Articles

EUR/USD Forecast: Bears take the lead after dismal European data

267169 October 31, 2022 20:56 FXStreet Market News

EUR/USD Current Price: 0.9921

- The European Consumer Price Index soared by a record high of 10.7% YoY.

- Tepid Chinese macroeconomic data weighed on the market mood at the beginning of the week.

- EUR/USD keeps gaining bearish traction in the near term but holds above 0.9900.

The EUR/USD pair trades around 0.9920, losing ground at the beginning of the week after closing Friday at 0.9965. Financial markets started Monday on the backfoot amid tepid Chinese data, signaling the economy contracted further in October, as the NBS Manufacturing PMI fell to 49.2 in October, while the Non-Manufacturing PMI slid to 48.7. Markets concerns were exacerbated by China’s decision to put Wuhan under a strict lockdown amid rising coronavirus cases.

Meanwhile, worrisome EU data hit the shared currency. German Retail Sales were up by 0.9% MoM in September, although down 0.9% from a year earlier. The EU economy grew by 0.2% in the three months to September, according to the preliminary estimate of the Q3 Gross Domestic Product, while the annualized growth was 2.1%, below the previous 4.1%. Finally, the preliminary estimate of the October EU Consumer Price Index came in at 10.7%, a new record high and higher than the 10.2% expected.

The US has a quiet day in terms of data, but a busy week on that side, as the US Federal Reserve will decide on monetary policy on Wednesday, while the country will publish the Nonfarm Payrolls report on Friday.

EUR/USD short-term technical outlook

The EUR/USD pair bottomed at 0.9913, not far from the current level. The bearish potential seems limited due to the cautious stance, but bulls have moved to the sidelines. The daily chart shows that the pair retreated further after testing a bearish 100 SMA, while the 20 SMA keeps grinding north below the current level. Technical indicators, in the meantime, ease within positive levels, reflecting the ongoing decline instead of suggesting more slides ahead.

In the near term and according to the 4-hour chart, chances skew to the downside. The pair is developing below a flat 20 SMA, while the 100 and 200 SMAs are also directionless, converging around 0.9830. Technical indicators head nowhere amid the limited intraday volatility but stand within negative levels. A downward extension below 0.9900 should open the door for a steeper decline in the next couple of sessions.

Support levels: 0.9900 0.9865 0.9830

Resistance levels: 0.9965 1.0010 1.0055

View Live Chart for the EUR/USD

Full ArticleEUR/USD to test the October 21 low near 0.9705 on a break below 0.9855 – BBH

267168 October 31, 2022 20:56 FXStreet Market News

The euro remains heavy despite higher-than-expected Eurozone Preliminary Inflation data. Economists at BBH expect the EUR/USD pair to challenge the October 21 low around 0.9705 on a move under 0.9855.

Eurozone October CPI came in hot

“A break below 0.9855 is needed to set up a test of the October 21 low near 0.9705.”

“Headline came in at 10.7% YoY vs. 10.3% expected and 9.9% in September, while core came in as expected at 5.0% YoY vs. 4.8% in September. These readings will keep pressure on the ECB to continue tightening aggressively even as the eurozone slips into recession. As a result, ECB tightening expectations remain heightened. The problem is that the eurozone is already tipping into recession even as the ECB tightens aggressively.”

Full ArticleAfter last week’s earnings dump of the major big cap companies, what’s on tap this week?

267167 October 31, 2022 20:35 Forexlive Latest News Market News

US stocks are set to open lower after the strong week last week when a number of the major mega cap companies announced their earnings. The Dow industrial average is higher this month and is close to the 14.41% gain from January 1976.

Dow is close to the January 1976 14.41% gain

What is on tap for this week?

Tuesday

- Pfizer

- Clorox

- Airbnb

- AMD

Wednesday

- Qualcomm

- Roku

- CVS

- Paramount

- eBay

Thursday

- Marriott

- PayPal

- Doordash

- Peloton

- Starbucks

Friday

- Hershey’s

- AMC

- DraftKings

On Saturday, Berkshire Hathaway will have their traditional Saturday earnings release.

Needless to say, the earnings calendar is not one that will likely move the markets like last week’s releases. So the market…

As a result they markets can focus more on the central bank rate decision is including the reserve Bank of Australia (Tuesday morning and Australia), the Fed on Wednesday and the BOE on Thursday (See video from this weekend “Three down. Three to go.”..

Full ArticleECB to deliver another 75 bps hike in December as inflation refuses to peak – Commerzbank

267166 October 31, 2022 20:29 FXStreet Market News

Euroarea inflation increased again in October to 10.7% year-on-year. This also increases the pressure on the European Central Bank (ECB) to further raise key rates sharply, in the view of economists at Commerzbank.

Inflation rate rises and rises

“The inflation rate in the euro area rose further in October to 10.7%, which was significantly higher than expected. Prices are rising more strongly across the board. The inflation rate excluding the volatile prices of energy, food, alcohol and tobacco rose by 0.2 points to 5.0%.”

