Articles

“Who will win the election?” is the wrong question

76031 September 30, 2020 21:21 Forexlive Latest News Market News

“Will there be a clear, uncontested and accepted winner?” is a better question

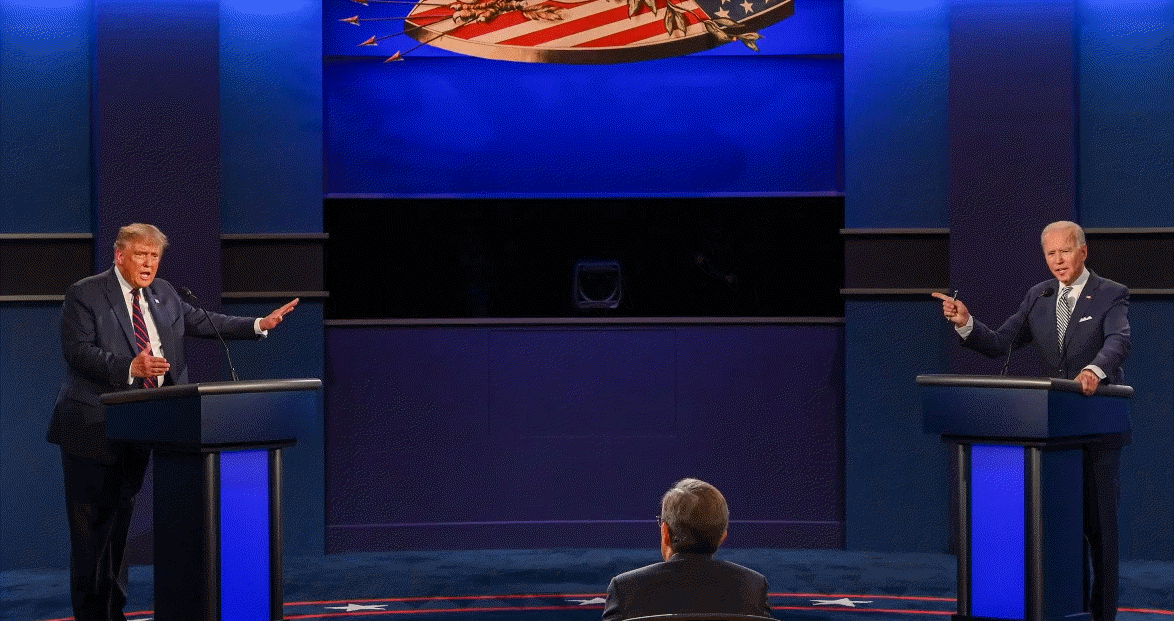

The betting odds of a Biden Presidency ticked higher after yesterday’s debate. I believe Trump’s constant interrupting was at least partly strategic in the hope of tripping up Biden and making him look more like the bumbling caricature he’s tried to construct. By and large that didn’t work and I doubt Trump won over many undecideds.

Given the polling lead, Biden should be a large favourite but he’s stuck at 60/40 because no one can forget Trump’s upset win over Hillary Clinton, or Brexit.

For markets, I think the outcome itself is less important in the short term than the question of whether or not their will be a clear winner; and whether Trump will ever concede.

BMO’s fixed income team writes today about the tail risk of a contested election but ponders the

degree to which the consensus opinion is already fully incorporated into

current valuations.

Let’s face it, very few in the market are anticipating a

smooth election nor for any potential transition of power to be uneventful. The

extent to which November serves to disrupt functioning of the federal government

or fuel further civil unrest remains to be seen and, frankly, is the most

significant tail risk as we ponder potential outcomes.

I’m open to the ‘sell the rumour, buy the fact trade’ but skeptical that it’s even possible to price in uncertainty in that way. Uncertainty is — by definition — something that persists for an indefinite amount of time. If Trump refuses to concede even on a clear loss, he will still have a strong political base and I expect him to use it to dog Biden for years. It’s a question of how far he’s willing to go and with Trump, the sky is the limit.

The ‘buy the fact’ trade relies on an eventual return to Obama-era levels of civility (which isn’t saying much) but I just don’t think that’s coming.

Full ArticleMnuchin on stimulus: “We’re going to give it one more serious try to get this done, we’re hopeful”

76030 September 30, 2020 21:12 Forexlive Latest News Market News

Upbeat comments from Mnuchin

- Expects he and Pelosi will deliver a response to the need for relief

- Expects a relief proposal similar to problem solvers plan

- Says he’s giving himself and Pelosi ‘one more chance’ at a relief bill

I think the market is starting to give this a chance of passing but it could all come crashing down in a hurry. It’s a tough one to handicap because there’s so much going on politically.

