Articles

Japan CFTC JPY NC Net Positions fell from previous ¥50K to ¥45K

108723 January 30, 2021 04:56 FXStreet Market News

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer.

Trading foreign exchange on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial advisor if you have any doubts.

Opinions expressed at FXStreet are those of the individual authors and do not necessarily represent the opinion of FXStreet or its management. FXStreet has not verified the accuracy or basis-in-fact of any claim or statement made by any independent author: errors and Omissions may occur.Any opinions, news, research, analyses, prices or other information contained on this website, by FXStreet, its employees, partners or contributors, is provided as general market commentary and does not constitute investment advice. FXStreet will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Full ArticleUnited Kingdom CFTC GBP NC Net Positions fell from previous £13.7K to £8K

108722 January 30, 2021 04:56 FXStreet Market News

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer.

Trading foreign exchange on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial advisor if you have any doubts.

Opinions expressed at FXStreet are those of the individual authors and do not necessarily represent the opinion of FXStreet or its management. FXStreet has not verified the accuracy or basis-in-fact of any claim or statement made by any independent author: errors and Omissions may occur.Any opinions, news, research, analyses, prices or other information contained on this website, by FXStreet, its employees, partners or contributors, is provided as general market commentary and does not constitute investment advice. FXStreet will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Full ArticleGBP/USD slips back under 1.3700 as week draws to a close

108721 January 30, 2021 04:49 FXStreet Market News

- GBP/USD has slipped back from session highs around 1.3750 and is back under 1.3700.

- Volumes are now dropping off, however, as the weekend approaches.

Liquidity is dropping off and news flow slowing down as a very choppy week draws to a close. GBP/USD is ending the session towards the upper end of this week’s range and has just slipped to the south of the 1.3700 level, back from session highs of closer to 1.3750. For the most part, trade has stuck within a 1.3640ish-1.3750ish range, in fitting with a broadly indecisive tone seen in FX markets.

GBP this week

GBP has actually been one of the better performing G10 currencies on the week, with GBP/USD one of the only G10/USD major pairings to actually be on course to finish the week in the green. A few factors might have contributed to mild GBP outperformance;

1) The UK maintains it large lead over most of its developed market peers in terms of percentage of the population to have received at least one Covid-19 jab, raising the likelihood of a comparatively soon economic reopening drive that might see the UK economy outperform in 2021.

2) The vaccine delivery delays that have thus far plagued the EU are yet to impact the UK (though the EU might be about to make this the UK’s problem by clamping down on exports of Pfizer vaccines from the Belgium factory to the UK).

3) UK infection rates continue to drop, with the latest figures showing infections at 29K, well below the recent peak of close to 70K new confirmed infections per day, boding well for the prospect of a drop off in the daily death toll and reduction in pressure on health care services in early February.

4) Markets continue to wind down their bets that the Bank of England will take interest rates into negative territory.

Driving the day

Month-end flows seemed the dominant force in FX markets on Friday; whilst stocks fell, risk-sensitive currencies NOK, CAD and NZD all managed to make decent gains – Usually these currencies would fall in line with stocks. Meanwhile, despite stock market downside, JPY was the worst hit currency. GBP appeared to largely avoid much by way of any month-end volatility and did not see much action around the time of the final 4pm London Fix of the year.

Full ArticleCFTC Commitments of Traders: Dollar remains short across the board

108720 January 30, 2021 04:40 Forexlive Latest News Market News

Weekly forex futures positioning data from the CFTC for the week ending Tuesday, January 26

- EUR long 163K vs 163K long last week. Unchanged

- GBP long 8K vs 14K long last week. Longs trimmed by 6K

- JPY long 45K vs 50K long last week. Longs trimmed by a 5K

- CHF long 10K vs 9K long last week. Longs increased by 1K

- AUD long 1K vs 5K long last week. Longs trimmed by 4K

- NZD long 15K vs 16K long last week. Longs trimmed by 1K

- CAD long 14K vs 10K long last week. Longs increase by 4K

- Last week’s report

Overall there were small changes in the net currency positions. However the dollar range short/the currencies long across the board.

