Articles

Wednesday 26th November 2025: Asian Markets Rally on Fed Cut Optimism and Strong Global Cues

423898 November 26, 2025 16:14 ICMarkets Market News

Global Markets:

- Asian Stock Markets : Nikkei up 2.08%, Shanghai Composite up 0.14%, Hang Seng up 0.47% ASX up 0.92%

- Commodities : Gold at $4,200.80 (0.86%), Silver at $51.695 (1.19%), Brent Oil at $62.04 (0.39%), WTI Oil at $58.18 (0.13%)

- Rates : US 10-year yield at 4.005, UK 10-year yield at 4.4960, Germany 10-year yield at 2.6728

News & Data:

- (USD) Core PPI m/m 0.1% to 0.2% expected

- (USD) PPI m/m 0.3% to 0.3% expected

- (USD) Core Retail Sales m/m 0.3% to 0.3% expected

- (USD) Retail Sales m/m 0.2% to 0.4% expected

Markets Update:

Asian stock markets are trading sharply higher on Wednesday, extending Tuesday’s gains and taking strong cues from Wall Street. Renewed optimism about a possible US Federal Reserve rate cut in December—driven by softer US economic data and dovish remarks from Fed officials—has boosted sentiment across the region. Reports showed a steep drop in US consumer confidence for November and weaker-than-expected retail sales growth for September. According to CME Group’s FedWatch Tool, the probability of a quarter-point rate cut next month has surged to 82.7 percent from 50.1 percent a week earlier.

Australian shares are significantly higher, with the S&P/ASX 200 climbing above 8,600, supported by broad gains led by technology stocks, while gold miners lag. Major miners like Rio Tinto, BHP, and Fortescue are advancing, and tech names such as Block, Zip, and Appen are also posting strong gains. Banks are trading firmer as well. However, gold miners are mostly weak. In economic data, total construction work in Australia fell 0.7 percent in Q3, missing expectations.

Japan’s Nikkei 225 is surging more than 2 percent to above 49,600, with strong gains across exporters, financials, and tech firms. Major names including SoftBank, Panasonic, Sony, and major banks are all advancing.

Elsewhere in Asia, South Korea, Taiwan, Hong Kong, Singapore, and others are also higher. Wall Street finished strongly overnight, while European markets are also trading in positive territory. Crude oil prices, however, slipped on renewed Russia-Ukraine peace signals.

Upcoming Events:

- 01:30 PM GMT – USD Unemployment Claims

- 01:30 PM GMT – USD Core Durable Goods Orders m/m

- 01:30 PM GMT – USD Durable Goods Orders m/m

The post Wednesday 26th November 2025: Asian Markets Rally on Fed Cut Optimism and Strong Global Cues first appeared on IC Markets | Official Blog.

IC Markets Global – Europe Fundamental Forecast | 26 November 2025

423897 November 26, 2025 16:14 ICMarkets Market News

IC Markets Global – Europe Fundamental Forecast | 26 November 2025

What happened in the Asia session?

The Asia session was dominated by the divergence between Australian and New Zealand monetary policy expectations. Australia’s sticky inflation data reinforces the RBA’s cautious stance, while New Zealand’s slowing economy continues to warrant further RBNZ easing. The AUD/NZD cross benefited from this policy divergence, with potential for further upside if the RBNZ signals more cuts ahead. Global risk sentiment remained supported by increased confidence in a December Fed rate cut following dovish comments from Fed Governor Waller and San Francisco Fed’s Daly.

What does it mean for the Europe & US sessions?

With the US Thanksgiving holiday on Thursday and early market close on Friday, liquidity will thin considerably. Today represents the last full trading day with both European and US markets open simultaneously this week. Position sizing should account for potentially amplified moves in thin conditions. The outgoing interim governor’s press conference will provide final guidance before Anna Bremen takes over on December 1.

The Dollar Index (DXY)

Key news events today

Unemployment Claims (1:30 pm GMT)

Core Durable Goods Orders m/m (1:30 pm GMT)

Durable Goods Orders m/m (1:30 pm GMT)

CB Consumer Confidence (Tentative)

What can we expect from DXY today?

The US dollar is under pressure today, falling approximately 0.5% to trade near 99.75-99.80 on the Dollar Index (DXY) after a series of disappointing US economic data on Tuesday cemented expectations for a December Federal Reserve rate cut. Markets are now pricing in an 83% probability of a 25 basis point rate reduction at the December 9-10 FOMC meeting, up sharply from around 50% just a week ago. Today’s session features critical releases including US jobless claims, durable goods orders, and the Fed Beige Book, alongside major central bank decisions from the RBNZ and the UK Autumn Budget.

Central Bank Notes:

- The Federal Open Market Committee (FOMC) voted, by majority, to lower the federal funds rate target range by 25 basis points to 3.75% — 4.00% at its October 28–29, 2025, meeting, marking the second consecutive cut following the 25 basis points reduction in September.

- The Committee maintained its long-term objectives of maximum employment and 2% inflation, noting that the labor market continues to soften, with modest job creation and an unemployment rate edging higher. In comparison, inflation remains above target at around 3.0%.

- Policymakers highlighted ongoing downside risks to economic growth, tempered by signs of resilient economic activity. September’s consumer price index (CPI) came in slightly lower than expected at 3.0% year-over-year, easing inflation pressure but still warranting vigilance given tariff-driven price effects.

- Economic activity expanded modestly in the third quarter, with GDP growth estimates around 1.0% annualized; however, uncertainty remains elevated amid persistent global trade tensions and the U.S. government shutdown, which is impacting data availability.

- The updated Summary of Economic Projections anticipates an unemployment rate averaging approximately 4.5% for 2025, with headline and core personal consumption expenditures (PCE) inflation projections remaining near 3.0%, indicating a slow easing path ahead.

- The Committee emphasized its flexible, data-dependent approach and underscored that future policy adjustments will be guided by incoming labor market and inflation data. As in prior meetings, there was dissent, including one member advocating a more aggressive 50-basis-point cut.

- The FOMC announced the planned conclusion of its balance sheet reduction (quantitative tightening) program, intending to cease runoff in the near term to maintain market stability. Treasury redemption caps will remain steady at $5 billion per month, and agency mortgage-backed securities caps will remain at $35 billion.

- The next meeting is scheduled for 9 to 10 December 2025.

Next 24 Hours Bias

Weak Bullish

Gold (XAU)

Key news events today

Unemployment Claims (1:30 pm GMT)

Core Durable Goods Orders m/m (1:30 pm GMT)

Durable Goods Orders m/m (1:30 pm GMT)

CB Consumer Confidence (Tentative)

What can we expect from Gold today?

Gold enters Wednesday holding firm around $4,130–$4,140, supported by surging Fed rate cut expectations (now above 80% for December), weaker U.S. economic data, and ongoing geopolitical uncertainty surrounding the Russia-Ukraine conflict. Today’s U.S. durable goods orders and jobless claims data will be critical in shaping near-term price direction, with stronger-than-expected readings potentially capping gains while soft data could push gold toward the $4,155–$4,200 resistance zone.

Next 24 Hours Bias

Medium Bullish

The Euro (EUR)

Key news events today

ECB Financial Stability Review (9:00 am GMT)

ECB President Lagarde Speaks (5:00 am GMT)

Autumn Forecast Statement (12:30 pm GMT)

What can we expect from EUR today?

The Euro faces a mixed environment today: supportive factors include steady ECB policy, stable inflation near target, resilient services sector growth, and upgraded growth forecasts. Headwinds include manufacturing weakness, global trade uncertainty, and a relatively firm US dollar. Traders will closely watch Lagarde’s speech and the Financial Stability Review for any shifts in ECB guidance or risk assessment that could move the currency.

Central Bank Notes:

- The Governing Council of the ECB kept the three key interest rates unchanged at its 30 October 2025 meeting. The main refinancing rate remains at 2.15%, the marginal lending facility at 2.40%, and the deposit facility at 2.00%. This decision reflects policymakers’ assessment that the current monetary stance remains consistent with medium-term price stability, while incoming data confirm a gradual return of inflation towards the target.

- Recent indicators point to stable price dynamics. Headline inflation remains near the 2% mark, with energy prices contained and food inflation easing slightly after earlier supply bottlenecks. Wage growth continues to moderate, contributing to the slowdown in domestic cost pressures. The ECB reiterated its commitment to a data-driven, meeting-by-meeting approach and emphasized flexibility amid uncertain global financial conditions.

