Articles

Oil prices pop by 50-cents after Trump tweets about Russia violating Poland’s airspace

421317 September 10, 2025 22:14 Forexlive Latest News Market News

Trump wrote on Truth Social:

“What’s with Russia violating Poland’s airspace with drones? Here we go!”

I don’t think he mean’s ‘here we go with WWIII’ but someone is buying oil on that. It’s a strange thing to write.

This article was written by Adam Button at investinglive.com.

EIA weekly crude oil inventories +3939K vs -1040K expected

421316 September 10, 2025 21:45 Forexlive Latest News Market News

- Prior was +2415K

- Gasoline +1458K vs -243K expected

- Distillates +4715K vs +35K expected

- Refinery utilization +0.6% vs -0.6% expected

WTI crude oil was up 68-cents ahead of this report to $63.32 but numbers like this are certainly a headwind. I’m increasingly bearish on oil.

The private report from late yesterday showed:

- Crude +1250K

- Gasoline +329K

- Distillates +1500K

This article was written by Adam Button at investinglive.com.

US July wholesale sales +1.4% vs +0.2% expected

421315 September 10, 2025 21:14 Forexlive Latest News Market News

- Prior sales were +0.3%

- Inventories +0.1% vs +0.2% prior

- Prior inventories +0.2%

This is a lower-tier report but the inventories feed into GDP and lead to large, short-term swings, especially with all the stockpiling and de-stocking around tariffs.

This article was written by Adam Button at investinglive.com.

Trump is out with the usual rant about Powell not cutting rates

421314 September 10, 2025 20:30 Forexlive Latest News Market News

The market is almost-fully priced for 25 basis point rate cuts at each of the next three FOMC meetings but the most-interesting one right now is on September 17 when Fed funds futures imply about a 10% chance of a 50 basis point cut.

It would take a shockingly-low CPI number to get those probabilities up but the report is tomorrow and we will see. Today the President jumped on the PPI numbers and called again for rate cuts. Of course, he was saying the same thing last month when PPI was +0.9% m/m.

Just out: No Inflation!!! “Too Late” must lower the RATE, BIG, right now. Powell is a total disaster, who doesn’t have a clue!!! President DJT

It was Trump who appointed Powell. I don’t envy whoever will be appointed to replace him.

This article was written by Adam Button at investinglive.com.

US dollar wobbles on PPI, stock markets stay higher

421313 September 10, 2025 20:14 Forexlive Latest News Market News

The US dollar initially fell on the headlines but recouped most of the drop in short order. USD/JPY fell from 147.50 down to 147.05 but quickly recovered nearly the entire move.

It wasn’t the same case in stock markets as a 20 point gain in S&P 500 futures turned to 32 points.

This article was written by Adam Button at investinglive.com.

US August PPI final demand 2.6% vs 3.3% expected

421312 September 10, 2025 19:39 Forexlive Latest News Market News

- Prior was +3.3%

- Prices m/m -0.1% vs +0.3% expected (prior was +0.9%)

- PPI ex-food and energy +2.8% vs +3.5% expected (prior was +3.7%)

- ex-food and energy m/m -0.1% vs +0.3% expected (prior was +0.9%)

- Ex-food, energy and trade +2.8% y/y vs +2.8% prior

- Ex-food, energy and trade 0.3% m/m vs +0.6% prior

Tomorrow the CPI report is due. This is a great sign that an undershoot could be coming and US equity futures have jumped. If we get a lower reading that expected on CPI — especially a miss this large — a 50 bps cut is more likely.

The sequential drop in PPI ex-food and energy was the largest in the last 10 years.

This article was written by Adam Button at investinglive.com.

US producer price index data will refocus the market on inflation

421311 September 10, 2025 19:30 Forexlive Latest News Market News

Tariffs and uncertainty have so far hit employment but there could be inflation in the pipeline as companies draw down on inventories and try to preserve margins.

The good news is that oil prices are low and likely to be lower if OPEC continues to add barrels. That could help to offset input pricing pressures.

We should get some clues today at the bottom of the hour with August PPI. The consensus is a steady 3.3% rise y/y and 3.5% excluding food and energy. The report might offer some hints on inflation ahead of tomorrow’s all-important CPI reading.

Otherwise the US economic calendar is quiet, with weekly US oil inventory data to come at 10:30 am ET and a 10-year Treasury auction at 1 pm ET.

This article was written by Adam Button at investinglive.com.

SNB’s Chairman Schlegel: US dollar is still absolutely the dominant currency

421310 September 10, 2025 19:30 Forexlive Latest News Market News

- US dollar is still absolutely the dominant currency.

- The Fed is central to international financial system; there is currently no alternative.

- Effect of tariffs on Switzerland is difficult to determine.

- Bar is high to go into negative interest rate territory, but will do it if really necessary.

- Absolutely crucial to preserve central bank independence.

The demise of the US dollar was greatly exagerated (once again). The world’s financial system is basically US centred and even if the USD loses its crown in the future, it will take decades. There’s a reason the Fed Chair is called the second most important person in the world.

