Articles

USD/JPY hits fresh 1-week highs but fails to break above 111.00

24935 March 30, 2019 00:03 FXStreet Market News

- Higher US yields support US dollar gains versus the yen.

- US economic data showed mixed numbers.

The USD/JPY pair is rising on Friday for the second day in-a-row supported by higher US yields and an improvement in risk appetite. Gains are limited so far with the US dollar unable to break above 111.00.

The greenback is posting mix results across the board. It is rising against major European currencies that accelerated to the downside, following the vote against PM May Brexit deal at the UK Parliament. While at the same time is posting losses versus the majority of Emerging market currencies, although during the last hour it gained momentum.

The improvement today in risk sentiment weakened the yen. Equity prices in Wall Street are up 0.50% on average, while European markets are about to close with gains between 0.25% and 0.90%. US yields are another factor against the Japanese currency today. The 10-year is up for the second consecutive day, holding above 2.40%.

Data from the US released today showed mix numbers. Inflations numbers from the personal spending report came below expectation while later, new home sales numbers surpass market consensus. Also, the Consumer Sentiment index from the University of Michigan surprised with a positive revision to 98.4, the highest in 4 months.

USD/JPY – Short-term levels to watch

The pair peaked at 110.93, the highest level since March 20 and as of writing trades at 110.70. To the upside, the immediate resistance is seen at 110.95/111.00, followed by 111.20 and 111.45. On the flip side, support might be located at 110.50 (daily low), 110.15/20 and 109.90.

UK could ask for another short extension, PM May open to change political declaration

24934 March 29, 2019 23:53 FXStreet Market News

Citing government officials, Bloomberg reported that British Prime Minister Theresa May is open to changing the Brexit political declaration and could ask the EU for another short extension. Furthermore, PM May’s spokesman recently told reporters that although the result was not what they wanted, it was a good sign to see a number of senior colleagues voting with them. “Taking part in the EU elections is not inevitable,” the spokesman added.

