Articles

S&P 500 Index opens higher but retreats, Nasdaq surges on rising tech shares

60177 July 31, 2020 21:56 FXStreet Market News

- Wall Street’s main indexes opened last day of July in positive territory.

- Nasdaq Composite gains more than 1% on rising tech shares.

- S&P 500 remains on track to close fourth straight month with gains.

Major equity indexes in the US opened the last day of the week and the month in the positive territory supported by upbeat earnings figures from US tech giants.

As of writing, the S&P 500 was up 0.2% on the day at 3,252, the Dow Jones Industrial Average was flat at 26,298 and the Nasdaq Composite was rising 1.07% at 10,830. On a monthly basis, the S&P 500 is up nearly 5% and remains on track to finish the fourth straight month in the positive territory.

Facebook (FB), Apple Inc (AAPL) and Amazon.com Inc (AMZN) shares are up between 4.6% and 7.7% on Friday boosted by upbeat second-quarter earnings figures.

Among the 11 major S&P 500 sectors, the Consumer Discretionary Index and the Technology Index both gain more than 1% as the top performers. On the other hand, falling crude oil prices continue to weigh on energy shares. At the moment, the Energy Index is down 1.4%.

S&P 500 chart (daily)

Full ArticleUnited States Chicago Purchasing Managers’ Index above expectations (43.9) in July: Actual (51.9)

60176 July 31, 2020 21:49 FXStreet Market News

EUR/USD is trading around 1.1850, off the peak above 1.19 – the highest since June 2018. Stimulus uncertainty, coronavirus, and other factors weigh on the dollar. Eurozone GDP fell by 12.1% in Q2. US personal income missed with 1.1% while spending beat with 5.6%.

Full ArticleGold surrenders early gains to all-time highs, back around $1960 region

60175 July 31, 2020 21:45 FXStreet Market News

- Sustained selling around the USD assisted gold to catch some fresh bids on the last day of the week.

- A positive opening in the US equity markets prompted some profit-taking amid overbought conditions.

Gold reversed a major part of its early positive move to all-time highs and has now retreated to the lower end of its daily trading range, around the $1960 region.

Following the previous day’s modest pullback and a subsequent rebound from the $1940 area, the precious metal managed to regain traction and touched a fresh record higher level of $1984. The uptick marked the tenth day of a positive move in the previous eleven and was sponsored by the heavily offered tone surrounding the US dollar, which tends to benefit the dollar-denominated commodity.

The USD remained depressed on the last day of the week fell to its lowest level since May 2018 amid worries that the ever-increasing coronavirus cases could undermine the US economic recovery. The greenback was further pressured by a more dovish statement by the Fed on Wednesday and the failure of the US lawmakers to reach an agreement on the next package of stimulus measures.

However, a modest pickup in the global risk sentiment – as depicted by indications of a positive opening in the US equity markets – undermined the precious metal’s safe-haven status. This coupled with a goodish rebound in the US Treasury bond yields further collaborated towards capping gains for the non-yielding yellow metal, instead prompted traders to take some profits off the table.

Technical levels to watch

Full ArticleUSD/JPY is in the middle of big reversal as Treasury yields rebound

60173 July 31, 2020 21:33 Forexlive Latest News Market News

Big move to the upside

It’s month-end so easy explanations on currency moves are often fleeting. One spot I’m watching is the bond market today. US 5-year yields hit a record low of 0.2122% but they’ve rebounded to flat at 0.2311%. US 10-year yields are also battling some critical levels and now up 1 bps to 0.5560% from a low of 0.5186%. 30s are also 5 bps off the low.

That turn at the long end is likely feeding back into USD/JPY. It’s also taking the shine off gold.

This is quite the reversal candle:

Full Article

US Dollar Index clings to gains around 93.00

60172 July 31, 2020 21:29 FXStreet Market News

- DXY alternates gains with losses around the 93.00 mark.

- US 10-year yields advance to the 0.56% region.

- US Core PCE rose 0.2% MoM and 0.9% YoY in July.

The greenback is trading without a clear direction in the 93.00 neighbourhood when gauged by the US Dollar Index (DXY) on Friday.

