Articles

United States Core Personal Consumption Expenditure – Price Index (YoY) meets expectations (1.8%) in March

135001 April 30, 2021 20:51 FXStreet Market News

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer.

Trading foreign exchange on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial advisor if you have any doubts.

Opinions expressed at FXStreet are those of the individual authors and do not necessarily represent the opinion of FXStreet or its management. FXStreet has not verified the accuracy or basis-in-fact of any claim or statement made by any independent author: errors and Omissions may occur.Any opinions, news, research, analyses, prices or other information contained on this website, by FXStreet, its employees, partners or contributors, is provided as general market commentary and does not constitute investment advice. FXStreet will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Full ArticleUS: Personal Income surges by 21.1% in March, Personal Spending increases by 4.2%

135000 April 30, 2021 20:49 FXStreet Market News

- Personal Income in US rose sharply in March.

- US Dollar Index clings to recovery gains, stays below 91.00.

The US Bureau of Economic Analysis reported on Friday that Personal Income in March rose by 21.1% fueled by stimulus checks. This reading came in better than the market expectation for an increase of 20.3% and followed February’s contraction of 7%.

Further details of the publication revealed that Personal Spending increased by 4.2% in the same period, compared to analysts’ estimate of 4.1%.

Market reaction

The US Dollar Index showed no immediate reaction to these figures and stays in the positive territory near 90.90.

Full ArticleBreaking: US annual Core PCE inflation rises to 1.8% in March as expected

134999 April 30, 2021 20:49 FXStreet Market News

Inflation in the US, as measured by the Personal Consumption Expenditures (PCE) Price Index, rose to 0.5% in March from 0.2% in February and came in higher than the market expectation of 0.3%. On a yearly basis, the PCE Price Index jumped to 2.3% from 1.5%.

More importantly, the annual Core PCE Price Index, the Federal Reserve’s preferred gauge of inflation, arrived at 1.8% and matched analysts’ estimates.

Market reaction

This report doesn’t seem to be having a significant impact on the greenback’s performance against its rivals. As of writing, the US Dollar Index was up 0.28% on the day at 90.88.

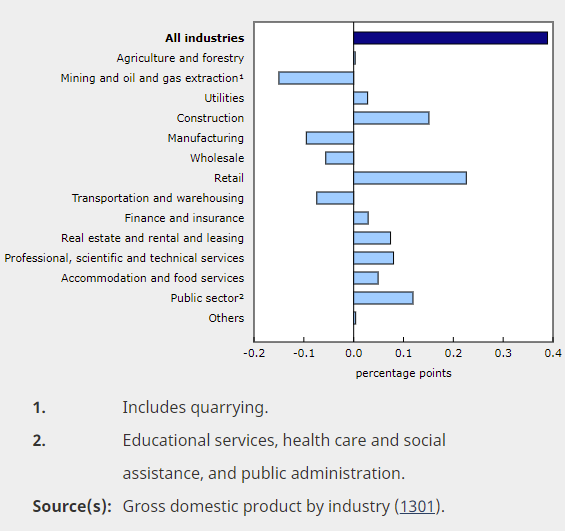

Full ArticleCanada GDP for February 0.4% versus 0.5% estimate

134997 April 30, 2021 20:45 Forexlive Latest News Market News

Canada GBP for February 2021

- Monthly GDP 0.4% versus 0.5% estimate. Last month +0.7%

- YoY GDP -2.2% versus -2.3% estimate. Last month -2.3%

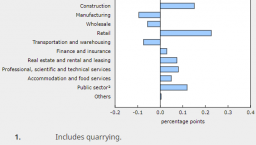

- 14 of the 20 sectors were higher

- this is the 10th consecutive monthly increase, although economic activity is 2% below the level observed in February 2020

- services +0.6%

- goods producing industries -0.2% for the first time since April

- preliminary information indicates an approximate 0.9% increase in real GDP for March

