Articles

Ex-Dividend 30/4/2025

415731 April 29, 2025 17:39 ICMarkets Market News

|

1

|

Ex-Dividends | ||

|---|---|---|---|

|

2

|

30/4/2025 | ||

|

3

|

Indices | Name |

Index Adjustment Points

|

|

4

|

Australia 200 CFD

|

AUS200 | 0.4 |

|

5

|

IBEX-35 Index | ES35 | – |

|

6

|

France 40 CFD | F40 | – |

|

7

|

Hong Kong 50 CFD

|

HK50 | 39.22 |

|

8

|

Italy 40 CFD | IT40 | – |

|

9

|

Japan 225 CFD

|

JP225 | – |

|

10

|

EU Stocks 50 CFD

|

STOXX50 | – |

|

11

|

UK 100 CFD | UK100 | – |

|

12

|

US SP 500 CFD

|

US500 | 0.44 |

|

13

|

Wall Street CFD

|

US30 | – |

|

14

|

US Tech 100 CFD

|

USTEC | 1.65 |

|

15

|

FTSE CHINA 50

|

CHINA50 | 2.11 |

|

16

|

Canada 60 CFD

|

CA60 | 0.06 |

|

17

|

Germany Tech 40 CFD

|

TecDE30 | – |

|

18

|

Germany Mid 50 CFD

|

MidDE50 | – |

|

19

|

Netherlands 25 CFD

|

NETH25 | – |

|

20

|

Switzerland 20 CFD

|

SWI20 | – |

|

21

|

Hong Kong China H-shares CFD

|

CHINAH | 20.56 |

|

22

|

Norway 25 CFD

|

NOR25 | – |

|

23

|

South Africa 40 CFD

|

SA40 | – |

|

24

|

Sweden 30 CFD

|

SE30 | 7.78 |

|

25

|

US 2000 CFD | US2000 | 0.25 |

The post Ex-Dividend 30/4/2025 first appeared on IC Markets | Official Blog.

Indian Govt: Indian, US officials meet in Washington, trade talks make positive progress

415730 April 29, 2025 17:00 Forexlive Latest News Market News

- Indian, US officials meet in Washington, bilateral trade agreement talks make positive progress.

- Discussed a pathway for concluding the first tranche of the mutually beneficial trade pact.

- To hold in-person talks over various sectors from end-May.

US Treasury Secretary Bessent said that India might be the first trade deal that they will announce. These are some positive comments and the market will likely continue to have positive expectations until we get the details.

Bessent will join the White House Press Briefing today at 12:30 GMT/08:30 ET and the Secretary of Commerce Lutnick will speak at 18:00 GMT/14:00 ET on CNBC.

This article was written by Giuseppe Dellamotta at www.forexlive.com.

Eurozone April final consumer confidence -16.7 vs -16.7 prelim

415729 April 29, 2025 16:15 Forexlive Latest News Market News

- Prior -14.5

- Economic confidence 93.6 vs 94.5 expected

- Prior 95.2 (revised to 95.0)

- Industrial confidence -11.2 vs -10.1 expected

- Prior -10.6 (revised to -10.7)

- Services confidence 1.4 vs 2.2 expected

- Prior 2.4 (revised to 2.2)

Again, no surprise with consumer and business confidence surveys slumping amid the trade uncertainty. Focus remains on trade negotiations and how it evolves in the next weeks and months.

This article was written by Giuseppe Dellamotta at www.forexlive.com.

