Articles

United States Initial Jobless Claims above expectations (335K) in September 24: Actual (362K)

172673 September 30, 2021 20:40 FXStreet Market News

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

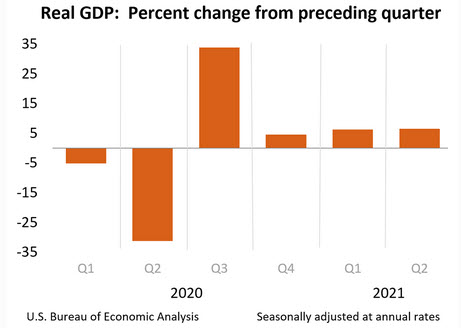

US Q2 GDP (third reading) 6.7% vs 6.6% expected

172671 September 30, 2021 20:35 Forexlive Latest News Market News

The final look at second quarter GDP

- The advance reading on Q2 was 6.5%

- The second reading was 6.6%

- Q1 was 6.4% annualized

- 2020 GDP was -3.4%

- Personal consumption +% vs +11.9% second reading

- GDP price index +6.2% vs +6.1% second reading

- Core PCE +6.1% vs +6.1% expected

- GDP final sales +8.1% vs +7.9% second reading

The first look at Q3 GDP will be released at the end of October. We get the latest PCE data tomorrow.

- Inventories cut 1.26 pp from GDP vs -1.30 pp in second reading

- Inventories cut -2.62 pp in Q1

- Business investment 9.2% vs 9.3% second reading

- Business investment in equipment +11.6% vs +13.0% advance

- Exports +7.6% vs +6.6% second reading

- Imports +7.1% vs +6.7% second reading

- Trade was a 0.24 pp drag vs -0.44 pp in advance report

- Home investment -11.5% vs -9.8% advance

- Consumer spending on durables +11.3% vs +9.9% advance

- Personal consumption to pp GDP added 7.92 pp to GDP

- Government spending cut 0.36 pp vs -0.33 pp in second reading

- Full report

Full Article

United States Gross Domestic Product Annualized came in at 6.7%, above forecasts (6.6%) in 2Q

172670 September 30, 2021 20:35 FXStreet Market News

United States Continuing Jobless Claims registered at 2.802M above expectations (2.8M) in September 17

172669 September 30, 2021 20:35 FXStreet Market News

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

US initial jobs claims 362K versus 333K estimate

172668 September 30, 2021 20:33 Forexlive Latest News Market News

HIGH RISK WARNING: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives, experience level, and risk tolerance. You could lose some or all of your initial investment; do not invest money that you cannot afford to lose. Educate yourself on the risks associated with foreign exchange trading, and seek advice from an independent financial or tax advisor if you have any questions.

ADVISORY WARNING: FOREXLIVE™ provides references and links to selected blogs and other sources of economic and market information as an educational service to its clients and prospects and does not endorse the opinions or recommendations of the blogs or other sources of information. Clients and prospects are advised to carefully consider the opinions and analysis offered in the blogs or other information sources in the context of the client or prospect’s individual analysis and decision making. None of the blogs or other sources of information is to be considered as constituting a track record. Past performance is no guarantee of future results and FOREXLIVE™ specifically advises clients and prospects to carefully review all claims and representations made by advisors, bloggers, money managers and system vendors before investing any funds or opening an account with any Forex dealer. Any news, opinions, research, data, or other information contained within this website is provided as general market commentary and does not constitute investment or trading advice. FOREXLIVE™ expressly disclaims any liability for any lost principal or profits without limitation which may arise directly or indirectly from the use of or reliance on such information. As with all such advisory services, past results are never a guarantee of future results.

Full Article

United States Gross Domestic Product Price Index registered at 6.2% above expectations (6.1%) in 2Q

172667 September 30, 2021 20:33 FXStreet Market News

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

US Dollar Index Price Analysis: Next on the upside comes 94.74

172666 September 30, 2021 20:33 FXStreet Market News

- DXY clinched new 2021 highs around 94.50 on Thursday.

- Further north comes the 94.74 level (September 2020 high).

The rally in DXY stays everything but abated and now extends gains to 94.50, the highest level since September 2020.

If the buying impulse maintains the pace, then the next target of note is seen emerging at the September 2020 high at 94.74 ahead of the round level at 95.00 the figure.

Extra gains remain likely while above August’s peak at 93.72. although a corrective move should not be ruled out, as per the current overbought condition of the index.

DXY daily chart

Full ArticleGermany Consumer Price Index (YoY) registered at 4.1%, below expectations (4.2%) in September

172665 September 30, 2021 20:29 FXStreet Market News

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Brazil Unemployment Rate registered at 13.7%, below expectations (13.9%) in July

172664 September 30, 2021 20:29 FXStreet Market News

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

South Africa Trade Balance (in Rands) came in at 42.4B, above expectations (39B) in August

172663 September 30, 2021 20:26 FXStreet Market News

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Germany Harmonized Index of Consumer Prices (YoY) above expectations (4%) in September: Actual (4.1%)

172662 September 30, 2021 20:26 FXStreet Market News

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

USD/CAD Price Analysis: Bounces off lows, down little below mid-1.2700s

172661 September 30, 2021 20:21 FXStreet Market News

- USD/CAD edged lower on Thursday, albeit lacked any strong follow-through selling.

- Weaker oil prices undermined the loonie and extended support amid bullish USD.

- A sustained move beyond the 1.2770-75 area will set the stage for further gains.

The USD/CAD pair witnessed some selling on Thursday and eroded a part of the previous day’s gains to weekly tops. The pair remained on the defensive through the mid-European session, albeit has managed to recover a major part of the early lost ground and was last seen trading around the 1.2740-35 region.

The US dollar was seen consolidating its recent rally to the highest level since September 2020 and was seen as a key factor that acted as a tailwind for the USD/CAD pair. That said, prospects for an early policy tightening by the Fed helped limit any deeper losses for the greenback. Apart from this, a softer tone around crude oil prices undermined the commodity-linked loonie and extended some support to the major.

From a technical perspective, the USD/CAD pair stalled this week’s bounce from sub-1.2600 levels near the 1.2770-75 region, just ahead of the 61.8% Fibonacci level of the 1.2896-1.1.2594 pullback. The intraday pullback, however, showed some resilience below the 200-hour SMA and found a decent support near the 38.2% Fibo. level. The mentioned resistance and support levels should now act as a pivotal point for intraday traders.

Meanwhile, technical indicators on daily/4-hour charts maintained their bullish bias and are still far from being in the overbought territory. Moreover, oscillators on the 1-hour chart have again started gaining positive traction and support prospects for a further near-term appreciating move. However, bulls are likely to wait for some follow-through buying beyond the 61.8% Fibo. level before placing aggressive bets.

The USD/CAD pair might then aim to surpass the 1.2800 mark and accelerate the momentum towards the next relevant hurdle near the 1.2830 horizontal support. Some follow-through buying has the potential to lift the pair further to the 1.2900 mark and allow bulls to challenge YTD tops, around mid-1.2900s touched on August 20.

On the flip side, the 1.2705-1.2700 area (38.2% Fibo. level) now seems to protect the immediate downside ahead of the 23.6% Fibo. level, around the 1.2670-65 region. Failure to defend the mentioned support levels will negate the bullish bias and turn the USD/CAD pair vulnerable to slide back towards the 1.2600 mark.