- retail trade +4.5% following two months of declines. 10 of the 12 sectors were up in February as a result of using of lockdown measures with clothing and clothing accessories up 23.5%, sporting goods, hobby, booking music stores +28.2%, and home and furniture up 11.7%

- construction rose 2.0% February with all subsectors up

- mining quarrying and oil and gas extraction fell for the first time in six months at -2.8% with two of three subsectors contracting

- manufacturing felt -0.9% versus 1.5% gain in January. Both durable and nondurable manufacturing were down in February (durable -0.9% versus +2.2% in January. Nondurable -1.0% in February with four of nine subsectors down)

- professional services +1.2%

- public-sector +0.6%

- other industries +3.5% following five consecutive months of declines. Food services and drinking places rose 4.0%. Transportation fell -2.0%. Wholesale trade fell -1.0%. Utilities +1.3%. Finance insurance +0.4%

CLICK HERE for the full report

Full ArticleCanada: Real GDP expands by 0.4% in February vs. 0.5% expected

134996 April 30, 2021 20:45 FXStreet Market News

- Canadian economy grew at a softer pace than expected in February.

- USD/CAD stays relatively quiet around 1.2270 after the data.

Canada’s Real Gross Domestic Product (GDP) expanded at a monthly rate of 0.4% in February, the data published by Statistics Canada showed on Wednesday. This reading came in slightly weaker than the market expectation for a growth of 0.5%.

“This 10th consecutive monthly increase continued to offset the steepest drops on record in Canadian economic activity observed in March and April 2020,” the publication read. “However, total economic activity was about 2% below the level observed in February 2020, before the COVID-19 pandemic.”

Market reaction

The USD/CAD pair paid little to no attention to the GDP report and was last seen posting small daily losses at 1.2274.

Full ArticleBitcoin Weekly Forecast: Markets revert to mean, but BTC price remains indecisive

134990 April 30, 2021 20:45 FXStreet Market News

- Bitcoin price to receive a boost as CME plans to launch Micro BTC Futures on May 3.

- Unsurprisingly, the SEC delayed its decision on the Bitcoin ETF by extending the deadline up to June 17.

- BTC shows ambiguity as it could rise to a new all-time high or suffer a steep correction.

Bitcoin price shows considerable strength after springing from the recent crashes. Still, it is uncertain whether the current bullish impulse will morph into a new uptrend or lead to a more profound decline.

CME’s turn to carry the BTC torch

Even though the past week saw blood in the markets, things seem to have calmed down as Bitcoin appears to have found its footing.

Chicago Mercantile Exchange (CME) announced the launch of Micro Bitcoin Futures (MBT) on May 3, which could see a spike in interest from retail investors.

According to the firm’s senior managing director, Sean Tully, the decision to launch this new financial product comes after the company netted $4.70 million in revenues from its offering of Bitcoin Futures contracts in the first quarter of 2021. Now CME expects that the MBT would appeal to a broader audience due to its relatively smaller lot sizing and fee structure.

On the other end of the spectrum, the US Securities and Exchange Commission (SEC) gave itself an extension for deciding on VanEck’s Bitcoin ETF. The accelerated institutional demand could play a vital role in whether it would be approved or not.

The order published on April 28 reads,

… pursuant to Section 19(b)(2) of the Act,6 the Commission designates June 17, 2021, as the date by which the Commission shall either approve or disapprove, or institute proceedings to determine whether to disapprove, the proposed rule change…

While US regulators continue evaluating the approval of a Bitcoin ETF, institutions continue accumulating more Bitcoin. Nexon became the latest publicly listed firm to acquire BTC.

The Tokyo-based gaming company purchased $100 million worth of Bitcoin at an average price of $58,266, joining Telsa, MicroStrategy and others.

Bitcoin price finds itself at crossroads

Bitcoin price has dipped to $47,000 on April 25 but has swiftly regained the losses incurred and now sits at an inflection point. Indeed, it could very well kick-start another rally that takes out the current highs as Ethereum has, or it might be the start of a much steeper correction.

