Articles

KuCoin hack turns Uniswap into crypto laundromat

76060 September 30, 2020 22:49 FXStreet Market News

- Uniswap has become a popular place for laundering stolen coins.

- Several projects appear to be less decentralized than expected.

KuCoin hack teaches us a couple of costly lessons about the decentralized finance (DeFi) industry. Some of them may become a revelation for investors.

KuCoin’s story: the summary

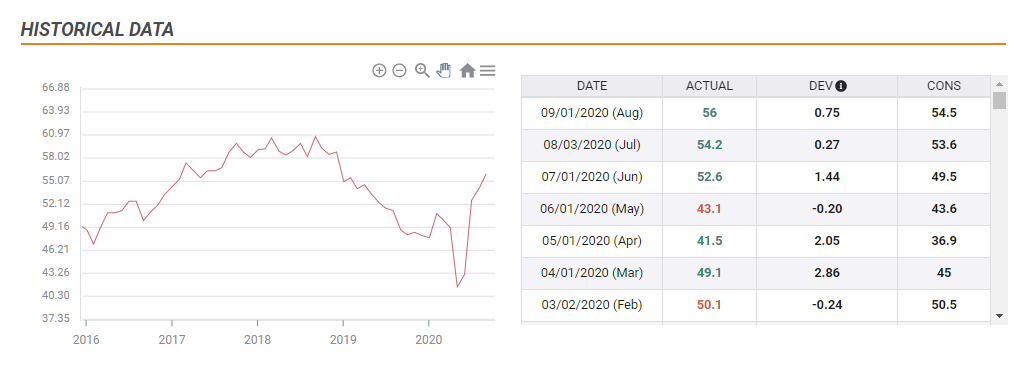

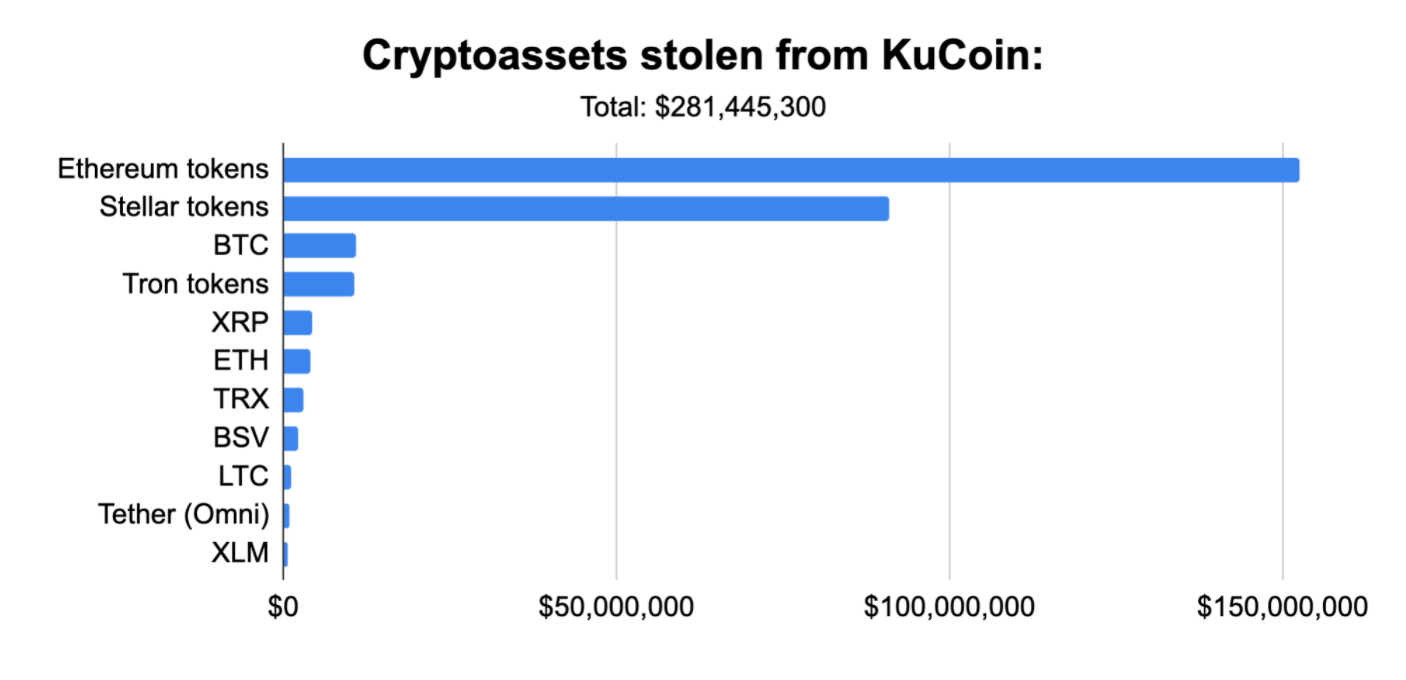

On 25 September, an unknown hacker exploited the vulnerability of the Asia-based cryptocurrency exchange KuCoin and drained its hot wallets of $281 million in cryptocurrency assets. The episode has become the third-largest theft in the history of cryptocurrency trading platforms.

The bad guys got away with a variety of assets, including Bitcoins, Litecoin and XRP. However, ERC-20 tokens accounted for over half of the loot.

The composition of the assets stolen from KuCoin

Source: www.elliptic.co

Lesson 1: Centralized exchanges turned into a dead end

According to the data provided by Elliptic’s research, the service that enables detecting and investigating risky crypto transactions, hackers attempted to sell the stolen assets on the regular exchanges. However, this route was blocked within minutes after the hack. All major trading platforms are equipped with the tools to identify where the assets originated from and freeze any accounts receiving such funds.

