Articles

Kudlow: Trump administration will not replace Fed Chair Powell

24966 March 30, 2019 07:33 FXStreet Market News

In an interview with CNBC, White House economic advisor Larry Kudlow said that the Trump administration will not replace Fed Chair Powell .

Additional quotes (via Reuters):

- White House advisor Kudlow: negotiating quotas and tariffs with Mexico and Canada

- Trump administration will not replace Fed Chair Powell

- good headway being made in China talks

Earlier comments:

WH Econ Advisor Kudlow: Fed should ‘immediately’ cut rates

China and the US remain at odds over timing of lifting tariffs – Nikkei

24965 March 30, 2019 07:03 FXStreet Market News

Posted in the Asian review – Nikkei, it reported that while talks are to continue next week with Beijing, seeking an immediate end to duties in Washington on Wednesday, after two days of discussions in Beijing this week that failed to bridge the gap, there are concerns, notably from China’s Xi.

- Xi is reportedly wary about a summit with Trump as a result of the difficulty in reaching a compromise.

The article reports:

“There appears to be disagreement over what should happen to the additional tariffs on each other’s goods after a deal is struck.”

More here

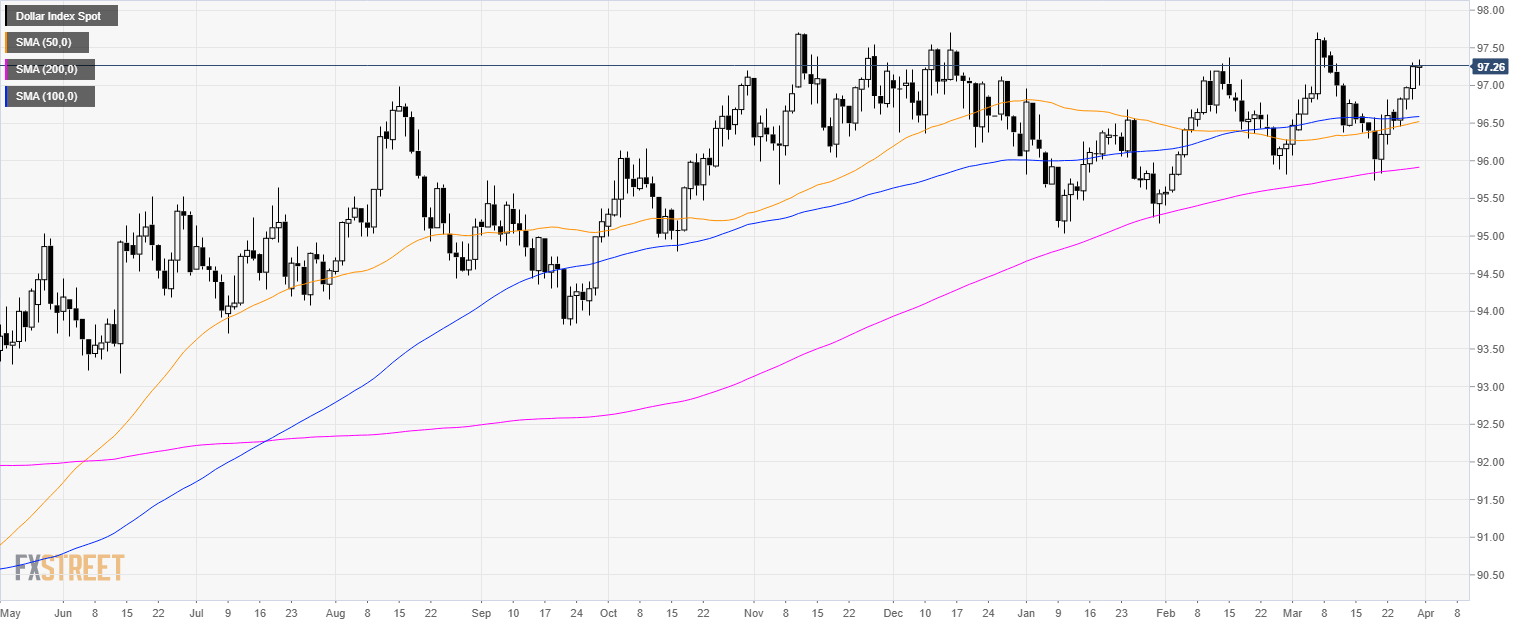

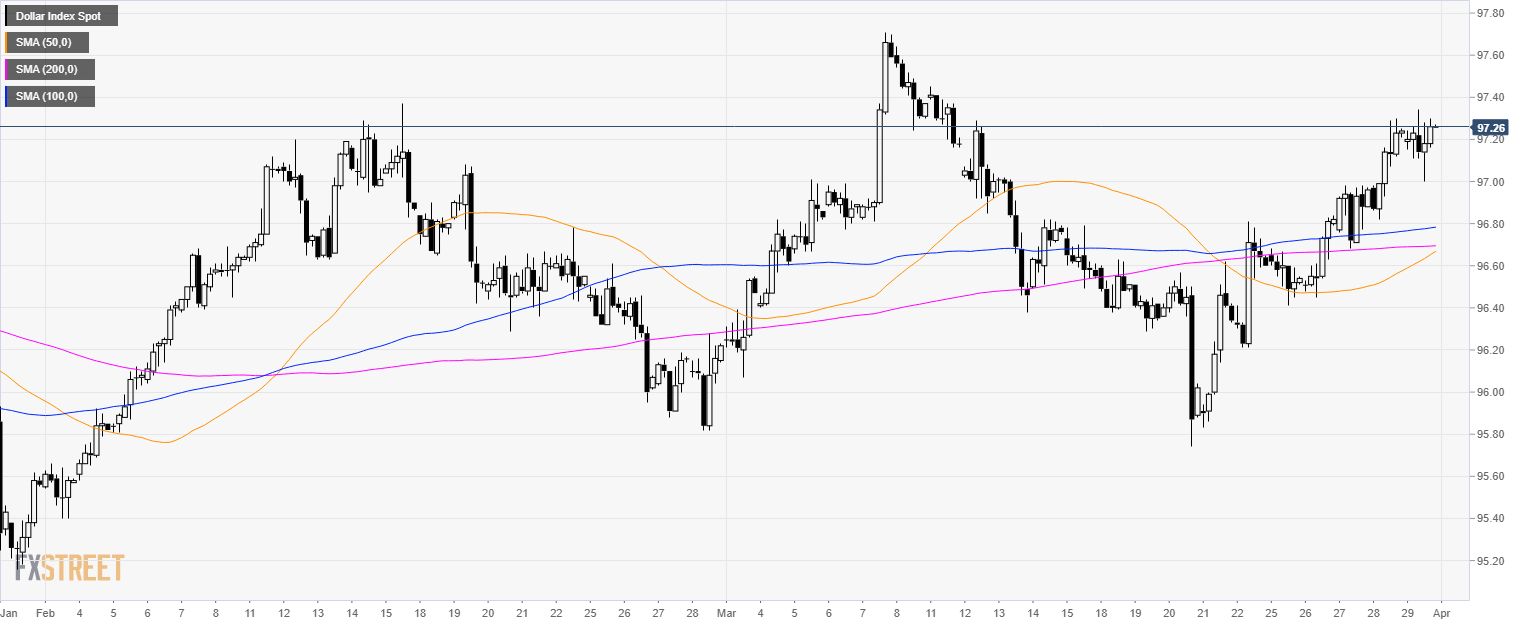

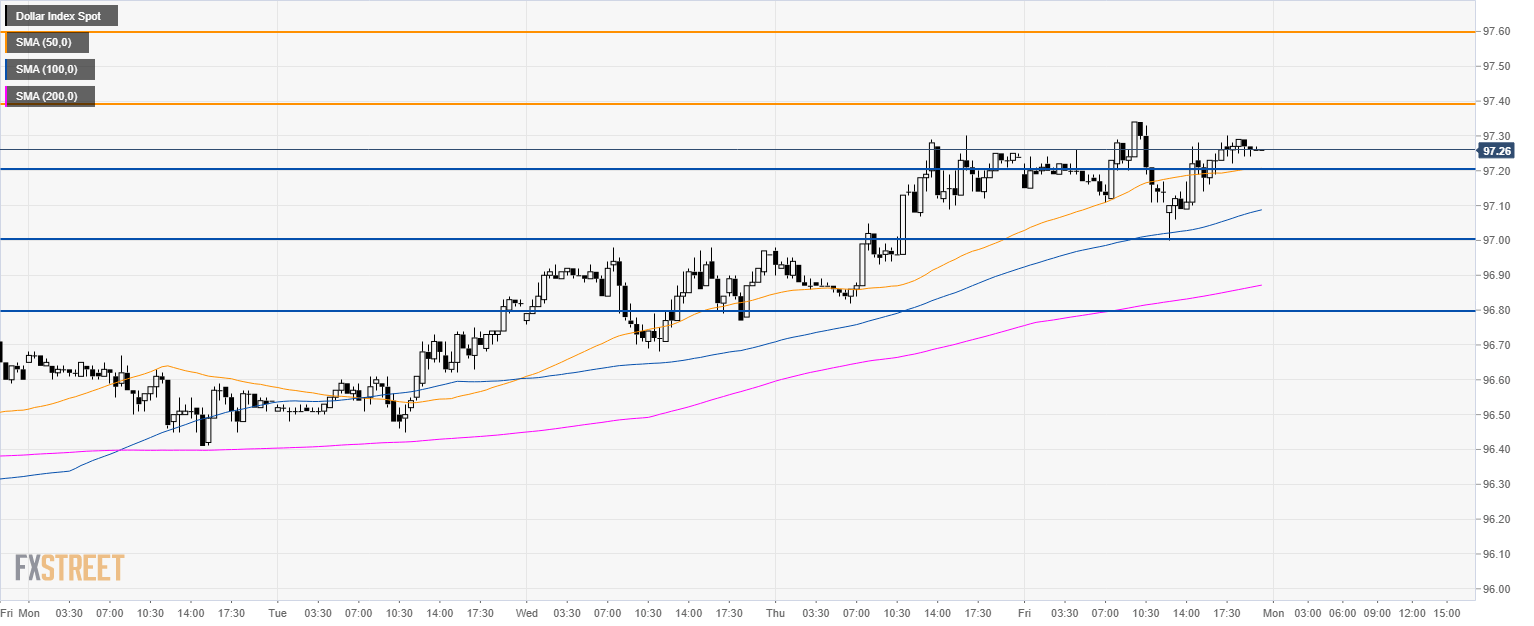

US Dollar Index Technical Analysis: DXY finishing the week on its highs near 97.40 key resistance

24964 March 30, 2019 06:53 FXStreet Market News

DXY daily chart

- The US Dollar Index (DXY) is trading in a bull trend above its 200-day simple moving average (SMA).