EUR/USD Weekly Forecast: Central banks and fears halt the advance

108716 January 30, 2021 04:21 FXStreet Market News

- A “vigilant” ECB and a mildly dovish Federal Reserve weighed on investors mood.

- Eyes turn to US employment-related data next week, NFP in the spotlight.

- EUR/USD is technically neutral in the mid-term, bears will have to wait.

The EUR/USD pair has fallen in range this week but finished it above the 1.2100 level. The greenback appreciated on risk aversion generated by turmoil in equities markets. Traders looked beyond US first-tier data, instead focused on the individuals’ investors craze that stole headlines these days.

Gathered on social media, investor pushed some particular equities to unexplored highs. Gamestop and Blackberry are some of the companies that were on focus. Silver also fell in their radar on Thursday, with the metal jumping roughly 6% in the day. Trading apps such as Robinhood halted trading, spurring fears and putting Wall Street in sell-off mode. The sitcom continues, and will likely keep investors on their toes next week.

Pandemic still dictating economic progress

On the pandemic front, the number of new contagions is decreasing in Europe and the US, but they are still high. Vaccines distribution is delayed globally, also fueling the dismal mood, as shortfalls are directly linked to a delay in a possible economic comeback.

Data wise, European figures were generally discouraging. German published the IFO Business Climate, which contracted to 90.1 in January, while the GFK Consumer Confidence Survey resulted at -15.6 in February, much worse than anticipated. Inflation in the country picked up modestly in January, as it printed at 1.0% YoY, according to preliminary estimates. Also, the economy grew 0.1% QoQ in the last quarter of the year, better than anticipated but way below the previous 8.5%.

On the other hand, US data was mostly upbeat. Durable Goods Orders were the only down note, as they rose by a modest 0.2% in January. However, Q4 Gross Domestic Product resulted at 4.0%, beating expectations, while weekly unemployment claims continued shrinking, down to 875K in the week ended January 22.

Still, macroeconomic figures indicate shy economic progress. It seems that investors still believe that growth will return in the second half of the year.

Central bankers are worried

Another critical development this week was central banks hinting on possible interventions. The Bank of Japan and the European Central Bank, both expressed concerns about the exchange rate. ECB’s Government Council member, Klass Knot said that the central bank could decide to cut its deposit rate further below zero if that proved necessary to keep its inflation target in sight, adding that the ECB has tools to counter the EUR’s appreciation if needed, in an interview with Bloomberg TV.

The Federal Reserve announced its latest decision on monetary policy, and as widely estimated, they left rates and bond-buying programs unchanged. The central bank reiterated that the “path of the economy would depend significantly on the course of the virus, including progress on vaccinations,” while adding that the pace of the recovery in economic activity and employment has moderated in recent months. A generally dovish statement maintained markets in risk-off mode.

US employment taking center stage

On Monday, Germany will publish December Retail Sales, while the US will release the January official ISM Manufacturing PMI, foreseen at 60 from 60.7 in the previous month. Later in the week, the EU will publish the preliminary estimate of Q4 GDP, foreseen at -1.8%. The Union will also offer the preliminary estimate of January’s inflation. By the end of the week, the focus will shift to US employment data, as the country will publish on Friday the Nonfarm Payrolls report. The country is expected to have added 85K new jobs in January, after losing 145K positions in December.

EUR/USD technical outlook

The EUR/USD pair has spent the week trading between Fibonacci levels. It found support around the 38.2% retracement of the November/January rally at 1.2060, while sellers defended the 23.6% retracement of the same advance at around 1.2175.

The weekly chart indicates that bulls retain the lead, but are beginning to doubt. Technical indicators eased within positive levels, maintaining their bearish slopes. Moving averages continue to advance well below the current level, with the 20 SMA hovering a handful of pips below the 50% retracement of the mentioned rally at 1.1970.