- Eurosystem staff projections have not been materially altered since September. Headline inflation averages remain at 2.0% for 2025, 1.8% for 2026, and 2.0% for 2027. Recent softening in producer prices and subdued pipeline pressures suggest limited upside risks to inflation, though geopolitical tensions and potential commodity shocks continue to pose uncertainties to the outlook.

- Euro area GDP growth remains on track with earlier forecasts, projected at 1.1% for 2025, 1.1% for 2026, and 1.4% for 2027. Forward-looking indicators, including PMIs and industrial sentiment surveys, signal some stabilization in activity following weakness in the third quarter. Public investment and recovering export activity are expected to offset softer private sector demand in the near term.

- The labor market remains resilient, with unemployment rates at multi-decade lows and participation rates strong. Real income growth continues to support household spending, even as consumption growth normalizes from earlier highs. Financing conditions remain favorable, aided by stable banking sector liquidity and improved credit demand among small and medium-sized firms.

- Business sentiment remains mixed, reflecting lingering uncertainty over global trade policy and the path of US tariffs. However, easing supply chain costs and improved export competitiveness due to softer exchange rates are providing some relief to manufacturing and external-oriented sectors.

- The Governing Council reaffirmed that future decisions will depend on an integrated assessment of incoming data—covering inflation trends, financial conditions, and the state of policy transmission. The Council emphasized that no pre-set path for rates exists; keeping all options open should the economic outlook shift markedly.

- Balance sheet reduction continues smoothly, with holdings under the APP and PEPP declining as reinvestments have ceased. The ECB confirmed that the pace of portfolio runoff remains in line with its previously communicated normalization plan, supporting a gradual withdrawal of monetary accommodation in a predictable manner.

- The next meeting is on 17 to 18 December 2025

Next 24 Hours Bias

Weak Bearish

The Swiss Franc (CHF)

Key news events today

No major news event

What can we expect from CHF today?

The Swiss franc enters today’s session in a consolidating mode, with no major Swiss economic data releases scheduled. Market participants will focus on broader risk sentiment and developments from the US economic calendar, including unemployment claims and durable goods orders that may influence USD/CHF direction[attached image]. The RBNZ rate decision overnight and ECB President Lagarde’s speech later today could also indirectly impact CHF through euro cross-rate dynamics.

Central Bank Notes:

- The SNB maintained its key policy rate at 0% during its meeting on 25 September 2025, pausing a sequence of six consecutive rate cuts as inflation stabilized and the Swiss franc remained firm.

- Recent data showed a modest rebound in inflation, with Swiss consumer prices rising 0.2% year-on-year in August after staying above zero for three consecutive months; this helped alleviate fears of deflation that were mounting earlier in the year.

- The conditional inflation forecast remains broadly unchanged from June: headline inflation is expected to average 0.2% in 2025, 0.5% in 2026, and 0.7% in 2027. The risk of a negative rate move has diminished for now, but the SNB retains flexibility should inflationary pressures weaken again.

- The global economic outlook has deteriorated further, weighed down by heightened trade tensions—especially with the U.S.—and ongoing uncertainty in key Swiss export markets.

- Swiss GDP growth moderated in Q2 after a strong Q1 boosted by front-loaded U.S. exports. The SNB expects growth to slow and remain subdued, with forecasted GDP expansion between 1% and 1.5% in both 2025 and 2026.

- Labor market sentiment in the Swiss industrial sector has softened on concerns over export competitiveness and potential adjustments to production, but the overall growth outlook stays broadly unchanged

- The SNB reiterated its readiness to respond as needed if deflation risks re-emerge, emphasizing its commitment to medium-term price stability and a robust, transparent communication policy, with the introduction of more detailed monetary policy minutes beginning in October.

- The next meeting is on 11 December 2025.

Next 24 Hours Bias

Weak Bearish

The Pound (GBP)

Key news events today

No major news event

What can we expect from GBP today?

The British pound faces a pivotal day with Chancellor Rachel Reeves delivering the Autumn Budget amid challenging economic conditions. Sterling is trading around 1.3100-1.3180 against the US dollar and near 1.1375 against the euro, with traders heavily positioned for downside through options markets.

The budget must address a £20-30 billion fiscal hole through tax increases while maintaining credibility with bond markets. UK inflation has cooled to 3.6% in October, raising expectations for an 80% probability of a Bank of England rate cut in December.

Central Bank Notes:

- The Bank of England’s Monetary Policy Committee (MPC) met on 6 November 2025 and voted by a majority of 7–2 to keep the Bank Rate unchanged at 4.00 percent for a second consecutive meeting. The decision reflects the Committee’s cautious approach as inflation remains above target, but underlying economic momentum continues to weaken. Two members maintained their votes for a 25-basis-point cut, citing further signs of labor-market softening and weak business sentiment.

- The BOE adjusted its guidance on quantitative tightening (QT), maintaining the reduced pace established in September. The planned reduction of UK government bond holdings remains at £67.5 billion over the next 12 months, leaving the current gilt balance near £550 billion. Policymakers described the recalibrated QT path as “appropriate for current market conditions,” emphasizing the importance of liquidity management amid heightened volatility.

- Headline inflation moderated slightly to 3.6 percent in October from 3.8 percent previously, driven by easing food and transport prices. However, core inflation has shown only gradual progress, holding near 3.9 percent. The MPC noted that services inflation and administered energy costs continue to exert pressure, highlighting the challenge of achieving the 2 percent target sustainably. The Committee’s latest projections see inflation falling toward 3 percent by mid-2026, with further downside expected if energy and wage dynamics continue to normalize.

- Economic activity remains subdued. Estimates place Q3 GDP growth close to zero, with both business output and consumer spending restrained. The unemployment rate has edged up to 4.8 percent, while pay growth cooled to just under 5 percent year-on-year. MPC members acknowledged that pay settlements are weakening further, signaling an easing in labor cost pressures as demand softens. Surveys from the manufacturing and services sectors suggest muted hiring intentions through year-end.

- International factors continue to complicate the policy outlook. Fluctuating oil prices—partly linked to renewed Middle East tensions—alongside fragile global demand have contributed to higher market volatility. The MPC reiterated that external shocks, including global food and energy disruptions, could temporarily slow the disinflation path but remain unlikely to derail the medium-term moderation in prices.

- The Committee assessed risks around inflation as balanced. Downside risks arise from sluggish domestic growth and declining real income momentum, while upside risks remain tied to elevated inflation expectations and stubborn services inflation. Policymakers emphasized the need for patience, maintaining that any rate cuts ahead of clear inflation progress could undermine confidence in policy credibility.

- The MPC’s overall stance remains restrictive but increasingly balanced, with future moves expected to follow a cautious, data-driven trajectory. The Committee reaffirmed that monetary policy will stay tight until there is compelling evidence that inflation is returning to the 2 percent target on a durable basis.

- The next meeting is on 18 December 2025.

Next 24 Hours Bias

Weak Bearish

The Canadian Dollar (CAD)

Key news events today

No major news event

What can we expect from CAD today?

The Canadian dollar is experiencing a challenging period, trading near seven-month lows. Key factors weighing on the currency include: the Bank of Canada holding rates at 2.25% with signals that the easing cycle may be over; weak retail sales and modest economic growth projections (1.1–1.2%); soft oil prices removing a traditional support for the loonie; and ongoing U.S. tariff pressures despite President Trump quietly holding off on additional tariffs.

Central Bank Notes:

- The Council noted that U.S. tariff tensions have eased slightly following early progress in bilateral discussions, though the external trade environment remains fragile. Businesses continue to hold back on long-term investment, with the Bank highlighting that sustained clarity on U.S. trade policy is needed to restore confidence.

- The Bank acknowledged that uncertainty persists despite the softer U.S. tone, as incoming data show limited improvement in export orders. The manufacturing sector has stabilized but remains below pre-2024 output levels, reflecting weak global demand and cautious corporate spending.

- Canada’s economy showed tentative signs of recovery in early Q4, with GDP estimated to expand by 0.3% in October after two quarters of contraction. Mining and energy activity strengthened modestly, aided by steady crude demand, while goods exports posted a fractional gain.

- Service sector growth remained uneven, supported mainly by tourism-related and technology services. However, retail spending and household consumption were subdued, constrained by slower job creation and lingering consumer caution. The Bank judged overall momentum as fragile but improving marginally.

- Housing activity showed modest reacceleration in major urban markets as mortgage rates stabilized near record lows. Nonetheless, affordability pressures and stricter lending standards continue to limit overall resale volumes, resulting in only a gradual recovery in the housing sector.

- Headline CPI inflation rose to 2.1% in October, reaching the Bank’s target for the first time in six months. Higher energy prices and a modest uptick in food and shelter costs drove the increase. Core inflation measures remained stable, suggesting underlying price pressures are contained.