DXY 4-hour chart

- DXY is trading above its main SMAs suggesting bullish momentum.

DXY 30-minute chart

- DXY is trading above its main SMAs suggesting a bullish bias in the short-term.

- The bull trend is intact and the market will have to break above 97.40 key resistance to extend gains towards the 96.60 level.

- Looking to the downside, support is at 97.20, 97.00 and 96.80 level.

Additional key levels

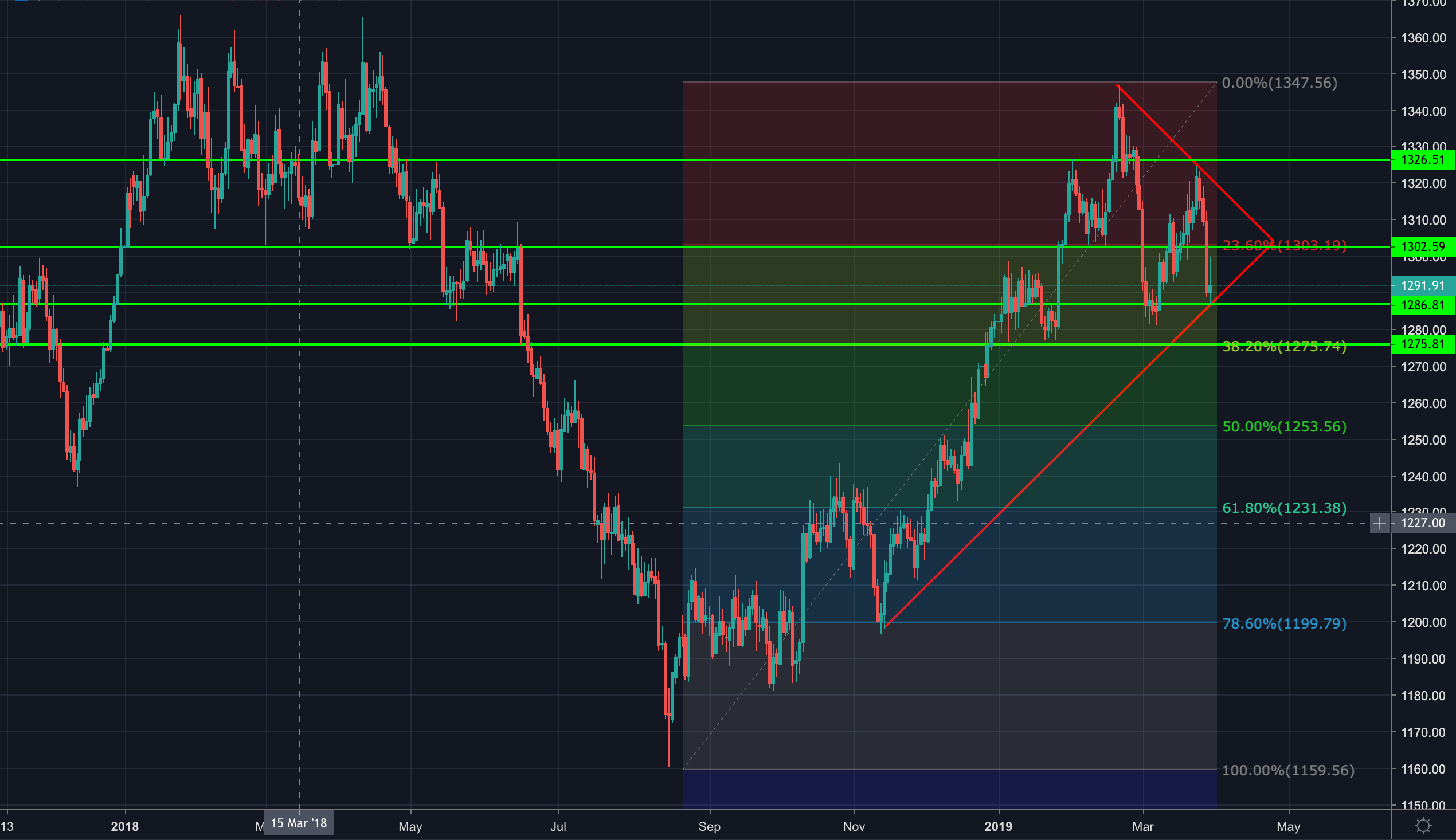

Gold Technical Analysis: Bulls still under water unless break and hold above $1302

24963 March 30, 2019 06:33 FXStreet Market News

- Gold recovers from drop that took price out of the rising channel and below 1300 the prior session where the 38.2% and the 23.6% Fibos of the late Feb highs and early March swing lows were broken, testing the bottom of the cloud where it stablised and bounced back from.

- However, MACD and RSI were oversold and bulls aimed for the 1300 price tag as the 50% reversion target of yesterday’s move.

- From here, daily stochastics are neutral and unless bulls can get and hold above 1302, the downside remains compelling, with a target set at 1275.