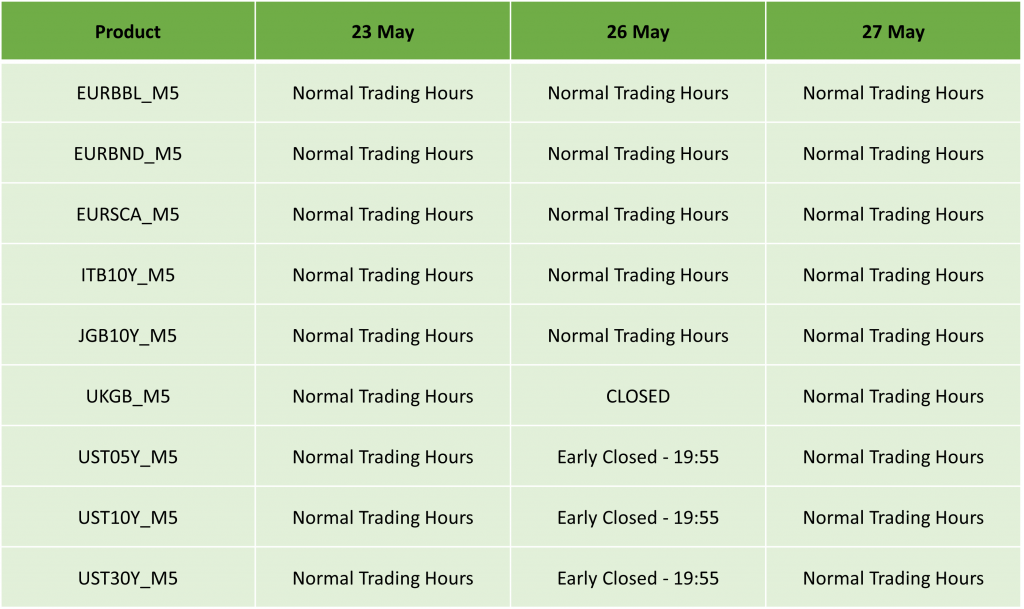

Memorial Day Holiday Trading Schedule – 2025

415720 April 29, 2025 16:14 ICMarkets Market News

Dear Client,

Please find our updated Trading schedule and general information related to the Memorial Day on Monday, 26 May, 2025.

Liquidity over the holidays is expected to be particularly thin so please take the necessary precaution to ensure that you are not affected by increased volatility, spreads and intermittent pricing.

All times mentioned below are Platform time (GMT +3).

Forex / Crypto Pairs:

Precious Metals:

Spot Energies:

Indices:

Energy Futures:

Bonds Futures:

Equities:

Kind regards,

IC Markets Global.

The post Memorial Day Holiday Trading Schedule – 2025 first appeared on IC Markets | Official Blog.

ECB consumer survey shows 1 year inflation expectations rising to 2.9%

415719 April 29, 2025 15:30 Forexlive Latest News Market News

- 1 year inflation expectations rising to 2.9% vs 2.6% prior

- 3 year inflation expectations rising to 2.5% vs 2.4% prior

- 1 year growth expectations stable at -1.2%

The rising inflation expectations shouldn’t be surprising given the trade war. Tariffs are a stagflationary shock.

This article was written by Giuseppe Dellamotta at www.forexlive.com.

Eurozone March M3 money supply +3.6% vs +4.0% y/y expected

415718 April 29, 2025 15:14 Forexlive Latest News Market News

- Eurozone March M3 money supply +3.6% vs +4.0% y/y expected

- Prior +4.0%

- Loans to households Y/Y 1.7% vs 1.5% prior

- Loans to companies Y/Y 2.3% vs 2.2% prior

This article was written by Giuseppe Dellamotta at www.forexlive.com.

China: If US wants resolution, it should stop making threats

415717 April 29, 2025 14:30 Forexlive Latest News Market News

- If US wants resolution, it should stop making threats.

- US should seek dialogue with China on tariffs.

- Tariffs war was launched by US.

Nothing new here. The Chinese continue to repeat that they are open for dialogue and resolution but they won’t be the first to call since the ‘tariff war was launched by US’.

This article was written by Giuseppe Dellamotta at www.forexlive.com.

ECB’s Cipollone: Trade policy uncertainty could reduce business investment

415716 April 29, 2025 14:14 Forexlive Latest News Market News

- Potential for sudden stops in capital flows, payment disruption and volatility in currency markets requires robust contingency planning.