EUR/GBP Techncial Analysis: Euro jumps to 0.8650 on Brexit votes

24933 March 29, 2019 23:33 FXStreet Market News

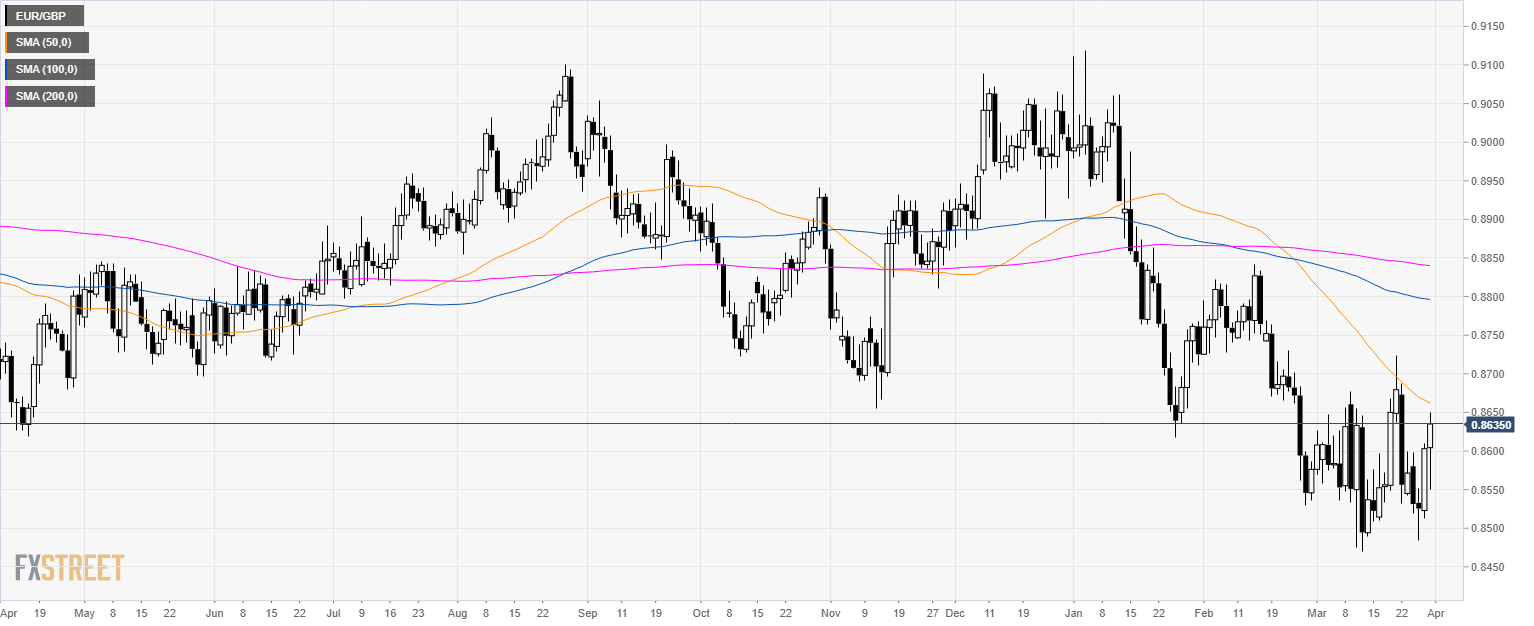

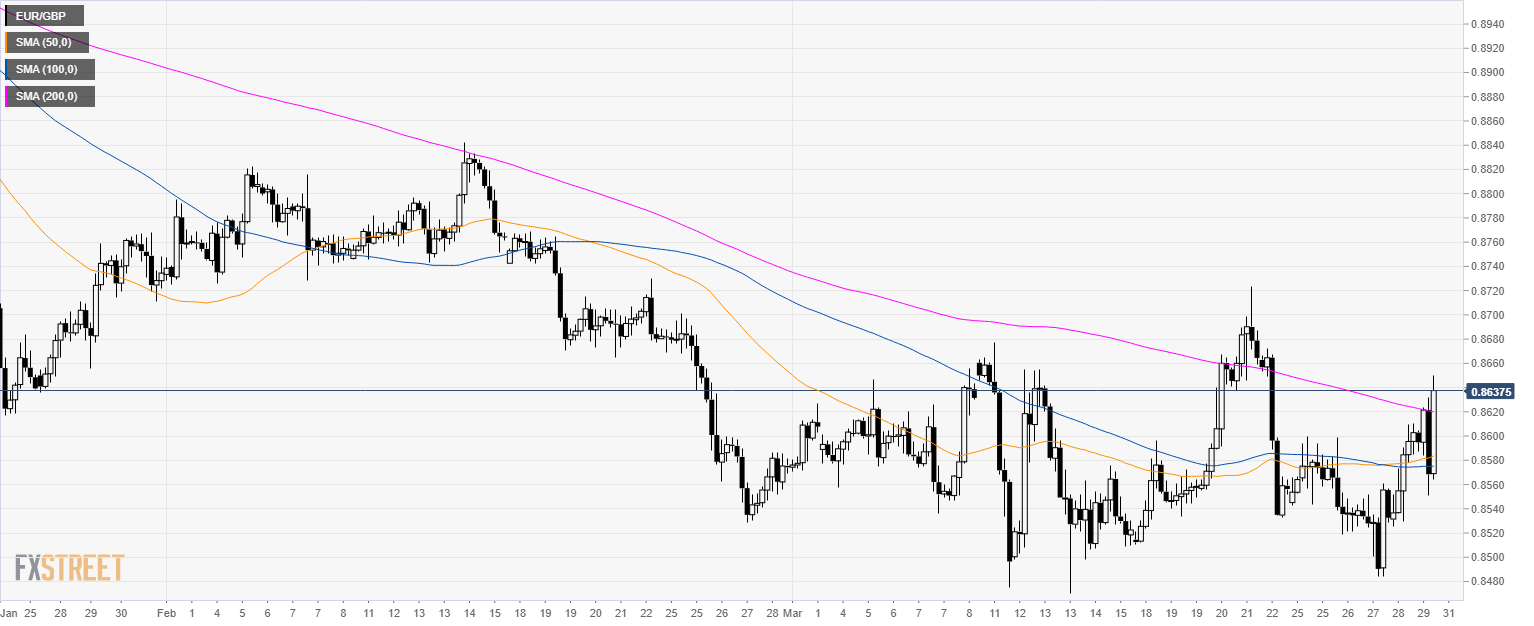

EUR/GBP daily

- EUR/GBP is trading in a bear trend below its main simple moving averages (SMAs).

