Articles

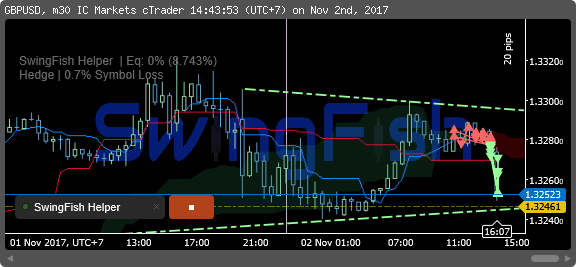

184 | +8.743% | 4 Setups

2205 November 2, 2017 15:08 SwingFish Trading Room Journal CADJPY • GBPJPY • GBPUSD

09:01 Morning everyone

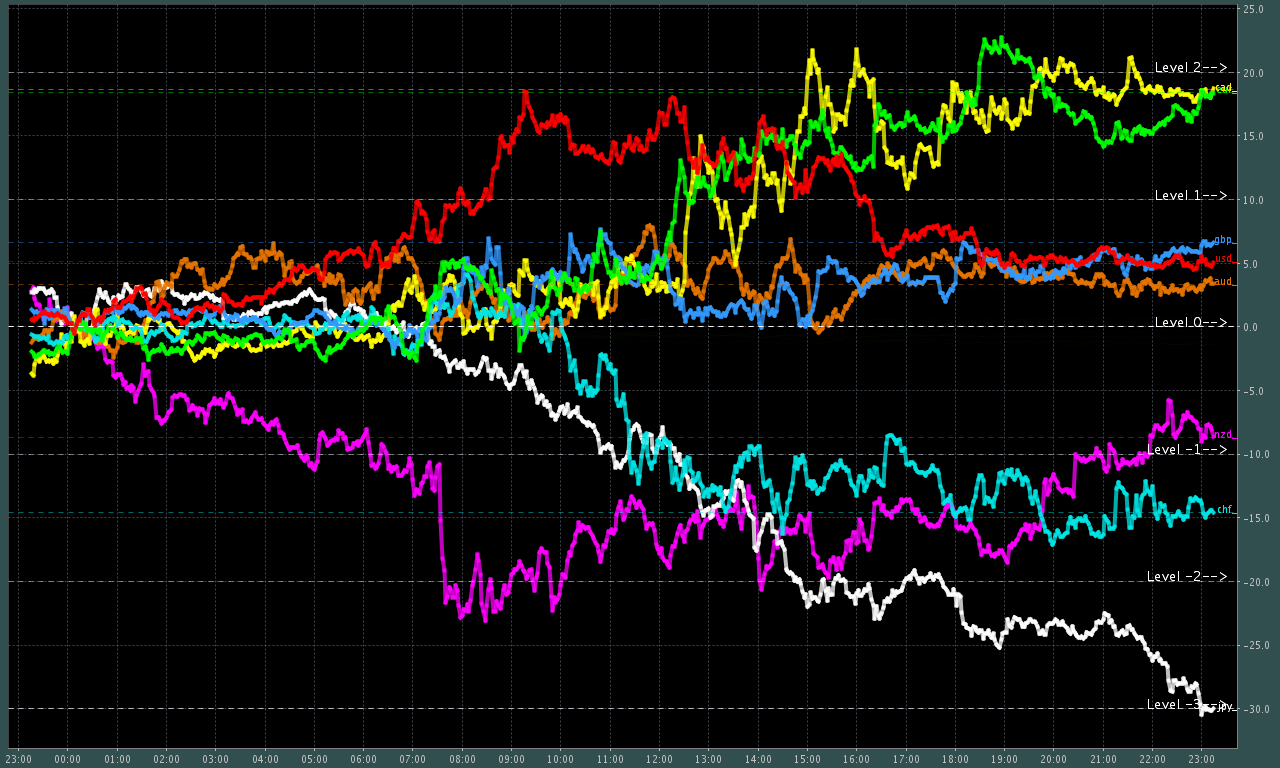

NZD swang up massive resulting of Yesterdays night-spikes … its still unclear what caused that moe .. but there is some corrections be expected today or tomorrow.

