Articles

Gold Technical Analysis: $1,230 is the level to beat for the bulls

16783 November 30, 2018 12:03 FXStreet Market News

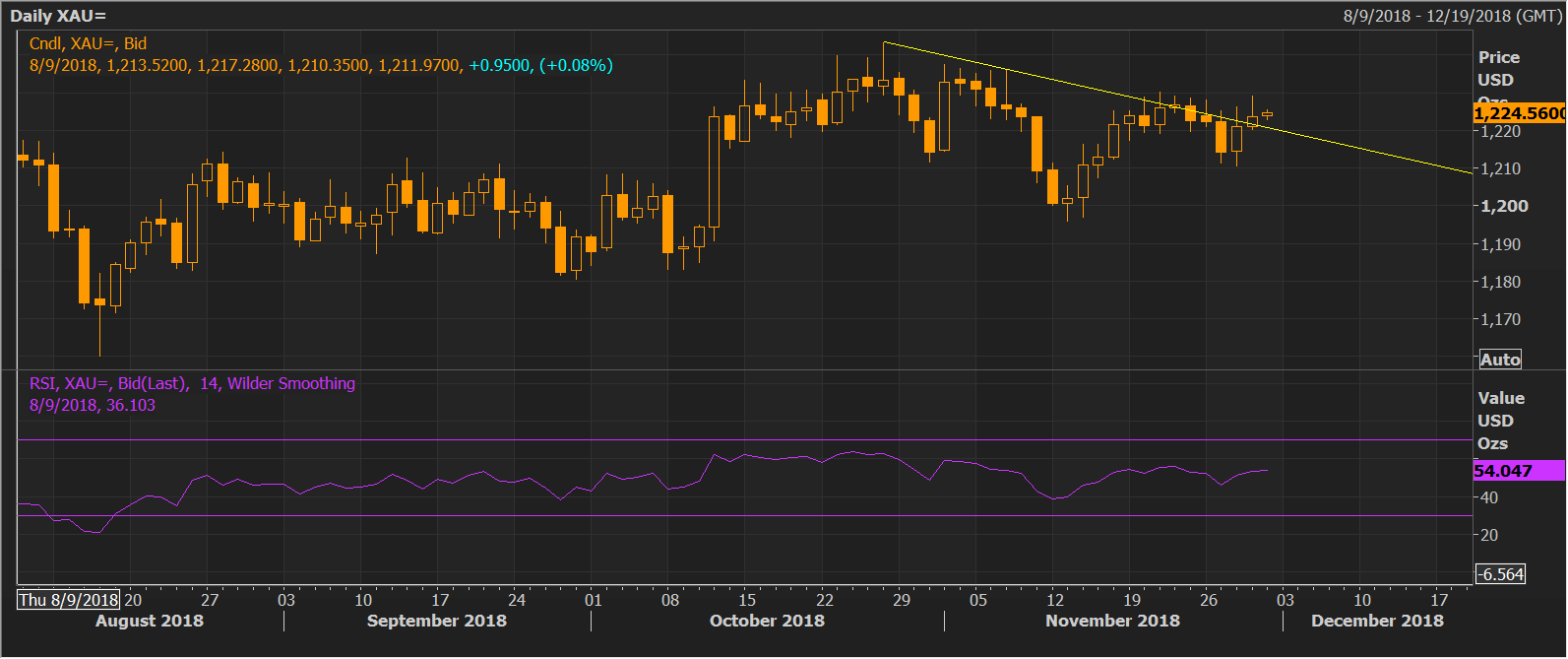

- Gold has crossed the trendline falling from, the Oct. 26 and Nov. 7 lows. The bull breakout, however, would be confirmed above the horizontal resistance at $1,230 (Nov. 21 high).

Daily chart

- As can be seen above, the yellow metal closed at $1,223 yesterday, confirming an upside break of the falling trendline resistance. The long upper shadow of yesterday’s candle, however, takes the shine off the bullish breakout, as it likely represents selling pressure near the key resistance at $1,230.