Centralized cryptocurrency exchanges are very cooperative and tend to prevent the money laundering through their accounts. Moreover, some of the largest trading platforms cooperate with the authorities, providing them with tools to analyze blockchains and monitor suspicious activity.

Thus Coinbase reportedly has dealt with various US authorities, including the Drug Enforcement Administration (DEA) and the Internal Revenue Service (IRS). The cryptocurrency exchange provides a cryptocurrency investigation tool called “Coinbase Analytics.”

Lesson 2: DEXs turned into crypto laundromats

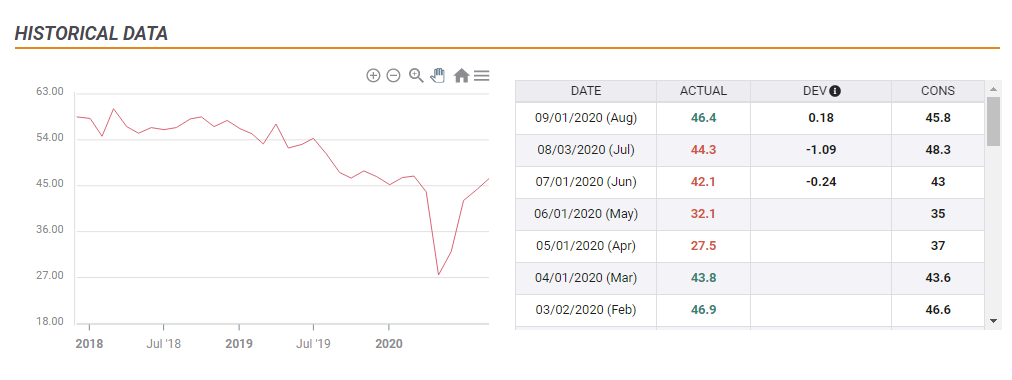

Meanwhile, decentralized exchanges (DEXs) provided hackers with another option to bypass the anti-money laundering procedures and cash out the stolen assets.

Unlike the centralized counterparts, DEXs are governed by smart contracts, meaning that there is no intermediary or centralized authority between the participants of the trade.

This circumstance has a couple of consequences. First, the participants stay anonymous as they do not have to disclose their identities and go through know-your-customer (KYC) processes. Second, there is no one to freeze the account to seize the funds as everything is processed automatically, based on the rules of the smart contract.