- The Governing Council reiterated its data-dependent stance, indicating that the current policy rate remains appropriate amid tentative growth and balanced inflation risks. Officials noted that while additional stimulus is not ruled out, the emphasis has shifted toward monitoring the sustainability of the recovery rather than immediate rate adjustments.

- The next meeting is on 17 to 18 December 2025.

Next 24 Hours Bias

Medium Bearish

Oil

Key news events today

EIA Crude Oil Inventories ( 2:30 pm GMT)

What can we expect from Oil today?

Oil prices are trading near one-month lows as markets assess progress toward a Russia-Ukraine peace deal that could ease sanctions on Russian crude exports and add significant supply to an already oversupplied market. WTI

is hovering around $58 per barrel, while Brent is trading just above $62 per barrel. The dominant theme driving oil markets today is the combination of geopolitical de-escalation and bearish supply fundamentals expected through 2026.

Next 24 Hours Bias

Medium Bearish

The post IC Markets Global – Europe Fundamental Forecast | 26 November 2025 first appeared on IC Markets | Official Blog.

Wednesday 26th November 2025: Technical Outlook and Review

423883 November 26, 2025 16:00 ICMarkets Market News

DXY (U.S. Dollar Index):

Potential Direction: Bullish

Overall momentum of the chart: Bearish

The price could see a short-term pullback toward the pivot before rising again toward the 1st resistance.

Pivot: 99.54

Supporting reasons: Identified as a pullback support that aligns closely with the 61.8% Fibonacci retracement, where renewed buying pressure could emerge to push the price higher.

1st support: 99.29

Supporting reasons: Identified as an overlap support, indicating a potential area where the price could again stabilize.

1st resistance: 99.98

Supporting reasons: Identified as a pullback resistance, indicating a potential area that could halt any further upward movement

EUR/USD:

Potential Direction: Bearish

Overall momentum of the chart: Bearish

The price could see a short-term pullback toward the pivot before continuing its bearish move down toward the 1st support.

Pivot: 1.1581

Supporting reasons: Identified as an overlap resistance, where selling pressures could intensify and potentially cap any upward retracement.

1st support: 1.1539

Supporting reasons: Identified as a pullback support, indicating a potential level where the price could stabilize once again.

1st resistance: 1.1623

Supporting reasons: Identified as a pullback resistance, indicating a potential level that could cap further upward movement.

EUR/JPY:

Potential Direction: Bullish

Overall momentum of the chart: Bullish

The price could see a short-term pullback toward the pivot before rising again toward the 1st resistance.

Pivot: 179.93

Supporting reasons: Identified as a pullback support, where renewed buying pressure could emerge to push the price higher.

1st support: 178.67

Supporting reasons: Identified as a pullback support that aligns with the 50% Fibonacci retracement, indicating a potential area where the price could again stabilize.

1st resistance: 181.69

Supporting reasons: Identified as a swing high resistance, indicating a potential level that could cap further upward movement.

EUR/GBP:

Potential Direction: Bearish

Overall momentum of the chart: Bullish

The price has already reacted off the pivot and may continue its bearish move toward the 1st support

Pivot: 0.8799

Supporting reasons: Identified as an overlap resistance, where selling pressures could intensify and potentially cap any upward retracement

1st support: 0.8751

Supporting reasons: Identified as an overlap support, indicating a potential area where the price could stabilize once more.

1st resistance: 0.8865

Supporting reasons: Identified as a swing high resistance, indicating a potential level that could cap further upward movement.

GBP/USD:

Potential Direction: Bullish

Overall momentum of the chart: Bullish

The price could see a short-term pullback toward the pivot before rising again toward the 1st resistance.

Pivot: 1.3106

Supporting reasons: Identified as a pullback support that aligns with the 61.8% Fibonacci retracement, where renewed buying pressure could emerge to push the price higher.

1st support: 1.3012

Supporting reasons: Identified as a swing low support, indicating a potential area where the price could stabilize once more.

1st resistance: 1.3214

Supporting reasons: Identified as a swing high resistance, indicating a potential level that could halt further upward movement.

GBP/JPY:

Potential Direction: Bullish

Overall momentum of the chart: Bullish

The price could see a short-term pullback toward the pivot before rising again toward the 1st resistance.

Pivot: 204.86

Supporting reasons: Identified as an overlap support, where renewed buying pressure could emerge to push the price higher.

1st support: 203.09

Supporting reasons: Identified as a pullback support, indicating a potential level where the price could stabilize once more.

1st resistance: 206.85

Supporting reasons: Identified as a swing high resistance, indicating a potential level that could halt further upward movement.

USD/CHF:

Potential Direction: Bullish

Overall momentum of the chart: Bearish

The price could see a short-term pullback toward the pivot before rising again toward the 1st resistance.

Pivot: 0.8030

Supporting reasons: Identified as a pullback support, where renewed buying pressure could emerge to push the price higher.

1st support: 0.7987

Supporting reasons: Identified as a pullback support that aligns with the 50% Fibonacci retracement, indicating a potential level where the price could stabilize once again.

1st resistance: 0.8109

Supporting reasons: Identified as a swing high resistance, indicating a potential level that could cap further upward movement.

USD/JPY:

Potential Direction: Bullish

Overall momentum of the chart: Bullish

The price could see a short-term pullback toward the pivot before rising again toward the 1st resistance.

Pivot: 155.02

Supporting reasons: Identified as an overlap support, where renewed buying pressure could emerge to push the price higher.

1st support: 154.08

Supporting reasons: Identified as an overlap support, indicating a strong area where buyers might return, and the price could stabilize once again.

1st resistance: 157.61

Supporting reasons: Identified as a swing high resistance. This level represents the next key area where upward movement could be capped amid increased selling pressure

USD/CAD:

Potential Direction: Bullish

Overall momentum of the chart: Bearish

The price could fall toward the pivot and could make a short-term pullback toward this level before rising again toward the 1st resistance.

Pivot: 1.4073

Supporting reasons: Identified as a pullback support that aligns with the 38.2% Fibonacci retracement, where renewed buying pressure could emerge to push the price higher.

1st support: 1.4034

Supporting reasons: Identified as a pullback support that aligns with the 61.8% Fibonacci retracement, indicating a key level where the price could stabilize once more.

1st resistance: 1.4134

Supporting reasons: Identified as a swing high resistance, making it a possible target for bullish advances and a level where some sellers could return to cap gains

AUD/USD:

Potential Direction: Bearish

Overall momentum of the chart: Bullish

The price could see a short-term pullback toward the pivot before continuing its bearish move down toward the 1st support.

Pivot: 0.6480

Supporting reasons: Identified as a pullback resistance that aligns with the 38.2% Fibonacci retracement, where selling pressures could intensify and potentially cap any upward retracement.

1st support: 0.6421

Supporting reasons: Identified as a swing low support, this area has provided strong support historically and may attract buying interest for a potential short-term bounce

1st resistance: 0.6519

Supporting reasons: Identified as an overlap resistance that aligns with the 61.8% Fibonacci retracement, indicating a potential area that could halt any further upward movement.

NZD/USD

Potential Direction: Bearish

Overall momentum of the chart: Bullish

The price could see a short-term pullback toward the pivot before continuing its bearish move down toward the 1st support.

Pivot: 0.5636

Supporting reasons: Identified as a pullback resistance that aligns with the 50% Fibonacci retracement, where selling pressures could intensify and potentially cap any upward retracement.

1st support: 0.5582

Supporting reasons: Identified as a swing low support, this area has provided strong support historically and may attract buying interest for a potential short-term bounce

1st resistance: 0.5687

Supporting reasons: Identified as an overlap resistance, indicating a potential area that could halt any further upward movement.

US30 (DJIA):

Potential Direction: Bullish

Overall momentum of the chart: Bullish

The price could see a short-term pullback toward the pivot before rising again toward the 1st resistance.

Pivot: 46,804.82

Supporting reasons: Identified as a pullback support, where renewed buying pressure could emerge to push the price higher.

1st support: 46,442.68

Supporting reasons: Identified as a pullback support, suggesting a potential area where the price could stabilize once again.

1st resistance: 47,417.04

Supporting reasons: Identified as a pullback resistance that aligns with the 61.8% Fibonacci retracement, indicating a potential area that could halt any further upward movement.

DE40 (DAX):

Potential Direction: Bullish

Overall momentum of the chart: Bullish

The price could see a short-term pullback toward the pivot before rising again toward the 1st resistance.