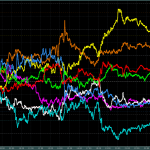

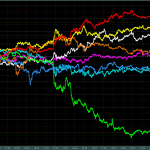

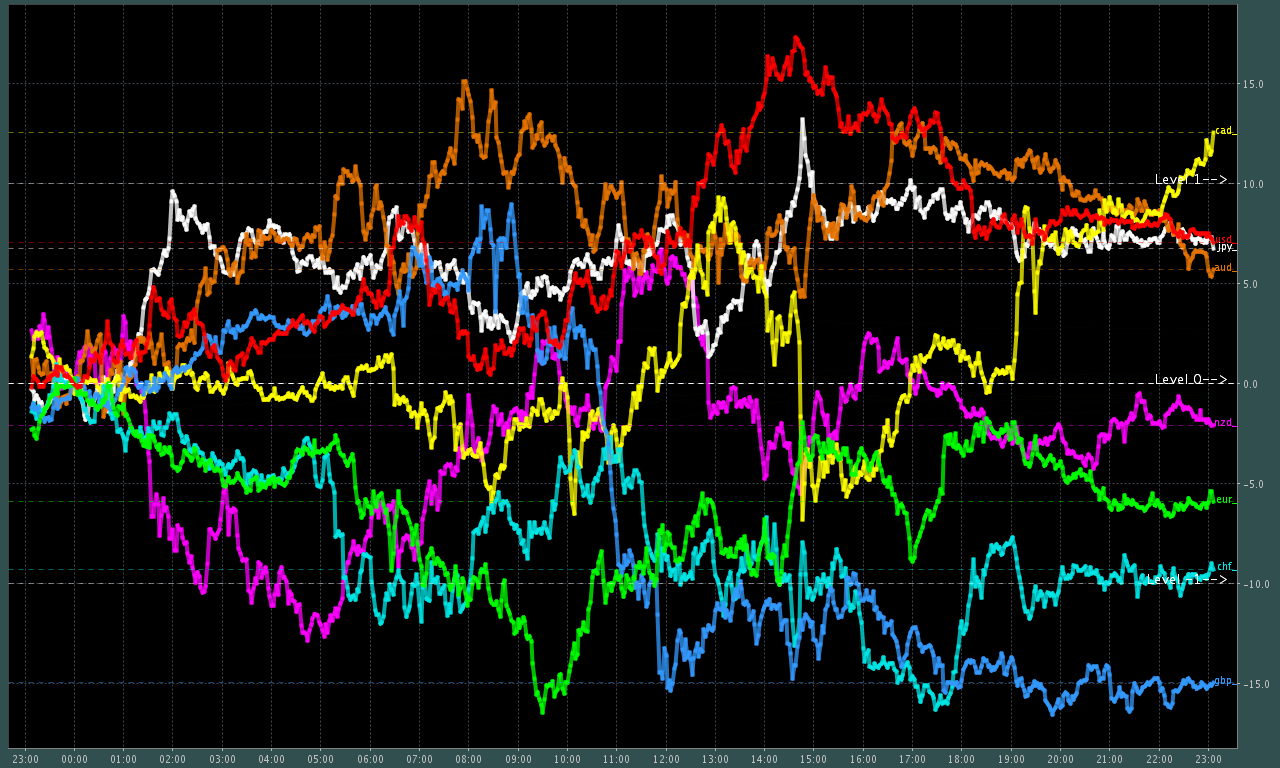

Divergence data

Positive: AUD, CAD

Negative:Â GBP, JPY, CHF

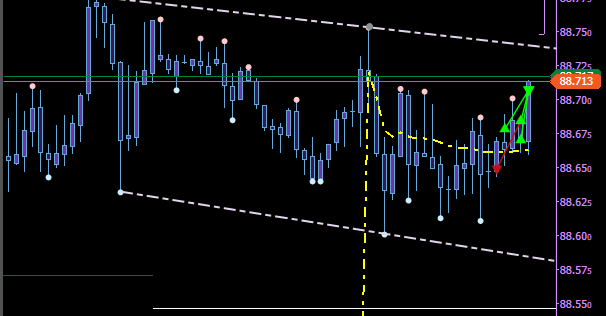

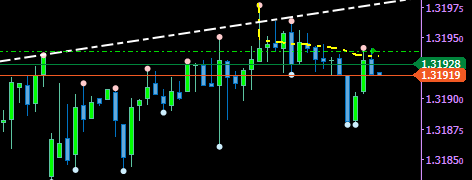

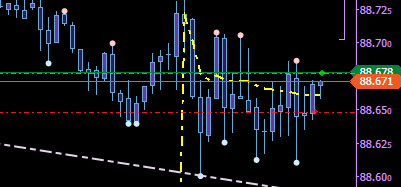

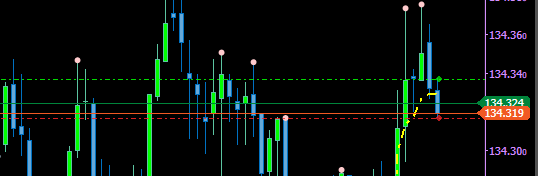

09:03 quick CADJPY Scalp down for 3.4 pips .. did not work so well hedge placed just about 2 minutes later.