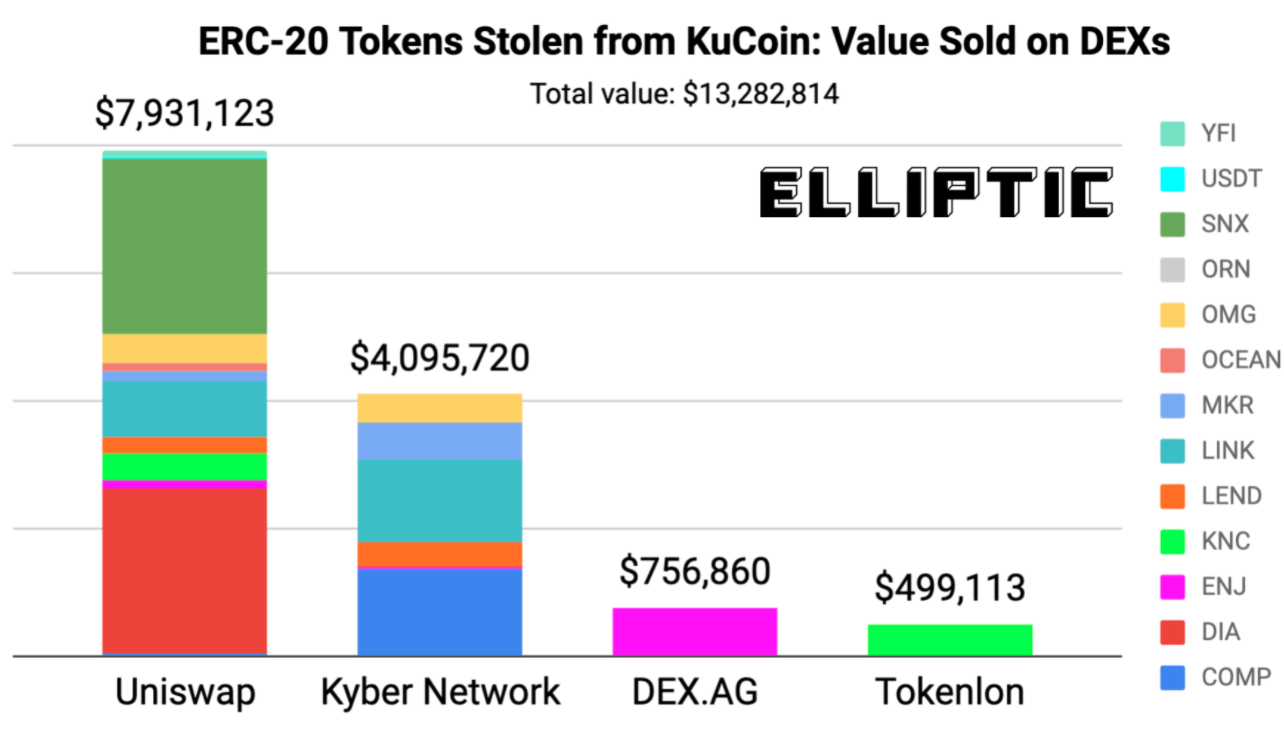

KuCoin thief benefitted from the explosive growth of decentralized exchange activity on Ethereum and began selling the stolen ERC-20 tokens on these platforms without risk of being frozen.

DEXs involved in laundering funds stole from KuCoin

Source: www.elliptic.co

As the chart above shows, the hacker focused on four DEXs, Uniswap, Kyber Network, DEX.AG and Tokenlon, and laundered about $13.3 million in coins by the time of writing. Uniswap accounts for the lion’s share of this activity.

While Elliptic claims that its blockchain monitoring solutions can trace the funds on DEXs, there is still no way to block the transactions that involve the funds originated from the hack.

Lesson 3: Decentralization can be falsified

Several projects introduced the measure to lock the funds stolen by the hacker. That’s what Tether did, which is hardly surprising for the community. However, several projects that deemed to be decentralized pursued a similar strategy,

For example, Ampleforth (AMPL) and Ocean Protocol (OCEAN) also took decisive action against KuCoin’s bad guy.

Ocean Protocol team performed a hard fork from a few blocks before the hack to roll back the transactions. A new chain will become the main for the protocol. Basically, Ocean Protocol opted for the Ethereum’s approach to the DAO hack. Read our in-depth story of what happened next.