Pivot: 23,488.29

Supporting reasons: Identified as a pullback support, where renewed buying pressure could emerge to push the price higher.

1st support: 22,917.77

Supporting reasons: Identified as a swing low support, indicating a key level where the price could stabilize once more.

1st resistance: 23,956.58

Supporting reasons: Identified as a pullback resistance that aligns with the 61.8% Fibonacci retracement, indicating a potential area that could halt any further upward movement.

US500 (S&P 500):

Potential Direction: Bearish

Overall momentum of the chart: Bullish

The price could see a short-term pullback toward the pivot before continuing its bearish move down toward the 1st support.

Pivot: 6,773.23

Supporting reasons: Identified as an overlap resistance, where selling pressures could intensify and potentially cap any upward retracement.

1st support: 6,673.25

Supporting reasons: Identified as an overlap support, indicating a potential level where the price could stabilize once again.

1st resistance: 6,870.93

Supporting reasons: Identified as a swing high resistance, indicating a potential area that could halt any further upward movement.

BTC/USD (Bitcoin):

Potential Direction: Bearish

Overall momentum of the chart: Bearish

The price has already reacted off the pivot and may continue its bearish move toward the 1st support

Pivot: 89,178.40

Supporting reasons: Identified as an overlap resistance that aligns with the 61.8% Fibonacci retracement, where selling pressures could intensify and potentially cap any upward retracement

1st support: 81,214.21

Supporting reasons: Identified as an overlap support, indicating a potential level where the price could stabilize once more.

1st resistance: 93,070.41

Supporting reasons: Identified as an overlap resistance, indicating a potential area that could halt any further upward movement.

ETH/USD (Ethereum):

Potential Direction: Bearish

Overall momentum of the chart: Bullish

The price could see a short-term pullback toward the pivot before continuing its bearish move down toward the 1st support.

Pivot: 3,057.32

Supporting reasons: Identified as a pullback resistance, where selling pressures could intensify and potentially cap any upward retracement.

1st support: 2,855.95

Supporting reasons: Identified as a pullback support, indicating a potential level where the price could stabilize once more.

1st resistance: 3,230.74

Supporting reasons: Identified as an overlap resistance, indicating a potential area that could halt any further upward movement.

WTI/USD (Oil):

Potential Direction: Bearish

Overall momentum of the chart: Bullish

The price could see a short-term pullback toward the pivot before continuing its bearish move down toward the 1st support.

Pivot: 58.99

Supporting reasons: Identified as an overlap resistance, where selling pressures could intensify and potentially cap any upward retracement.

1st support: 57.41

Supporting reasons: Identified as a swing low support, indicating a key level where the price could stabilize once more.

1st resistance: 60.28

Supporting reasons: Identified as a pullback resistance, indicating a potential area that could halt any further upward movement.

XAU/USD (GOLD):

Potential Direction: Bearish

Overall momentum of the chart: Bullish

The price has already reacted off the pivot and may continue its bearish move toward the 1st support

Pivot: 4,147.61

Supporting reasons: Identified as an overlap resistance that aligns with the 61.8% Fibonacci retracement, where selling pressures could intensify and potentially cap any upward retracement

1st support: 4,093.68

Supporting reasons: Identified as a pullback support, indicating a key level where the price could stabilize once more.

1st resistance: 4,219.46

Supporting reasons: Identified as an overlap resistance, indicating a potential area that could halt any further upward movement.

The accuracy, completeness and timeliness of the information contained on this site cannot be guaranteed. IC Markets Global does not warranty, guarantee or make any representations, or assume any liability regarding financial results based on the use of the information in the site.

News, views, opinions, recommendations and other information obtained from sources outside of www.icmarkets.com, used in this site are believed to be reliable, but we cannot guarantee their accuracy or completeness. All such information is subject to change at any time without notice. IC Markets Global assumes no responsibility for the content of any linked site.

The fact that such links may exist does not indicate approval or endorsement of any material contained on any linked site. IC Markets Global is not liable for any harm caused by the transmission, through accessing the services or information on this site, of a computer virus, or other computer code or programming device that might be used to access, delete, damage, disable, disrupt or otherwise impede in any manner, the operation of the site or of any user’s software, hardware, data or property.

The post Wednesday 26th November 2025: Technical Outlook and Review first appeared on IC Markets | Official Blog.

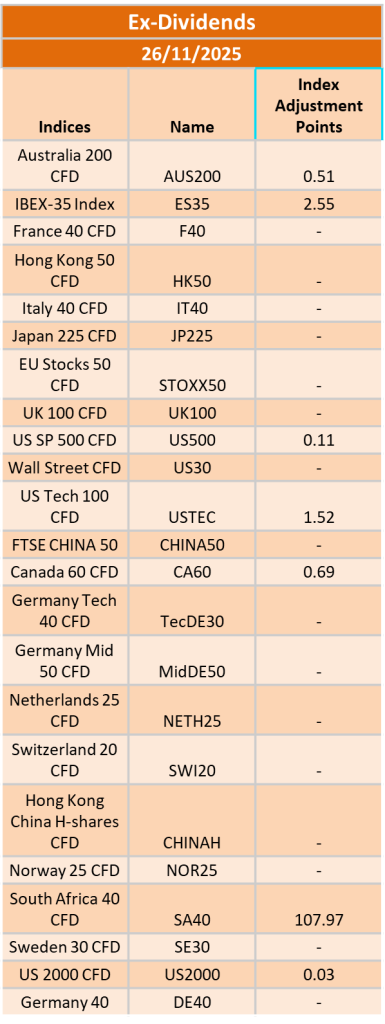

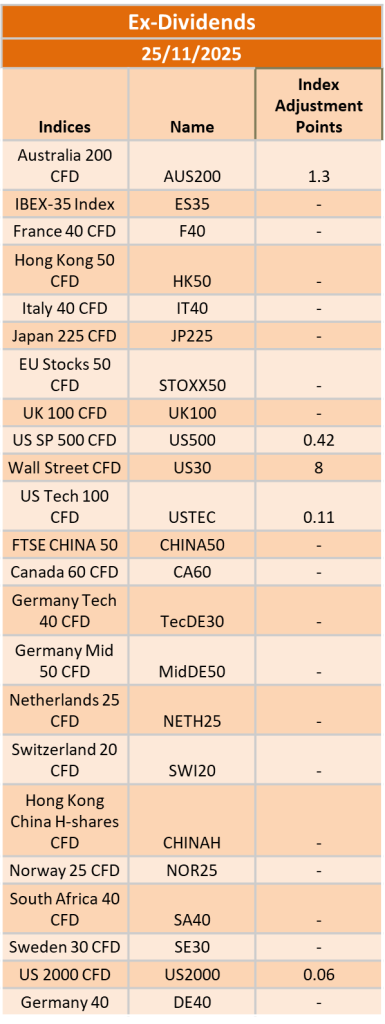

Ex-Dividend 26/11/2025

423848 November 25, 2025 17:39 ICMarkets Market News

The post Ex-Dividend 26/11/2025 first appeared on IC Markets | Official Blog.

General Market Analysis – 25/11/25

423846 November 25, 2025 16:14 ICMarkets Market News

US Stocks Rally on Fed Rate Cut Hopes – Nasdaq up over 2%

US equities opened the week on a firm footing, with all three major indices posting solid gains as expectations for a December rate cut increased again. Markets are now assigning an 80% chance of a 25-basis-point cut at the December FOMC meeting, up from just 40% only days ago. The Dow Jones rose 0.44% to close at 46,448, while the S&P 500 jumped 1.55% to 6,705, while major tech players rallied strongly, driving the Nasdaq up 2.69% to finish at 22,872. Treasury markets reflected the dovish shift, with the 2-year yield slipping 1.1 basis points to 3.497% and the 10-year yield falling 3.8 basis points to 4.025%, while the U.S. dollar was more muted, with the DXY edging 0.08% lower to 100.20. Oil prices climbed as resistance to the proposed Ukraine peace accord raised fresh uncertainty around supply conditions. Brent gained 1.33% to trade at $63.39, while WTI rose 1.46% to $58.91. Gold also pushed higher from key support levels, rallying 1.64% to settle at $4,131.89 by the New York close.

Oil Rises on Peace Doubts and Fed Cuts

Oil prices pushed higher in trading yesterday after having pulled back significantly over the past week on hopes of a peace deal between Russia and Ukraine. The US has been actively trying to negotiate a deal between the two parties, and progress had led to WTI prices dropping nearly 6% over the course of last week. However, updates yesterday that Ukraine may push back again on some of Russia’s requests led to a 1.5% rally. Market pricing for a Federal Reserve rate cut increased again last night, now up to a near 80% chance from just 40% a couple of days ago, and the dollar side of the trade has helped yesterday’s move. Traders are expecting more volatility in ‘Black Gold’ in the next few days, with more updates and movement expected from both sides of the equation. Support for WTI now sits near the recent low just above $57, with resistance now around the $60.25 mark.