- All eyes on the third and last Brexit vote.

EUR/GBP 4-hour chart

- EUR/GBP is trading above its main SMAs suggesting a bullish bias in the medium-term.

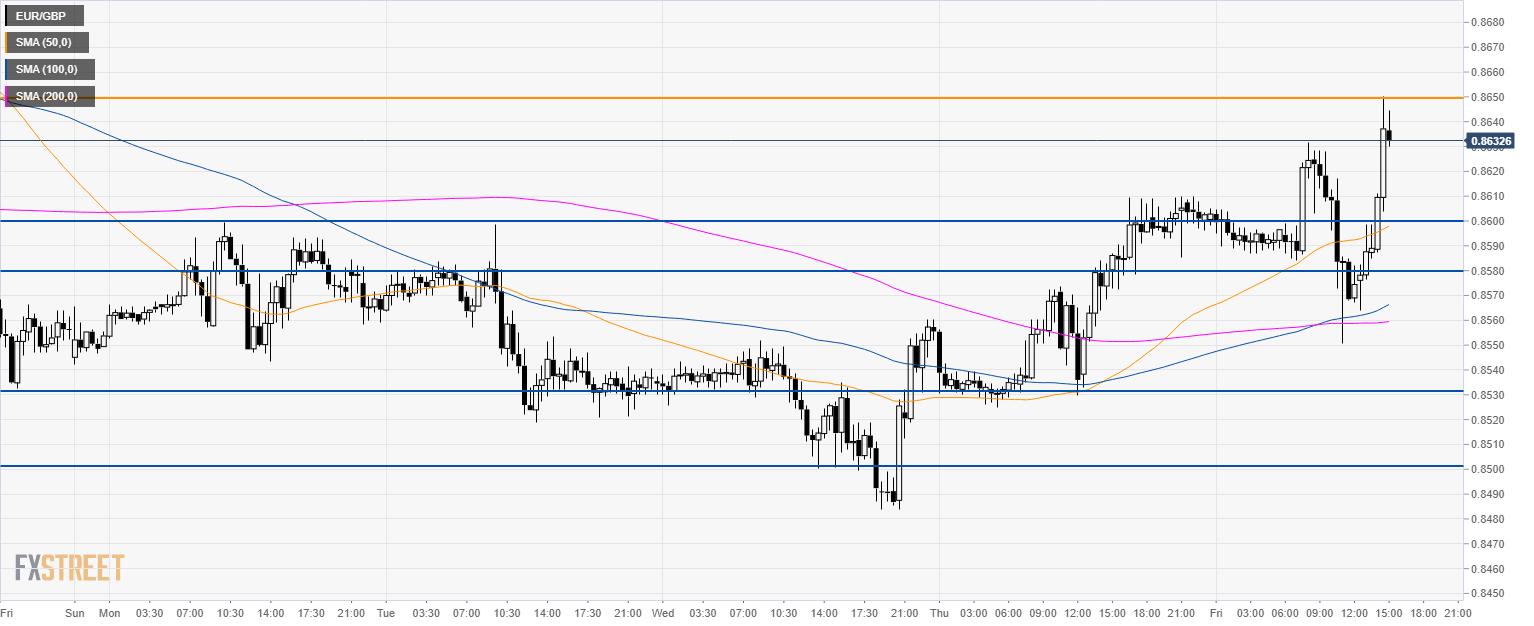

EUR/GBP 30-minute chart

- EUR/GBP is trading above its main SMAs suggesting a bullish momentum in the short-term.

- EUR/GBP is challenging 0.8650 key resistance. A break above the level would open the doors to the 0.8700 handle.

- Support is at 0.8600 and 0.8580 level.

Additional key levels

EU Commission: A “no-deal scenario on April 12 is now a likely scenario

24932 March 29, 2019 23:03 FXStreet Market News

Below is the European Commission’s official statement following the rejection of British PM May’s Withdrawal deal in the House of Commons.