Ampleforth team tweaked their smart contract to block the hacker’s address from moving their AMPL. While this solution may look less drastic, it reveals the lack of decentralization and opens up the way to censorship. Unlike the Ocean, where users can opt for the old chain and follow the suit of Etthereum Classic, Ampleforth changed the contract unilaterally and gave the community no choice.

Kardiachain, Orion Protocol, and Aleph all have taken similar steps showing their real centralized face.

Full Article

United States EIA Crude Oil Stocks Change came in at -1.98M below forecasts (1.569M) in September 25

76059 September 30, 2020 22:40 FXStreet Market News

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer.

Trading foreign exchange on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial advisor if you have any doubts.

Opinions expressed at FXStreet are those of the individual authors and do not necessarily represent the opinion of FXStreet or its management. FXStreet has not verified the accuracy or basis-in-fact of any claim or statement made by any independent author: errors and Omissions may occur.Any opinions, news, research, analyses, prices or other information contained on this website, by FXStreet, its employees, partners or contributors, is provided as general market commentary and does not constitute investment advice. FXStreet will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Full ArticleWeekly EIA oil inventory report -1980K vs +1000K expected

76058 September 30, 2020 22:33 Forexlive Latest News Market News

Weekly petroleum supply data from the EIA:

- Gasoline +683K vs -1400K

- Distillates -3184K

- Cushing +1785K

There’s been little response from the oil market.

From the API yesterday:

- Crude -831K

- Gasoline +1620K

- Distillates -3420K

Full Article

OMG Network Price Analysis: OMG is ready for another leg up after 70% gains

76055 September 30, 2020 22:33 FXStreet Market News

- OMG is up by more than 70% since its low on September 21 at $2.48.

- The digital asset has turned several indicators in its favor and looks poised for another move up.

OMG is currently trading at $3.8 and has been outperforming the market for the past three days. Santiment, a behavior analytics platform, has released a report on whether the digital asset will continue soaring or not.

OMG Exchange Inflow Chart

According to Santiment, OMG has been one of the top-performing assets in the past 36 hours. It seems that the exchange inflow of coins had eclipsed its previous high in August when 270,000 OMG coins were moved to exchanges. Although this metric usually indicates a potential selloff or at least intense selling pressure, Santiment points out that active OMG deposits have been lower than in August.

OMG Daily Active Deposits

The number of OMG tokens sent to exchanges hit 418,000 now; however, the number of daily active deposits is around seven times lower, which would indicate that the scaling solution network will not experience a large selloff.

More positive metrics in favor of OMG

The report continues pointing out other positive on-chain metrics favoring the bulls. For instance, the number of OMG-related mentions on social media has been going up recently, although it remains significantly lower than the uptick in August.

According to Santiment, the growing trend would ‘allow the price to still grow further before we see a strong correction,’ but caution is advised.

OMG/USD daily chart

One of the most positive indicators for OMG is that the price climbed above the 100-MA and turned it into support. Similarly, the 50-MA was also conquered as support and is being re-tested currently. Furthermore, the MACD turned bullish on September 28 for the first time since August 10. The last time, the price of OMG exploded 300% in less than ten days.

OMG New Addresses

Another metric in favor of the bulls is the number of new addresses joining the network. On September 28, this metric saw a notable spike, far above the last high at 498 addresses with 642 now. An increase usually represents an increase in interest from investors, a bullish sign.