- There are further signs that geopolitical considerations increasingly influence decisions to invest in gold.

- Recent increase in trade policy uncertainty could reduce Euro Area business investment by 1.1% in the first year and real GDP growth by around 0.2% in 2025-2026.

- The observed increase in financial market volatility might imply lower GDP growth of about 0.2% in 2025.

This article was written by Giuseppe Dellamotta at www.forexlive.com.

Spain Q1 preliminary GDP +0.6% vs +0.7% q/q expected

415715 April 29, 2025 14:14 Forexlive Latest News Market News

- Spain Q1 preliminary GDP +0.6% vs +0.7% q/q expected

- Prior 0.7%

- Q1 GPD Y/Y 2.8% vs 3.1% expected

- Prior 3.4%

This article was written by Giuseppe Dellamotta at www.forexlive.com.

Spain April Flash CPI 2.2% vs 2.0% expected

415714 April 29, 2025 14:14 Forexlive Latest News Market News

- Spain April Flash CPI 2.2% vs 2.0% expected

- Prior 2.3%

- Core CPI 2.4% vs 2.0% prior

This article was written by Giuseppe Dellamotta at www.forexlive.com.

Tuesday 29th April 2025: Asia-Pacific Markets Rise as Investors Eye U.S. Tariffs and Earnings Reports

415713 April 29, 2025 14:14 ICMarkets Market News

Global Markets:

- Asian Stock Markets : Nikkei up 0.38%, Shanghai Composite down 0.12%, Hang Seng up 0.02% ASX up 0.92%

- Commodities : Gold at $3322.35 (-0.79%), Silver at $32.8 (-0.49%), Brent Oil at $64.18 (-0.15%), WTI Oil at $61.30 (-0.19%)

- Rates : US 10-year yield at 4.217, UK 10-year yield at 4.5050, Germany 10-year yield at 2.5065

News & Data:

- (CAD) Core Retail Sales m/m 0.5% to -0.1% expected

- (CAD) Retail Sales m/m -0.4% to -0.4% expected

Markets Update:

Asia-Pacific markets mostly edged higher on Tuesday as investors awaited key U.S. corporate earnings and economic data, closely watching how President Donald Trump’s tariffs might impact business performance. Sentiment was also influenced by ongoing trade negotiations between the U.S. and several Asia-Pacific nations.

In China, the CSI 300 index dipped slightly by 0.13%, while Hong Kong’s Hang Seng Index managed a small gain of 0.12% after trimming earlier advances. In India, the Nifty 50 rose 0.22%, whereas the BSE Sensex remained largely unchanged.

South Korea’s Kospi index gained 0.63%, with the tech-heavy Kosdaq rising 1.03%, reflecting investor confidence in smaller-cap stocks. Australia’s S&P/ASX 200 also posted a strong performance, climbing 0.96%. Japanese markets were closed due to a public holiday.

U.S. stock futures were relatively flat after a volatile Monday session that saw major indices swing between gains and losses. The S&P 500 recorded a slight increase of 0.06%, closing at 5,528.75 — its fifth consecutive winning session. The Dow Jones Industrial Average added 114.09 points, or 0.28%, finishing at 40,227.59. Meanwhile, the Nasdaq Composite slipped 0.1% to end the day at 17,366.13.

Investors were particularly focused on the performance of major tech firms ahead of their earnings reports. Among the “Magnificent Seven,” Apple and Meta Platforms ended up around 0.4% each. Microsoft declined 0.2%, while Amazon fell 0.7%, reflecting some pre-earnings caution in the tech sector.

Upcoming Events:

- 02:00 PM GMT – USD JOLTS Job Openings

The post Tuesday 29th April 2025: Asia-Pacific Markets Rise as Investors Eye U.S. Tariffs and Earnings Reports first appeared on IC Markets | Official Blog.

IC Markets Europe Fundamental Forecast | 29 April 2025

415712 April 29, 2025 14:14 ICMarkets Market News

IC Markets Europe Fundamental Forecast | 29 April 2025

What happened in the Asia session?