Full Article

Bitcoin Price Analysis: BTC could be poised for another $10,000 retest

76029 September 30, 2020 21:12 FXStreet Market News

- BTC is slowing down significantly after its initial rebound from $10,000.

- Several exchanges have released reports in favor of a bearish outlook and a retest of the critical $10,000 support level.

Bitcoin is currently trading at $10,700 after a failed attempt to climb above $11,000. The digital asset has established a robust support level at $10,000, defended on several occasions throughout September.

One of the leading cryptocurrency exchanges, OKCoin, has released a report stating that ‘traders lean bearish on BTC.’ According to the report, several on-chain metrics are showing a bearish outlook for the flagship cryptocurrency. It seems that the number of active users and transactions has remained flat during September.

This is a bearish factor that negatively impacts the growth of the Bitcoin network, explains OKCoin. The report also mentions the upcoming U.S. presidential election, stating:

The performance of most markets has historically been mixed around the time of previous U.S. elections, bitcoin included

BTCC, one of the oldest cryptocurrency exchanges, seems to agree. They also released a report stating that Bitcoin is losing momentum in the short-term. Let’s look at some technical indicators and other on-chain metrics to determine the most likely scenarios.

BTC/USD daily chart

The most important factor on the daily chart is the $10,000 support level. Throughout 2020 and some part of 2019, the $10,000 level acted as the most critical resistance level until it was finally broken for good on July 27. More often than not, intense resistance levels turn into strong support levels, which we see now.

Bitcoin is currently trading at $10,700 right between the 50-MA, acting as a resistance point, and the 100-MA, which is support.

BTC/USD 4-hour chart

On the 4-hour chart, Bitcoin’s price has established a lower high, and bears are close to confirming a downtrend. The MACD has turned bearish already, but the 50-MA continues acting as a support level. The 100-MA also turned into support on September 28 but was lost recently, and bulls are trying to recover it.

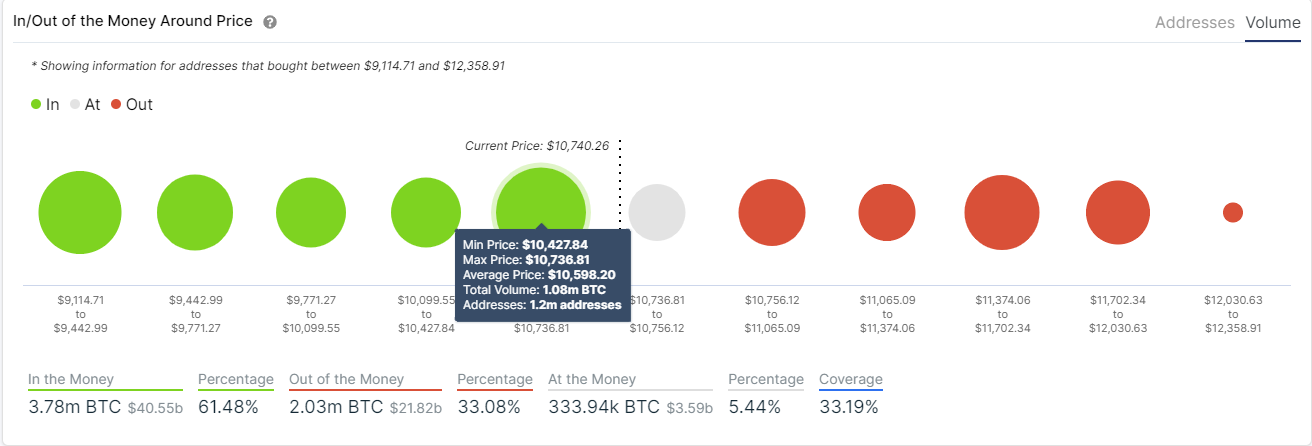

Not everything is against Bitcoin

On the other hand, several other metrics are actually in favor of the bulls. The In/Out of the Money Around Price chart by IntoTheBlock shows stronger support than resistance. Between $10,427 and $10,736, more than one million addresses bought 1,000,000 Bitcoin. Furthermore, below this support area, the IOMAP chart indicates that support is strong well until $9,000.

BTC IOMAP Chart

Another interesting point was raised by Willy Woo, a famous on-chain analyst. Woo states that the spike in activity by new participants is not yet reflected in the price, something that doesn’t happen often.