The Comission regrets the negative vote in the House of Commons today. As per the European Council (Article 50) decision on 22 March, the period provided for in Article 50 (3) is extended to 12 April. It will be for the UK to indicate the way forward before that data, for consideration by the European Council. A “no-deal” scenario on 12 April is now a likely scenario. The EU has been preparing for this since December 2017 and is now fully prepared for a “no-deal” scenario at midnight on 12 April. The EU will remain united. The benefits of the Withdrawal Agreement, including a transition period, will in no circumstances be replicated in a “no-deal” scenario. Sectoral mini-deals are not an option.

GBP/USD Technical Analysis: Cable volatile on Brexit chaos

24931 March 29, 2019 22:53 FXStreet Market News

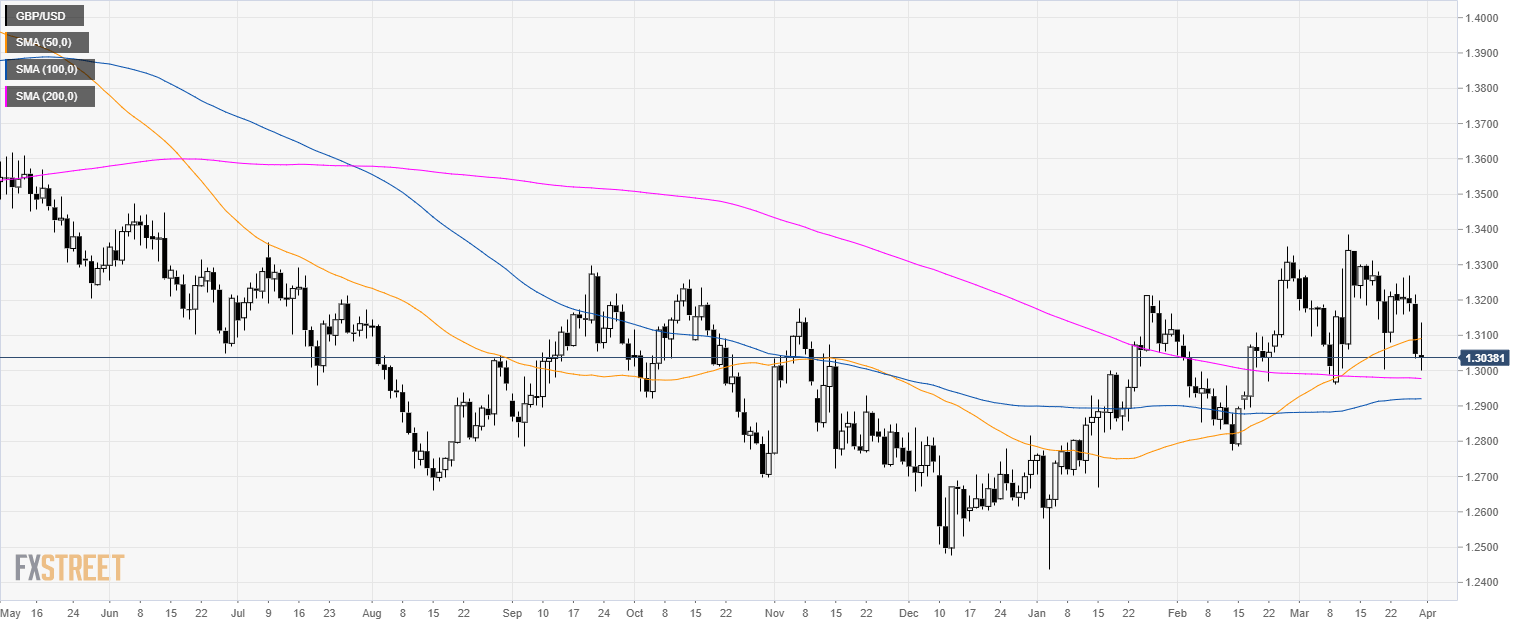

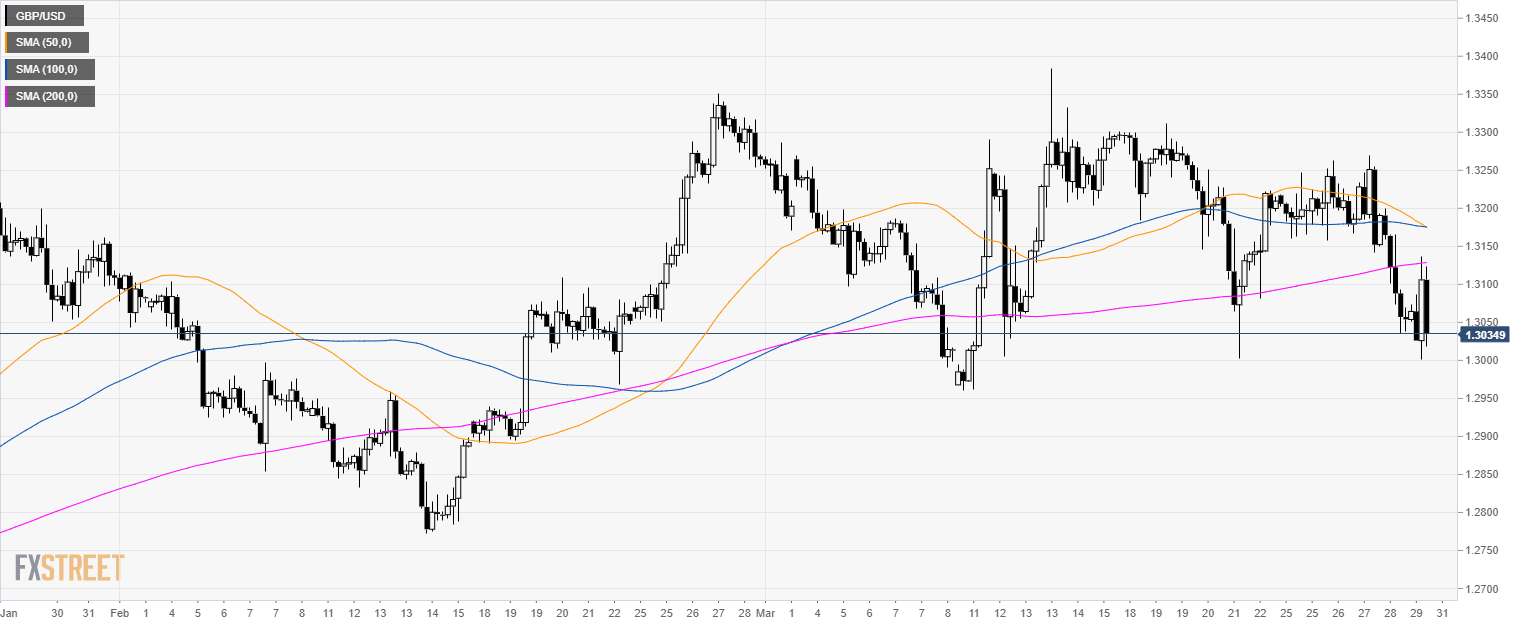

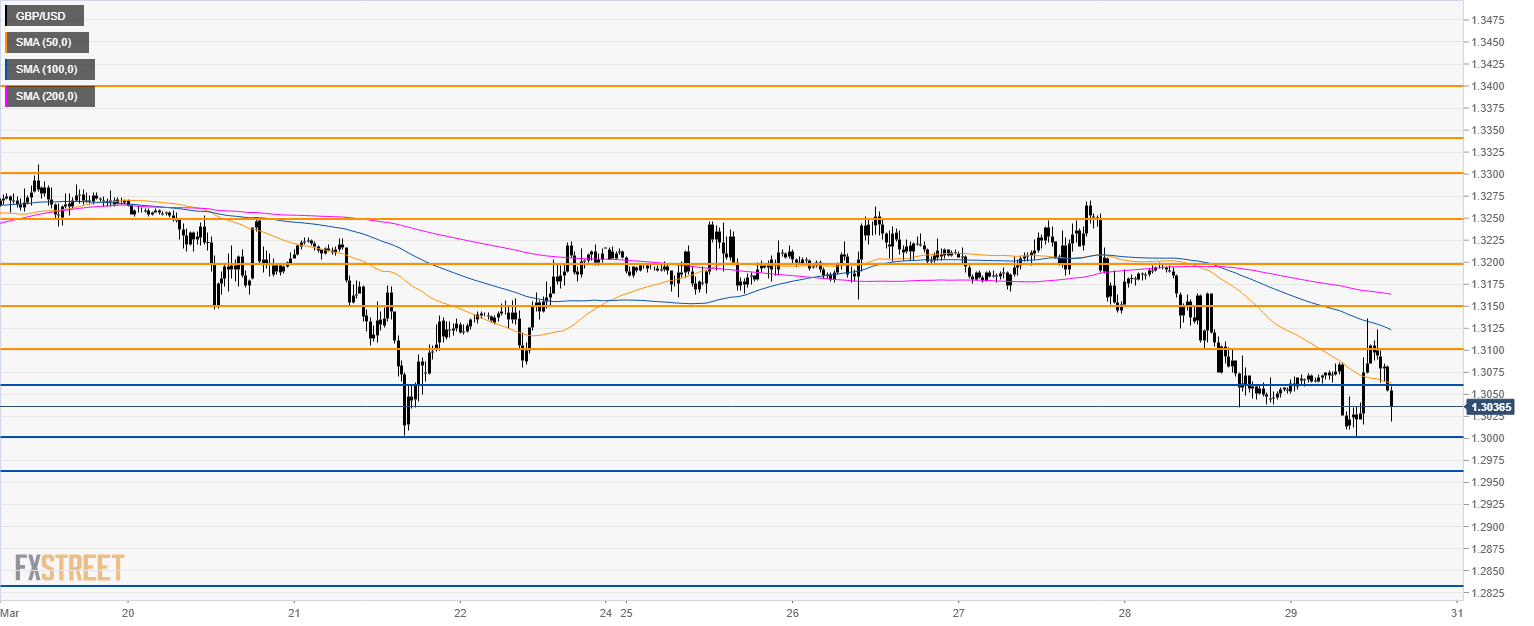

GBP/USD daily chart

- GBP/USD is trading is in consolidation mode above its 200-day simple moving average (SMAs).

- GBP/USD is very volatile as the Brexit votes are unfolding.

GBP/USD 4-hour chart

- GBP/USD is trading below its main SMAs suggesting a bearish momentum in the medium-term.

GBP/USD 30-minute chart