In the daily chart, the bearish case gains strength. A bearish 20 SMA keeps capping the upside, now converging with a Fibonacci resistance. The Momentum indicator recovered from its recent lows but remain below its 100 line, while the RSI indicator consolidates sub-50.

The mentioned Fibonacci levels are the ones to watch for a directional breakout. 1.2060 and 1.1970 provide support. Beyond the 1.2170/80 area, on the other hand, the pair has room to recover towards the 1.2260 price zone.

EUR/USD sentiment poll

According to the FXStreet Forecast Poll, the sentiment towards the EUR/USD pair is bullish, as those betting for higher levels are a majority in the three time-frame under study. On average, the pair is seen holding above the 1.21 threshold and closer to the 1.2200 level. Follow-through is out of the picture for now.

The Overview chart shows that moving averages are now directionless. Investors are not willing to risk in the current uncertain scenario. Still, and with some exception, the pair is seen holding above the 1.2000 mark for the next few weeks.

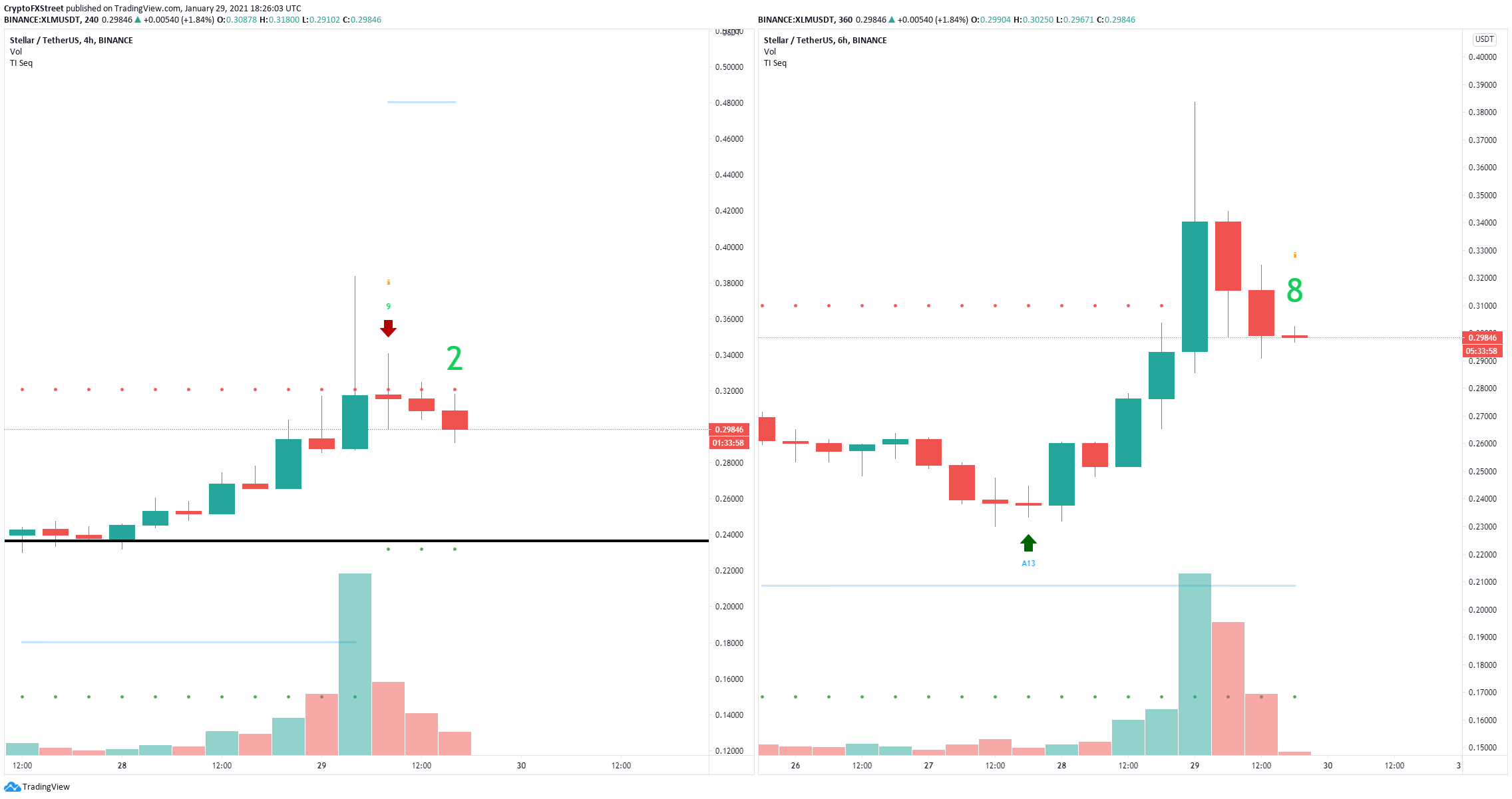

XLM Price Analysis: Stellar massive 30% breakout was stopped abruptly, signaling weakness

108713 January 30, 2021 04:12 FXStreet Market News

- XLM price had a significant 30% breakout above a descending triangle pattern on the 12-hour chart.

- The digital asset topped out at $0.38 before plummeting.

- It seems that the breakout wasn’t as strong as the bulls hoped.

XLM price topped out at $0.411 on January 7 and has been under consolidation since then. After a significant breakout that started on January 28, the digital asset hit $0.383 but quickly dropped towards $0.291.

XLM price could be poised for a deeper fall

After a successful breakout above the resistance trendline at $0.29, XLM price jumped by 30% but saw a massive rejection at $0.383 and dropped to $0.291 within the next 12 hours. This massive dive shows that the breakout, although meeting its target, couldn’t hold at that level.

XLM/USD 12-hour chart

The previous resistance trendline at $0.29 which now coincides with the 50-SMA is a support level. Failure to hold this point will drive XLM price down to $0.235.

XLM sell signals