According to Woo, this is a clear bullish sign and a divergence. Eric Thies pointed out another interesting fact on Twitter.

This seems to indicate that if history repeats itself, we could see Bitcoin enter another massive bull rally and probably surpass its last all-time high.

Nonetheless, $11,000 remains the most crucial resistance level in the short-term. A breakout above this point would allow Bitcoin to retest $12,000. The $10,500 support level where the 100-MA is established on the daily chart is the most important on the bearish side. It also coincides with the most substantial support area in the IOMAP chart. A bearish breakout will push Bitcoin down to $10,000

Full ArticleGermany says delays in EU recovery fund is most likely unavoidable

76028 September 30, 2020 21:09 Forexlive Latest News Market News

HIGH RISK WARNING: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives, experience level, and risk tolerance. You could lose some or all of your initial investment; do not invest money that you cannot afford to lose. Educate yourself on the risks associated with foreign exchange trading, and seek advice from an independent financial or tax advisor if you have any questions.

ADVISORY WARNING: FOREXLIVE™ provides references and links to selected blogs and other sources of economic and market information as an educational service to its clients and prospects and does not endorse the opinions or recommendations of the blogs or other sources of information. Clients and prospects are advised to carefully consider the opinions and analysis offered in the blogs or other information sources in the context of the client or prospect’s individual analysis and decision making. None of the blogs or other sources of information is to be considered as constituting a track record. Past performance is no guarantee of future results and FOREXLIVE™ specifically advises clients and prospects to carefully review all claims and representations made by advisors, bloggers, money managers and system vendors before investing any funds or opening an account with any Forex dealer. Any news, opinions, research, data, or other information contained within this website is provided as general market commentary and does not constitute investment or trading advice. FOREXLIVE™ expressly disclaims any liability for any lost principal or profits without limitation which may arise directly or indirectly from the use of or reliance on such information. As with all such advisory services, past results are never a guarantee of future results.

Full Article

Fed’s Barkin: Forward guidance will be powerful as economy comes back

76027 September 30, 2020 21:02 FXStreet Market News

The Federal Reserve’s forward guidance will be “particularly powerful” as the economy comes back, Richmond Federal Reserve President Thomas Barkin said on Wednesday, as reported by Reuters.

Additional takeaways

“Real challenge now is getting the last 5% of unemployed workers back into jobs.”

“Banks still seem pretty healthy.”

“Fed decisions on banks buybacks and dividends should be on a bank-by-bank basis.”

“Not seeing excessive leverage in the economy yet.”

“Inequality driven by 30-40 year trends, worried that lower-income workers displaced during the current crisis will be hard-pressed to find their next job.”

Market reaction

The US Dollar Index largely ignored these comments and was last seen gaining 0.15% on the day at 94.02.

Full ArticleEUR/USD Forecast: Demand eases amid worsening sentiment

76025 September 30, 2020 21:02 FXStreet Market News

EUR/USD Current Price: 1.1713

- A dismal market mood has helped the greenback throughout the first half of the day.

- US data was slightly encouraging, but speculative interest ignored it.

- EUR/USD has eased from its weekly high, bears remain side-lined.

The EUR/USD pair hit a weekly high of 1.1754 at the beginning of the day, as the greenback remained under selling pressure ahead of the US presidential debate. The market´s sentiment deteriorated further after the event, leading to some modest dollar’s gains. The mentioned debate provided nothing of substance for financial markets, except that US President Trump refused to say that he would accept the election results, which dented further the market’s mood.

The pair retreated from the mentioned high, to trade around the 1.1700 level ahead of US data, and following the release of German macroeconomic figures. Retail Sales in the country were up by 3.1% in the month, better than anticipated, while the unemployment rate improved to 6.3% in September.

The US released the ADP survey, which showed that the private sector added 749K new jobs in September, beating the market’s expectations of 650K. The country also published the final reading of Q2 GDP, which resulted in -31.4% slightly better than the previous estimate of -31.7%. US figures had a limited impact on the pair, although equities ticked higher with the news.

EUR/USD short-term technical outlook

The EUR/USD pair is trading around the 38.2% retracement of its latest daily decline, after failing to surpass the 50% retracement of the same slump. The 4-hour chart shows that the pair is losing its bearish strength, but also that selling interest is limited. A bullish 20 SMA now converges with the 23.6% retracement of the mentioned decline in the 1.1670 price zone, while a bearish 100 SMA reinforces the 61.8% retracement at 1.1770. Technical indicators eased from their highs, but remain well into positive levels.