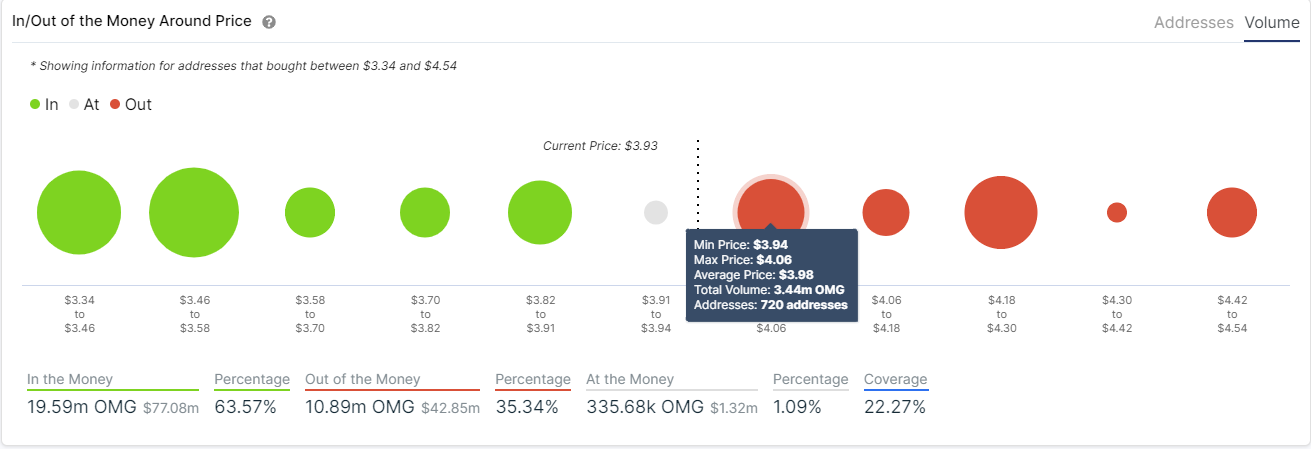

OMG IOMAP Chart

However, it’s important to note that a strong resistance level has been established at around $4.10, which has rejected the price on several different occasions. The In/Out of the Money Around Price chart by IntoTheBlock also shows a notable amount of resistance between $3.94 and $4.06, where 720 addresses bought 3.4 million OMG coins.

On the other side, the range between $3.82 and $3.91 is acting as a support area; however, a bearish breakout below this area will take OMG down to $3.58, where the next notable support area was established.

Full ArticleUSD/JPY Price Analysis: Sits near two-week tops, comfortably above mid-105.00s

76054 September 30, 2020 22:33 FXStreet Market News

- USD/JPY reversed an early dip to 100-hour EMA and moved back closer to two-week tops.

- The technical set-up still favours bullish traders and supports prospects for additional gains.

The USD/JPY pair attracted some dip-buying near 100-hour EMA and moved back closer to daily tops, around the 105.70 region, during the early North American session. Bulls are likely to wait for some follow-through buying beyond the 105.80 region – or three-week tops set earlier this Wednesday – before placing fresh bets.

Meanwhile, technical indicators on the daily chart have been recovering from the negative territory. This coupled with the fact that oscillators on hourly charts maintained their bullish bias support prospects for additional gains. Hence, a move beyond the 106.00 mark, towards testing the 106.25-30 resistance zone, now looks a distinct possibility.

On the flip side, dips towards the 100-hour EMA, currently around mid-105.00s, might still be seen as a buying opportunity. That said, a convincing breakthrough, leading to a subsequent weakness below the 105.20-15 region will negate the constructive outlook and prompt some aggressive technical selling around the USD/JPY pair.

Bears might then drag the pair back below the key 105.00 psychological mark. The downward momentum could further get extended towards the 104.45 horizontal support before the USD/JPY pair eventually drops to multi-month lows, around the 104.00 round-figure mark.

USD/JPY 1-hourly chart

Technical levels to watch

Full ArticleISM Manufacturing PMI Preview: Low bar for upside surprise could turn dollar-positive

76053 September 30, 2020 22:33 FXStreet Market News

- The ISM Manufacturing PMI is set to marginally edge higher in September.

- Expectations for a drop in employment open door to a beat.

- The dollar has room to gain ground – but for the wrong reasons.

Has the fiscal cliff sent the economy plunging? The expiry of several government programs in late July is probably hurting the economy – but it will probably take time to propagate to the manufacturing sector. The loss of the $600/week federal unemployment insurance top-up is slowing the bounce in retail sales, but it takes more time for weaker revenue at stores to hit factories – and especially hiring there.

Economists expect a minor increase in the headline ISM Purchasing Managers’ Index, from 56 in August to 56.3 in September. Any score above 50 represents expansion. It would still keep the indicator below the peak levels seen in 2018.