Mike Carney, leader of Canada’s Liberal Party, looks to have won a full term as Prime Minister following an early vote count, as reported by local broadcasters. It was a tightly contested election where the Canadian Broadcasting Corporation (CBC) said it was projecting a Liberal win in the elections with around 160 seats, while the Conservatives held 138 seats. The Loonie weakened slightly as USD/CAD reversed off Tuesday’s lows at 1.3808, rising strongly toward 1.3900.

What does it mean for the Europe & US sessions?

Germany’s consumers have seen their confidence level plummet since November 2021 with no signs of improvement. The estimate of -25.6 for May points to another month of consumer pessimism despite the recently adopted fiscal stimulus package, which many hope would be implemented swiftly and effectively. Should consumer sentiment deteriorate more than anticipated, the Euro could face headwinds before the start of the European session.

Canadian voters continue to head to the polls to elect members of the House of Commons to the 45th Canadian Parliament – this will be the first election to use a new 343-seat electoral map based on the 2021 Canadian census. Mark Carney, incumbent Prime Minister and the leader of the Liberal party, will be looking to secure another term for his party. Traders should brace themselves for higher volatility in the Loonie, especially if there is a major upset for the incumbents.

The Dollar Index (DXY)

Key news events today

JOLTS Job Openings (2:00 pm GMT)

CB Consumer Confidence (2:00 pm GMT)

What can we expect from DXY today?

After decreasing from 7.76M to 7.57M in February, job openings are anticipated to fall for the second consecutive month in March, down to 7.49M as reported by the JOLTS report. With the ongoing trade uncertainty between the U.S. and its major trading partners, it will not be surprising to see many U.S. corporations applying the brakes on aggressive hiring policies in the near term. Meanwhile, consumer confidence is set to report another notable drop. Following last Friday’s sharp decline in the University of Michigan’s sentiment survey, the Conference Board (CB) is expected to fall from 92.9 in the previous month to 87.7 in April – this would mark the fifth successive month of decline. The dollar could face strong headwinds should the above data come in worse than originally forecasted.

Central Bank Notes:

- The Board of Governors of the Federal Reserve System voted unanimously to maintain the Federal Funds Rate in a target range of 4.25 to 4.50% on 19 March 2025

- The Committee seeks to achieve maximum employment and inflation at the rate of 2% over the longer run but uncertainty around the economic outlook has increased; the Committee is attentive to the risks to both sides of its dual mandate.

- Recent indicators suggest that economic activity has continued to expand at a solid pace while the unemployment rate has stabilized at a low level in recent months, and labour market conditions remain solid. However, inflation remains somewhat elevated.

- GDP growth forecasts were revised downward for 2025 (1.7% vs. 2.1% in the December projection) while PCE inflation projections have been adjusted slightly higher for 2025, with core inflation expected to reach 2.5%, partly due to tariff-related pressures.

- In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook and is prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of its goals.

- Beginning in April, the Committee will slow the pace of decline of its securities holdings by reducing the monthly redemption cap on Treasury securities from $25B to $5B while maintaining the monthly redemption cap on agency debt and agency mortgage-backed securities at $35B.

- The next meeting is scheduled for 6 to 7 May 2025.

Next 24 Hours Bias

Weak Bearish

Gold (XAU)

Key news events today

JOLTS Job Openings (2:00 pm GMT)

CB Consumer Confidence (2:00 pm GMT)

What can we expect from Gold today?

After decreasing from 7.76M to 7.57M in February, job openings are anticipated to fall for the second consecutive month in March, down to 7.49M as reported by the JOLTS report. With the ongoing trade uncertainty between the U.S. and its major trading partners, it will not be surprising to see many U.S. corporations applying the brakes on aggressive hiring policies in the near term. Meanwhile, consumer confidence is set to report another notable drop. Following last Friday’s sharp decline in the University of Michigan’s sentiment survey, the Conference Board (CB) is expected to fall from 92.9 in the previous month to 87.7 in April – this would mark the fifth successive month of decline. The dollar could face strong headwinds should the above data come in worse than originally forecasted, which would provide a lift for gold.