there is a high chance it may still fall .. but they may be an up-swing first, that’s why the hedge is the saver option.

09:16 Reversing hedge to buy CADJPY (double buy position)

09:26 Closing out all CADJPY positions with 0.552% total account gain. price may go up to 88.91 on CADJPY .. but this was a hedged Setup, so damage control first.

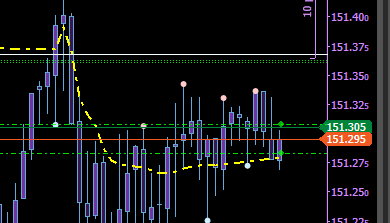

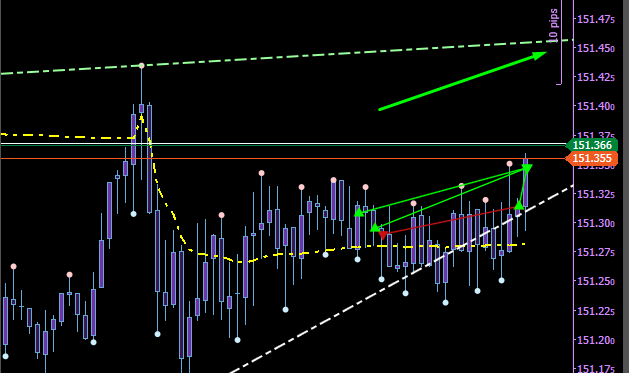

10:09 Buy GBPJPY and BuyLimit order GBPJPY on the vWap a few pips down to auto scale-in.

10:28 BuyLimit GBPJPY Filled (i may exit this one early once it’s paid for .. )

10:35 manually hedge the whole GBPJPY Position .. it swung down a lot, bias is still upwards with 151.451 as a goal

the position is too large for a swing down.

going to have Breakfast 😉

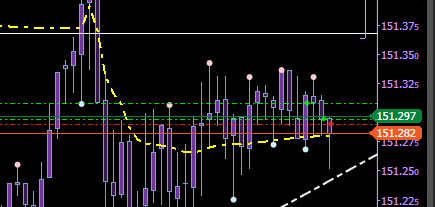

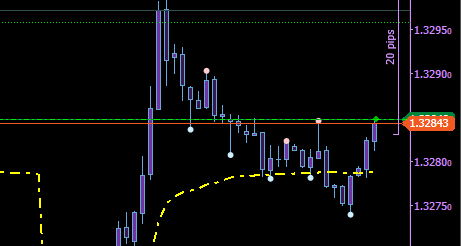

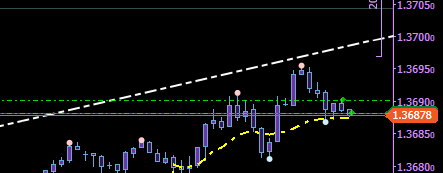

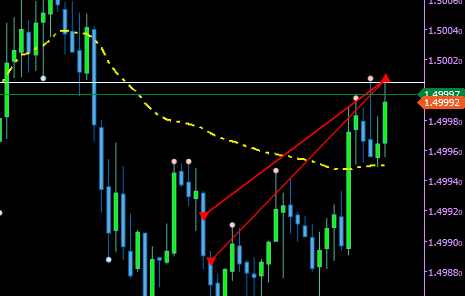

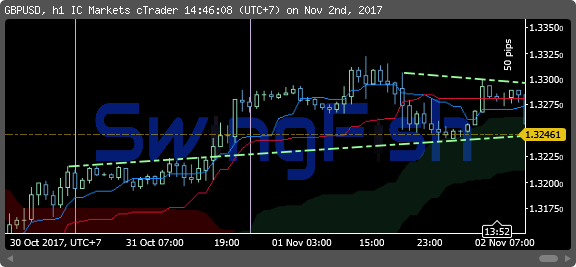

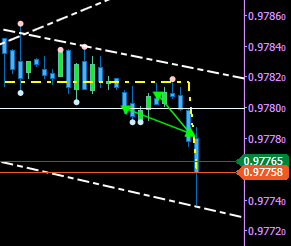

11:50 Buying GBPUSD

11:55 Scaling in 50% on GBPUSD Buy while in loss

12:10 Hedging GBPUSD, waiting on both GBPJPY and GBPUSD for Frankfurt opening to get some short-term direction

12:32 Reverse GBPJPY Hedge. Realising 0.52% loss to the account. waiting for the hedge pays for the loss to exit.

