, points out that the GBP/USD pair is holding the bottom of its 4 month trading range and will find initial resistance at the 55 day ma at 1.2988 and the resistance line at 1.3035, where it is likely to struggle.

Key Quotes

“Support lies at 1.2710/1.2662, the August low and 3 month support line. Below 1.2662 would trigger further weakness to the 61.8% Fibonacci retracement of the 2016-2018 advance and the June 2017 low at 1.2593/89. Above 1.3035 lies the November 14 high at 1.3072. Further resistance comes in at the 1.3175 current November high below which we will retain a longer term bearish bias.”

“A rise above the July, September and October highs at 1.3258/1.3363 would put the June high at 1.3473 on the cards.”

EUR/USD: Further recovery on the way – Commerzbank

16792 November 30, 2018 14:33 FXStreet Market News

Karen Jones, Analyst at Commerzbank, suggests that the EUR/USD witnessed an outside day to the upside, suggesting a reluctance to break down further and suggests another stab at recovery.

Key Quotes

“The market needs to overcome the current November high at 1.1500 to alleviate immediate downside pressure and allows for gains to 1.1581/1.1622 (2018 downtrend and 16th October high). Dips lower will ideally be contained by the 1.1262 level – this guards the 1.1216 November low.”

“Below the 1.1216 current November low lies the 61.8% Fibonacci retracement of the 2017-18 advance at 1.1186. Failure there would put the late May and June 2017 lows at 1.1119/10 on the cards.”

“Long term trend (1-3 months): A rise above the recent high at 1.1625 would confirm a trend reversal and put the 55 week moving average at 1.1852 back on the cards.”

Forex Today: US dollar treads water ahead of Trump-Xi meeting, Eurozone CPI – Up next

16791 November 30, 2018 14:03 FXStreet Market News

A typical caution trading prevailed in Friday’s Asian session, as investors remained unnerved ahead of an uncertain outcome of this weekend’s key meeting on trade between the US President Trump and his Chinese counterpart Xi. The US dollar remains on the defensive across its main competitors, as markets digest the latest FOMC minutes that showed the Fed kept the options on the interest rates open. Most majors stuck to tight trading ranges, with the Antipodeans little impressed by the official Chinese manufacturing PMI numbers. The Aussie wavered above the 0.73 handle while the Kiwi traded around the 0.6850 barrier. The Yen was underpinned amid moderate risk-aversion, keeping the USD/JPY pair sidelined near 113.40 region. The Euro was seen picking up some bids and tested the 1.14 handle and the Cable consolidated below the 1.2800 level.

Both crude benchmarks looked to stabilize while gold prices on Comex traded modestly flat near 1230, as the bulls were set to extend yesterday’s rally.

Main Topics in Asia

Japan’s Tokyo CPI hits expected 1% y/y, Unemployment ticks up to 2.4%

Japan factory output on the rise, expands most since 2015 – Reuters

Canada affirms new NAFTA signing

BOK: Growth forecast to be in line with October prediction, CPI likely to move higher

China trade hawk Navarro to attend Trump-Xi trade war dinner – SCMP

Mexico’s side: New NAFTA may take a year to get through the US Congress

UK PM Theresa May: UK will be more divided if parliament votes down Brexit deal

China Press: China to cut gasoline, diesel prices; more stimulus ahead?

China Press: Trade deal possible at G20 but US must be ‘fair minded’ – Reuters

Key Focus Ahead

We have a busy start to Friday’s EUR calendar, as the German retail sales, imports prices and UK Nationwide housing prices are all due at the same time, i.e., at 0700 GMT. Later in the EU session, the employment data and flash CPIs estimate will be published at 1000 GMT among other minority reports.

In the NA session, the Canadian Q2 GDP figures will headline amid a data-quiet US docket, although markets will see the Bakers Hughes US oil rigs count data at 1800 GMT.

The following central bankers are due to deliver the speeches at their respective events later today.

1000 GMT: ECB Governing Council member Mersch

1245 GMT: ECB Governing Council member Coeure

1400 GMT: FOMC member Williams

However, the macro news and the central bankers” speeches are likely to play a second fiddle to the broader market sentiment that will be dominated by the expectations from the outcome of Trump-Xi weekend’s meeting on trade at the G20 meetings in Argentina.

World leaders arrived in Buenos Aires on Thursday ahead of the gathering of the Group of 20, where global trade tensions, fuelled by the US President Trump’s trade war with China, are expected to hog the limelight.

EUR/USD: Bull gaining strength ahead of Trump-Xi meeting

The odds of a rally to 1.1472 would rise sharply if the Eurozone’s preliminary consumer price index (CPI) for November, scheduled for release at 10:00 GMT today, blows past estimates, bolstering the possibility of an early ECB rate hike.

GBP/USD coiling around 1.2780 as markets head into Trump-Xi G20 headliner

GBP/USD is moving sideways at the 1.2780 level as markets gear up for this weekend’s G20 summit, where traders will be keeping their eyes peeled for headlines coming out of the Trump-Xi sideline meeting set to take place on Saturday.

Dollar Index: Teasing bearish reversal ahead of weekend’s Trump-Xi meeting

The recovery in Treasury yields likely indicates the markets have digested the tweak in Fed view. As a result, the greenback could draw a strong bid if the meeting between US President Donald Trump and Chinese President Xi Jinping in Argentina ends on a sour note.

All eyes on Argentina; US/China Trade Tensions dominate broader direction

With little of note on the domestic docket, today focus and attention remain squarely affixed to the weekend’s G20 summit for direction.