US Dollar Index stays offered and risks extra downside

After bottoming out in the mid-92.00s – or +2-year lows – earlier in the session, the index has managed to regain some composure and it is now gyrating around the 93.00 neighbourhood.

In the meantime, the dollar stays well under pressure in the ongoing scenario of the unabated pandemic, lower US yields, poor results from key fundamentals and a massive dose of monetary stimulus.

In the US data space, inflation figures measured by the PCE rose at a monthly 0.2% and 0.9% on a year to June. In addition, Personal Income contracted 1.1% inter-month in June and Personal Spending expanded 5.6% on a monthly basis. Later in the session, the Chicago PMI is due seconded by the final U-Mich print for the current month.

What to look for around USD

The dollar remains under heavy pressure and receded to levels last traded over two years ago in the sub-93.00 zone, as investors keep the bearish stance on the currency unchanged against the usual backdrop of US-China geopolitical jitters, the spread of the pandemic and the dovish message from the Fed, all gauged against efforts to return to a somewhat normal economic activity. Also weighing on the buck, market participants seem to have shifted their preference for other safe havens instead of the greenback on occasional bouts of risk aversion. On another front, the speculative community kept adding to the offered note around the dollar for yet another week, opening the door to a potential development of a more serious bearish trend in the dollar.

US Dollar Index relevant levels

At the moment, the index is gaining 0.15% at 93.10 and a break above 94.20 (38.2% Fibo of the 2017-2018 drop) would open the door to 96.03 (50% Fibo of the 2017-2018 drop) and finally 96.83 (55-day SMA). On the downside, the next support is located at 92.55 (2020 low Jul.31) seconded by 91.80 (monthly low May 18) and finally 89.23 (monthly low April 2018).

Full ArticleChile Industrial Production (YoY): -2.6% (June) vs -5.7%

60171 July 31, 2020 21:17 FXStreet Market News

EUR/USD is trading around 1.1850, off the peak above 1.19 – the highest since June 2018. Stimulus uncertainty, coronavirus, and other factors weigh on the dollar. Eurozone GDP fell by 12.1% in Q2. US personal income missed with 1.1% while spending beat with 5.6%.

Full ArticleBrazil Primary Budget Surplus came in at -188.682B below forecasts (-163.5B) in June

60170 July 31, 2020 21:17 FXStreet Market News

EUR/USD is trading around 1.1850, off the peak above 1.19 – the highest since June 2018. Stimulus uncertainty, coronavirus, and other factors weigh on the dollar. Eurozone GDP fell by 12.1% in Q2. US personal income missed with 1.1% while spending beat with 5.6%.

Full ArticleBrazil Nominal Budget Balance below expectations (-164.079B) in June: Actual (-210.161B)

60169 July 31, 2020 21:12 FXStreet Market News

EUR/USD is trading around 1.1850, off the peak above 1.19 – the highest since June 2018. Stimulus uncertainty, coronavirus, and other factors weigh on the dollar. Eurozone GDP fell by 12.1% in Q2. US personal income missed with 1.1% while spending beat with 5.6%.

Full ArticleChile Unemployment rate came in at 12.2%, below expectations (12.3%) in June

60168 July 31, 2020 21:02 FXStreet Market News

EUR/USD is trading around 1.1850, off the peak above 1.19 – the highest since June 2018. Stimulus uncertainty, coronavirus, and other factors weigh on the dollar. Eurozone GDP fell by 12.1% in Q2. US personal income missed with 1.1% while spending beat with 5.6%.

Full ArticleUSD/JPY climbs to fresh daily highs above 105.00 after mixed US data

60167 July 31, 2020 21:02 FXStreet Market News

- USD/JPY pair gained traction in the early American session.

- US Dollar Index continues to have a tough time climbing above 93.00.

- Personal Spending in the US rose more than expected in June.

The USD/JPY pair extended its daily rebound in the early American session and touched a fresh daily high of 105.20. As of writing, the pair was up 0.4% on a daily basis at 105.13.

DXY rises modestly following US data dump

The data published by the US Bureau of Economic Analysis showed on Friday that Personal Spending in June increased by 5.6% and came in slightly better than the market expectation of 5.5%. On a negative note, however, Personal Income declined by 1.1% in the same period. Finally, the core Personal Consumption Expenditures (PCE) Price Index edged lower to 0.9% on a yearly basis.