Additionally, the TD Sequential indicator has presented a sell signal on the 4-hour chart which had a lot of continuation and it’s about to exhibit the same call on the 6-hour chart, adding even more credence to the bearish outlook.

However, despite the significant crash in the past 24 hours, if the bulls can defend $0.29, the price target remains at $0.38 in the long-term.

Full ArticleColombia Interest rate in line with forecasts (1.75%) in January

108712 January 30, 2021 04:02 FXStreet Market News

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer.

Trading foreign exchange on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial advisor if you have any doubts.

Opinions expressed at FXStreet are those of the individual authors and do not necessarily represent the opinion of FXStreet or its management. FXStreet has not verified the accuracy or basis-in-fact of any claim or statement made by any independent author: errors and Omissions may occur.Any opinions, news, research, analyses, prices or other information contained on this website, by FXStreet, its employees, partners or contributors, is provided as general market commentary and does not constitute investment advice. FXStreet will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Full ArticleRobinHood imposes more restrictions on stocks

108711 January 30, 2021 03:49 Forexlive Latest News Market News

Imposes buy limit for a number of meme stocks

Robin Hood is reducing the amount of stock you can buy on a number of the meme stocks from 5 shares to 2 or 1 share.

1 share limit:

- AMC,

- Game stop

- Koss

- Moderna

2 share limit

- Bed Bath and Beyond

- Qualtric

Full Article

Cardano Price Prediction: ADA remains indecisive, but a 30% move is underway

108706 January 30, 2021 03:02 FXStreet Market News

- Cardano price has been under consolidation since January 7.

- The digital asset has formed a 12-hour symmetrical triangle pattern.

- A breakout or breakdown in the next week will most likely drive ADA price by 30%.

Cardano price hasn’t benefited much from the recent Bitcoin pump. The digital asset has been trading in a tightening range and it’s close to bursting. A clear breakout or breakdown can quickly push the digital asset by more than 30%.

