Articles

European Monetary Union CFTC EUR NC Net Positions declined to €155.6K from previous €165.9K

83936 October 31, 2020 03:45 FXStreet Market News

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer.

Trading foreign exchange on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial advisor if you have any doubts.

Opinions expressed at FXStreet are those of the individual authors and do not necessarily represent the opinion of FXStreet or its management. FXStreet has not verified the accuracy or basis-in-fact of any claim or statement made by any independent author: errors and Omissions may occur.Any opinions, news, research, analyses, prices or other information contained on this website, by FXStreet, its employees, partners or contributors, is provided as general market commentary and does not constitute investment advice. FXStreet will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Full ArticleAustralia CFTC AUD NC Net Positions rose from previous $6.8K to $8.9K

83935 October 31, 2020 03:45 FXStreet Market News

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer.

Trading foreign exchange on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial advisor if you have any doubts.

Opinions expressed at FXStreet are those of the individual authors and do not necessarily represent the opinion of FXStreet or its management. FXStreet has not verified the accuracy or basis-in-fact of any claim or statement made by any independent author: errors and Omissions may occur.Any opinions, news, research, analyses, prices or other information contained on this website, by FXStreet, its employees, partners or contributors, is provided as general market commentary and does not constitute investment advice. FXStreet will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Full ArticleUnited States CFTC Gold NC Net Positions dipped from previous $249.6K to $248.6K

83934 October 31, 2020 03:45 FXStreet Market News

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer.

Trading foreign exchange on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial advisor if you have any doubts.

Opinions expressed at FXStreet are those of the individual authors and do not necessarily represent the opinion of FXStreet or its management. FXStreet has not verified the accuracy or basis-in-fact of any claim or statement made by any independent author: errors and Omissions may occur.Any opinions, news, research, analyses, prices or other information contained on this website, by FXStreet, its employees, partners or contributors, is provided as general market commentary and does not constitute investment advice. FXStreet will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

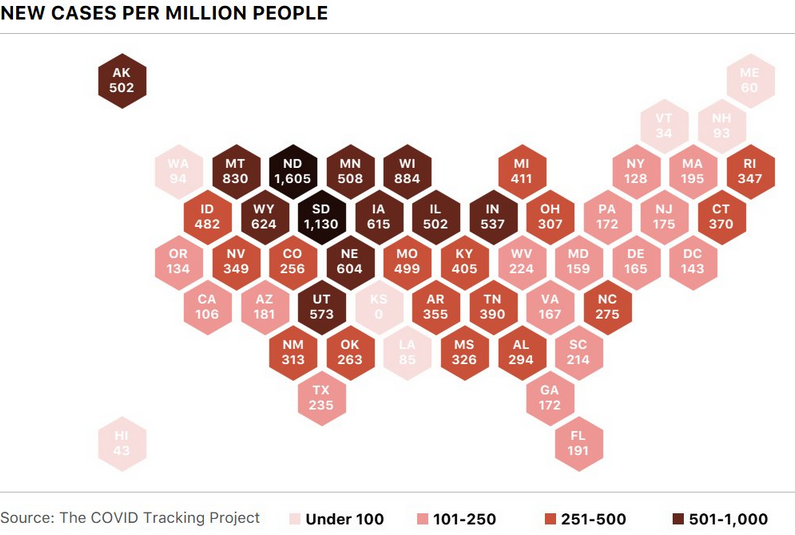

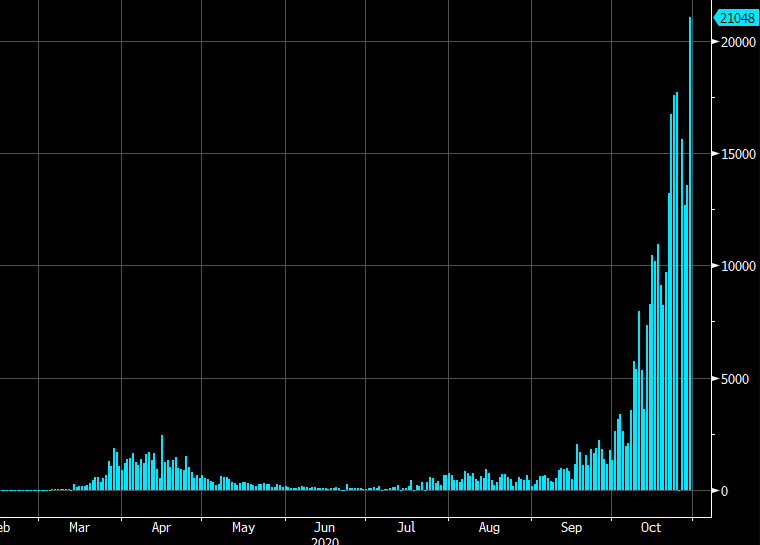

Full ArticleUS daily virus cases hit 90,000 for the first time

83932 October 31, 2020 03:09 Forexlive Latest News Market News

Record high cases in the US

- 90,155 cases vs 81,599 a day ago

- 83,034 cases a week ago

- 21 states report that hospitalizations are at record high

I would argue that the biggest reason the market is where it is right now is the pandemic, not the election. The next few months are going to be rough.