Gold daily chart

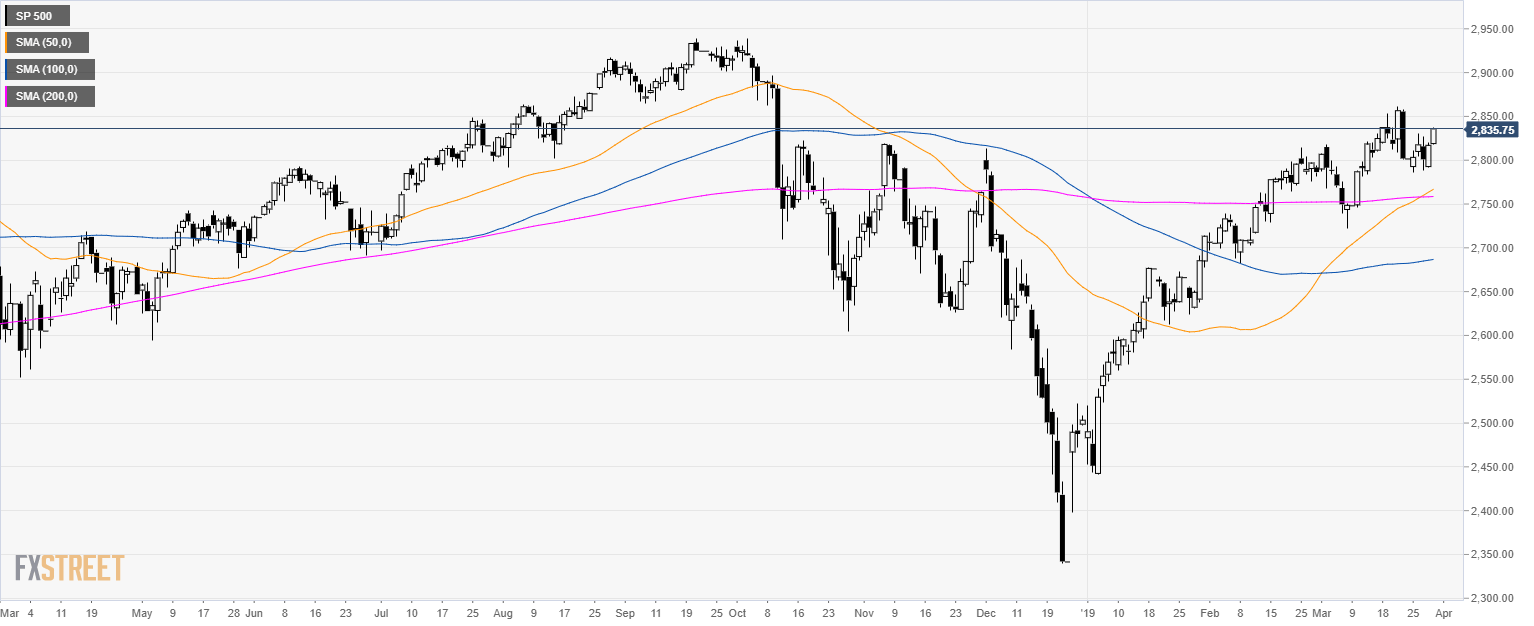

S&P500 Technical Analysis: US Stocks ends up the week on their highs near 2,835.00 level

24962 March 30, 2019 06:03 FXStreet Market News

S&P500 daily chart

- The S&P500 is trading above its main simple moving average suggesting bullish momentum.