Economic Calendar Picks up Today

The macroeconomic calendar picks up today with traders preparing for a deluge of data before an anticipated calmer end to the week due to the US Thanksgiving holiday. There is little to move the dial on the calendar in the first two trading sessions of the day, however strong overnight moves and the potential for more geopolitical updates should keep markets buoyant. Risk events pick up strongly once New York opens though, with more delayed data due to hit the street. September PPI and Retail Sales data is due out, just 40 days late: the PPI (exp +0.3% m/m), Core PPI (exp +0.2% m/m), Retail Sales (exp +0.4% m/m), and Core Retail Sales (exp +0.3% m/m) will all be released at the same time, with traders expecting plenty of volatility around the event. Later in the session, we also have the latest Pending Home Sales (exp +0.5%) and Richmond Manufacturing Index (exp -5) data out; however, expect the earlier data to dominate sentiment.

The post General Market Analysis – 25/11/25 first appeared on IC Markets | Official Blog.

Tuesday 25th November 2025: Technical Outlook and Review

423840 November 25, 2025 16:00 ICMarkets Market News

DXY (U.S. Dollar Index):

Potential Direction: Bullish

Overall momentum of the chart: Bearish

The price could see a short-term pullback toward the pivot before rising again toward the 1st resistance.

Pivot: 99.80

Supporting reasons: Identified as a pullback support that aligns closely with the 38.2% Fibonacci retracement, where renewed buying pressure could emerge to push the price higher.

1st support: 99.35

Supporting reasons: Identified as an overlap support that aligns closely with the 78.6% Fibonacci retracement, indicating a potential area where the price could again stabilize.

1st resistance: 100.35

Supporting reasons: Identified as a swing high resistance, indicating a potential area that could halt any further upward movement

EUR/USD:

Potential Direction: Bearish

Overall momentum of the chart: Bearish

The price could see a short-term pullback toward the pivot before continuing its bearish move down toward the 1st support.

Pivot: 1.1567

Supporting reasons: Identified as a pullback resistance, where selling pressures could intensify and potentially cap any upward retracement.

1st support: 1.1494

Supporting reasons: Identified as an overlap support, indicating a potential level where the price could stabilize once again.

1st resistance: 1.1623

Supporting reasons: Identified as a pullback resistance, indicating a potential level that could cap further upward movement.

EUR/JPY:

Potential Direction: Bullish

Overall momentum of the chart: Bullish

The price could see a short-term pullback toward the pivot before rising again toward the 1st resistance.

Pivot: 179.93

Supporting reasons: Identified as a pullback support, where renewed buying pressure could emerge to push the price higher.

1st support: 178.67

Supporting reasons: Identified as a pullback support, indicating a potential area where the price could again stabilize.

1st resistance: 181.69

Supporting reasons: Identified as a swing high resistance, indicating a potential level that could cap further upward movement.

EUR/GBP:

Potential Direction: Bearish

Overall momentum of the chart: Bullish

The price has already reacted off the pivot and may continue its bearish move toward the 1st support

Pivot: 0.8828

Supporting reasons: Identified as an overlap resistance, where selling pressures could intensify and potentially cap any upward retracement

1st support: 0.8751

Supporting reasons: Identified as an overlap support, indicating a potential area where the price could stabilize once more.

1st resistance: 0.8865

Supporting reasons: Identified as a swing high resistance, indicating a potential level that could cap further upward movement.

GBP/USD:

Potential Direction: Bearish

Overall momentum of the chart: Bullish

The price could see a short-term pullback toward the pivot before continuing its bearish move down toward the 1st support.

Pivot: 1.3106

Supporting reasons: Identified as an overlap resistance that aligns with the 38.2% Fibonacci retracement, where selling pressures could intensify and potentially cap any upward retracement.

1st support: 1.3012

Supporting reasons: Identified as a swing low support, indicating a potential area where the price could stabilize once more.

1st resistance: 1.3179

Supporting reasons: Identified as a pullback resistance that aligns with the 78.6% Fibonacci retracement, indicating a potential level that could halt further upward movement.

GBP/JPY:

Potential Direction: Bullish

Overall momentum of the chart: Bullish

The price could see a short-term pullback toward the pivot before rising again toward the 1st resistance.

Pivot: 204.86

Supporting reasons: Identified as an overlap support, where renewed buying pressure could emerge to push the price higher.

1st support: 203.09

Supporting reasons: Identified as a pullback support, indicating a potential level where the price could stabilize once more.

1st resistance: 206.85

Supporting reasons: Identified as a swing high resistance, indicating a potential level that could halt further upward movement.

USD/CHF:

Potential Direction: Bullish

Overall momentum of the chart: Bearish

The price could see a short-term pullback toward the pivot before rising again toward the 1st resistance.

Pivot: 0.8030

Supporting reasons: Identified as a pullback support, where renewed buying pressure could emerge to push the price higher.

1st support: 0.7987

Supporting reasons: Identified as a pullback support that aligns with the 50% Fibonacci retracement, indicating a potential level where the price could stabilize once again.

1st resistance: 0.8109

Supporting reasons: Identified as a swing high resistance, indicating a potential level that could cap further upward movement.

USD/JPY:

Potential Direction: Bullish

Overall momentum of the chart: Bullish

The price could see a short-term pullback toward the pivot before rising again toward the 1st resistance.

Pivot: 155.02

Supporting reasons: Identified as an overlap support, where renewed buying pressure could emerge to push the price higher.

1st support: 154.08

Supporting reasons: Identified as an overlap support, indicating a strong area where buyers might return, and the price could stabilize once again.

1st resistance: 157.61

Supporting reasons: Identified as a swing high resistance. This level represents the next key area where upward movement could be capped amid increased selling pressure

USD/CAD:

Potential Direction: Bullish

Overall momentum of the chart: Bearish

The price could fall toward the pivot and could make a short-term pullback toward this level before rising again toward the 1st resistance.

Pivot: 1.4073

Supporting reasons: Identified as a pullback support, where renewed buying pressure could emerge to push the price higher.

1st support: 1.4034

Supporting reasons: Identified as a pullback support, indicating a key level where the price could stabilize once more.

1st resistance: 1.4134

Supporting reasons: Identified as a swing high resistance, making it a possible target for bullish advances and a level where some sellers could return to cap gains

AUD/USD:

Potential Direction: Bearish

Overall momentum of the chart: Bullish

The price could see a short-term pullback toward the pivot before continuing its bearish move down toward the 1st support.

Pivot: 0.6480

Supporting reasons: Identified as a pullback resistance that aligns with the 38.2% Fibonacci retracement, where selling pressures could intensify and potentially cap any upward retracement.

1st support: 0.6421

Supporting reasons: Identified as a swing low support, this area has provided strong support historically and may attract buying interest for a potential short-term bounce

1st resistance: 0.6519

Supporting reasons: Identified as an overlap resistance that aligns with the 61.0% Fibonacci retracement, indicating a potential area that could halt any further upward movement.

NZD/USD

Potential Direction: Bearish

Overall momentum of the chart: Bullish

The price has already reacted off the pivot and may continue its bearish move toward the 1st support

Pivot: 0.5636

Supporting reasons: Identified as a pullback resistance, where selling pressures could intensify and potentially cap any upward retracement

1st support: 0.5556

Supporting reasons: Identified as a support that is supported by the 161.8% Fibonacci extension, this area has provided strong support historically and may attract buying interest for a potential short-term bounce

1st resistance: 0.5687

Supporting reasons: Identified as an overlap resistance, indicating a potential area that could halt any further upward movement.

US30 (DJIA):

Potential Direction: Bearish

Overall momentum of the chart: Bullish

The price could see a short-term pullback toward the pivot before continuing its bearish move down toward the 1st support.

Pivot: 46,723.38

Supporting reasons: Identified as an overlap resistance, where selling pressures could intensify and potentially cap any upward retracement.

1st support: 45,767.10

Supporting reasons: Identified as an overlap support that aligns with the 100% Fibonacci projection, suggesting a potential area where the price could stabilize once again.

1st resistance: 47,417.04

Supporting reasons: Identified as a pullback resistance, indicating a potential area that could halt any further upward movement.

DE40 (DAX):

Potential Direction: Bearish

Overall momentum of the chart: Bullish

The price could see a short-term pullback toward the pivot before continuing its bearish move down toward the 1st support.