Source: FXStreet

The more significant figure is the employment component, which serves as a hint toward Friday’s jobs report. It is set to show a decline from 46.4 to 45.8, representing a deeper contraction in hiring. As mentioned earlier, that may happen, but probably not immediately.

Moreover, the figure has been on an upturned and even beat estimates in August. Even if the manufacturing labor market remains in contraction, a score closer to 50 is likely now.

Source: FXStreet

Potential market reaction

An upbeat ISM Manufacturing PMI employment component would compound robust ADP’s private-sector jobs report and create an upbeat narrative toward Friday’s Non-Farm Payrolls. ADP, America’s largest payroll firm, reported an increase of 749,000 positions in September, better than expected.

In theory, better figures mean a stronger currency, thus a stronger dollar. The greenback indeed has room to rise – yet for the wrong reason. Another robust Non-Farm Payrolls report could discourage lawmakers from cutting a deal on the next fiscal relief package, thus boosting the dollar in its role as a safe-haven currency.

That has already happened with the last jobs report. Back in early September, Republicans reduced their offer to below $1 trillion after the US recorded around 1.4 million job gains in August. The ruling party later raised it above that round number when August’s retail sales statistics fell short of estimates.

Democrats also have various calculations. Challenger Joe Biden is leading in the polls and he may prefer to wait to get into office and push for a different package once in office. However, a deteriorating economic situation may push them to act sooner.

Conclusion

Overall, an upbeat employment component is dollar positive and a disappointment is dollar negative – yet for the wrong reasons.

More: Presidential Debate: Stocks set to suffer on Trump’s refusal to accept the results

Full ArticleRising stimulus hopes underpin equity rally and long-bond slump

76051 September 30, 2020 22:17 Forexlive Latest News Market News

Is there a path to a deal?

I think the turn in equities at the moment is all about hopes for a new US stimulus package.

This is from a Bloomberg reporter:

Mnuchin says White House counteroffer will be similar to Problem Solvers $1.5 trillion plan. Key point on plan: it has an escalator clause that could allow $2 trillion if virus persists, closer to Pelosi’s $2.2 trillion level

This is a genuine attempt at compromise. I can see the case from both sides for making it happen but the devil is in the details.

Mnuchin said earlier we will know by tomorrow afternoon if there is a path to a deal.

The talk is clearly having an effect on the market and I believe it’s why we’ve seen the sharp turnaround in equity markets. The S&P 500 is up 0.8% after falling as much as 1.0% premarket. US 30-year yields are also up 3.6 bps to 1.45% suggesting that more supply could be coming.

Full Article

EUR/USD: Investors to take profits in the last quarter – Rabobank

76050 September 30, 2020 22:17 FXStreet Market News

During the course of September EUR/USD has moved as high as 1.1917 and as low as 1.1612. According to economists at Rabobank, there are sufficient negative headlines for the market to cover short USD positions going into Q4 and question their EUR longs.

Key quotes

“The fundamentals behind the USD have certainly altered hugely since the start of the crisis. In particular the extension of the Fed’s temporary USD liquidity swap lines and the FIMA repo facilities suggest that panic buying of USD is unlikely to again reach the frantic levels seen in March in the foreseeable future. That said, the panic buying of the USD in March demonstrated the greenback’s role as a safe-haven for many investors. In turn, this suggests that further sharp dips in risk appetite are still likely to at least trigger bouts of USD short-covering.”

“The prospect of a contested US election comes at a time when the market is becoming accustomed that some of the restrictions linked with COVID-19 will be in place for longer than perhaps had been assumed at the start of the crisis. These restrictions threaten to be a drag on the global economic recovery, which should force some investors to question their positions in risky assets. Simultaneous continued tensions between the US and China may also threaten the recent optimism of investors and result in a pullback towards safe-haven currencies such as the USD.”

“Signs of a second wave of COVID-19 in Europe will be a setback to recovery hopes and, particularly if unemployment rates rise, anti-EU sentiment may re-emerge in some countries. We see scope for investors to take profits on long EUR positions in Q4 which would pave the way for a moderately softer tone in EUR/USD. We see scope for a dip towards EUR/USD 1.16 on a three-month view.”