Support levels: 1.1670 1.1625 1.1590

Resistance levels: 1.1725 1.1770 1.1810

View Live Chart for the EUR/USD

Full ArticleECB’s Villeroy: Tracking broader set of variables could help ECB reconcile secondary objectives

76024 September 30, 2020 21:02 FXStreet Market News

“Our inflation objective, being symmetric and medium-term, -– if credibly, I stress credibly, symmetric and medium-term –- would probably achieve similar outcomes ex-post to flexible average inflation targeting,” argued European Central Bank (ECB) Governing Council member François Villeroy de Galhau on Wednesday, as reported by Reuters.

Tracking a broader set of variables, assets of financial institutions and nominal GDP, could help the ECB reconcile its secondary objectives with the primary mandate, Villeroy further added.

Market reaction

The EUR/USD pair largely ignored these comments and was last seen losing 0.22% on the day at 1.1716.

Full ArticleUnited States Gross Domestic Product Annualized above forecasts (-31.7%) in 2Q: Actual (-31.4%)

76023 September 30, 2020 20:49 FXStreet Market News

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer.

Trading foreign exchange on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial advisor if you have any doubts.

Opinions expressed at FXStreet are those of the individual authors and do not necessarily represent the opinion of FXStreet or its management. FXStreet has not verified the accuracy or basis-in-fact of any claim or statement made by any independent author: errors and Omissions may occur.Any opinions, news, research, analyses, prices or other information contained on this website, by FXStreet, its employees, partners or contributors, is provided as general market commentary and does not constitute investment advice. FXStreet will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Full ArticleCanada Gross Domestic Product (MoM) meets forecasts (3%) in July

76022 September 30, 2020 20:49 FXStreet Market News

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer.

Trading foreign exchange on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial advisor if you have any doubts.

Opinions expressed at FXStreet are those of the individual authors and do not necessarily represent the opinion of FXStreet or its management. FXStreet has not verified the accuracy or basis-in-fact of any claim or statement made by any independent author: errors and Omissions may occur.Any opinions, news, research, analyses, prices or other information contained on this website, by FXStreet, its employees, partners or contributors, is provided as general market commentary and does not constitute investment advice. FXStreet will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Full ArticleCanada Raw Material Price Index up to 3.2% in August from previous 3%

76021 September 30, 2020 20:49 FXStreet Market News

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer.

Trading foreign exchange on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial advisor if you have any doubts.

Opinions expressed at FXStreet are those of the individual authors and do not necessarily represent the opinion of FXStreet or its management. FXStreet has not verified the accuracy or basis-in-fact of any claim or statement made by any independent author: errors and Omissions may occur.Any opinions, news, research, analyses, prices or other information contained on this website, by FXStreet, its employees, partners or contributors, is provided as general market commentary and does not constitute investment advice. FXStreet will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Full ArticleCanada Industrial Product Price (MoM): 0.3% (August) vs previous 0.7%

76020 September 30, 2020 20:49 FXStreet Market News

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer.

Trading foreign exchange on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial advisor if you have any doubts.

Opinions expressed at FXStreet are those of the individual authors and do not necessarily represent the opinion of FXStreet or its management. FXStreet has not verified the accuracy or basis-in-fact of any claim or statement made by any independent author: errors and Omissions may occur.Any opinions, news, research, analyses, prices or other information contained on this website, by FXStreet, its employees, partners or contributors, is provided as general market commentary and does not constitute investment advice. FXStreet will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Full ArticleCanada: Real GDP grew by 3% in July as expected

76019 September 30, 2020 20:45 FXStreet Market News

- Canadian economy grew by 3% in July as expected.

- USD/CAD posts modest daily losses below 1.3400 after the data.

Following a 6.5% expansion in June, the economic activity in Canada, as measured by the real Gross Domestic Product (GDP), grew by 3% in July, the data published by Statistics Canada showed on Wednesday. This reading matched the market expectation.

Market reaction

The USD/CAD pair edged slightly lower after the data and was last seen losing 0.05% on the day at 1.3380.

Additional takeaways from the press release

“The third consecutive monthly gain continued to offset the steepest drops experienced by Canadian economic activity in March and April, however, overall economic activity was still about 6% below February’s pre-pandemic level.”

“Preliminary information indicates an approximate 1% increase in real GDP for August.”

“Overall, the economic recovery continued its course but at a more moderate pace than what was observed for the months of May to July.”

Full Article

-637370674288541374.png)

-637370674418853596.png)