Pivot: 23,539.09

Supporting reasons: Identified as a pullback resistance, where selling pressures could intensify and potentially cap any upward retracement.

1st support: 22,917.77

Supporting reasons: Identified as a swing low support, indicating a key level where the price could stabilize once more.

1st resistance: 23,776.73

Supporting reasons: Identified as a pullback resistance, indicating a potential area that could halt any further upward movement.

US500 (S&P 500):

Potential Direction: Bullish

Overall momentum of the chart: Bullish

The price could see a short-term pullback toward the pivot before rising again toward the 1st resistance.

Pivot: 6.660.83

Supporting reasons: Identified as a pullback support, where renewed buying pressure could emerge to push the price higher.

1st support: 6,532.80

Supporting reasons: Identified as a swing low support, indicating a potential level where the price could stabilize once again.

1st resistance: 6,763.10

Supporting reasons: Identified as a swing high resistance, indicating a potential area that could halt any further upward movement.

BTC/USD (Bitcoin):

Potential Direction: Bearish

Overall momentum of the chart: Bullish

The price could see a short-term pullback toward the pivot before continuing its bearish move down toward the 1st support.

Pivot: 89,178.40

Supporting reasons: Identified as a pullback resistance that aligns with the 61.8% Fibonacci retracement, where selling pressures could intensify and potentially cap any upward retracement.

1st support: 81,214.21

Supporting reasons: Identified as an overlap support, indicating a potential level where the price could stabilize once more.

1st resistance: 93,070.41

Supporting reasons: Identified as an overlap resistance, indicating a potential area that could halt any further upward movement.

ETH/USD (Ethereum):

Potential Direction: Bearish

Overall momentum of the chart: Bullish

The price could see a short-term pullback toward the pivot before continuing its bearish move down toward the 1st support.

Pivot: 3,057.32

Supporting reasons: Identified as a pullback resistance, where selling pressures could intensify and potentially cap any upward retracement.

1st support: 2,818.56

Supporting reasons: Identified as a pullback support, indicating a potential level where the price could stabilize once more.

1st resistance: 3,230.74

Supporting reasons: Identified as an overlap resistance, indicating a potential area that could halt any further upward movement.

WTI/USD (Oil):

Potential Direction: Bearish

Overall momentum of the chart: Bullish

The price could see a short-term pullback toward the pivot before continuing its bearish move down toward the 1st support.

Pivot: 59.38

Supporting reasons: Identified as a pullback resistanc, where selling pressures could intensify and potentially cap any upward retracement.

1st support: 58.40

Supporting reasons: Identified as a pullback support, indicating a key level where the price could stabilize once more.

1st resistance: 60.28

Supporting reasons: Identified as a pullback resistance, indicating a potential area that could halt any further upward movement.

XAU/USD (GOLD):

Potential Direction: Bearish

Overall momentum of the chart: Bullish

The price could see a short-term pullback toward the pivot before continuing its bearish move down toward the 1st support.

Pivot: 4,147.61

Supporting reasons: Identified as a pullback resistance that aligns closely with the 61.8% Fibonacci retracement, where selling pressures could intensify and potentially cap any upward retracement.

1st support: 4,093.68

Supporting reasons: Identified as a pullback support, indicating a key level where the price could stabilize once more.

1st resistance: 4,219.46

Supporting reasons: Identified as an overlap resistance, indicating a potential area that could halt any further upward movement.

The accuracy, completeness and timeliness of the information contained on this site cannot be guaranteed. IC Markets Global does not warranty, guarantee or make any representations, or assume any liability regarding financial results based on the use of the information in the site.

News, views, opinions, recommendations and other information obtained from sources outside of www.icmarkets.com, used in this site are believed to be reliable, but we cannot guarantee their accuracy or completeness. All such information is subject to change at any time without notice. IC Markets Global assumes no responsibility for the content of any linked site.

The fact that such links may exist does not indicate approval or endorsement of any material contained on any linked site. IC Markets Global is not liable for any harm caused by the transmission, through accessing the services or information on this site, of a computer virus, or other computer code or programming device that might be used to access, delete, damage, disable, disrupt or otherwise impede in any manner, the operation of the site or of any user’s software, hardware, data or property.

The post Tuesday 25th November 2025: Technical Outlook and Review first appeared on IC Markets | Official Blog.

IC Markets Global – Asia Fundamental Forecast | 25 November 2025

423839 November 25, 2025 16:00 ICMarkets Market News

IC Markets Global – Asia Fundamental Forecast | 25 November 2025

What happened in the U.S. session?

U.S. financial news during the overnight session was driven by optimism around potential Federal Reserve interest rate cuts, robust performances in technology stocks, and mixed macroeconomic data releases. Tech stocks, especially major semiconductor companies and Alphabet (Google’s parent), rallied strongly, buoying the Nasdaq Composite and S&P 500. Rumors and Fed officials’ comments raised the likelihood of a rate cut at the December FOMC meeting to above 70%, fueling gains across equities, particularly consumer and technology shares.

What does it mean for the Asia Session?

Asian traders should closely monitor key US macroeconomic releases, ongoing volatility in technology stocks, movements in major currencies like the Japanese yen, and potential policy actions from China and Japan on Tuesday, November 25, 2025. Market sentiment is strongly influenced by upcoming US inflation and retail sales data, which could drive volatility across Asian equities and currencies

The Dollar Index (DXY)

Key news events today

Core PPI m/m (1:30 pm GMT)

Core Retail Sales m/m (1:30 pm GMT)

PPI m/m (1:30 pm GMT)

Retail Sales m/m (1:30 pm GMT)

Pending Home Sales m/m (3:00 pm GMT)

Richmond Manufacturing Index (3:00 pm GMT)

What can we expect from DXY today?

The US dollar is holding firm on November 25, with the market focused on economic data and the Fed’s policy outlook. The outlook for the rest of the week hinges on several high-impact US releases, with traders watching for signals on the strength of the US consumer and any signs of broadening labor market weakness. The US dollar remains a dominant force, accounting for 88% of forex trades worldwide. While the dollar’s long-term fundamentals remain strong, its near-term direction hinges on Fed policy and risk sentiment globally.

Central Bank Notes:

- The Federal Open Market Committee (FOMC) voted, by majority, to lower the federal funds rate target range by 25 basis points to 3.75% — 4.00% at its October 28–29, 2025, meeting, marking the second consecutive cut following the 25 basis points reduction in September.

- The Committee maintained its long-term objectives of maximum employment and 2% inflation, noting that the labor market continues to soften, with modest job creation and an unemployment rate edging higher. In comparison, inflation remains above target at around 3.0%.

- Policymakers highlighted ongoing downside risks to economic growth, tempered by signs of resilient economic activity. September’s consumer price index (CPI) came in slightly below expectations at 3.0% year-over-year, easing inflationary pressure but still warranting vigilance amid tariff-driven price effects.

- Economic activity expanded modestly in the third quarter, with GDP growth estimates around 1.0% annualized; however, uncertainty remains elevated amid persistent global trade tensions and the U.S. government shutdown, which is impacting data availability.

- The updated Summary of Economic Projections anticipates an unemployment rate averaging approximately 4.5% for 2025, with headline and core personal consumption expenditures (PCE) inflation projections remaining near 3.0%, indicating a slow easing path ahead.

- The Committee emphasized its flexible, data-dependent approach and underscored that future policy adjustments will be guided by incoming labor market and inflation data. As in prior meetings, there was dissent, including one member advocating a more aggressive 50-basis-point cut.

- The FOMC announced the planned conclusion of its balance sheet reduction (quantitative tightening) program, intending to cease runoff in the near term to maintain market stability. Treasury redemption caps will remain steady at $5 billion per month, and agency mortgage-backed securities caps will remain at $35 billion.

- The next meeting is scheduled for 9 to 10 December 2025.

Next 24 Hours Bias

Medium Bullish

Gold (XAU)

Key news events today

Core PPI m/m (1:30 pm GMT)

Core Retail Sales m/m (1:30 pm GMT)

PPI m/m (1:30 pm GMT)

Retail Sales m/m (1:30 pm GMT)

Pending Home Sales m/m (3:00 pm GMT)

Richmond Manufacturing Index (3:00 pm GMT)

What can we expect from Gold today?

Gold begins the week in a consolidation phase between $4,000 and $4,100, reflecting market uncertainty about the Federal Reserve’s December rate decision. Despite the range-bound trading, fundamental support remains robust from continued central bank buying, elevated safe-haven demand driven by geopolitical tensions, and strong investment flows into gold ETFs.