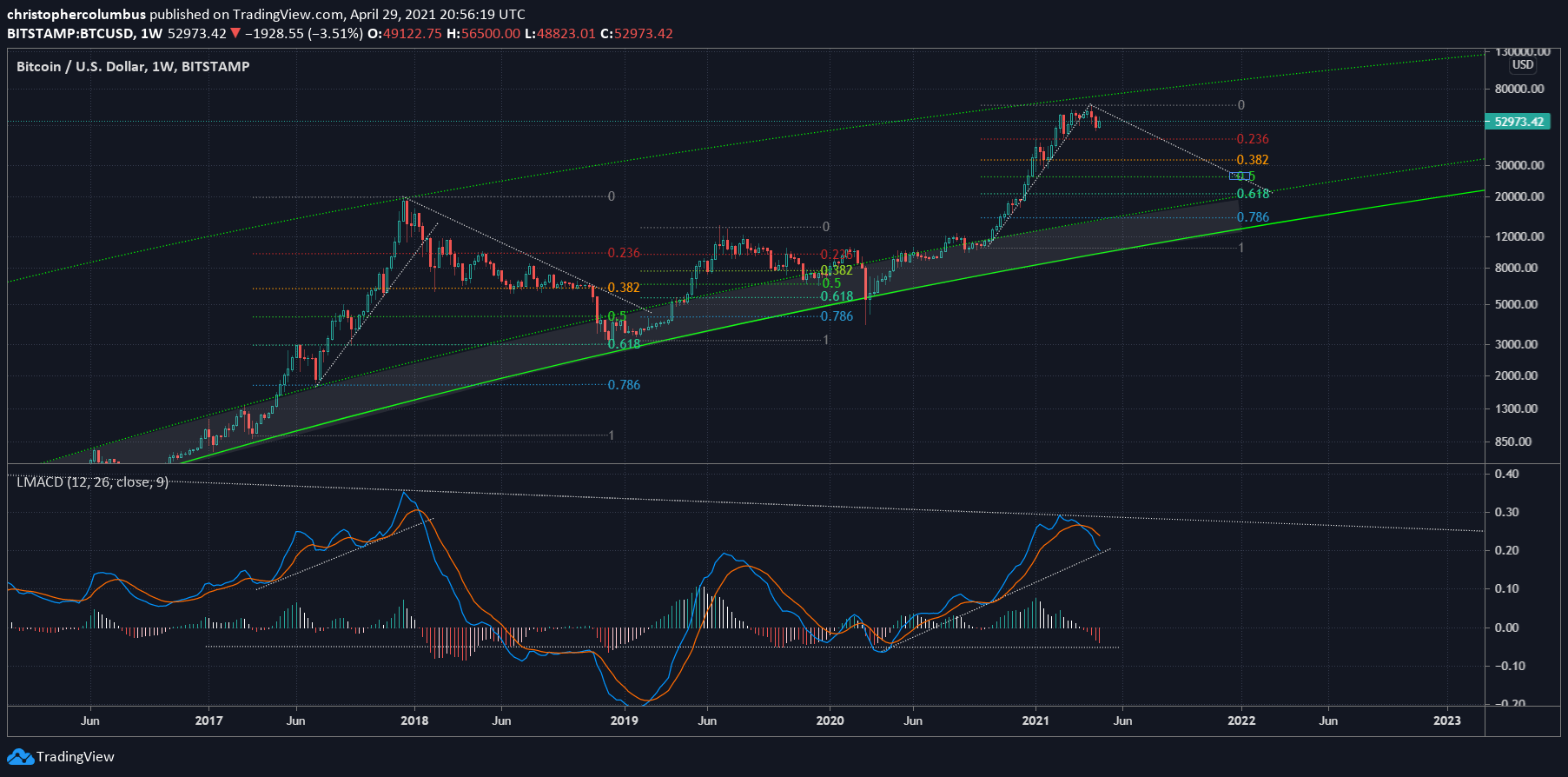

The weekly chart puts the flash crash in perspective and shows that the downward impulse pushed BTC price into the early March territory but failed to test the 21-week Exponential Moving Average (EMA) at $44,996. Had this level been tapped, the bullish scenario would have been acceptable.