12:43Â Closing GBPJPY to pay for hedged positions, adding 1.68% to the account (Total now: 1.467%)

the original target for that trade on GBPJPY was 151.451

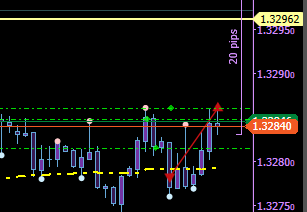

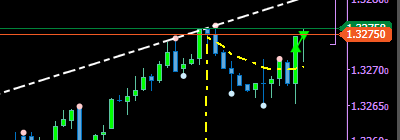

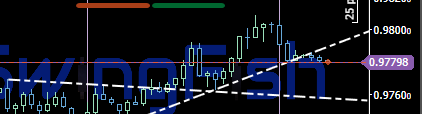

12:53 Reversing GBPUSD hedge in the middle of the field .. that could turn bad quickly the original target of 1.32962 is still in play

the reason was the dollar index appears to be continuing the way down, but that’s may more of an excuse

13:00 did not work out, hedging again 1.81% loss

off bring Wife to work .. let’s see what London has to offer later .. leave the hedge position on

14:21 Reversed everything downwards, added about 25% more to short positions .. targeting the trendline connects the waves on the 1 Hour Chart.

14:42 Closing all positions as there was a tiny pullback .. (the trendline maybe not correct)

have not looked the Gains while this trade was on .. and wow .. that last trade added MASSIVE to the account!

Closing up Today with a Total Gain of 8.743%

Full Article

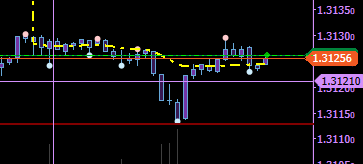

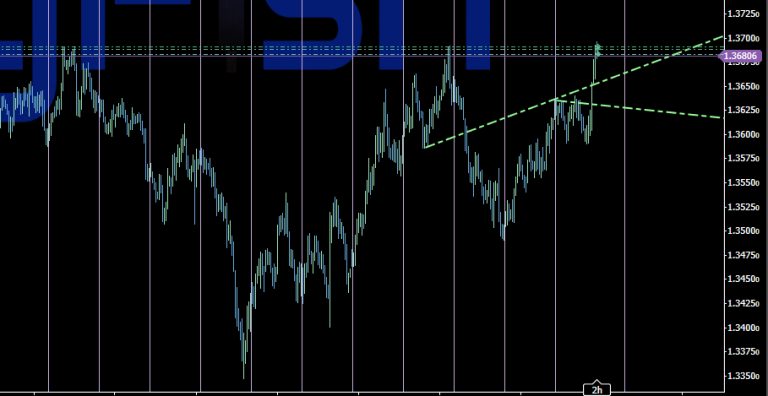

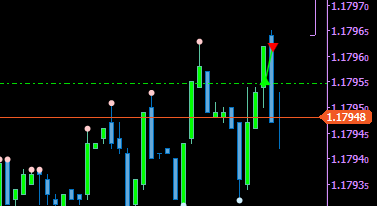

D1 Buy GBPUSD

2184 November 1, 2017 11:55 AoFX Forex Signals GBPUSD

GBPUSD Buy from the current price 1.3290

For enhancement Buy Limit 1.3242 1.3206

SL 1.3019

TP1 1.3415 TP2 1.3516 TP3 1.3623 TP4 1.3849 TP5 1.4062 TP6 1.4317 TP7 1.4563 TP8 1.4776 TP9 1.5020

Long-term deal

Full Article180 | +2.803% | 3 Setups

2024 October 27, 2017 09:58 SwingFish Trading Room Journal AUDJPY • GBPUSD • USDSGD

08:21 Friday Morning everyone.

this one will be a short session, as i go somewhere over the weekend,

I made 3.1% already in the scalping test posted last night.