Cardano price needs to crack this level to jump towards $0.50

On the 12-hour chart, the symmetrical triangle pattern has formed a resistance trendline at $0.37. A breakout above this point would drive Cardano price by 32% towards a high of $0.50.

ADA/USD 12-hour chart

The In/Out of the Money Around Price (IOMAP) chart shows that the range between $0.35 and $0.36 is the strongest barrier with 2.2 billion ADA in volume. Climbing above this area will easily push Cardano above $0.40.

ADA IOMAP chart

On the other hand, the support trendline at $0.32 must be defended at all costs by the bulls to avoid a massive dive towards $0.21. The IOMAP model suggests that the biggest support area is established between $0.308 and $0.319, coinciding with that support trendline.

Full ArticleS&P 500 drops back to 3700 amid unrelenting stock selling

108705 January 30, 2021 02:35 FXStreet Market News

- The S&P 500 has dropped back to close to the 3700 mark, down around 4% from earlier weekly highs.

- Stocks are being sold amid fears about the ongoing coordinated retail trader attack on Hedge Fund short positions.

The S&P 500 slipped all the way back to below the 3700 on Friday, down roughly 2.5% at lows, though having managed to climb back above the big figure in recent trade. At lows, the index was down well over 4% from the all-time high levels of nearly 3870 hit earlier in the week. No sectors have managed to escape the selling.

Driving the day

It is difficult to pinpoint what the main driver of equity market downside has been on Friday. A culmination of concerns over the impact of vaccine delays and the spread of new Covid-19 strains, combined with ongoing angst about the potential fallout from the ongoing surge in retail trader interest in bidding up highly shorted small-cap stocks such as GameStop, Koss and more, seems the most likely explanation.

Note that Johnson & Johnson released their final vaccine trial results, which seems not to impact risk appetite too much at the time. Whilst the headline efficacy of the vaccine was not as high as the Pfizer or Moderna vaccines (average of 66% efficacy globally), and showed somewhat disappointing efficacy against the South African strain of Covid-19, the vaccine was 85% effective in preventing severe disease across all global testing regions. JNJ shares have dropped by nearly 5%, perhaps as a result of the lower than hoped for efficacy. Indeed, disappointment in the JNJ result might be weighing on the market more broadly.

Still, the vaccine is only one shot, it ought to further accelerate global vaccination efforts, and comes off the back of positive Novavax trial data released on Thursday after the US close. Given past experience (i.e. the market reaction to positive Pfizer and AstraZeneca vaccine news), one would have expected stocks to rally in wake of two promising vaccine candidates emerging, but clearly this has not been the case.

Vaccine delays which appear to be affecting the EU particularly badly and fears about insufficient vaccine efficacy against newer variants of Covid-19 (such as the South African variant) seem to have neutralised or even straight-up outweighed any optimism there might have been about the two latest vaccine data releases.

Amid what seems to have been a worse than expected end to 2020 and start to 2021 in terms of global economic activity amid a worse than expected resurgence in the virus in major developed markets, investors had already been downgrading their outlooks for global growth in 2021. The latest news on vaccines and Covid-19 strains will not help these forecasts.