Next 24 Hours Bias

Weak Bearish

The Australian Dollar (AUD)

Key news events today

RBA Assist Gov Kent Speaks (2:05 am GMT)

What can we expect from AUD today?

Reserve Bank of Australia (RBA) Assistant Governor Christopher Kent will be delivering a speech titled “Australia’s External Position and the Evolution of the FX Markets” at an event hosted by Bloomberg in Sydney. During this event, he may be pressed with questions on the ongoing tariff negotiations between the U.S. and China – which is Australia’s largest trading partner. Demand for the Aussie remained robust as this currency pair climbed above the threshold of 0.6400 overnight.

Central Bank Notes:

- The RBA maintained the cash rate at 4.10% on 1 April, following a 25-basis point reduction on 18 February.

- Inflation has fallen substantially since the peak in 2022, as higher interest rates have been working to bring aggregate demand and supply closer towards balance.

- Recent information suggests that underlying inflation continues to ease in line with the most recent forecasts published in the February Statement on Monetary Policy.

- Private domestic demand appears to be recovering, real household incomes have picked up and there has been an easing in some measures of financial stress. However, businesses in some sectors continue to report that weakness in demand makes it difficult to pass on cost increases to final prices.

- At the same time, a range of indicators suggest that labour market conditions remain tight. Despite a decline in employment in February, measures of labour underutilisation are at relatively low rates and business surveys and liaison suggest that availability of labour is still a constraint for a range of employers. Wage pressures have eased a little more than expected but productivity growth has not picked up and growth in unit labour costs remains high.

- There are notable uncertainties about the outlook for domestic economic activity and inflation. The central projection is for growth in household consumption to continue to increase as income growth rises. But there is a risk that any pick-up in consumption is slower than expected, resulting in continued subdued output growth and a sharper deterioration in the labour market than currently expected.

- Uncertainty about the outlook abroad also remains significant. On the macroeconomic policy front, recent announcements from the U.S. on tariffs are having an impact on confidence globally and this would likely be amplified if the scope of tariffs widens, or other countries take retaliatory measures. Geopolitical uncertainties are also pronounced.

- The Board’s assessment is that monetary policy remains restrictive and the continued decline in underlying inflation is welcome, but there are nevertheless risks on both sides and the Board is cautious about the outlook.

- The Board will rely upon the data and the evolving assessment of risks to guide its decisions and is resolute in its determination to sustainably return inflation to target and will do what is necessary to achieve that outcome.

- The next meeting is on 20 May 2025.

Next 24 Hours Bias

Weak Bullish

The Kiwi Dollar (NZD)

Key news events today

No major news events.

What can we expect from NZD today?

The Kiwi has rallied over 7% since the beginning of April with no signs of demand waning. This currency pair dipped under the threshold of 0.6000 as Asian markets came online on Tuesday but the weaker greenback should keep it supported as the day progresses.

Central Bank Notes:

- The Monetary Policy Committee (MPC) agreed to reduce the Official Cash Rate (OCR) by 25 basis points bringing it down to 3.50% on 9 April, marking the fifth consecutive rate cut.

- The Committee assessed that annual consumer price inflation remains near the midpoint of the MPC’s 1 to 3% target band while firms’ inflation expectations and core inflation are consistent with inflation remaining at target over the medium term.

- Economic activity has evolved largely as expected since the February Monetary Policy Statement; higher-than-expected export prices and a lower exchange rate have supported primary sector incomes and overall economic growth.

- Although monetary restraint had been removed at pace, household spending and residential investment have remained weak.

- The recently announced increases in global trade barriers weaken the outlook for global economic activity. On balance, these developments create downside risks to the outlook for economic activity and inflation.

- The Committee noted that the increase in tariffs will take time to work through the global economy, but the direct price increases for economies imposing tariffs and the dampening impact of increased economic uncertainty on global demand will occur relatively quickly.