- GBP/USD is trading below its main SMAs suggesting a bearish momentum in the short-term.

- Key support to break for bears is 1.2965. Further down the next main support is seen at 1.2830.

- Resistance is at 1.3100 and 1.3150 level.

Additional key levels

WTI off fresh 2019 highs, eyes on oil rig count

24930 March 29, 2019 22:33 FXStreet Market News

- Prices of the barrel of WTI climb further to $60.50, 2019 highs.

- OPEC+ cuts, US sanctions keep propping up sentiment.

- Baker Hughes’ report coming up next.

Crude oil prices are resuming the upside at the end of the week, taking the barrel of American benchmark WTI to fresh 2019 highs in the $60.50 region.

WTI bid, looks to data

Prices of the barrel of West Texas Intermediate are up for the second session in a row, managing to leave behind the choppy trade seen in the first half of the week as traders re-shifted their attention to tightening supply conditions, particularly on the back of US sanctions against oil producers (and probably Turkey in the near future) and the in-place agreement to curb oil output by the OPEC+.

The barrel of WTI also managed to regain traction after Wednesday’s dip on an unexpected weekly build in US crude oil supplies, as reported by the DoE.

Later in the session, Baker Hughes will report on the US drilling activity during the week ended on March 22.

What to look for around WTI

Crude oil has climbed further north of the critical $60.00 mark per barrel and recorded new 2019 highs. Following the up move, the underlying bullish view in crude oil remains well in place on the back of the so-called ‘Saudi put’, tight conditions in the US markets (amidst US net imports in historic low levels and the rising activity in refiners ahead of the summer session), the current OPEC+ agreement to cut oil output and ongoing US sanctions against Iranian and Venezuelan crude oil exports. In addition, speculative longs continue to flow into the markets, reversing the downside that prevailed in late 2018. Further out, the OPEC+ could announce an extension of the current agreement to curb oil production at the cartel’s meeting in June.

WTI significant levels

At the moment the barrel of WTI is gaining 0.72% at $59.69 and a breakout of $60.49 (2019 high Mar.29) would open the door for $61.64 (200-day SMA) and then $63.74 (61.8% Fibo of the October-December drop). On the other hand, the next support is located at $57.91 (low Mar.25) seconded by $55.53 (55-day SMA) and finally $54.37 (low Mar.8).