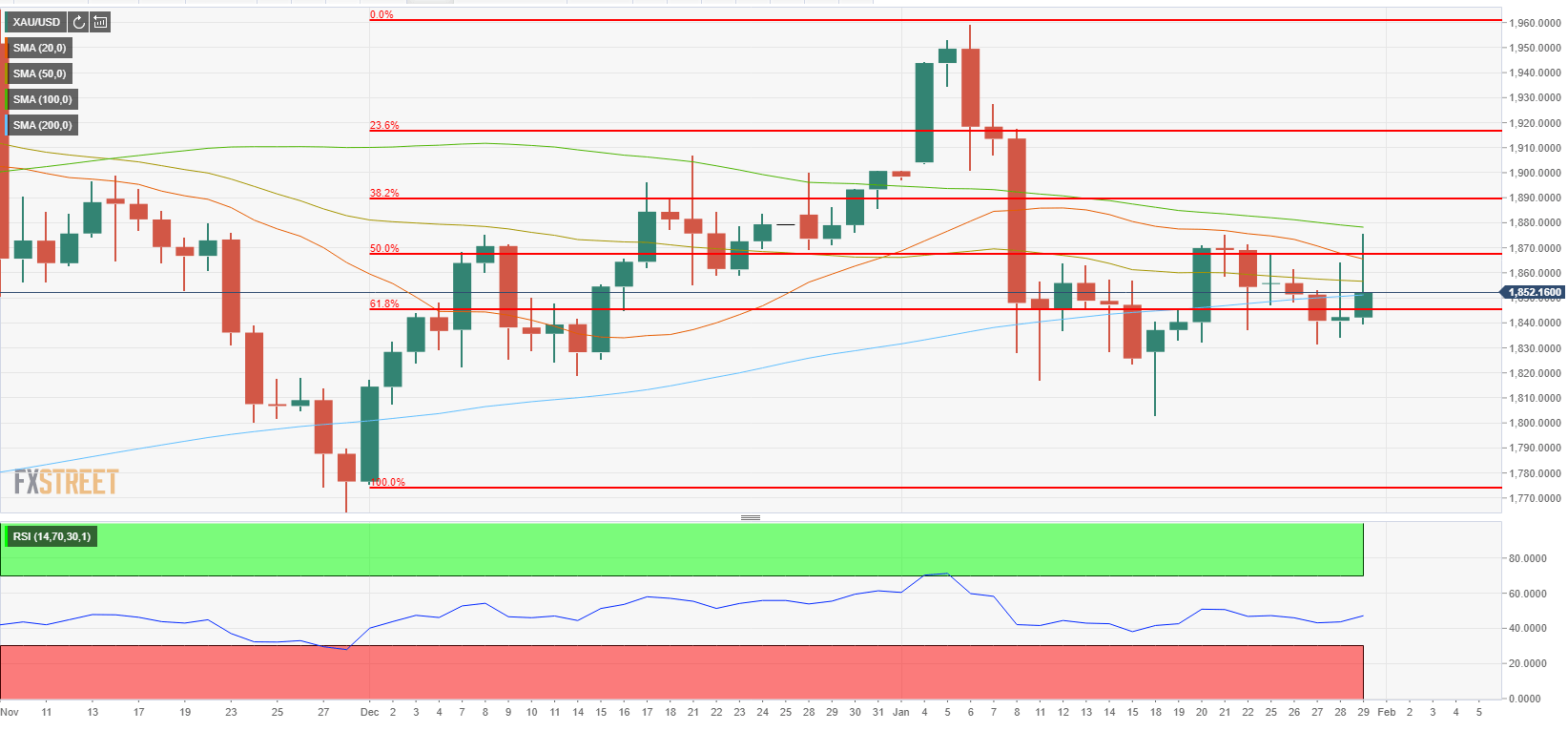

Full ArticleGold Weekly Forecast: XAU/USD looks to capitalize on safe-haven flows amid Wall Street chaos

108701 January 30, 2021 02:17 FXStreet Market News

- XAU/USD finished week little changed despite broad USD strength.

- Gold could edge higher if it continues to hold above 200-day SMA.

- Wall Street chaos could help gold reclaim its safe-haven status.

After gaining more than 1% in the previous week, the XAU/USD pair struggled to preserve its bullish momentum and edged lower during the first half of the week. Although the pair staged a rebound and rose above $1,860 on Thursday from the weekly low it set at $1,831 on Wednesday, it couldn’t close the day in the positive territory. With buyers remaining in control on Friday, the pair closed the week virtually flat slightly above $1,850.