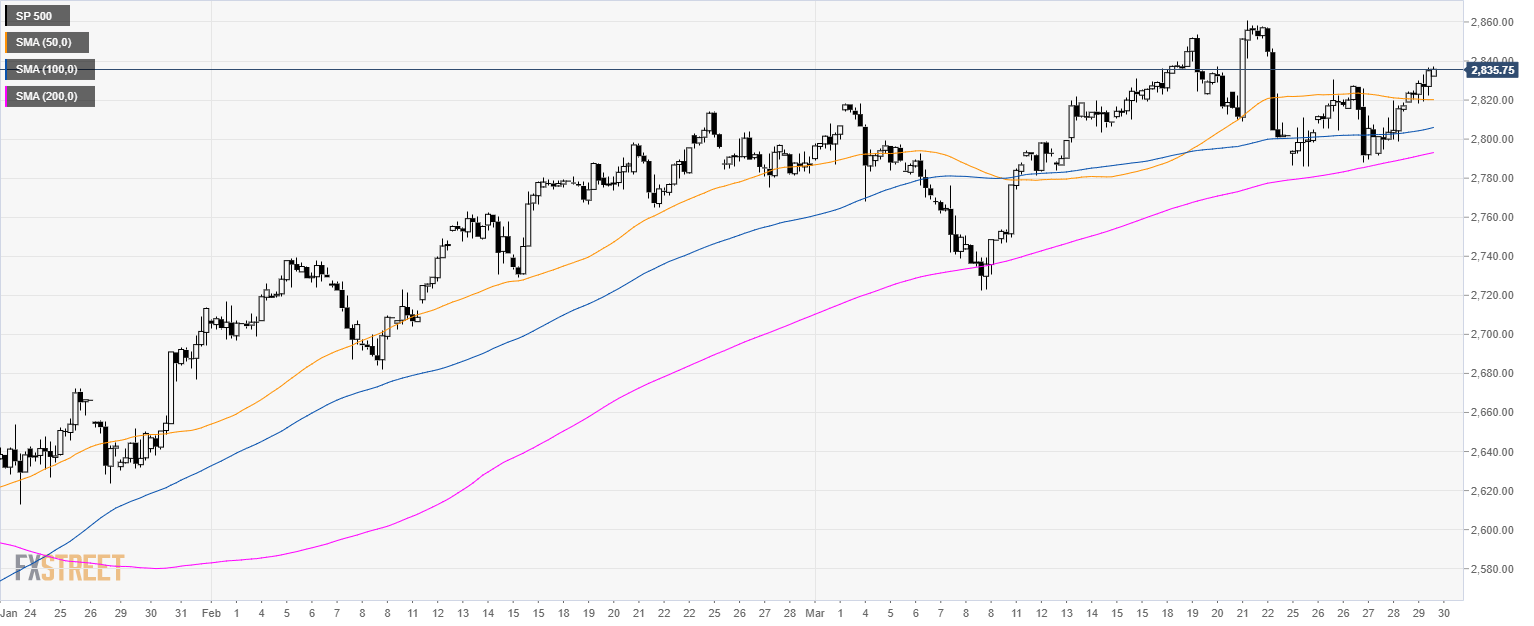

S&P500 4-hour chart

- The S&P500 is trading above its main SMAs suggesting a bullish bias in the medium-term.

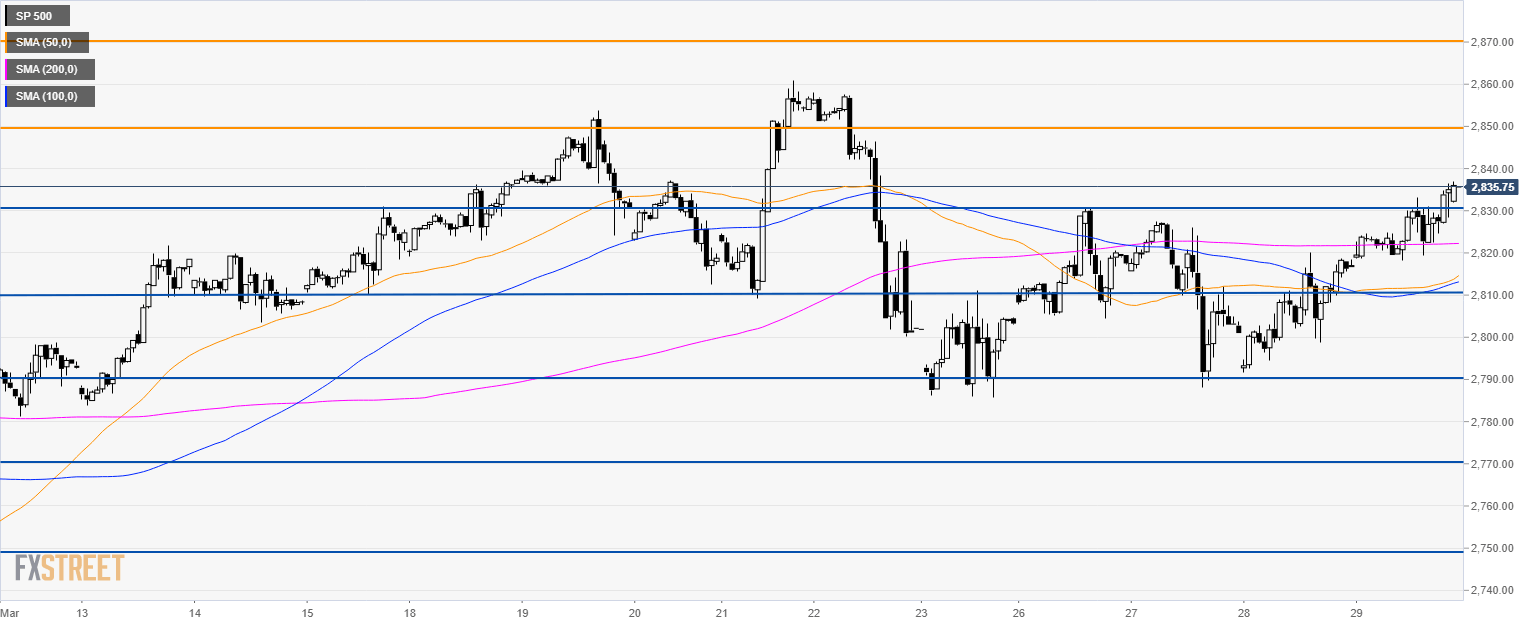

S&P500 60-minute chart

- The S&P500 is trading above its main SMAs suggesting bullish momentum in the short-term.

- The break above 2,830.00 can drive the market to 2,850.00 and 2,870.00 resistance.

- To the downside, support is at 2,810.00; 2,790.00 and 2,770.00 level.

Additional key levels

Trump crossing the wires late in the day: Additional sanctions in North Korea deemed unnecessary at this point

24961 March 30, 2019 05:53 FXStreet Market News

U.S. President Trump has made some comments which are crossing the wires after the Wall Street close:

- Very good likelihood border with Mexico will be closed next week.

- Very unhappy with Mexico regarding immigration issue.

- Additional sanctions in North Korea deemed unnecessary at this point.