- As a result, a break above that level is needed to put the bulls back into the driver’s seat.

- The 14-day relative strength index (RSI) is reporting bullish conditions above 50.00. Further, Fed’s dovish turn may have put the greenback on the path to deeper losses. So, a break above $1,230 could happen soon.

- The prospects of bull breakout, however, would weaken sharply, if gold prices find acceptance below yesterday’s low of $1,230.

Trend: Cautiously bullish

XAU/USD

Overview:

Today Last Price: 1225.16

Today Daily change: 1.1e+2 pips

Today Daily change %: 0.0915%

Today Daily Open: 1224.04

Trends:

Previous Daily SMA20: 1217.42

Previous Daily SMA50: 1219.75

Previous Daily SMA100: 1208.44

Previous Daily SMA200: 1235.01

Levels:

Previous Daily High: 1228.9

Previous Daily Low: 1220.3

Previous Weekly High: 1230.3

Previous Weekly Low: 1217.7

Previous Monthly High: 1243.43

Previous Monthly Low: 1182.54

Previous Daily Fibonacci 38.2%: 1225.62

Previous Daily Fibonacci 61.8%: 1223.59

Previous Daily Pivot Point S1: 1219.93

Previous Daily Pivot Point S2: 1215.82

Previous Daily Pivot Point S3: 1211.34

Previous Daily Pivot Point R1: 1228.53

Previous Daily Pivot Point R2: 1233.01

Previous Daily Pivot Point R3: 1237.12

China Press: Trade deal possible at G20 but US must be ‘fair minded’ – Reuters

16780 November 30, 2018 11:53 FXStreet Market News

Reuters reports the key highlights from an editorial piece posted in the state-run China Daily newspaper, citing that a trade deal between the US and China can be reached at the G20 meeting in Argentina this week, but says that the US needs to be “fair-minded” if it wants to ease the escalating trade war fears.

Key Quotes:

“Beijing wants a deal, just as Washington does. And it is willing to cooperate with Washington in dealing with concerns about trade if they are fair-minded.”

“Should there be any other aspirations, such as taking advantage of the trade spat to throttle Chinese growth, then an agreement is unlikely to be reached.”

USD/CHF risk reversals hit two-month low on rising demand for put options (bearish bets)

16779 November 30, 2018 11:33 FXStreet Market News

The USD/CHF one-month 25 delta risk reversals (CHF1MRR) are currently trading at -0.673 in favor of put options – the level last seen on Sept. 24.

Notably, the risk reversals stood at -0.338 on Nov. 12, which means the implied volatility premium (or the demand) for put options has increased sharply in the last 2.5-weeks.

The data indicates the investors are adding bets to position for further weakness in the USD/CHF pair, which is currently trading at 0.9959 – down 1.67 percent from the high of 1.01285 seen on Nov. 13.

*Negative risk reversals indicate the implied volatility premium for put options is higher than that for calls.

CHF1MRR

China Press: China to cut gasoline, diesel prices; more stimulus ahead?

16778 November 30, 2018 11:03 FXStreet Market News

Headlines are crossing in the Chinese media that China is planning to cut gasoline and diesel prices in a bid to counter the economic slowdown, in the wake of the ongoing US-China trade war.

Meanwhile, all eyes remain on the Trump-Xi trade war dinner due later today for further cues on the trade scenario between the US and China.

UK PM Theresa May: UK will be more divided if parliament votes down Brexit deal

16777 November 30, 2018 10:53 FXStreet Market News

The UK PM Theresa May is on the wires now, via Reuters, speaking at the G20 meeting in Argentina.

May was asked if she has a plan B if the UK Parliament rejects her Brexit deal and she replied that she is focused on the December 11 meaningful vote.

She added: “Britain will be more divided if parliament votes down her deal and a divided country does not prosper”.

Japan factory output on the rise, expands most since 2015 – Reuters

16776 November 30, 2018 10:33 FXStreet Market News

As reported by Reuters, Japanese manufacturing output grew at its fastest pace since late 2015, a welcome sign for firms and manufacturers who continue to face down significant headwinds from trade frictions.