Full ArticleUS: Pending Home Sales surge by 8.8% in August vs. 3.2% expected

76049 September 30, 2020 22:17 FXStreet Market News

- Pending Home Sales in US rose at a stronger pace than expected in August.

- US Dollar Index stays in the positive territory above 94 after the data.

Pending Home Sales in the US rose by 8.8% on a monthly basis in August following July’s increase of 5.9%, the data published by the US National Association of Realtors showed on Wednesday. This reading came in better than the market expectation of 3.2%.

On a yearly basis, Pending Home Sales increased by 24.2% in August, comparesd to 15.5% in July.

Market reaction

These figures don’t seem to be having a significant impact on the USD’s performance against its rivals. As of writing, the US Dollar Index was up 0.2% on the day at 94.06.

Full ArticleS&P 500 opens higher supported by rising energy stocks

76047 September 30, 2020 22:09 FXStreet Market News

- Wall Street’s main indexes opened in the positive territory.

- CBOE Volatility Index is down more than 2% on stimulus hopes.

- S&P 500 Energy Index is up 1% as the best-performing major sector.

Major equity indexes in the US opened higher as the upbeat macroeconomic data releases from the US and renewed hopes for a deal on the stimulus aid provided a boost to sentiment. Reflecting the risk-on market environment, the CBOE Volatility Index, Wall Street’s fear gauge, is down 2% on the day.

As of writing, the S&P 500 was up 0.58% at 3,353, the Dow Jones Industrial Average was gaining 0.88% at 27,685 and the Nasdaq Composite was rising 0.4% at 11,366.

Earlier in the day, the data published by the Automatic Data Processing (ADP) Research Institue showed that employment in the US’ private sector increased by 749,000 in September, compared to analysts’ estimate of 650,000. Additionally, the US Bureau of Economic Analysis in its final estimate revised the second-quarter GDP contraction to 31.4% from 31.7%.

Meanwhile, US Treasury Secretary Steven Mnuchin said on Wednesday that he is hopeful that Republicans and Democrats can reach a deal on the coronavirus stimulus aid.

Among the 11 major S&P 500 sectors, the Energy Index is up 1% on the day as the best performer in the early trade.

S&P 500 chart (daily)

Full ArticleUnited States Pending Home Sales (YoY): 24.2% (August) vs 15.5%

76046 September 30, 2020 22:09 FXStreet Market News

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer.

Trading foreign exchange on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial advisor if you have any doubts.

Opinions expressed at FXStreet are those of the individual authors and do not necessarily represent the opinion of FXStreet or its management. FXStreet has not verified the accuracy or basis-in-fact of any claim or statement made by any independent author: errors and Omissions may occur.Any opinions, news, research, analyses, prices or other information contained on this website, by FXStreet, its employees, partners or contributors, is provided as general market commentary and does not constitute investment advice. FXStreet will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Full ArticleUS pending home sales for August +8.8%% vs. +3.1% estimate

76045 September 30, 2020 22:02 Forexlive Latest News Market News

HIGH RISK WARNING: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives, experience level, and risk tolerance. You could lose some or all of your initial investment; do not invest money that you cannot afford to lose. Educate yourself on the risks associated with foreign exchange trading, and seek advice from an independent financial or tax advisor if you have any questions.

ADVISORY WARNING: FOREXLIVE™ provides references and links to selected blogs and other sources of economic and market information as an educational service to its clients and prospects and does not endorse the opinions or recommendations of the blogs or other sources of information. Clients and prospects are advised to carefully consider the opinions and analysis offered in the blogs or other information sources in the context of the client or prospect’s individual analysis and decision making. None of the blogs or other sources of information is to be considered as constituting a track record. Past performance is no guarantee of future results and FOREXLIVE™ specifically advises clients and prospects to carefully review all claims and representations made by advisors, bloggers, money managers and system vendors before investing any funds or opening an account with any Forex dealer. Any news, opinions, research, data, or other information contained within this website is provided as general market commentary and does not constitute investment or trading advice. FOREXLIVE™ expressly disclaims any liability for any lost principal or profits without limitation which may arise directly or indirectly from the use of or reliance on such information. As with all such advisory services, past results are never a guarantee of future results.

Full Article

-637370724205135427.png)