Divergence data

Positive: USD, CAD, JPY

Negative:Â EUR

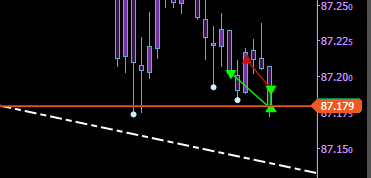

07:26 Shorting AUDJPY and Buying USDSGD

07:29 scaling in on USDSGD at the vWap

07:31 Hedging both AUDJPY and USDSGD trades

08:45 breaking up AUDJPY Hedge for a tiny gain of 0.329%

price likely to fall to 87.13 on AUDJPY .. but breaking up Hedges is about Damage control, not making money.

08:58 did not work .. Hedge On!

09:11 doing some extra analysis on USDSGD .. found a Tripple top .. so let’s just remove the Buy hedges and wait it out.

09:41 Closing all Trades with a total gain of Whooping 5.903%

not really 5.903%, as 3.1% of this are from my Night Scalp session a few hours ago, so the true gain is “only” 2.803% for this Friday, I’ll go out over the weekend .. so have to close up shop now … have a nice weekend guys ‘n Girls!

Total Gain Today: 2.803%Â (Plus the 3.1% from the late night scalping Session)

Full Article

179 (Asia Session) | -1.36% | 3 Setups

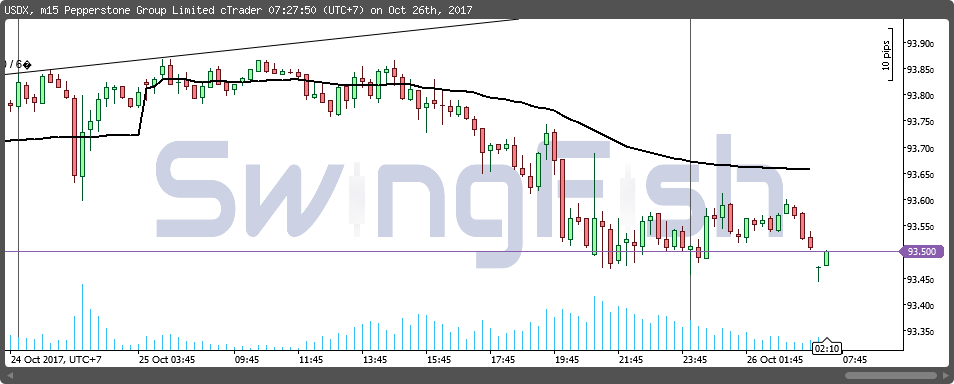

1985 October 26, 2017 11:24 SwingFish Trading Room Journal EURJPY • GBPUSD

07:26 good moves yesterday in US Session .. so lets see how the divergences make things “right again”

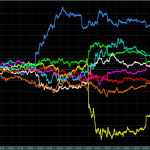

Divergence data

Positive: GBP, CHF, NZD

Negative:Â CAD, USDÂ pair to watch today: GBPCAD

07:26 watching Yen Pairs making nice moves while starting the day .. which makes me angry about myself beeing late again on my desk.

USDollar Gapped down a little but but instantlyfilled it .. so we wait a little before jump into the game.

07:39 trying a quick scalp up on EURJPY .. didn’t work .. first hedge on (just 1.9 pips, nothing harmful)

### Live Stream Starts Here ###

08:28 Exiting GBPUSD Buy

(it should go up a bit more to the Trendline .. but volatility starting to get up .. and on a large size scalp, this can be deadly) taking 1.033% and leave it that way.

08:31 thinking about releasing the EURJPY Hedge .. but we better wait for news to calm down first.

here a quick update Screenshot (no action was taken

11:12 Nikkei spiked up and I was not paying attention, Closing EURJPY Positions with a 2.39% Loss before the damage is going to be any greater.