During the previous bull runs, BTC bounced off this EMA as it continued its parabolic growth. Hence, investors could get to see Bitcoin price come to such a crucial support level this time around. But for that to happen, a decisive daily candlestick close below the 100-day Simple Moving Average (SMA) at $50,655 must occur. Although the 21-week EMA could keep falling prices at bay, failing to hold above it would likely lead to a downswing to the 200-day SMA at $36,022.

BTC/USD 1-week. 1-day chart

Dave The Wave, a renowned technical analyst in the cryptocurrency community, believes that the bearish carries a lot of weight. According to the chartist, the current bullish cycle resembled the one in 2017. When considering the recent price action and the evolution of the Moving Average Convergence Divergence (MACD) indicator, a steep correction could unfold.

Dave clarified that “a solid correction does not entail a multi-year bear market,” but it may be needed to maintain Bitcoin’s uptrend healthy.

BTC/USD 1-week chart

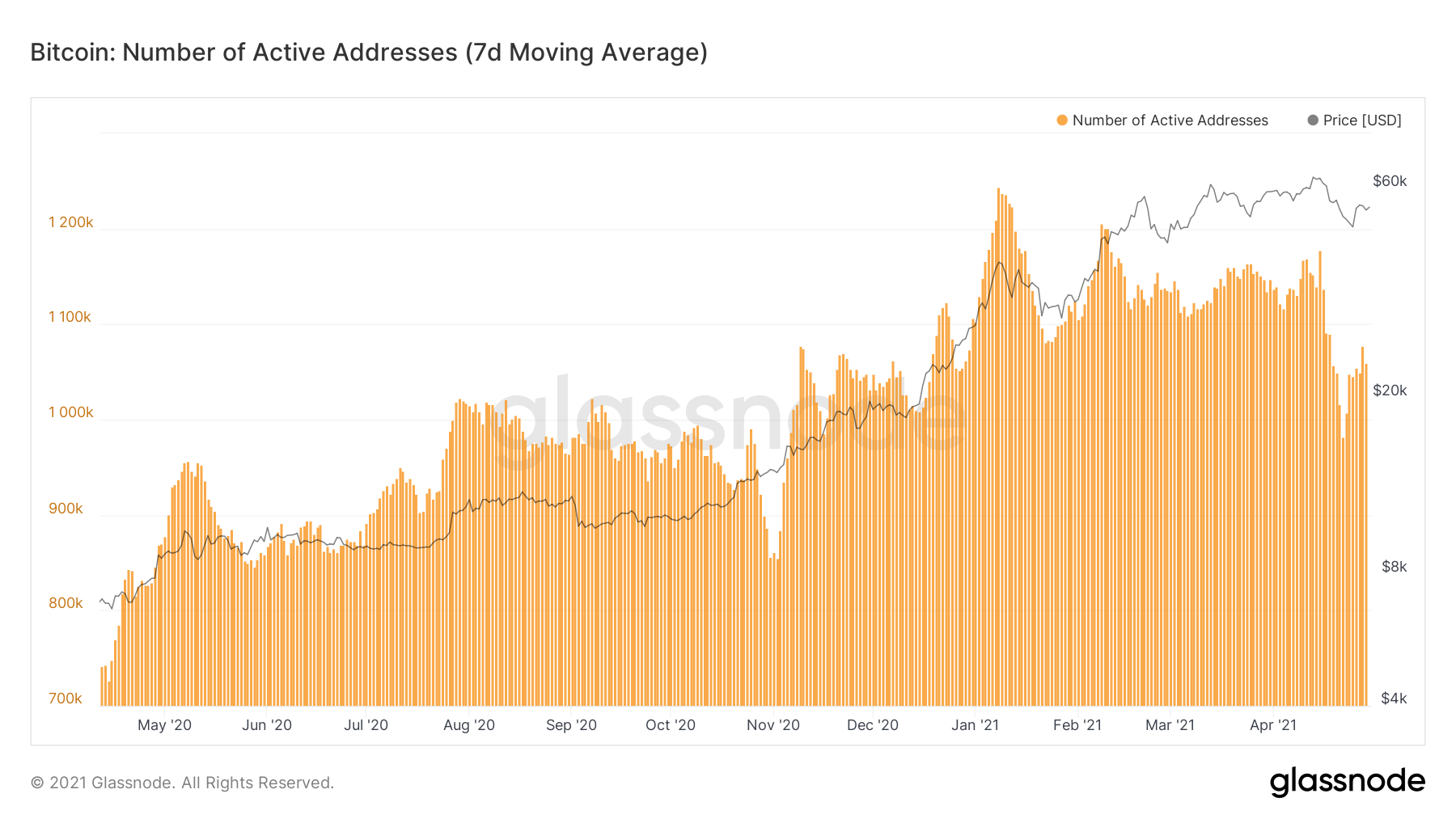

Several on-chain metrics support that a steeper correction is underway.

For instance, the number of daily active addresses interacting with the Bitcoin network has been steadily declining over the past few weeks. It went from 1.10 million daily active addresses to roughly 1.05 million, representing a 4.50% drop.

Such on-chain activity suggests that investors could either be booking profits or reallocating their funds, which is a bearish sign.

BTC daily active addresses chart

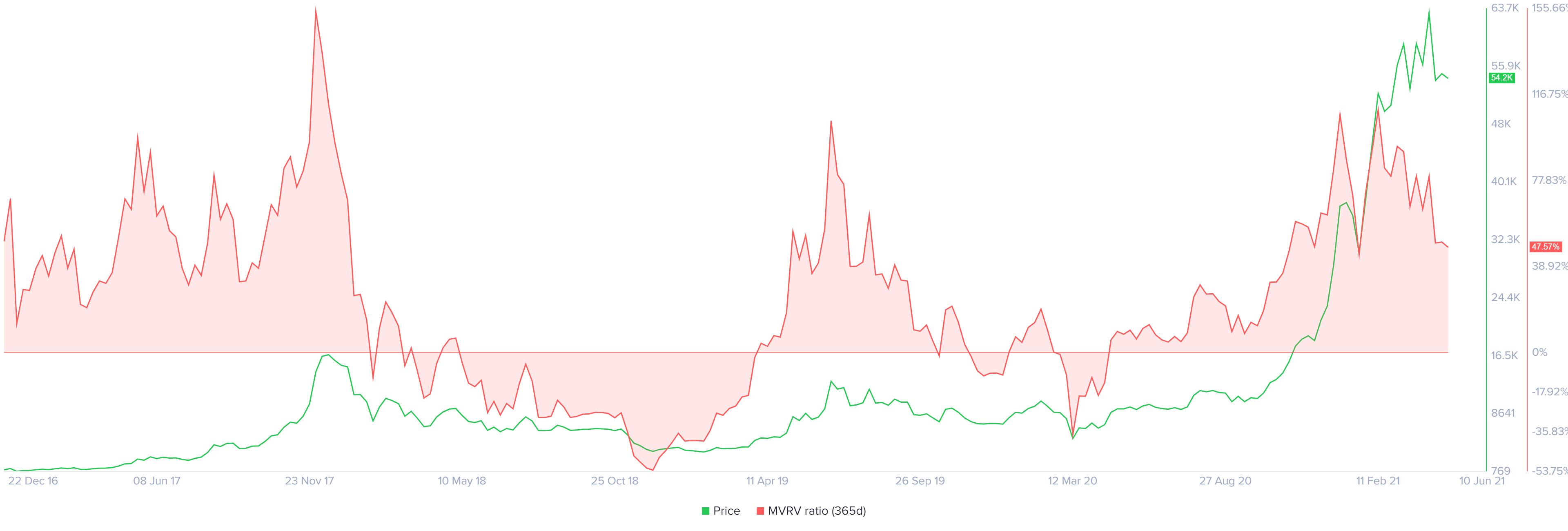

Moreover, Bitcoin’s 365-day MVRV reveals that most of the BTC tokens purchased over the past year sit 50% higher than at the time they were acquired. The high levels of profit that investors could incur now if they were to sell, indicate that a potential spike in profit-taking is underway.