- With CPI inflation close to the mid-point of the target range, significant spare capacity in the economy, and a weaker activity outlook stemming from global trade policy, the Committee agreed that a further reduction in the OCR was appropriate.

- Meanwhile, future policy decisions will be determined by the outlook for inflationary pressure over the medium term.

- The next meeting is on 28 May 2025.

Next 24 Hours Bias

Weak Bullish

The Japanese Yen (JPY)

Key news events today

No major news events.

What can we expect from JPY today?

Global trade policy uncertainties have kept demand for safe-haven currencies elevated with USD/JPY falling 1.2% overnight. This currency pair fell under 142 at the beginning of this session, with overhead pressures building once again.

Central Bank Notes:

- The Policy Board of the Bank of Japan decided on 19 March, by a unanimous vote, to maintain the following guidelines for money market operations for the inter-meeting period:

- The Bank will encourage the uncollateralized overnight call rate to remain at around 0.5%.

- The Bank will continue its plan to reduce the amount of its monthly outright purchases of JGBs, aiming to reach about 3 trillion yen by January-March 2026.

- Japan’s economy has continued to recover moderately, with some sectors showing improvement. Exports and industrial production have remained relatively stable, while corporate profits continue on an improving trend and business sentiment maintains a favourable level.

- The employment and income situation has shown moderate improvement, with private consumption on a moderately increasing trend despite ongoing impacts from price rises.

- On the price front, the year-on-year rate of increase in the consumer price index (CPI, all items less fresh food) has been in the range of 3.0-3.5% recently. Services prices continue to rise moderately, reflecting factors such as wage increases, while the effects of cost pass-through from past import price rises have diminished.

- Inflation expectations have continued to rise moderately, with underlying CPI inflation gradually increasing toward the price stability target of 2%. The virtuous cycle between wages and prices continues to strengthen, with businesses increasingly reflecting higher costs in selling prices.

- Japan’s economy is expected to maintain growth above its potential rate, supported by moderately growing overseas economies and the intensifying virtuous cycle from income to spending, underpinned by accommodative financial conditions.

- The next meeting is scheduled for 1 May 2025.

Next 24 Hours Bias

Weak Bearish

The Euro (EUR)

Key news events today

Germany GfK Consumer Climate (6:00 am GMT)

What can we expect from EUR today?

Germany’s consumers have seen their confidence level plummet since November 2021 with no signs of improvement. The estimate of -25.6 for May points to another month of consumer pessimism despite the recently adopted fiscal stimulus package, which many hope would be implemented swiftly and effectively. Should consumer sentiment deteriorate more than anticipated, the Euro could face headwinds before the start of the European session.

Central Bank Notes:

- The Governing Council reduced the three key ECB interest rates by 25 basis points on 17 April to mark the sixth successive rate cut.

- Accordingly, the interest rate on the main refinancing operations and the interest rates on the marginal lending facility and the deposit facility will be decreased to 2.40%, 2.65% and 2.25% respectively.

- The disinflation process is well on track with both headline and core inflation declining in March while services inflation has also eased markedly over recent months. Most measures of underlying inflation suggest that inflation will settle at around the Governing Council’s 2% medium-term target on a sustained basis.

- Wage growth is moderating, and profits are partially buffering the impact of still elevated wage growth on inflation. The euro area economy has been building up some resilience against global shocks, but the outlook for growth has deteriorated owing to rising trade tensions.

- Increased uncertainty is likely to reduce confidence among households and firms, and the adverse and volatile market response to the trade tensions is likely to have a tightening impact on financing conditions. These factors may further weigh on the economic outlook for the euro area.

- The asset purchase programme (APP) and pandemic emergency purchase programme (PEPP) portfolios are declining at a measured and predictable pace, as the Eurosystem no longer reinvests the principal payments from maturing securities.