In terms of Swiss monetary policy, the central bank is done with rate adjustments. They will need extremely strong reasons to go into negative territory.

This article was written by Giuseppe Dellamotta at investinglive.com.

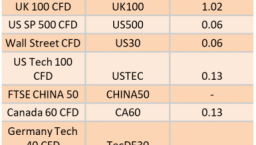

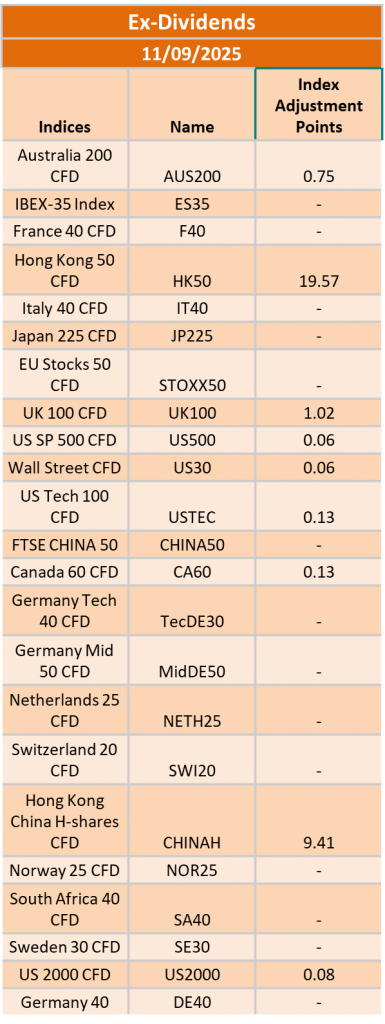

Ex-Dividend 11/9/2025

421308 September 10, 2025 19:14 ICMarkets Market News

The post Ex-Dividend 11/9/2025 first appeared on IC Markets | Official Blog.

investingLive European markets wrap: Gold stays bid, currencies muted; US PPI up next

421307 September 10, 2025 19:00 Forexlive Latest News Market News

Headlines:

- Gold stays upbeat in European morning trade

- The resilience in the US dollar could be a tell: is the market signalling a bottom?

- Markets keep the calm for now as we enter new territory in the Russia-Ukraine conflict

- EU’s von der Leyen: We need more sanctions on Russia

- Kremlin refuses to comment on drones incursion to Poland

- US-EU trade deal is the best possible one, says von der Leyen

- US MBA mortgage applications w.e. 5 September +9.2% vs -1.2% prior

Markets:

- AUD leads, CAD lags on the day

- European equities higher; S&P 500 futures up 0.4%

- US 10-year yields up 1.7 bps to 4.091%

- Gold up 0.7% to $3,650.03

- WTI crude oil up 0.9% to $63.22

- Bitcoin up 0.7% to $112,268

It was mostly a quiet session as markets are taking a bit of a breather ahead of more key US data this week.

Geopolitical tensions made headlines overnight with Poland having to shoot down drones from Russia as they crossed the western border of Ukraine. It’s not the first time that we saw the airspace get violated but it is the first time that the boundaries were pushed enough for a NATO country to take action in getting involved in the Russia-Ukraine conflict.

That being said, Russia is not making a big deal of things and keeping radio silent on the matter. So, that’s enough to say that they’re not wanting to make a fuss over the matter.

Major currencies were largely muted on the session, with little in terms of movements and conviction. The dollar is steady but remains vulnerable on the week, as we await the US PPI data later and more importantly the US CPI data tomorrow.

EUR/USD and USD/JPY are both flattish at 1.1705 and 147.45 respectively, resting within 30 pips ranges on the day. So, that sort of tells you what kind of a session it was in European morning trade.

In the equities space, stocks are staying upbeat with European indices keeping the bounce this week to push higher again. Meanwhile, US futures are also posting slight gains with tech shares leading the charge once again.

But overall, it is once again precious metals that is hogging the spotlight with gold finding bids following some profit-taking yesterday as it pushes back up to $3,650. Meanwhile, silver is also up 0.6% today to creep back above the $41 mark.

This article was written by Justin Low at investinglive.com.

US MBA mortgage applications w.e. 5 September +9.2% vs -1.2% prior

421306 September 10, 2025 18:14 Forexlive Latest News Market News

- Market index 297.7 vs 272.5 prior

- Purchase index 169.1 vs 158.7 prior

- Refinance index 1012.4 vs 902.5 prior

- 30-year mortgage rate 6.49% vs 6.64% prior

This is never a market moving release. Mortgage applications are generally inversely correlated to mortgage rates.

This article was written by Giuseppe Dellamotta at investinglive.com.

Kremlin refuses to comment on drones incursion to Poland

421305 September 10, 2025 18:00 Forexlive Latest News Market News

- No comment as questions on reports of the drones should be directed to the defence ministry

- EU and NATO accuse Russia of provocations on a daily basis

As far as everything goes, Moscow choosing to play this down is a good thing. As mentioned before this, it’s not the first time that Russia has violated the airspace beyond the western border of Ukraine. However, this is the first time that it did invite a response by Poland to shoot the drones down.

This article was written by Justin Low at investinglive.com.