USD/TRY off daily highs above 5.66, still up by around 2%

24928 March 29, 2019 21:53 FXStreet Market News

- The Turkish currency remains on the defensive.

- The pair moves to fresh 4-day highs beyond 5.66.

- All eyes on the municipal elections on Sunday.

The Turkish Lira remains week in the second half of the week, pushing USD/TRY to fresh multi-day highs beyond 5.6600 the figure although losing some momentum afterwards.

USD/TRY focused on politics

The selling pressure around TRY stays far from abated at the end of the week, always on the back of rising concerns over the financial health of the country at a time where its economy is already navigating in the recession territory.

In fact, souring sentiment around the EM FX space on the back of stronger greenback and amidst rising concerns over a global slowdown has been weighing on the Lira in past sessions, pushing spot to fresh 2019 highs near 5.85 during last week.

Additionally, efforts from the CBRT to control de sell off in the currency has been draining FX reserves and adding to the already worrying domestic scenario.

Also collaborating with the selling sentiment, Ankara insisted on buying a Russian arms system, ignoring US warnings of potential sanctions.

In the near future, all eyes will be upon the municipal elections on Sunday, regarded by the financial world as a test of President Erdogan’s government.

What to look for around TRY

The Lira is expected to remain under pressure in the near to medium terms, always tracking the performance of the risk-associated complex and specifically around the EM FX universe. The next key event in Turkey will be the municipal elections (Sunday), considered crucial as the much-need structural reforms are expected to kick in soon afterwards. Furthermore, TRY will remain in the centre of the debate ahead of the elections, as unwelcomed weakness in the currency could prompt an emergency rate hike by the CBRT. This scenario will surely collide with Erdogan’s intentions of lower rates and undermine at the same time the efforts of the economy to recover from the current recession.

USD/TRY key levels

At the moment the pair is gaining 2.00% at 5.6427 and faces the next hurdle at 5.6659 (high Mar.29) seconded by 5.8413 (2019 high Mar.22) and finally 5.8707 (high Oct.23 2018). On the downside, a break below 5.4737 (200-day SMA) would expose 5.3522 (55-day SMA) and then 5.2918 (low Mar.26).

USD/CAD plummets to weekly lows, around mid-1.3300s on upbeat Canadian GDP

24926 March 29, 2019 21:03 FXStreet Market News

• Canadian economic growth rate betters expectations and stands at 0.3% m/m.

• Surging oil prices further underpin Loonie and exert some additional pressure.

• Disappointing US economic data fails to lend any support or stall the downfall.

The bid tone surrounding the Canadian Dollar picked up the pace in the last hour, with the USD/CAD pair tumbling to fresh weekly lows, around mid-1.3300s.

The pair extended its retracement slide from three-week lows and lost some additional ground during the early North-American session in reaction to a positive surprise from the Canadian monthly GDP print, coming in to show a growth of 0.3% m/m as compared to a flat reading expected.

This against the backdrop of the ongoing bullish run in crude oil prices, amid the prevalent risk-on mood, provided a strong lift to the commodity-linked currency – Loonie and prompted some aggressive selling, taking along some short-term trading stops being placed near the 1.3400 handle.

Meanwhile, the US Dollar failed to preserve its early modest gains to near three-week lows and drifted back into the negative territory after yet another disappointing from the US economic data – personal income/spending data and softer core PCE price index for the month of February.

It would now be interesting to see if the pair is able to find any buying interest at lower levels or the current pull-back marks the end of the recent positive momentum as market participants now look forward to other US data releases – Chicago PMI and Revised UoM Consumer Sentiment, for some immediate respite.

Technical levels to watch

Canada: Industrial Product Price Index (IPPI) increased by 0.3% in February

24925 March 29, 2019 20:53 FXStreet Market News

“Prices for products manufactured in Canada rose 0.3% in February, mainly due to higher prices for energy and petroleum products,” Statistics Canada reported on Friday.

Key takeaways from the press release

- Prices for raw materials purchased by manufacturers operating in Canada increased 4.6%, primarily due to higher prices for crude energy products.

- The increase in the RMPI in February was primarily due to higher prices for crude energy products (+9.3%).

- From January to February, the Canadian dollar appreciated 0.7% relative to the US dollar.

- If the exchange rate had remained constant, the IPPI would have increased 0.5% instead of 0.3%.