- The Governing Council is determined to ensure that inflation stabilises sustainably at its 2% medium-term target. Especially in current conditions of exceptional uncertainty, it will follow a data-dependent and meeting-by-meeting approach to determining the appropriate monetary policy stance.

- In particular, the Council’s interest rate decisions will be based on its assessment of the inflation outlook in light of the incoming economic and financial data, the dynamics of underlying inflation and the strength of monetary policy transmission.

- The next meeting is on 5 June 2025.

Next 24 Hours Bias

Weak Bullish

The Swiss Franc (CHF)

Key news events today

No major news events.

What can we expect from CHF today?

The Swiss franc continues to see strong inflows due to elevated demand for safe-haven currencies as USD/CHF declined 1.2% overnight. This currency pair was floating around 0.8200 as Asian markets came online but overhead pressures persist.

Central Bank Notes:

- The SNB eased monetary policy by lowering its key policy rate by 25 basis points, from 0.50% to 0.25% on 20 March 2025, marking the fifth consecutive reduction.

- Underlying inflationary pressure has decreased further this quarter.

- Inflation in the period since the last monetary policy assessment has again been lower than expected, decreasing from 0.7% in November to 0.3% in February, primarily due to lower electricity prices.

- In the shorter term, the new conditional inflation forecast is slightly higher than December: 0.3% for Q2 2025, 0.4% for 2025 overall, and 0.8% for 2026 and 2027, based on the assumption that the SNB policy rate remains at 0.25% over the entire forecast horizon.

- GDP growth in Switzerland remains moderate, with the services sector continuing to show slightly stronger growth, while manufacturing faces challenges.

- The SNB anticipates GDP growth of around 1.0% to 1.5% for 2025.

- The SNB will continue to monitor the situation closely and will adjust its monetary policy if necessary to ensure inflation remains within the range consistent with price stability over the medium term.

- The next meeting is on 19 June 2025.

Next 24 Hours Bias

Weak Bearish

The Pound (GBP)

Key news events today

No major news events.

What can we expect from GBP today?

Demand for the pound remained robust as Cable rebounded over 0.5% after gapping lower at yesterday’s open. This currency pair once again climbed above the threshold of 1.3300, showing no signs of losing steam – a break above 1.3400 on Tuesday should come as no surprise.

Central Bank Notes:

- The Bank of England’s Monetary Policy Committee (MPC) voted by a majority of 8 to 1 to maintain the Bank Rate at 4.50% on 19 March 2025, while one member preferred to reduce it by 25 basis points (bps).

- The MPC also voted unanimously to reduce the stock of UK government bond purchases held for monetary policy purposes and financed by the issuance of central bank reserves, by £100B over the next 12 months to a total of £558B, starting in October 2024. On 18 December 2024, the stock of UK government bonds held for monetary policy purposes was £655B.

- Twelve-month CPI inflation increased to 3.0% in January from 2.5% in December, slightly higher than expected in the February Report; domestic price and wage pressures are moderating, but remain somewhat elevated.

- Although global energy prices have fallen back recently, they remain higher than last year and CPI inflation is still projected to rise to around 3.75% in 2025 Q3. While CPI inflation is expected to fall back thereafter, the Committee will pay close attention to any consequent signs of more lasting inflationary pressures.

- While UK GDP growth estimates have been slightly stronger than expected at the time of the February Monetary Policy Report, business survey indicators generally continue to suggest weakness in growth and particularly in employment intentions. In recent quarters, subdued activity has been judged to reflect both demand and supply factors.

- The labour market had continued to ease, although it was still judged to be broadly in balance – some indicators of employment intentions had deteriorated markedly, to levels consistent with shrinking employment while other indicators, such as the number of vacancies, had not weakened to the same extent.

- Domestic price and wage pressures were moderating, but remained somewhat elevated. A range of indicators suggested that underlying pay growth had eased further in recent months, although annual growth in private sector regular average weekly earnings had picked up to 6.1% in the three months to January.