Governments are going face a choice in the next week or two: Introduce harsh curbs now for a few weeks, or wait and hope for the best with the risk that you have to introduce harsher curbs later when hospitals fill up.

Full Article

BoE expected to ramp up QE next week – Standard Chartered

83931 October 31, 2020 03:09 FXStreet Market News

The Bank of England will expand its quantitative easing program at next week’s meeting, according to the Standard Chartered research team, which points out to a division in the committee about the effectiveness of negative interest rates.

Key quotes

“We expect the Bank of England (BoE) to announce an additional GBP 100bn of QE purchases on 5 November given the deterioration in the economic environment stemming from new COVID-19 restrictions; such an announcement would take the target to GBP 845bn. “

“Monetary Policy Committee (MPC) members remain divided over the effectiveness of taking rates negative, and a review into their potential use is unlikely to be completed until December at the earliest. Given the lack of consensus between MPC members, negative rates will likely be resisted this year barring significant economic or financial deterioration, either as the result of a shift to full national lockdown, a no-deal Brexit outcome and/or greater-than-expected easing by the European Central Bank (ECB).”

“We think the February 2021 meeting is the more likely time for a cut to negative, particularly if the Brexit aftermath (even with a deal) and COVID impact prove worse than expected.”

Full ArticleEUR/GBP dives below 0.9000 to hit eight-week lows

83930 October 31, 2020 02:56 FXStreet Market News

- EUR/GBP dives to eight-week lows below 0.9000.

- A dovish ECB and COVID-19 have sent the euro 0.8% lower this week.

- The pair is testing an important support level at 0.9000.

The euro has extended its decline from week-highs near 0.9100, reaching levels sub-0.9000 for the first time in almost two months. The increase of COVID-19 cases in Europe and the measures to tackle them have hammered the euro against a somewhat stronger pound this week

Euro hammered by the ECB and COVID-19

The common currency is trading lower against the pound sterling for the second consecutive day on Friday and set for a 0.85% weekly decline. Investors’ concerns about the impact of the new lockdowns introduced in France and Germany and the regional confinements in Spain on a fragile economic recovery have punished the euro this week.

Apart from that, the dovish message of the European Central Bank on Thursday, flagging the introduction of further stimulus measures in December have increased selling pressure on the euro.

In contrast, the pound has remained fairly strong this week, favoured by the absence of Brexit news. The reopening of the talks this week, with the EU aiming for a deal by mid-November has eased fears of a “hard Brexit” which has buoyed the GBP.

EUR/GBP flirting with an important support level at 0.9000

From a technical perspective, the euro is eroding the base of the last weeks’ trading range, at 0.9000 psychological level. A successful breach of this level might increase bearish pressure towards 0.8911 (61,8% Fibonacci retracement of the May – September rally) before testing September lows at 0.8865.

On the upside, an upside reaction should extend beyond the 0.9100 descending trendline resistance to negate the bearish trend, and extend later to 0.9145 (October 20 high) and 0.9220 (September 23 high).

Technical levels to watch

Full ArticleS&P 500 extends daily decline to 70 points

83928 October 31, 2020 02:40 Forexlive Latest News Market News

Fresh lows for stocks

The S&P 500 broke through an earlier set of lows and is now down 70 points to 3239, or 2.1% on the day. Despite the break lower, it’s not exactly breaking down as it sits just below the earlier lows.

In the bigger picture, the 3200 level needs to hold. I expect it will ahead of the election but who knows afterwards.

Even as I’m tying here stocks have had a small bounce to trim the decline to 65 points.

Full ArticleUniswap price can plummet as the network prepares for a colossal airdrop

83927 October 31, 2020 02:40 FXStreet Market News

- A new proposal to reward users that have interacted with Uniswap through a proxy is currently active.

- The proposal seeks to distribute 400 UNI tokens to 12,619 different addresses.

The initial airdrop of Uniswap rewarded users that interacted with Uniswap before September 1 with 400 UNI tokens. A new proposal seeks to help users who have interacted with the exchange through a proxy or third-party application.

Another 400 UNI tokens will be rewarded to 12,619 addresses if the proposal passes. So far, 28,551,129 votes are in favor, and only 1,275,672 are against it. Investors that have used any of the below projects might have the chance to claim 400 UNI tokens:

|

Project |

Accounts |

% of total |

|

Argent |

3418 |

27.09% |

|

DeFi Saver |

890 |

7.05% |

|

Dharma |

2833 |

22.45% |

|

eidoo |

301 |

2.39% |

|

FURUCOMBO |

57 |

0.45% |

|

MEW |

4278 |

33.90% |

|

Monolith |

19 |

0.15% |

|

Nuo |

740 |

5.86% |

|

Opyn |

79 |

0.63% |

|

rebalance |

4 |

0.03% |

Dharma, a decentralized exchange proxy, is committed to carrying out the Retroactive Airdrop proposal. Dharma users will have the ability to delegate their UI holds for voting if the proposal passes.