“Today’s data increase the likelihood that the ECB will raise its key interest rates again by 75 basis points in December, especially as the euro economy still grew by 0.2% in the third quarter compared with the second quarter.”

Full ArticleForexlive European FX news wrap 31 Oct – Stocks stall as data hits ‘Pivotal’ bets

267165 October 31, 2022 20:21 Forexlive Latest News Market News

As I leave the desk, a reminder of today’s European Session stories and the ‘5 Things You Need to Know’ via Newsquawk

1. European bourses began the week modestly firmer, though this proved shortlived and the complex has pivoted to being mixed overall in-fitting with the APAC handover

2. Stateside, futures are under more pressure, ES -0.5% as yields pickup a touch, NQ -0.7% lags slightly as such

3. USD is bolstered by the general risk tone, Yuan pressure post-PMIs and the latest piece from WSJ’s Timiraos; DXY to a 111.20+ peak

4. Core fixed benchmarks pressured with yields extending as we enter a week dominated by Central Bank activity

5. Commodities under pressure amid the USD pickup and weak Chinese PMIs alongside COVID woes

via Reuters: Stocks stalled and the dollar and bond yields edged higher on Monday as record euro zone inflation, weak Chinese data and Russia’s withdrawal from a crucial grain pact set traders up for another bumper Federal Reserve rate hike this week.

A potentially pivotal week for U.S. monetary policy was given a new twist from renewed “terminal rate” speculation, with the worrying growth signals from China and global inflation fears also stoked by higher agricultural prices.

Euro zone inflation also came in higher than economists had been expecting too, hitting a record of 10.7% year-on-year, in what will make for more uncomfortable reading for the European Central Bank, which is targeting 2% price growth.

Combined with news that Italy’s economy grew far more strongly than expected in the third quarter, euro zone bond yields moved higher although the euro succumbed to another bout of U.S. dollar strength.

Full ArticleEUR/USD Price Analysis: Further gains on the cards above 0.9900

267163 October 31, 2022 20:17 FXStreet Market News

- EUR/USD extends the decline to the vicinity of 0.9900.

- The multi-month support line near 0.9900 holds the downside.

EUR/USD comes under further pressure and trades closer to the 0.9900 neighbourhood on Monday.

The 0.9900 region, where the 8-month support line and the 55-day SMA converge, emerges as a quite decent contention zone for the time being. While above this region, the pair could attempt another visit to the October top near 1.0100 (October 27).

In the longer run, the pair’s bearish view should remain unaltered while below the 200-day SMA at 1.0495.

EUR/USD daily chart

Full ArticleEUR/JPY Price Analysis: Further gains remain on the table near term

267161 October 31, 2022 20:17 FXStreet Market News

- EUR/JPY adds to Friday’s advance and flirts with multi-session highs.

- Next on the upside aligns the 2022 peak at 148.40.

EUR/JPY extends the rebound and climbs to the 147.70 region at the beginning of the week.

Considering the current price action, there is still chances for the cross to advance further in the short-term horizon. That said, the immediate up barrier now emerges at the 2022 high at 148.40 (October 21) ahead of the December 2014 top at 149.78 (December 8).

In the short term the upside momentum is expected to persist while above the October lows near 141.00.

In the longer run, while above the key 200-day SMA at 137.36, the constructive outlook is expected to remain unchanged.

EUR/JPY daily chart

Full ArticleUSD/MYR now predicted to trade within 4.6950-4.7400 – UOB

267160 October 31, 2022 20:12 FXStreet Market News

Further side-lined trading in USD/MYR is probable in the near term, likely between 4.6950 and 4.7400 according to Markets Strategist Quek Ser Leang at UOB Group’s Global Economics & Markets Research.

Key Quotes

“USD/MYR snapped its 8-week winning streak as it closed lower by 0.34% last Friday. The price action is likely the early stages of a consolidation phase”.

“In other words, USD/MYR is likely to trade sideways this week, expected to be within a range of 4.6950/4.7400”.

Full ArticleAAVE price: What to expect from Aave with upcoming deployment on zkSync 2.0 testnet

267157 October 31, 2022 20:12 FXStreet Market News

- Aave could be deployed into the zkSync 2.0 testnet if an off-campus web3 student organization, FranklinDAO’s proposal gets voted in.

- Aave recently announced that alongside Uniswap, the open-source DeFi protocol could be deployed on Polygon’s zkEVM testnet.

- Analysts believe Aave price is likely to decline until November 5 as the sentiment among traders remains bearish.

Aave is a decentralized finance (DeFi) protocol that lets users lend and borrow cryptocurrencies and real-world assets without the hassle of a centralized intermediary. Aave’s deployment on zkSync 2.0 testnet and zkEVM testnet on Polygon is making headlines, as analysts evaluate the impact on the DeFi token’s price.