What happened last week

On Monday, the disappointing IFO sentiment data from Germany weighed on the market sentiment and allowed the greenback to start the week on a firm footing. On Tuesday, the better-than-expected Conference Board Consumer Confidence Index reading in the US and some strong quarterly earnings figures from key firms helped risk flows return to markets but failed to pave the way for a convincing rebound in XAU/USD.

On Wednesday, a Bloomberg report claiming that the European Central Bank (ECB) officials were uncomfortable about markets underestimating the usage of a rate cut as a policy tool triggered a sharp drop in the EUR/USD pair and provided an additional boost to the USD. The broad-based greenback strength dragged XAU/USD to $1,831 mid-week. Meanwhile, FOMC Chairman Jerome Powell refrained from delivering any surprising remarks on the policy outlook after the US Federal Reserve left its policy rate unchanged as anticipated.

On Thursday, the US Bureau of Economic Analysis advance estimate showed that the real Gross Domestic Product (GDP) expanded by 4% on a yearly basis in the fourth quarter as expected. On a positive note, the weekly Initial Jobless Claims declined by 67,000 to 847,000 in the week ending January 23.

Finally, the last data releases of the week from the US revealed that Personal Income increased by 0.6% in December but Personal Spending fell by 0.2% in the same period.

On coronavirus-related headlines, Johnson & Johnson announced on Friday that its coronavirus vaccine was 66% effective in the global trial.

Despite the short-term impact of those key data releases on risk perception and the USD’s market valuation, the chaos in Wall Street became the primary driver of financial markets throughout the week.

Day traders used social media platforms to organize a mass movement to buy several stocks, most notably GameStop and AMC Entertainment Holdings, that were widely known to be shorted by large hedge funds in the US. The unprecedented upsurge witnessed in those stocks caused large investment firms to suffer heavy losses and triggered a flight-to-safety in the financial markets on Wednesday, lifting the USD and dragging XAU/USD.

On Thursday, several brokers, which were used to purchase those shares, restricted trading and Wall Street’s main indexes closed higher amid a relief rally. Nevertheless, a huge backlash followed this development and US stocks finished the week on the back foot. Gold, on the other hand, gave signals that it started to recapture its safe-haven status with the XAU/USD pair posting strong gains on Friday.

Next week

At the start of the week, the Manufacturing PMI data from China, Germany and the US will be looked upon for fresh impetus. The business activity in those major economies’ manufacturing sectors are expected to continue to expand into the new year and the market reaction is likely to remain limited. Additionally, Germany’s Destatis will publish December Retail Sales data on Monday.

On Wednesday, the ADP Employment Change data will be featured in the US economic docket ahead of Friday’s critical Nonfarm Payrolls (NFP) report. The market consensus points out to an increase of 85K in NFP in January. A gloomy labour market report could assist the USD to attract investors.

More importantly, investors will keep a close eye on the performance of major equity indexes in the US. A panic selloff in US stocks amid heightened concerns over a market bubble could lift gold higher as seen at the start of the coronavirus crisis.

Gold technical outlook

Following Friday’s climb, the Relative Strength Index (RSI) indicator on the daily chart rose above 50, confirming that buyers continue to show interest in gold. However, the sharp retreat from the 100-day SMA, currently located at $1,878, suggests that sellers continue to defend this level. XAU/USD could have a difficult time pushing higher unless it manages to make a daily close above that hurdle.

Ahead of $1,878, $1,870 (Fibonacci 50% retracement of December rally) aligns as an interim resistance. Above $1,878, $1,890 (Fibonacci 38.2% retracement) could be set as the next target.

On the downside, the 200-day SMA seems to have formed key support at $1,851. If XAU/USD drops below that level, buyers could look to defend $1,845 (Fibonacci 6.8% retracement) before the price can test $1,831 (Jan. 27 low).

Gold sentiment poll

The slight positive shift seen in the technical outlook is also reflected in the FXStreet Forecast Poll, which shows that 67% of experts are bullish with an average target of $1,868 on a one-week view. The one-month view paints a more mixed picture with 60% bearishness and a price target of $1,854.

Full Article