Later in the session, the ISM Chicago’s Purchasing Managers’ Index (PMI) and the University of Michigan’s Consumer Sentiment Survey will be looked upon for fresh catalysts.

The US Dollar Index (DXY) stretched higher with the initial reaction to the mixed US data and helped the pair preserve its bullish momentum. At the moment, the DXY is posting small daily gains at 92.97.

Meanwhile, the 10-year US Treasury bond yield is still down 1% on the day and USD/JPY’s upside could remain limited if T-bond yields fail to stage a rebound in the second half of the day.

Technical levels to watch for

Full ArticleEUR/USD Price Analysis: Rally now sees a potential move to 1.20

60166 July 31, 2020 21:02 FXStreet Market News

- EUR/USD stays bid and briefly surpassed 1.19 earlier on Friday.

- Further gains now target the critical barrier at 1.20 the figure.

EUR/USD recorded new +2-year highs just above the 1.1900 mark at the end of the week, extending the move further into the overbought territory, as per the daily RSI.

The pair looks firmer and there is now room for a more convincing breakout of the 1.19 neighbourhood ahead of the psychological yardstick at 1.2000.

Looking at the broader picture, as long as the 200-day SMA, today at 1.1086, holds the downside, further gains in EUR/USD remains well on the table.

EUR/USD daily chart

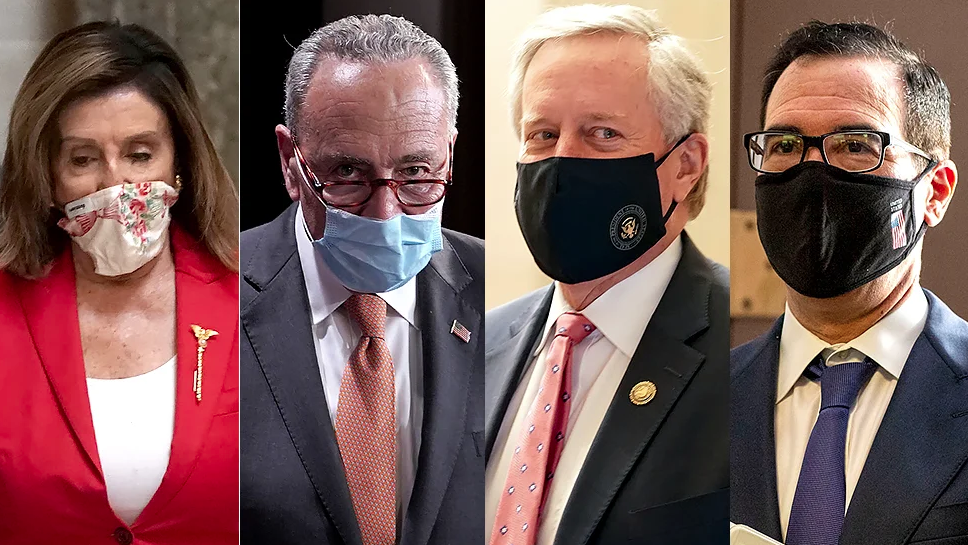

Full ArticleDetails on US stimulus package show sides struggling to find common ground

60164 July 31, 2020 20:56 Forexlive Latest News Market News

Politico has some of the details

- Democrats blocked a week-long extension

- Republicans hinted at a four-month extension

- Pelosi said an extension need to go to Q1 or at least through January

- Debate for money for state and local governments was ‘contentious’

- Democrats looking for nearly $1 trillion for state/local governments

- There was common ground on PPP but not liability protections

Here’s how Politico’s Jake Sherman summed up last night’s meeting: “At the end of the discussion, they found basically no overlap. They agreed to talk more by phone about the allocation of money in places they agree. A deal is not within reach at this moment.”

For equity markets, a stalemate here would be highly negative but it’s very tough to handicap how it works out. Congress never gets anything done until the last minute. Although the benefits have run out, Congressional recess doesn’t begin until Aug 6. So look for a deal then. It might get worse before it gets better though.

Full Article