Key quotes

Economists expect factory output to rebound this quarter as supply constraints caused by natural disasters that crimped production and physical distribution taper off, paving the way for a recovery from the third-quarter contraction.

The 2.9 percent rise in output handily beat a median market forecast of a 1.2 percent increase, and followed a revised 0.4 percent drop in the previous month. It was the fastest month-on-month gain since January 2015.

Still, slowing global demand and the intensifying U.S.-China trade war could threaten global trade and growth in the coming months, making Japan’s exports and capex vulnerable.

BOK: Growth forecast to be in line with October prediction, CPI likely to move higher

16774 November 30, 2018 10:03 FXStreet Market News

Reuters is out with the key headlines from the Bank of Korea’s (BOK), South Korean central bank, monetary policy report. Last hour, the BOK raised the key interest rate to 1.75% from 1.50%.

Growth forecast to be in line with the October prediction economy to grow broadly in line with the potential rate.

CPI likely to move around mid- to upper-1% range ahead.

US housing market outlook looking shaky – Reuters poll

16771 November 30, 2018 09:53 FXStreet Market News

According to the results of a Reuters poll, the US housing market could be seeing cracks beginning to show, with expectations of a rapid slowdown on the horizon.

Key quotes

After falling by a third during the financial crisis a decade ago, U.S. house prices have mostly recovered all their losses, rising at more than double the rate of inflation and wages over the last five years.

“The peak in price increases has been reached and with rates rising further and the economy slowing, price gains can only decelerate,” said Joel Naroff, chief economist at Naroff Economic Advisors.

A majority, 17 of 29 analysts who answered an additional question, said U.S. housing market turnover has already peaked.

“The magnitude and speed at which home sales have weakened is surprising, following just a three-quarter of a percentage point rise in mortgage rates. We suspect the problem is a lack of affordable product in the markets where potential home buyers would like to live,” wrote Mark Vitner, senior economist at Wells Fargo, in a note to clients.

PBOC set the yuan reference rate at 6.9357

16769 November 30, 2018 09:33 FXStreet Market News

The People’s Bank of China (PBOC) set the yuan reference rate at 6.9357 vs the previous day’s fix of 6.9353.

GBP/JPY Technical Analysis:145.00 remains familiar, but bulls continue to test towards the upswide.

16767 November 30, 2018 08:53 FXStreet Market News

- GBP/JPY trying to maintain technical posture, continuing late-Thursday sideways action.

- 145.00 remains a key sticking point of the GBP/JPY. but a new low at 144.50 leaves bulls lacking support.

GBP/JPY, 5-Minute

- The past two weeks see the GBP/JPY remaining in a rough range, but finding some bull potential as swing lows continue to push higher, sticking close to the 200-period moving average.

GBP/JPY, 1-Hour

- The GBP/JPY remains constrained by the last swing high and swing low, as the Guppy’s trend potential still looks fragile, and the pair has been spiraling around 145.00 .

GBP/JPY, 4-Hour

GBP/JPY

Overview:

Today Last Price: 144.99

Today Daily change: 6.0 pips

Today Daily change %: 0.0414%

Today Daily Open: 144.93

Trends:

Previous Daily SMA20: 146.21

Previous Daily SMA50: 146.69

Previous Daily SMA100: 145.68

Previous Daily SMA200: 146.98

Levels:

Previous Daily High: 145.84

Previous Daily Low: 144.52

Previous Weekly High: 145.96

Previous Weekly Low: 144.01

Previous Monthly High: 149.52

Previous Monthly Low: 142.78

Previous Daily Fibonacci 38.2%: 145.02

Previous Daily Fibonacci 61.8%: 145.34

Previous Daily Pivot Point S1: 144.35

Previous Daily Pivot Point S2: 143.77

Previous Daily Pivot Point S3: 143.02

Previous Daily Pivot Point R1: 145.68

Previous Daily Pivot Point R2: 146.42

Previous Daily Pivot Point R3: 147.01