Next 24 Hours Bias

Medium Bearish

The Australian Dollar (AUD)

Key news events today

No major news event

What can we expect from AUD today?

The Australian Dollar (AUD) was trading modestly weaker, pressured by global risk aversion and recent strength in the US Dollar. The currency remains supported in the medium term by hawkish Reserve Bank of Australia (RBA) policy but is sensitive to shifts in global sentiment and key domestic data releases. The Australian Dollar depreciated approximately 1.3% during the past week, influenced by global equity declines and investors’ cautious stance ahead of upcoming CPI data and other US macro releases.

Central Bank Notes:

- The Reserve Bank of Australia held its cash rate steady at 3.60% at the November policy meeting, citing persistent inflationary pressures and lingering uncertainties in both domestic and global outlooks. This is the third consecutive pause following the cut in August.

- Policymakers remain alert to renewed inflation momentum. After a temporary uptick in September’s CPI, trimmed mean inflation for Q3 stands at 3.0%, above the intended 2–3% band. The RBA now anticipates that core inflation will stay above target until at least mid-2026, delaying any hopes of further easing.

- Headline CPI climbed by 3.2% in the year to September 2025, driven by resilient housing (+2.5%) and insurance costs, while discretionary goods inflation is subdued. The transition to monthly CPI reporting from November will improve the accuracy of inflation tracking.

- Domestic demand remains firm, particularly in services and housing, while manufacturing and discretionary retail continue to lag. Household incomes have stabilized, but high borrowing costs and elevated rents are constraining consumption and risking a slowdown in Q1 2026.

- Labor market tightness persists, though job growth has moderated. Underutilization edged higher. Wage growth is plateauing, but weak productivity is keeping unit labor costs elevated—a medium-term risk that remains central to the Board’s narrative.

- The RBA highlights geopolitical tensions and volatile commodity markets as primary global risks, against a backdrop of modest upward revisions to world growth forecasts. The Board stresses that its stance remains “cautious and data-dependent,” with ongoing vigilance on inflation, labor, and spending trends.

- Monetary policy remains mildly restrictive, balancing progress on price stability against vulnerabilities in household demand and global outlook. Board communications reaffirm a dual mandate: price stability and full employment, while underscoring readiness to respond should risks materialize sharply.

- Analysts generally expect the cash rate to remain at current levels through early 2026, with only modest cuts possible later in the year if inflation moderates. The new monthly CPI release (first full edition Nov 2025) will be watched closely for timely signals on price trends.

- The next meeting is on 9 December 2025.

Next 24 Hours Bias

Medium Bearish

The Kiwi Dollar (NZD)

Key news events today

No major news event

What can we expect from NZD today?

The NZD remains under pressure due to anticipated RBNZ rate cuts, a weak domestic economic outlook, and a resilient US Dollar. The market consensus is for further NZD downside unless there is a policy surprise or a shift in global sentiment. Traders continue to watch key resistance levels and the RBNZ meeting for signs of recovery or additional weakness in the currency.

Central Bank Notes:

- The Monetary Policy Committee (MPC) agreed to cut the Official Cash Rate (OCR) by 50 basis points to 2.50% on 8 October 2025, exceeding market expectations for a smaller 25-basis-point reduction and signaling a stronger commitment to reviving growth.

- The decision was reached by consensus, marking a shift from previous split votes, and reflected policymakers’ shared view that sustained economic weakness and persistent disinflationary pressures required a more front-loaded policy response.

- Annual consumer price inflation stood at 2.7% in the June quarter and is seen nearing 3% for the September quarter—above the 2% midpoint but within the 1–3% target range. Despite high near-term readings, the MPC projects inflation will return toward 2% by the first half of 2026 as spare capacity and moderating tradables curb price momentum.

- Policymakers acknowledged that domestic demand remains weak, with household spending, business investment, and construction activity under pressure. While still elevated, services inflation is expected to ease gradually as wage growth slows and unemployment edges higher.

- Financial conditions have eased with expectations as wholesale and retail borrowing rates adjust to lower policy settings. Bank lending data indicate a modest uptick in mortgage approvals, though broader credit demand remains subdued.

- GDP growth stalled in the middle of 2025, with high-frequency indicators showing continued weakness into the third quarter. A combination of elevated costs for essentials and falling savings continues to restrain household consumption, while global trade frictions weigh on business sentiment.

- The MPC noted that global uncertainty—particularly from US trade regulation changes and soft Chinese demand—continues to pose downside risks to export sectors, though these are partly offset by a weaker New Zealand dollar improving competitiveness.

- Subject to data confirming a sustained soft patch in activity and moderating inflation pressures, the MPC signaled further scope to reduce the OCR toward 2.25% at its next meeting on 26 November 2025, consistent with current market and Westpac forecasts.

- The next meeting is on 26 November 2025.

Next 24 Hours Bias

Medium Bearish

The Japanese Yen (JPY)

Key news events today

No major news events

What can we expect from JPY today?

The Japanese Yen (JPY) continues to weaken against the US Dollar, trading near multi-month lows as of Tuesday, November 25, 2025, with USD/JPY last seen around 156.61–156.90. The yen remains under pressure due to fiscal concerns, ongoing stimulus measures, and speculation about potential government intervention in the currency markets.

Central Bank Notes:

- The Policy Board of the Bank of Japan met on 30–31 October and, by a clear majority vote, decided to maintain its key monetary policy approach for the upcoming period.

- The BOJ will continue to encourage the uncollateralized overnight call rate to remain at around 0.5%, in line with the prior stance.

- The gradual quarterly reduction in monthly outright purchases of Japanese Government Bonds (JGBs) remains intact, with amounts unchanged from the previous schedule. Purchases are set to decrease by about ¥400 billion per quarter through March 2026, shifting to about ¥200 billion per quarter from April to June 2026, and targeting a ¥2 trillion purchase level for Q1 2027. The bank reaffirmed its intention to maintain flexibility, with readiness to respond if market conditions warrant an adjustment.

- Japan’s economy continues to show moderate recovery, primarily led by solid capital expenditures, although export growth and corporate activity remain restrained by external demand uncertainty and the ongoing effects of U.S. trade policies.

- Annual headline inflation (excluding fresh food) accelerated to 2.9% year-on-year in September, marking the first uptick in four months and staying above the BOJ’s 2% target. Broad-based inflation persists, with food and energy cost pressures, but wage growth continues to support household consumption. Input cost pressures from the earlier surge in imports eased slightly.

- Short-term inflation momentum could moderate as food-price hikes ease, though rent, healthcare, and service-sector price increases tied to labor shortages provide support. Firms and households maintain a gradual upward drift in inflation expectations.

- For the near term, BOJ projects growth below trend as external demand stays subdued and corporate investment plans remain cautious. Still, accommodative financial conditions and steady gains in real labor income will underpin domestic consumption.

- Over the medium term, as overseas economies recover and trade conditions normalize, Japan’s growth potential should improve. Persistent labor market tightness, higher wage settlements, and rising medium- to long-term inflation expectations are expected to keep core inflation on a gradual upward trajectory, converging toward the 2% price stability target later in the forecast horizon.

- The next meeting is scheduled for 18 to 19 December 2025.

Next 24 Hours Bias

Weak Bearish

Oil

Key news events today

No major news event

What can we expect from Oil today?

Oil markets are predominantly bearish today, reacting to peace negotiations and projected increases in supply, with prices hovering near multi-week and yearly lows for both WTI and Brent benchmarks. Oil has posted its longest monthly losing run since 2023, reflecting cautious sentiment from traders and analysts about global inventory growth and future demand.

Brent and WTI both face technical resistance, and even minor optimism in peace talks is provoking bearish sentiment due to anticipated supply increases.

Next 24 Hours Bias

Medium Bearish

The post IC Markets Global – Asia Fundamental Forecast | 25 November 2025 first appeared on IC Markets | Official Blog.

Tuesday 25th November 2025: Asian Markets Mixed as Fed Rate-Cut Hopes Rise and Tech Stocks Lead Gains

423838 November 25, 2025 15:39 ICMarkets Market News

Global Markets:

- Asian Stock Markets : Nikkei up 0.02%, Shanghai Composite up 1.13%, Hang Seng up 0.53% ASX down -0.17%

- Commodities : Gold at $4,177.55 (0.18%), Silver at $51.260 (0.21%), Brent Oil at $62.45 (-0.43%), WTI Oil at $58.61 (-0.53%)

- Rates : US 10-year yield at 4.035, UK 10-year yield at 4.5400, Germany 10-year yield at 2.6970

News & Data:

- (EUR) German ifo Business Climate 88.1 to 88.6 expected

Markets Update:

Asian stock markets were mixed on Tuesday, mirroring the broadly positive cues from Wall Street and rising expectations of a U.S. Federal Reserve rate cut next month. Optimism grew after recent dovish comments from Fed officials, though concerns about high market valuations continue to weigh on sentiment. Fed Governor Christopher Waller signaled support for another quarter-point cut in December due to labor market concerns, echoing remarks from New York Fed President John Williams, who noted room for further adjustments. The CME FedWatch Tool now shows an 80.9 percent probability of a December cut, sharply higher than last week.