-

Wall Street ends just shy of highs; DJIA above 21-D SMA and targets break of 26000 psychological level

USD/CHF Technical Analysis: Greenback capped by 0.9975 key resistance

24960 March 30, 2019 05:33 FXStreet Market News

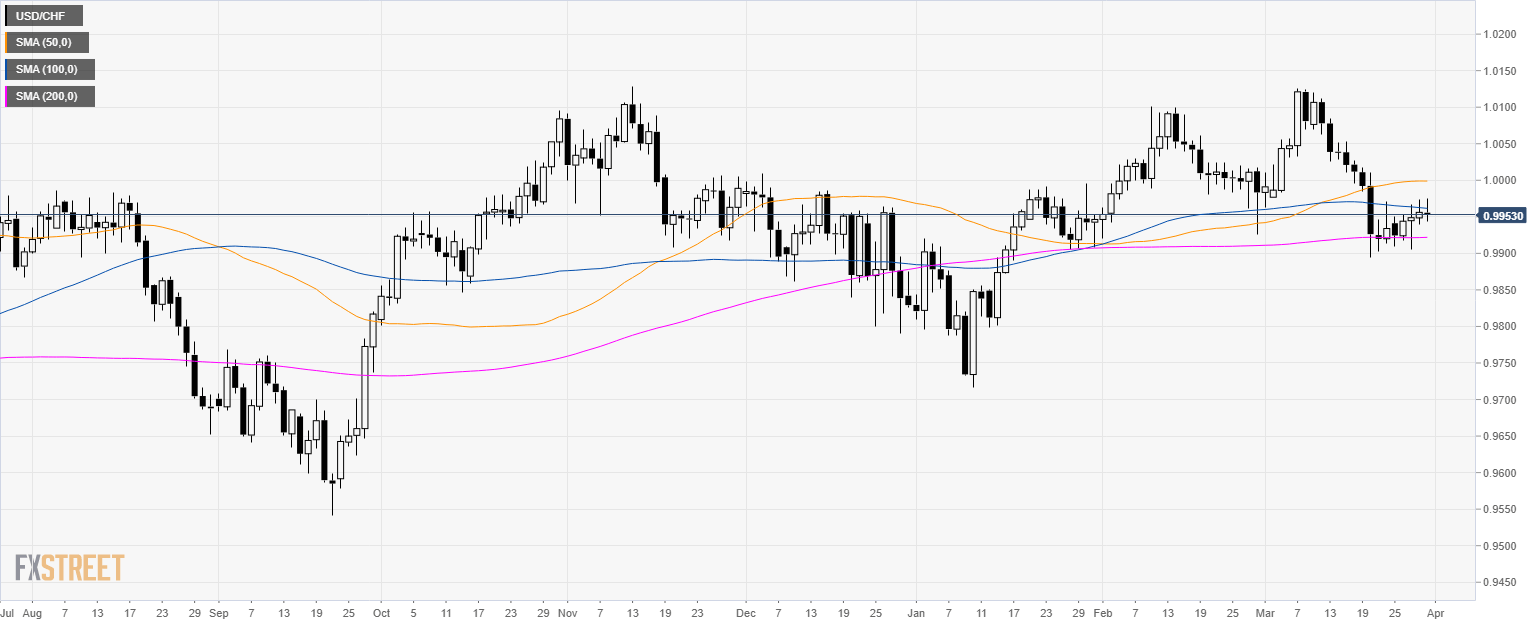

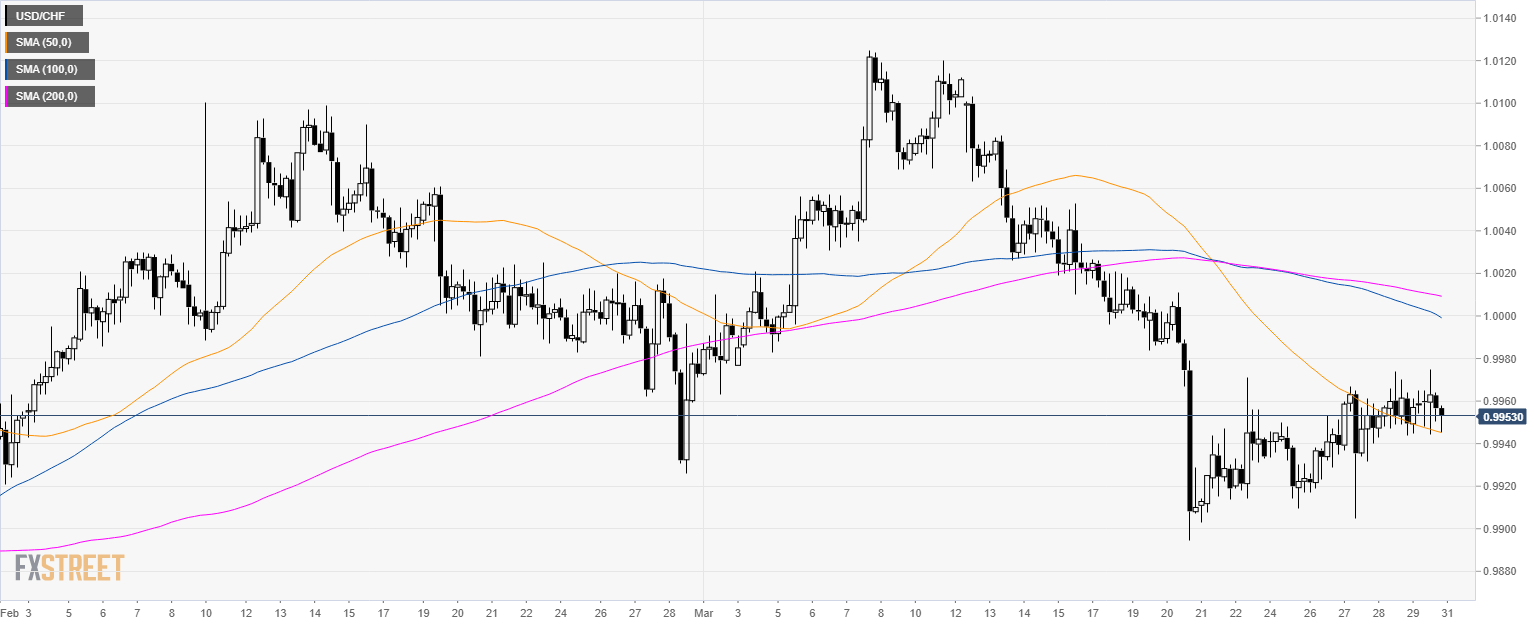

USD/CHF daily chart

- USD/CHF is trading in a sideways trend below the parity level.

USD/CHF 4-hour chart

- USD/CHF is trading below the 200 SMA suggesting a bearish bias in the medium-term.

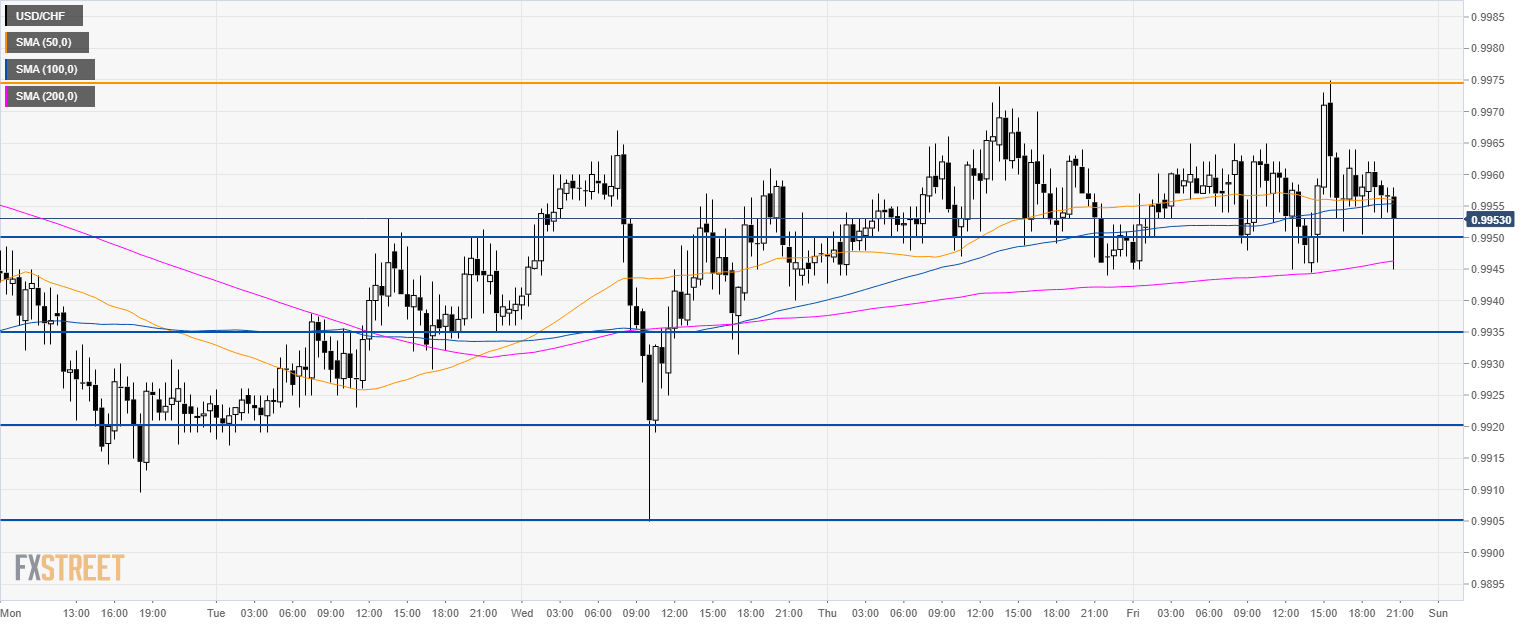

USD/CHF 30-minute chart

- USD/CHF is trading in a small range while the risk is tilted to the downside.

- A break below 0.9950 support should drive the market to 0.9935 and 0.9920 level to the downside.

- Looking up, key resistance is at 0.9975, followed by 0.9990 and 1.0005 level.

Additional key levels

Wall Street ends just shy of highs; DJIA above 21-D SMA and targets break of 26000 psychological level

24958 March 30, 2019 04:53 FXStreet Market News

- The Dow Jones Industrial Average DJIA, +0.82% rose 211.22 points, or 0.8%, to 25,928.68.

- The S&P 500 index SPX, +0.67% gained 18.96 points to 2,834.40, a rise of 0.7%.