Interestingly, the recent peak seen in the 365-day MVRV coincides with the high of late June 2019, which marked a local top at the time. Similar market reaction to this on-chain metric could see Bitcoin correct to at least the 21-week EMA at $44,996.

BTC 365-day MVRV chart

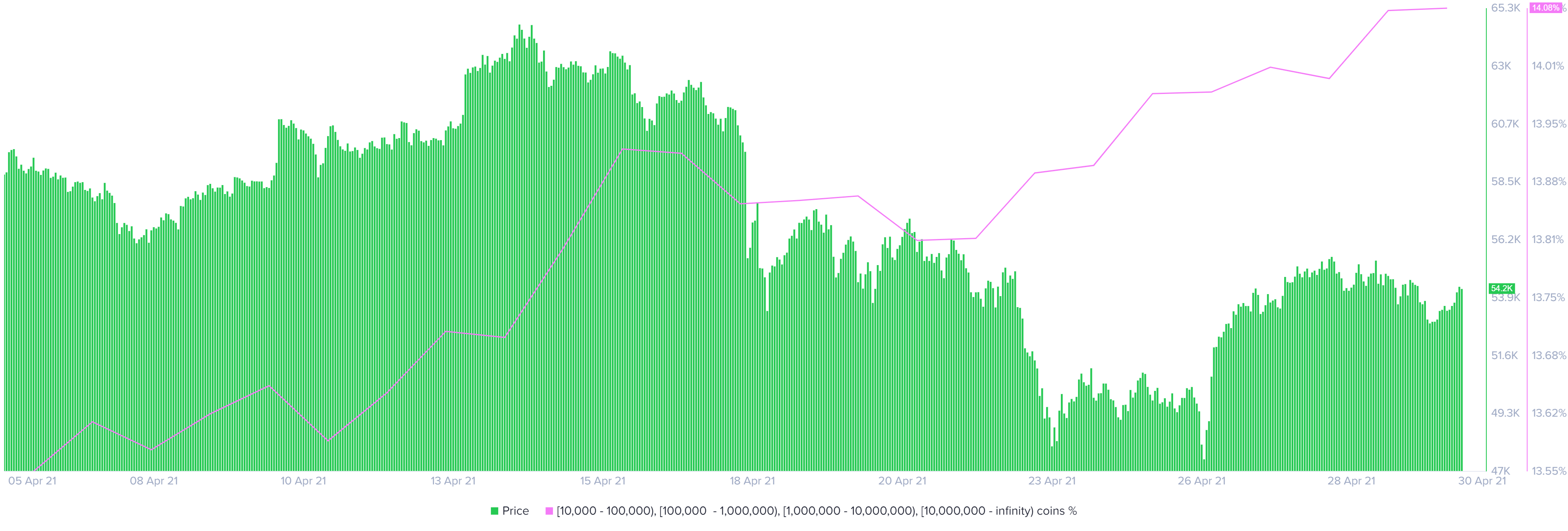

Despite the grim worst-case scenario, whales continue accumulating more Bitcoin at every dip.

Bitcoin’s supply distribution chart shows that the number of addresses with 10,000 BTC or more has significantly increased their holdings over the past week. These high-net-worth individuals acquired roughly 60,000 BTC and now own nearly 14% of the total supply.

The massive buying pressure behind the flagship cryptocurrency opposes the bearish scenario outlined above, calling for a continuation of the uptrend.

BTC supply distribution chart

If buyers can manage to push the Bitcoin above $60,103 and hold above this crucial hurdle, the bearish scenario will likely be invalidated.

Still, investors must pay close attention to the 100-day SMA at $50,655 since a decisive close below it will send BTC into a tailspin toward the 21-week EMA at $44,996 or the 200-day SMA at $36,022.