Also read: Chiliz price up 15% as FIFA World Cup 2022 draws close, here’s what to expect

Aave could arrive on zkSync 2.0 testnet soon

Aave, a leading DeFi protocol that powers lending and borrowing of cryptocurrencies and real-world assets for users could deploy on zkSync 2.0 testnet if a new proposal gets voted in. zkSync 2.0 is a zero-knowledge rollup layer-2 network that bundles up transactions and passes them down to Ethereum so they can be written to its ledger.

The current version of zkSync 2.0 solves the needs of most applications on Ethereum. It is expected to provide developers with a design space to experiment with applications not possible on Ethereum today.

The proposal was put forward by Franklin DAO, previously Penn DAO, an off-campus web3 organization of University of Pennsylvania students. The proposal is presented in partnership with Matter Labs and the objective is to expand the cross-chain experience of Aave V3.

Aave v3 deployment on zkSync 2.0 testnet

Once the decentralized exchange (DEX) liquidity requirements are met, a snapshot will be submitted to zkSync V2 testnet as next steps. In the second week of October, Aave announced its deployment on Polygon’s zkEVM testnet, alongside DeFi protocol Uniswap. Typically, an expansion of Aave’s cross-chain capabilities boosts the sentiment among Aave token holders.

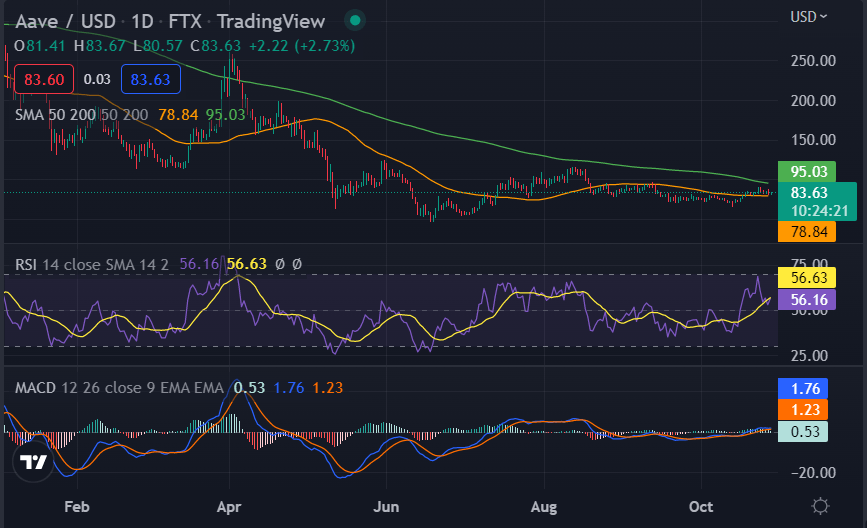

Aave price could continue to decline

Analysts evaluating the Aave price trend, predict a decline in AAVE till November 5. The sentiment among Aave holders is currently bearish, unless there is a shift in sentiment and increase in on-chain activity, analysts believe AAVE could continue its downtrend.

Ann Mugoiri, crypto analyst evaluated the daily price chart and argued that bears are defining the price movement today. AAVE/USD is correcting after a strong bullish move and the pair is exchanging hands at $86.03 today. Aave yielded 13.4% gains for holders over the past two weeks. Mugoiri argues that the selling pressure has returned and the trend remains bearish as Aave price steadily declines.

Aave/USD price chart

Full ArticleUSD/JPY: Break above 149.35 to set up a test of the October 21 high near 15 – BBH

267156 October 31, 2022 20:09 FXStreet Market News

USD/JPY gained more than 100 pips on Friday after the Bank of Japan delivered another dovish hold. Economists at BBH expect the pair to target 152 on a break past 149.35.

Data suggest the BoJ cannot maintain a heavy pace of intervention

“A break above 149.35 would set up a test of the USD/JPY high near 152 from October 21.”

“Reports suggest the BoJ recently spent JPY6.35 trln supporting the yen. In total, these interventions represent nearly 6% of its total foreign reserves and so it’s clear that this pace cannot be sustained on a regular basis. Rather, we think the BoJ will continue to intervene sporadically and quietly to try and keep the markets guessing.”

“With the BoJ delivering another dovish hold last Friday, we think USD/JPY remains a buy at current levels.”

Full ArticleIndia Infrastructure Output (YoY) above expectations (7.6%) in September: Actual (7.9%)

267155 October 31, 2022 20:09 FXStreet Market News

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

USD Index Price Analysis: Rising bets for a test of 114.00 near term

267153 October 31, 2022 20:05 FXStreet Market News

- DXY extends the upside momentum north of 111.00.

- Further rebound remains focused on the 114.00 region and above.

DXY climbs to fresh 4-session highs near 111.30 at the beginning of the week.

The index seems to have met a decent support near 109.50 (October 27). The continuation of the rebound could then target the area of monthly peaks around 114.00.

The near-term upside bias is expected to hold while above the 8-month support line near 108.50. The proximity of the 100-day SMA also reinforces this area of contention.

In the longer run, DXY is expected to maintain its constructive stance while above the 200-day SMA at 104.15.