Closing today with a Loss of: -1.36%

Tuesday Continues here in EU Session Revenge Trades

Full Article

175 | +2.544% | 2 Setups

1769 October 20, 2017 09:01 SwingFish Trading Room Journal AUDJPY • GBPUSD

05:59 market is still extremely quiet .. so its safer to put on some larger positions (for now)

Divergence data looks interesting Positive: AUD, CHF, EUR

and VERY Negative: NZD

06:10Â Scalp Upwards on AUDJPY

06:27 closing AUDJPY Buy, gaining 0.965%

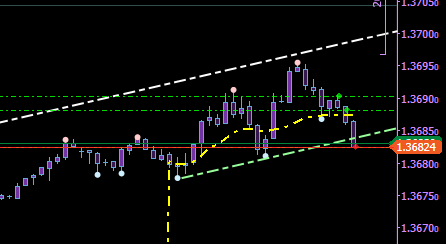

06:55 Short GBPUSD (following the USDollar going up)

06:58 strangely GBPUSD did not move for full 3 minutes and went then up, so better put a hedge on

07:01 looks like hedging was a good idea .. price fell back far more than the TP was originally set

School-Run time: leaving the hedge on

Looks like things are quiet for a while…

Doing somethings (not so) useful in the meanwhile

08:36 just stepped back in, seeing I missed a news move.

the structure looks like GBPUSD will go to the Trendline, so reversed the hedge trade and set TP at the trendline (1.3121)

08:42 Take Profit on both GBPUSD Trades, loss of the hedge trade 2.33%,gain of the counter Trades 3.909%, Total Gain: 1.579% .. Calling it a day.

Total Today: +2.544% (no Positions left open)

Full Article

174 | +3.68% | 4 Setups

1754 October 19, 2017 06:23 SwingFish Trading Room Journal AUDJPY • EURAUD • GBPUSD • USDCHF

Good Morning

05:54 market is still extremely quiet .. so its safer to put on some larger positions (for now)

Divergence data looks interesting Positive: CAD, EUR and Negative: CHF, JPY

05:58Â quick Scalp Upwards on EURUSD.

06:01 price falls quickly against me .. closing position as its very large size) with a 0.62% Loss

06:04 re-Enter Long EURUSD with the same size

06:09 Momentum is building .. scaling in on EURUSD

06:16 Closing EURUSD Trades (there is still some upside to somethings around 1.805 .. but the position is too large for a pullback, and I not want to hedge this early. closing paid for the initial loss and added a total gain of 1.04%

06:16 close buy GBPUSD gaining 1.63% (Total: 2.67%)

06:49 Buying in EURAUD .. but I will close this once it’s turned green .. getting very Jumpy

07:00 scaling in on the bottom EURAUD

07:04 closing EURAUD on the jump upwards gaining 0.92%

School run time .. stopping Live Stream with a 3.68% Gain

Full Article

173 | -1.43% | 4 Setups

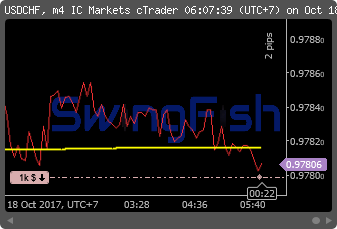

1674 October 18, 2017 14:13 SwingFish Trading Room Journal AUDJPY • EURAUD • GBPUSD • USDCHF

Good Morning

06:04 market is at a moreless neutral position right now .. any trade open right now are pure speculation .. so we start things “small”

Divergence data looks interesting Positive: CAD, USD, JPY, AUD and Negative: EUR, CHF, GBP

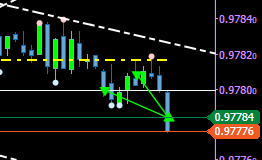

06:05 Completly Speculative Short USDCHF as you can see on H1 .. price is at a point where it could go anyway.

but based on other charts (like EURUSD and USDJPY it looks like it will break out south)

take on smaller size to “probe”

also, the vWap is almost 100% flat. .. but “first come – first serve” 😉

06:28 price retesting the vWap .. scaling in .. but be ready to hedge .. this can very easily go the another way.

06:58 took the position out on Tokyo opening (have to bring my daughter to school anyway) gaining 0.606%

— School Run time (back in a moment) —

07:05 should have waited 5 more minutes .. original TP was hit .. missing out on a 1.5% gain.

well better safe than sorry.

08:43 being a bit aggressive .. buying GBPUSD before vWap .. that may turn out not so good

H1 Chart does look kind of up’ish

08:52 Hedging GBPUSD

09:05 I hate it if I’m right but chicken out. waiting for another reversal

09:20 reversing hedge position with 1.1% loss .. not so sure this was a good idea as the channel top is quite close

10:02 Selling EURAUD targeting the Hourly Trendline. but I may exit at breakeven

10:09 closing GBPUSD trades realizing loss of 0.92%

10:54 EURAUD starts to behave erratic .. probably some momentum in USDollar building up …

will exit once AUDUSD hits the recent trend line.