Full ArticleUS March core PCE +1.8% y/y vs +1.8% expected

134989 April 30, 2021 20:40 Forexlive Latest News Market News

Highlights from the personal consumption expenditure report for March 2021:

- Prior was +1.4% y/y

- PCE core MoM +0.4% vs +0.3% expected

- Prior MoM +0.1%

- Deflator YoY +2.3% vs +2.3% expected

- Prior deflator YoY +0.5%

- Deflator MoM +0.5% vs +0.5% expected

- Prior MoM deflator +0.2%

Consumers spending and income for March:

- Personal income +21.1% vs +20.3% expected. Prior month -7.1%

- Personal spending +4.2% vs +4.1% expected. Prior month -1.0%

- Real personal spending +3.6% vs +3.7% expected. Prior month -1.2%

It took until February revisions until the January stimulus checks were fully incorporated into the January data. I expect a similar kind of upward revision for March when we get next month’s report.

Full Article

United States Personal Consumption Expenditures – Price Index (YoY) registered at 2.3% above expectations (1.6%) in March

134988 April 30, 2021 20:40 FXStreet Market News

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer.

Trading foreign exchange on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial advisor if you have any doubts.

Opinions expressed at FXStreet are those of the individual authors and do not necessarily represent the opinion of FXStreet or its management. FXStreet has not verified the accuracy or basis-in-fact of any claim or statement made by any independent author: errors and Omissions may occur.Any opinions, news, research, analyses, prices or other information contained on this website, by FXStreet, its employees, partners or contributors, is provided as general market commentary and does not constitute investment advice. FXStreet will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

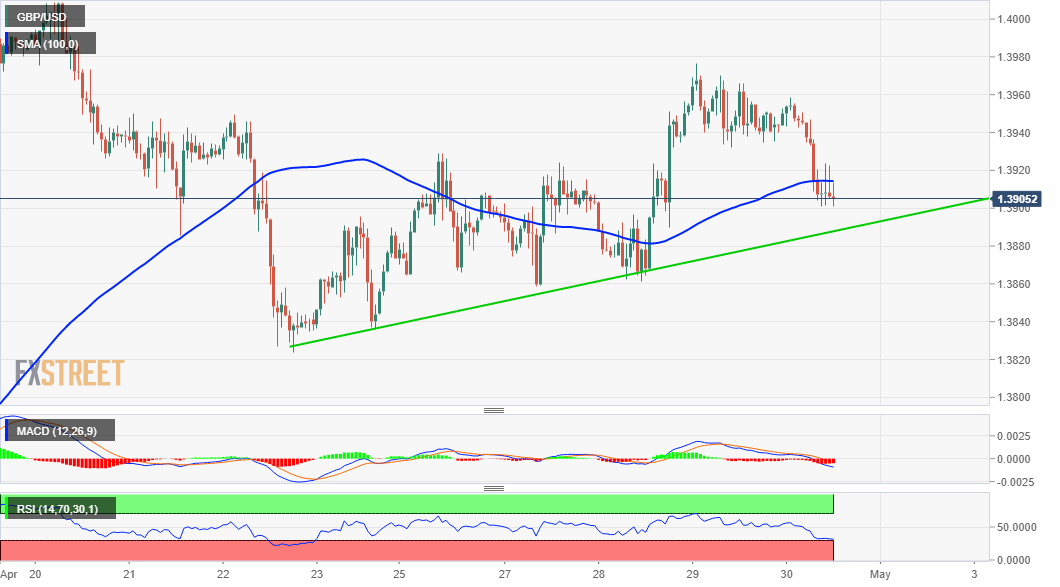

Full ArticleGBP/USD Price Analysis: Bears flirt with ascending trend-line, below 1.3900 mark

134986 April 30, 2021 20:40 FXStreet Market News

- GBP/USD witnessed some selling on Friday and snapped five days of the winning streak.

- Break below an ascending trend-line should pave the way for further near-term weakness.