Canada’s GDP Preview: The black-box of forecasting rates will be unaffected with GDP slowing down

Canada’s third-quarter GDP is expected to decelerate to 2.0% over the year, but the overall growth picture remains favorable for Canada and the Bank of Canada will not be affected by the third-quarter deceleration.

Fed: Slower pace of monetary tightening? – Westpac

16790 November 30, 2018 13:53 FXStreet Market News

Analysts at Westpac explain that the US equity markets like the fact that the Fed Chairman Powell appears open to a slower pace of monetary tightening.

Key Quotes

“Powell’s comment that the benchmark funds rate is “just below the broad range of estimates of the level that would be neutral for the economy” was enough to spark a strong bounce in US equities, while the 10 year yield briefly dipped below 3% for the first time since mid-September.”

“Westpac is forecasting rates will rise in December, and this will be followed by 3 further rate hikes in 2019. However, market pricing implies that while the Fed is likely to hike in December (about 80% priced), it will move only once in 2019.”

“Attention now turns to the G20 meeting in Buenos Aires this weekend. Expectations are high that presidents Trump and Xi will emerge with some sort of agreement on trade from a private dinner scheduled for Saturday evening. However, recent commentary from the US administration has been very unsupportive for this view.”

UK PM Theresa May rules out Norway-style Brexit compromise with Labour

16789 November 30, 2018 13:33 FXStreet Market News

The Guardian reports the comments delivered by the UK PM Theresa May at the G20 meeting in Argentina earlier today.

May said that she rules out a Norway-style Brexit compromise with her opposition Labour Party.

GBP/USD coiling around 1.2780 as markets head into Trump-Xi G20 headliner

16788 November 30, 2018 13:03 FXStreet Market News

- G20 summit draws the broader market’s attention as traders await Trump-Xi headlines, with many hoping for a peaceable, successful trade discussion between the two leaders.

- UK data remains thin for Friday, and even Brexit headlines will be playing second fiddle with G20 overhead.

GBP/USD is moving sideways at the 1.2780 level as markets gear up for this weekend’s G20 summit, where traders will be keeping their eyes peeled for headlines coming out of the Trump-Xi sideline meeting set to take place on Saturday. Brexit concerns that have plagued the Sterling for months have been shelved for the time being, but the UK’s House of Commons vote on Prime Minister Theresa May’s Brexit proposal still waits around the corner, slated for December 11th.

The Group of 20 Leaders’ Summit kicks off today in Buenos Aires, where the broader market focus will be settled almost entirely on the planned meeting between US President Donald Trump and China’s Xi Jinping, with the two leaders expected to discuss the current impasse on trade that the two countries face following several volleys of trade tariffs hurled at each other over 2018; tensions remain high with President Trump set on increasing Chinese tariffs to 25% across the board in January, and market participants remain concerned that escalating trade rhetoric may be the only result of the high-profile meeting.

The GBP/USD pairing is enjoying a brief reprieve from Brexit jitters that have kept the major pairing hobbled for several months as trade talks between the UK and the European Union came in under the wire, with PM May and the EU agreeing to a last-minute Brexit plan that still had wet ink heading into the EU’s recent Brexit summit, and now the next major roadblock has appeared on the horizon: a contested parliamentary vote within the UK’s House of Commons on whether or not to accept PM May’s/EU Brexit proposal, and concerns remain that May’s camp may not have the votes required to see the current proposals into the next stage.

GBP/USD Levels to watch

With market tensions remaining at elevated levels, both within and outside of the United Kingdom, upside potential for the GBP/USD remains limited, and as noted by FXStreet’s own Valeria Bednarik: “in the 4 hours chart, the pair has settled below a mild bearish 20 SMA, the Momentum indicator hovers around its mid-line, while the RSI is stable around 44, indicating limited buying interest. The downside potential will increase on a break below 1.2724, the weekly low, opening doors then for a slide toward the year low at 1.2661.”

Support levels: 1.2755 1.2725 1.2690

Resistance levels: 1.2810 1.2855 1.2900

Australia: GDP likely to grow at 05% q/q – NAB

16787 November 30, 2018 12:53 FXStreet Market News

In view of analysts at NAB, the forthcoming GDP figures of Australian economy are forecasted to show a slightly slower quarterly rate of 0.5% q/q, but the year-ended growth is still likely to show a solid 3.2% y/y.

Key Quotes

“Consumption looks to have slowed following two better than expected prints and we expect dwelling investment to make a small subtraction from growth alongside the cooling in the housing market.”

“Looking forward, we expect growth over the next two years to be driven by public infrastructure investment, business investment and further growth in net exports, with consumption to only see modest growth. The uncertainty around our forecasts is still centred on consumption. We have 0.5% q/q for Q3 though both official retail sales volumes and our NAB Cashless Retail Sales index suggest there is some downside to this.”

“National accounts measures of wages and inflation will be another marker of whether growth in household earnings and disposable income are seeing a lift from an increase in wage growth.”

“Monetary policy implications: While the release for Q3 will provide an update on the overall pace of growth, as well as some insights into how different sectors are travelling, it will not be a view changer for monetary policy.”

RBA to keep rates at record lows until 2020 – Reuters Poll

16786 November 30, 2018 12:33 FXStreet Market News

The Reserve Bank of Australia (RBA) is seen extending its record spell of steady rates into 2020, according to a median forecast of economists polled by Reuters.

Key points

All but one of 43 economists polled see RBA holding the cash rate steady at 1.5 percent at the Dec. 4 meeting

The first rate rise since November 2010 seen in Q1 2020, unchanged from the previous poll.

23 of 38 respondents see at least one hike by March 2020, two predicted cuts

13 of 38 economists including ANZ, AMP, Perpetual, Westpac see no change in policy until mid-2020 vs. 9 in the previous poll.