11:40 AUDUSD broke the cWap downwards (never reached the upper channel .. but, i did not exit as i should have .. EURAUD still on. i start get the feeling this is gonna be a expensive trade .. aiming for Breakeven now .. to get out of this mess .. and re-start on a better price.

12:46 Knowledge turns into hope .. I have not closed the trade yet .. even it does make a vWap reversal to the upside right now

12:50 .. volatility picking up .. making this trade probably even more expensive

13:00 NEWS:

FOMC Member Harker Speech

Patrick T. Harker took office on July 1, 2015, as the eleventh president and chief executive officer of the Third District Federal Reserve Bank, at Philadelphia. In 2016, he serves as an alternate voting member of the Federal Open Market Committee.

13:07 exiting EURAUD with much larger loss as planned

13:30 quick Scalp long AUDJPY .. very likely going to 88.30 .. but i will exit now covering parts of the lossses

Total Today: -1.43%

### Stream Stops Here ###

check out what happens right after!

original Target of EURAUD trade was hit just a few Candles after closing the position with a loss.

Full Article

168 | +1.33% | 4 Setups

1411 October 11, 2017 19:15 SwingFish Trading Room Journal AUDJPY • EURAUD • GBPJPY • GBPUSD

05:55 Short EURAUD (Quick Probe Trade in the range)

06:05 looks like that wont work out very well .. i may place a hedge on this early, since i had no more reason to enter as filling the current range. which looks a bit like a bullish flag anyway.

06:19 placed Hedge trade on EURAUD … time to take shower and get some coffee.

06:41 EURAUD trade played out just as planned .. but no Profit for me .. because i hedged it already before go to take the morning shower.

08:11 decided to get rid of the EURAUD hedge on the vWap downwards.

the momentum was large enough to pay for the Hedge .. but I decided to stay in it for a bit longer and generate some green P/L .. that was a bad idea .. as the price went back up quickly …

Lesson to be learned: don’t be greedy!

hedged again .. holding 0.45% Floating P/l on this hedge.

08:23 AUDJPY made a nice vWap touch as well .. so decided to go long on this one.

it went up rather quickly and I could have cleaned the desk with that trade .. but as stated before, greed made me stay …

closed the AUDJPY Long after hedging EURAUD trade with a 0.32% gain.

it looks like its still on the way up .. to my original Target of 87.695, but I am out already .. moving on.

9:52 closing out EURAUD Hedges .. but not let it rise till the trendline because AUDUSD hit the Pivot and pulled back.

11:07 Shorting GBPJPY

after entering noticing that this is actually a terrible Ratio .. but okay we in it now .. let’s make the best out of it.

enabling SwingFishHelper to Protect equity by 0.3% …

12:00 accidentally scaled in instead of hedge .. but GBPJPY Short trade worked out just as planned

P/L right now +0.594%

12:07 Stoping Livestream (have to reboot the Computer)

### i will stop the LiveStream here, I may start another Stream in UK Session ###

14:44 started to play with GBPUSD and went long .. which did not work well.

plus had to pickup Wife and Kid .. so placed a hedge.

19:32 played a little with the hedges, in the end the GBPUSD Long towards vWap paid for the whole show.

Closing the day with a total gain of 1.329%

Full Article

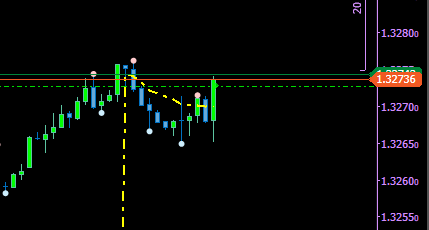

D1 Buy GBPUSD

453 August 29, 2017 02:08 AoFX Forex Signals GBPUSD

GBPUSD Buy from the current price 1.2925

To enhance Buy Limit 1.2884 1.2857

SL 1.2762

TP1 1.2983 TP2 1.3051 TP3 1.3111 TP4 1.3184 TP5 1.3267 TP6 1.3356 TP7 1.3432

Full ArticleH4 Buy GBPUSD

396 August 10, 2017 01:36 AoFX Forex Signals GBPUSD

GBPUSD Buy Stop 1.3054

TP1 1.3108 TP2 1.3146 TP3 1.3199 TP4 1.3267

Full Article