- Based on the Committee’s evolving view of the medium-term outlook for inflation, a gradual and careful approach to the further withdrawal of monetary policy restraint is appropriate and it will continue to monitor closely the risks of inflation persistence and what the evolving evidence may reveal about the balance between aggregate supply and demand in the economy.

- Monetary policy will need to continue to remain restrictive for sufficiently long until the risks to inflation returning sustainably to the 2% target in the medium term have dissipated further and the Committee will decide the appropriate degree of monetary policy restrictiveness at each meeting.

- The next meeting is on 8 May 2025.

Next 24 Hours Bias

Medium Bullish

The Canadian Dollar (CAD)

Key news events today

Federal Election (All Day)

What can we expect from CAD today?

Mike Carney, leader of Canada’s Liberal Party, looks to have won a full term as Prime Minister following an early vote count, as reported by local broadcasters. It was a tightly contested election where the Canadian Broadcasting Corporation (CBC) said it was projecting a Liberal win in the elections with around 160 seats, while the Conservatives held 138 seats. The Loonie weakened slightly as USD/CAD reversed off Tuesday’s lows at 1.3808, rising strongly toward 1.3900.

Central Bank Notes:

- The Bank of Canada today maintained its target for the overnight rate at 2.75%, with the Bank Rate at 3% and the deposit rate at 2.70% – marking the first pause after seven consecutive meetings where rates were reduced.

- The major shift in direction of U.S. trade policy and the unpredictability of tariffs have increased uncertainty, diminished prospects for economic growth, and raised inflation expectations.

- Pervasive uncertainty makes it unusually challenging to project GDP growth and inflation in Canada and globally – the April Monetary Policy Report (MPR) presents two scenarios that explore different paths for US trade policy.

- In the first scenario, uncertainty is high but tariffs are limited in scope – Canadian growth weakens temporarily and inflation remains around the 2% target. In the second scenario, a protracted trade war causes Canada’s economy to fall into recession this year and inflation rises temporarily above 3% next year.

- Global economic growth was solid in late 2024 and inflation has been easing towards central bank targets. However, tariffs and uncertainty have weakened the outlook. In the U.S., the economy is showing signs of slowing amid rising policy uncertainty and rapidly deteriorating sentiment, while inflation expectations have risen. In the Euro Area, growth has been modest in early 2025, with continued weakness in the manufacturing sector. China’s economy was strong at the end of 2024 but more recent data shows it slowing modestly.

- In Canada, the economy is slowing as tariff announcements and uncertainty pull down consumer and business confidence. Consumption, residential investment and business spending all look to have weakened in the first quarter. Trade tensions are also disrupting recovery in the labour market. Employment declined in March and businesses are reporting plans to slow their hiring. Wage growth continues to show signs of moderation.

- The Governing Council will continue to assess the timing and strength of both the downward pressures on inflation from a weaker economy and the upward pressures on inflation from higher costs while proceeding carefully, with particular attention to the risks and uncertainties facing the Canadian economy.

- Monetary policy cannot resolve trade uncertainty or offset the impacts of a trade war and the Governing Council will focus on ensuring that Canadians continue to have confidence in price stability through this period of global upheaval by supporting economic growth while ensuring that inflation remains well-controlled.

- The next meeting is on 4 June 2025.

Next 24 Hours Bias

Weak Bullish

Oil

Key news events today

API Crude Oil Stock (8:30 pm GMT)

What can we expect from Oil today?

Lower demand growth expectations for crude oil continue to weigh on this commodity as WTI oil tumbled 2.3% on Monday. U.S. President Donald Trump’s push to reshape world trade by imposing tariffs on all U.S. imports has created a high risk that the global economy will slip into a recession this year, according to a majority of economists in a Reuters poll. Moving over to U.S. inventories, the API stockpiles have been building steadily since February, a sign of weaker demand. Another week of higher inventory levels would heap even more pressure on oil prices later today.

Next 24 Hours Bias

Medium Bearish

The post IC Markets Europe Fundamental Forecast | 29 April 2025 first appeared on IC Markets | Official Blog.