Articles

156 | +1.32% | 2 Trades

799 September 26, 2017 16:28 SwingFish Trading Room Journal AUDJPY • USDCHF

Sunny Tuesday Morning ..

i have to go to the Bank later, so no UK session Trades, sorry

trades of the day Long USDCHF and Short AUDJPY both target the white trendline.

Results:

USDCHF: Exit Early (some Family stuff to take care off) original Target was reached.

Then AUDJPY: Whipsawed twice, then it did what i expected it to do .. covered the Hedges and added 1,3% gain

Closing up Shop today with a 1.32% Gain.

Full Article

we now Trade Chatroom Analysis.

796 September 26, 2017 00:30 SwingFish SwingFish Updates

our member’s do provide a while already Forex and CFD Analysis via the Chatrooms.

starting Today (Week 40) we will also Trade them. so you can see how they do turn out.

the Demo Account will be publicly visible on MyFxBook, SwingFish Website, and even able to copy signals for Free via the cMirror Platform.

Trades will be executed to maintain a max risk of 2% on the account, per trade set.

meaning if a trade has multiple entries, the risk will be split over all trades and orders.

here are all links together:

- Author: Yaser Alwawi

- Analysis: Forex & CFD Analysis

- Account: Strategy Yaser’s Analysis

- copy via cMirror: cMirror Strategy

155 | +0.796% | 4 Trades

781 September 25, 2017 23:50 SwingFish Trading Room Journal AUDSGD • DAX • EURAUD • USDSGD

in the Aftermath of the German Election . Good morning everyone,

strangely DAX Futures gaped down but that gap could not even be considered as such, so much for the bad Afd Party shock.

start the day with a short Trade on USDSGD.

looked very clean, but then sitting on the toilet and watching it from my Mobile, made me change my mind, sold the risk and set the Stop to +0.7. which was then hit about 2 minutes later. gain 0.21% for the Chicken out trade 😉

Later a Nice vWap Reversal on EURAUD, failed once but on the second try, it worked as expected. (another tiny gain)

Quick Trade on AUDSGD .. which led to an Auto Hedge, which I choose then to ignore as I went on the DAX

the DAX, however, turned into a massive Whipsaw massacre .. tons of trades and cover trades to pay for losses.

in the end, went out with a 0.796% Total gain for the day. so let’s just ignore that this did happen at all 😉

Full Article

a ‘close one’ 58% Drawdown then 715$ gain

947 September 25, 2017 15:21 SwingFish Strategies GBPAUD

Starting September 21. GBPAUD startet to massively Rise .. with no pullback at all.Friday there

this caused a 58% Drawdown.

We Turned off AutoTrade, Placed a Short Order at the Peak of 3 Lots and waited it out.

at price then finally falled we experiences a 715$ Equity Raise, closed all trades and continue AutoTrade.

Total Gain as of then: +41.94%

that was a “close one”

the Drawdown caused however a Margin call on the Demo account that is used to Mirror the trades to the cTrader Network

i have not checked this account for a very long time … so i also placed a additionsl short order there to pay for the margin calls, which turned out just fine. here is a extra post about the Mirror-account.

Full Article

DAX futures open with -24,5 pips after election

779 September 25, 2017 05:21 SwingFish Forex Signals DAX

Honestly .. i expected more..

but lets see how it does on Frankfurt opening …

At the Trump election it ripped a 380pip hole on the Frankfurt bell.

Full ArticleCurrency Outlook Week 40

769 September 25, 2017 02:06 AoFX Forex Signals EURX • GBPX • JPYX • USDX

USDX

USDX having difficulty breaking the 90.99 level and started to draw a higher bottom than the previous one and broke the channel but has difficulty breaching the resistance 92.65 And if the resistance broke and settled above it then the pair will start achieve his targets but the resistance 95.20 is the strongest But if the 90.99 support is broken then he will complete his bearish journey

GBPX

We have noted above that the stability of the Pound Index above 2.591 will move the pair to the upside trend and has targets to achieve. Indeed, the first goal has been achieved, but the weekly candle does not warn of an ups or downs, it’s a confusing candle. I expect him to retest the 2.591 but if he achieve his second target and stabilizing above 2.6306 level that will open the door to achieve more targets

We also talked about the stability of the Yen Index above the level 57.254 will let him start achieve his targets , but the probability of re-testing 57,254 is larger

EURX

Previously we talked about Euro index by closing a day candle above 2.3157 will support the bullishness and expected a correction to complete the head and shoulders reflective. My expectation was right and went up to get his first target and in order to complete his targets he must break the neckline and stability above 2.3242

Full ArticleLess Analysis / Signals

745 September 22, 2017 17:33 SwingFish SwingFish Updates

Just to give you all a heads up, due to the current market situation

- German election

- Interest rates

- some artificial stuff going on

There may be less signals, as fundamentals do now play a much larger role.