How will the price of Uniswap react to the proposal?

Clearly, another massive airdrop will create significant selling pressure, most likely pushing UNI’s price further down. Although 28 million votes are in favor, it’s important to note that the proposal will fail if it receives less than 40 million votes.

On the 12-hour chart, UNI has established a descending wedge, and it’s bounded inside a downtrend. The MACD is bearish and continues to gain momentum. The lower support trendline at $2.28 is critical. A breakdown from this point can lead UNI to a new low at $1.6. If the proposal passes, this will be the most likely scenario.

UNI/USD 12-hour chart

On the other hand, if the proposal doesn’t receive 40 million votes and gets canceled. UNI could jump towards the upper boundary of the pattern at $2.66. A breakout above this level can drive the price of UNI towards the high at $3.4.

Full ArticleWTI remains near $35 multi-month lows after Baker Hughes’ report

83926 October 31, 2020 02:26 FXStreet Market News

- WTI futures remain near multi-month lows at $35.

- Oil prices plunge about 11% on the week on coronavirus concerns.

- Baker Hughes reports the sixth consecutive weekly increase on US oil rigs.

Front-month WTI futures remain near multi-month lows, at $35.35, set for an 11% weekly drop as the release of the Baker Hughes oil rigs data has failed to offer support.

Oil prices plunge on fears about new lockdowns

The US West Texas Intermediate has taken a dip this week, weighed by concerns about the impact on global demand as COVID-19 cases surge in the US and Europe. The new lockdowns introduced in France and Germany, with Spain declaring regional lockdowns has boosted negative pressure on oil prices.

Beyond that, Baker Hughes reported that the number of active oil rigs in the US increased by 10 to 221. These numbers confirm the sixth consecutive increase in the oil rigs count, which adds concerns about an oversupply as the second wave od the pandemic accelerates.

Earlier today, news that Kuwait would back any OPEC+ decision regarding oil production cuts has offered some respite to crude price and allowed the WTI to pop up above $36 for a short time before moving back to the low range of $35.

Oil producers are divided about Russia and Saudi Arabia’s idea of extending the current output cuts of 7.7 million barrels a day into next year, which is weighing further on prices.

Technical levels to watch

Full ArticleBelgium imposes new harsh curbs as virus spirals out of control

83924 October 31, 2020 02:17 Forexlive Latest News Market News

This includes heavy restrictions

Belgium has a population of 11.5 million and clocked over 20,000 cases yesterday. That’s among the highest in the world and would be equivalent to more than 600,000 cases per day in the US.

- School holiday through Nov 15

- Only one guest allowed in the home

- All non-essential retailers to close, including barbers

- Gathering of up to 4 people allowed outside

Officials are warning that the health system could collapse if cases continue to rise.

Full Article

No new policy announcements expected at next week’s FOMC meeting – TDS

83923 October 31, 2020 02:12 FXStreet Market News

Previewing the FOMC’s November policy meeting, “we expect the Fed to make the QE program more accommodative by increasing the average maturity of purchases, but not yet,” said TD Securities analysts.

Key quotes

“Fed officials have been emphasizing that the economy is still far from recovered, and risks are tilted to the downside, but the official data have continued to surprise on the upside side thus far. Against that backdrop, we don’t expect any new policy announcements at next week’s FOMC meeting, and changes to the wording of the statement are likely to be minimal, but potential changes to the QE program and associated guidance will likely be discussed.”

“FX markets are more likely to be concerned with the aftermath of the US election than the Fed. FX vols in across the G7 suggest the market is expecting some kind of election risk premia/uncertainty to persist well beyond November 3rd.”

“We think there is a greater risk of another residual USD short squeeze ahead of the key events. 1.1600/10 in EURUSD, 121.00/15 in EURJPY and 104 in USDJPY are the key lines in the stands we are watching to trigger possible USD extension risk.”

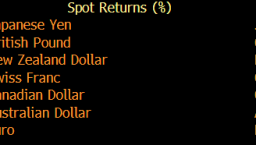

Full ArticleThe euro is the laggard this week and the yen led the way

83920 October 31, 2020 02:02 Forexlive Latest News Market News

Risk aversion and spiking covid cases in Europe dog EUR/JPY

EUR/JPY is the worst-performer this week, falling all five days and breaking through the September low to the worst levels since July.

Looking at the chart, there’s an ugly head-and-shoulders pattern shaping up.

The measured target is near 116.00.

How will be get there? You could certainly see it happening with a contested election but even a divided congress could do it.

Alternatively, a continued jump in covid cases in Europe and elsewhere would undermine the recovery and lead to a flight to the yen.

In short, there are more ways to envision this happening than not.

But be careful out there this week; I expect that far more fortunes will be lost than gained in the next seven days.

Full Article