- The Nasdaq Composite Index COMP, +0.78% advanced 60.16 points, or 0.8%, to 7,729.32. DJIA, +0.82%

Wall Street was firm into the close and chasing the session highs across the benchmarks, albeit falling just shy of those while the optimism over progress on U.S.-China trade talks trumped prospects of slowing global economic expansion and political turmoil in European as May loses a third vote on her deal in Parliament. However, there were some headlines crossing last in the day China’s Xi is somewhat concerned that the sides seem to be at odds due to a disagreement over what should happen to the additional tariffs on each other’s goods after a deal is struck.

“China is insisting that all additional tariffs be removed after the two sides reach a deal. U.S. President Donald Trump, on the other hand, wants the duties kept in place for a “substantial period of time” to maintain pressure on China and protect any deal” – reported the Nikkei.

Meanwhile, The U.S. and China will continue trade talks in Washington on Wednesday. Elsewhere, the focus was on Brexit in Parliament. UK Prime Minister Theresa May was unable to get her deal across the line, losing the vote by 344 to 286 -a slimmer margin, but a tragedy to her premiership nonetheless. The default option is that the UK will leave the EU on 12th April without any firm plan not a deal in place – Sterling took on the 1.30 figure and made a low of 1.2976 vs the greenback.

DJIA levels

As for the Dow, it notched a 1.5% weekly gain and roughly a 0.1% gain for March; The index added11.2% for the first quarter. Technically, the DJIA is now through the 21-D SMA and bulls will look to last week’s Tuesday scored high of 26109 on a breach of the psychological 26000 level. While capped below there, however, there is still the risk of a run all the way down to the 23.6% Fibo retracement of the late Dec swing lows to late Feb swing highs at the low end of the twenty-five hundreds. This area guards a break all the way down to the 38.2% Fibo of the same range around 24400.

EUR/USD ends week under pressure as recovery fades

24957 March 30, 2019 04:33 FXStreet Market News

- Pair fails to recover and holds at weekly lows.

- Euro ends week lower versus US dollar and also against GBP and CHF.

The euro was unable to recover ground against the US dollar on Friday. After reaching levels near 1.1250 tuned again to the downside and it was about to end hovering around 1.1215/20, down 70 pips from the level it had a week ago.

“The EUR/USD pair fell for a second consecutive week, approaching the yearly low of 1.1175 as fear ruled. The common currency started the week with a positive stance amid a better-than-expected German IFO survey, which brought temporal relief by coming above the market’s expectations. The upward mood, however, didn’t last long and was quickly reverted throughout the rest of the week, as an inverted US Treasury yields’ curve and more data from the EU pointing to a deeper economic slowdown in the Union, sent investors running into safety, with the greenback being the overall winner”, wrote Valeria Bednarik, Chief Analyst at FXStreet.

The weekly and the monthly chart shows the EUR/USD under pressure and with a bearish bias that could point to a test of March lows next week. An improvement in risk sentiment could help the euro.

Key economic data from the US will be released next week. The latest numbers and recession fears continue to favor the Fed’s dovish stance. As fears about the global slowdown expanded, other central banks, including the ECB, turned also dovish offsetting the negative effect on the US dollar of the end of rate hikes from the Fed.

EUR/USD Levels

On the downside, 1.1200 and 1.1175 (March low) could be seen as key supports for the next days. A break lower could clear the way to a slide to 1.1100, the next medium term support. On the upside, a level to watch next week is 1.1285 (Mar 27 high / Mar 6 low) and then 1.1320/30.

US Dollar Index firm above 97.00, consolidates weekly gains

24956 March 30, 2019 04:03 FXStreet Market News

- US dollar rises on Friday against European currencies, falls versus commodity and Emerging market currencies.

- DXY post fourth consecutive daily gain.

The greenback posted mixed results on Friday, but measured by the US Dollar Index rose on the back of an appreciation against European currencies.

The Index peaked at 97.33, the highest level since March 11 and then pulled back finding support at 97.00 after a soft reading of the PCE core. Then started to move to the upside boosted by the rejection at the UK Parliament of PM May’s Brexit deal and also by US new home sales and consumer confidence numbers.

Near the end of the week, it is hovering around 97.20/25, up for the fourth-day in-a-row, extending the rally that started last week.

Despite the Fed’s shift to a dovish stance and to a pause in the rate hike path, the DXY is about to end the month with a gain of 1.10%. Risk aversion, Brexit uncertainty and also the change in the ECB tone supported the greenback.

Week ahead

The key data next week in the US will the official employment report to be released on Friday. Market consensus point to an increase in payrolls of 175K. Also, the ISM manufacturing index, retail sales, and durable goods orders are due. The Brexit drama will continue next week and also speculations about the ongoing trade negotiations between the US-China.

US: New Home Sales roar back in February – Wells Fargo

24955 March 30, 2019 03:53 FXStreet Market News

Data released today showed that new home sales rose 4.9% in February. According to analysts at Wells Fargo, discounting has helped bring back home buyers.

Key Quotes:

“The weakness in sales during the fourth quarter and fears the Fed would continue to hike interest rates encouraged builders to slash prices late last year, particularly in the West. Prices are now below their year-ago level and that is bringing back buyers.”

“Lower mortgage rates are also bringing buyers back, particularly in the South and West, and are still falling.”

“While today’s good news on home sales is certainly welcome, the improvement comes at a seasonally slow period and was exaggerated by seasonal adjustment.”