The GBP/USD pair witnessed some selling on the last trading day of the week and extended the previous day’s retracement slide from the 1.3975 region, or over one-week tops. This marked the first day of a negative move in the previous six sessions and dragged the pair below the 1.3900 mark during the early North American session.

The US dollar built on the overnight modest bounce from the lowest level since February 26 and gained traction for the second consecutive session. A modest pullback in the equity markets was seen as a key factor that benefitted the safe-haven greenback, which, in turn, exerted some downward pressure on the GBP/USD pair.

From a technical perspective, the GBP/USD pair has now dropped back closer to a one-week-old ascending trend-line. The mentioned support is pegged near the 1.3885 region, which if broken decisively might prompt some technical selling. The pair might then accelerate the fall towards weekly lows, around the 1.3860-55 region.

Some follow-through selling has the potential to drag the GBP/USD pair further towards the 1.3825-20 intermediate support en-route the 1.3800 mark. The next relevant support is pegged near the 1.3740-35 area, which if broken will set the stage for the resumption of the recent downfall from near three-year lows.

On the flip side, the 1.3960 region now seems to act as immediate strong resistance, above which bulls are likely to make a fresh attempt to conquer the key 1.4000 psychological mark. The subsequent move up has the potential to push the GBP/USD pair towards the 1.4080 intermediate hurdle en-route the 1.4100 mark.

GBP/USD 1-hour chart

Technical levels to watch

Full ArticleUS Q1 employment cost index +0.9 vs +0.7% expected

134985 April 30, 2021 20:35 Forexlive Latest News Market News

HIGH RISK WARNING: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives, experience level, and risk tolerance. You could lose some or all of your initial investment; do not invest money that you cannot afford to lose. Educate yourself on the risks associated with foreign exchange trading, and seek advice from an independent financial or tax advisor if you have any questions.

ADVISORY WARNING: FOREXLIVE™ provides references and links to selected blogs and other sources of economic and market information as an educational service to its clients and prospects and does not endorse the opinions or recommendations of the blogs or other sources of information. Clients and prospects are advised to carefully consider the opinions and analysis offered in the blogs or other information sources in the context of the client or prospect’s individual analysis and decision making. None of the blogs or other sources of information is to be considered as constituting a track record. Past performance is no guarantee of future results and FOREXLIVE™ specifically advises clients and prospects to carefully review all claims and representations made by advisors, bloggers, money managers and system vendors before investing any funds or opening an account with any Forex dealer. Any news, opinions, research, data, or other information contained within this website is provided as general market commentary and does not constitute investment or trading advice. FOREXLIVE™ expressly disclaims any liability for any lost principal or profits without limitation which may arise directly or indirectly from the use of or reliance on such information. As with all such advisory services, past results are never a guarantee of future results.

Full Article

Brazil Nominal Budget Balance dipped from previous -41B to -44.528B in March

134984 April 30, 2021 20:35 FXStreet Market News

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer.

Trading foreign exchange on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial advisor if you have any doubts.

Opinions expressed at FXStreet are those of the individual authors and do not necessarily represent the opinion of FXStreet or its management. FXStreet has not verified the accuracy or basis-in-fact of any claim or statement made by any independent author: errors and Omissions may occur.Any opinions, news, research, analyses, prices or other information contained on this website, by FXStreet, its employees, partners or contributors, is provided as general market commentary and does not constitute investment advice. FXStreet will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Full ArticleBrazil Primary Budget Surplus registered at -4.981B, below expectations (-2.1B) in March

134983 April 30, 2021 20:35 FXStreet Market News

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer.

Trading foreign exchange on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial advisor if you have any doubts.

Opinions expressed at FXStreet are those of the individual authors and do not necessarily represent the opinion of FXStreet or its management. FXStreet has not verified the accuracy or basis-in-fact of any claim or statement made by any independent author: errors and Omissions may occur.Any opinions, news, research, analyses, prices or other information contained on this website, by FXStreet, its employees, partners or contributors, is provided as general market commentary and does not constitute investment advice. FXStreet will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Full Article