In Australia, the S&P/ASX 200 traded slightly higher, supported by gains in major mining stocks and a mixed performance across other sectors. Rio Tinto led miners with strong gains, while gold producers like Newmont and Resolute Mining advanced sharply. Tech stocks were mixed, with Block declining and Appen rising. Banks were mostly lower, while individual movers included Web Travel, up nearly 10 percent on strong results, and Ramsay Health Care, which gained on improved earnings guidance.

Japan’s Nikkei 225 also moved higher in post-holiday trade, buoyed by strength in automakers and technology stocks such as Tokyo Electron and Advantest. Major exporters like Panasonic and Mitsubishi Electric advanced, though SoftBank declined.

Elsewhere in Asia, China, Hong Kong, South Korea, and Taiwan traded higher, while New Zealand, Singapore, Malaysia, and Indonesia were modestly lower. Meanwhile, Wall Street extended Friday’s rebound, led by a strong surge in the Nasdaq, while European markets ended mixed and crude oil prices rose.

Upcoming Events:

- 01:30 PM GMT – USD Core PPI m/m

- 01:30 PM GMT – USD PPI m/m

- 01:30 PM GMT – USD Core Retail Sales m/m

- 01:30 PM GMT – USD Retail Sales m/m

The post Tuesday 25th November 2025: Asian Markets Mixed as Fed Rate-Cut Hopes Rise and Tech Stocks Lead Gains first appeared on IC Markets | Official Blog.

IC Markets Global – Europe Fundamental Forecast | 25 November 2025

423837 November 25, 2025 15:39 ICMarkets Market News

IC Markets Global – Europe Fundamental Forecast | 25 November 2025

What happened in the Asia session?

During today’s Asia session, financial markets were primarily influenced by optimism over a possible US Federal Reserve rate cut in December, which boosted Asian equities and impacted core instruments such as technology stocks, US Treasury yields, and regional forex pairs. Asian stocks, Japanese yen, and US Treasury yields were most affected by the headlines and economic data during today’s Asia session, as market participants responded to monetary policy signals and softening global macro data.

What does it mean for the Europe & US sessions?

The market is alert to U.S. government data releases and their effects, as any surprising outcome in inflation or sales can impact Federal Reserve policy expectations. ECB, European banking sector, and EU investment rules developments continue to drive sentiment and capital flows, with ongoing efforts to support local industries and adapt to global trends. Watch for updates in central bank communications, particularly from the Reserve Bank of New Zealand, which may cut rates in its latest meeting, potentially influencing risk sentiment globally.

The Dollar Index (DXY)

Key news events today

Core PPI m/m (1:30 pm GMT)

Core Retail Sales m/m (1:30 pm GMT)

PPI m/m (1:30 pm GMT)

Retail Sales m/m (1:30 pm GMT)

Pending Home Sales m/m (3:00 pm GMT)

Richmond Manufacturing Index (3:00 pm GMT)

What can we expect from DXY today?

The US dollar remains steady today, Tuesday, as investors continue to weigh the potential for a Federal Reserve rate cut in December. Market sentiment is cautious, with increased speculation putting mild pressure on the dollar against major currencies, although it has not led to significant moves so far. The dollar is currently stable but faces potential volatility pending today’s US economic releases and evolving Federal Reserve rate cut outlook for December.

Central Bank Notes:

- The Federal Open Market Committee (FOMC) voted, by majority, to lower the federal funds rate target range by 25 basis points to 3.75% — 4.00% at its October 28–29, 2025, meeting, marking the second consecutive cut following the 25 basis points reduction in September.

- The Committee maintained its long-term objectives of maximum employment and 2% inflation, noting that the labor market continues to soften, with modest job creation and an unemployment rate edging higher. In comparison, inflation remains above target at around 3.0%.

- Policymakers highlighted ongoing downside risks to economic growth, tempered by signs of resilient economic activity. September’s consumer price index (CPI) came in slightly lower than expected at 3.0% year-over-year, easing inflation pressure but still warranting vigilance given tariff-driven price effects.

- Economic activity expanded modestly in the third quarter, with GDP growth estimates around 1.0% annualized; however, uncertainty remains elevated amid persistent global trade tensions and the U.S. government shutdown, which is impacting data availability.

- The updated Summary of Economic Projections anticipates an unemployment rate averaging approximately 4.5% for 2025, with headline and core personal consumption expenditures (PCE) inflation projections remaining near 3.0%, indicating a slow easing path ahead.

- The Committee emphasized its flexible, data-dependent approach and underscored that future policy adjustments will be guided by incoming labor market and inflation data. As in prior meetings, there was dissent, including one member advocating a more aggressive 50-basis-point cut.

- The FOMC announced the planned conclusion of its balance sheet reduction (quantitative tightening) program, intending to cease runoff in the near term to maintain market stability. Treasury redemption caps will remain steady at $5 billion per month, and agency mortgage-backed securities caps will remain at $35 billion.

- The next meeting is scheduled for 9 to 10 December 2025.

Next 24 Hours Bias

Weak Bullish

Gold (XAU)

Key news events today

Core PPI m/m (1:30 pm GMT)

Core Retail Sales m/m (1:30 pm GMT)

PPI m/m (1:30 pm GMT)

Retail Sales m/m (1:30 pm GMT)

Pending Home Sales m/m (3:00 pm GMT)

Richmond Manufacturing Index (3:00 pm GMT)

What can we expect from Gold today?

Gold remains in a range between $4,000 and $4,100, with a bullish bias unless significant support levels are breached; if prices were to fall below $3,905, analysts warn of further downside risks. The near-term outlook suggests that gold could resume its upward trend if global uncertainty persists and monetary easing takes place. Gold is benefiting from both macroeconomic uncertainty and rising expectations for U.S. monetary easing, keeping prices elevated and volatility high.

Next 24 Hours Bias

Medium Bullish

The Euro (EUR)

Key news events today

German Ifo Business Climate (9:00 am GMT)

ECB President Lagarde Speaks (2:50 pm GMT)

What can we expect from EUR today?

The Euro is pressured by technical and fundamental headwinds, but short-term rebounds are possible at key support zones. Eurozone economic growth remains resilient despite slower employment and inflation deceleration. European policy attention is focused on support for Ukraine, AI adoption, and regulatory strategy, all of which could impact currency sentiment in the near term.

Central Bank Notes:

- The Governing Council of the ECB kept the three key interest rates unchanged at its 30 October 2025 meeting. The main refinancing rate remains at 2.15%, the marginal lending facility at 2.40%, and the deposit facility at 2.00%. This decision reflects policymakers’ assessment that the current monetary stance remains consistent with medium-term price stability, while incoming data confirm a gradual return of inflation towards the target.

- Recent indicators point to stable price dynamics. Headline inflation remains near the 2% mark, with energy prices contained and food inflation easing slightly after earlier supply bottlenecks. Wage growth continues to moderate, contributing to the slowdown in domestic cost pressures. The ECB reiterated its commitment to a data-driven, meeting-by-meeting approach and emphasized flexibility amid uncertain global financial conditions.

- Eurosystem staff projections have not been materially altered since September. Headline inflation averages remain at 2.0% for 2025, 1.8% for 2026, and 2.0% for 2027. Recent softening in producer prices and subdued pipeline pressures suggest limited upside risks to inflation, though geopolitical tensions and potential commodity shocks continue to pose uncertainties to the outlook.

- Euro area GDP growth remains on track with earlier forecasts, projected at 1.1% for 2025, 1.1% for 2026, and 1.4% for 2027. Forward-looking indicators, including PMIs and industrial sentiment surveys, signal some stabilization in activity following weakness in the third quarter. Public investment and recovering export activity are expected to offset softer private sector demand in the near term.

- The labor market remains resilient, with unemployment rates at multi-decade lows and participation rates strong. Real income growth continues to support household spending, even as consumption growth normalizes from earlier highs. Financing conditions remain favorable, aided by stable banking sector liquidity and improved credit demand among small and medium-sized firms.