Stay tuned, we won’t give up!

You are more than welcome to join our chatroom for realtime informations and updates

Full ArticleUB-Noise (cTrader) is “Back in the Green”

739 September 22, 2017 17:07 SwingFish Strategies

that was a close one! Lesson Learned!

after the margin call I added a Sell position manually on cTrader GBPAUD to pay for the loss caused bu the Broker terminating a few trades in the chain.

the position is now with 2300Euros in profit (stop level)

enabled trailing stop now .. as we are already green …

154 | +3.54% | 3 Trades

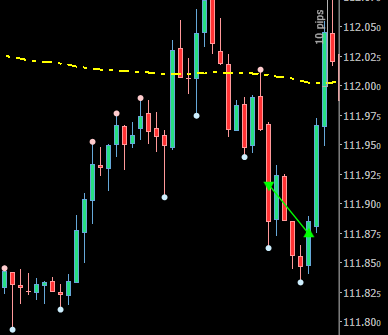

725 September 22, 2017 16:30 SwingFish Trading Room Journal DAX • GOLD • USDJPY

Good morning everyone,

well, “morning” is a bit imaginary as it is 12:20 right now.

had to burn some Midnight oil again…

DAX has fallen overnight .. it will create a nice Gap (as of now around 12566 (1 Hour before Pre market opening)

quick Scalp up on GOLD

late entry over the vWap .. exit in the first sign of weakness

Another short (and late) scalp on USDJPY

did “Chicken out” and not afterwards, that was a good decition

got rid of the DAX-Hedge .. but the market turned quite strangely due to Draghi Speach .. so i went out before the big move …over all a green ish day .. i think the DAX will go up to 12642, but with recent events on it .. its maybe not such a good idea.

Full Article

UB-Noise Demo account Margin-called

727 September 22, 2017 06:33 SwingFish Strategies GBPAUD

the Demo account that mirrors the Live account for the UB-Noise Strategy was margin called Last night.

sorry about that. i had not checked the balance on that account for ages, since this account is only used to copy trades to the cTrader Platform.

the Live account is still in massive drawdown (as expected) but all trades are still active there.

Full Article

know your Exit ! (or: never trade the Money)

714 September 21, 2017 14:22 SwingFish Traders Library you should know

Knowing where to exit is more important than knowing where to enter.

or in other words, Greed Kills ! as the market will tell you where it will likely to go, not your Profits/Losses!!

why? if you enter late, your position size will be smaller, because you will need a wider stop point (not really a big thing, just the reward is smaller, and the time the trade is “red” may be longer, nothing that can kill us, and in the end ist money being made.

but if you exit too late (or greed makes you stay in the trade),

especially in smaller timeframes, that can have Fatal results.

here is a typical Scenario in how to find an exit point.

Full Article153 | +0.995% | 2 Trades

703 September 21, 2017 11:38 SwingFish Trading Room Journal GOLD • NZDUSD

was up until 3 in the morning. now it’s 9 in the morning (same day)

Yesterday was a pretty much non-eventful day because everything waited for FOMC and FED announcements.

however, despite my Bias, all indices did go UP .. which is a very strange behavior ..

okay the DAX will go up because of the EURO dropping so hard. but DOW, Nasdaq, Russel had no real reason to do so.

so in a bit sleepy motion made the first 0.12% on a VERY tiny GOLD scalp.

not really had an angle to put a take profit anyway .. so I closed it out.

not really had an angle to put a take profit anyway .. so I closed it out.

then being stupid for the first time today: the first hedge

was watching AUDJPY making a beautiful Reversal (left on the picture, I did see it as it was +3 from the vWap, so I did not enter there)

entered upwards NZDUSD (right chart) .. realized that AUD and NZD correlating so on the first sign of this going bad, I place a hedge trade as this very likely would turn bad… and it did.

### STREAM STARTS HERE ###

Finally, found an angle on the NZDUSD trade (trendline connecting the last lows) the conjunction point is just a few pips away.

on the way back to the vWap (which is quite common) the SwingFishHelper did Auto-Hedge for me, that was okay but too early, so let’s gamble a little, reversed the Hedge position .. and got out early on the minor-trendline. adding a nice gain of 0.875% to the account. I’m quite sure price may go to the 0.7311 area on NZDUSD (i put an arrow on the chart for my original Target)

.. but since this was a hedge-resolution trade, going out with 0 is the goal .. anything greener is just a gift.

NEVER PUSH YOUR LUCK!

calling it a day with total Gain of 0.995%

Full Article