Articles

US weekly oil inventory data is coming up next

150692 June 30, 2021 22:26 Forexlive Latest News Market News

Weekly US petroleum inventory data

Oil is bouncing around ahead of tomorrow’s OPEC+ meeting. WTI was last at $73.72 after rising as high as $74.12.

The next big input is the weekly US storage report at the bottom of the hour.

API data late yesterday:

- Crude -8153K

- Gasoline +2418K

- Distillates +428K

- Cushing -1318K

Full Article

NFP Preview: Four reasons why June’s jobs report could be a dollar downer

150688 June 30, 2021 22:21 FXStreet Market News

- June’s Nonfarm Payrolls figures could fall short of elevated expectations once again.

- Fed Chair Powell created high expectations, which will be hard to be met.

- Wage gains could reverse the previous trends, lowering inflation expectations.

- NFP could trigger a reversal of dollar gains.

Time for King Dollar to be knocked off the throne? June’s highly anticipated Nonfarm Payrolls report – due on July 2 and ahead of a long weekend – could provide other currencies an opportunity to bring the greenback back to the ground.

There are four reasons to expect the NFP to down the dollar:

1) Reopening is hard

There is no Undo button for returning the economy to pre-pandemic levels – as the two disappointing jobs reports have shown. The economy has sprung back to fast growth in the spring, but while restoring jobs for those that have been furloughed may be relatively easy, matching employers’ needs with employees’ desires is a more complex task.

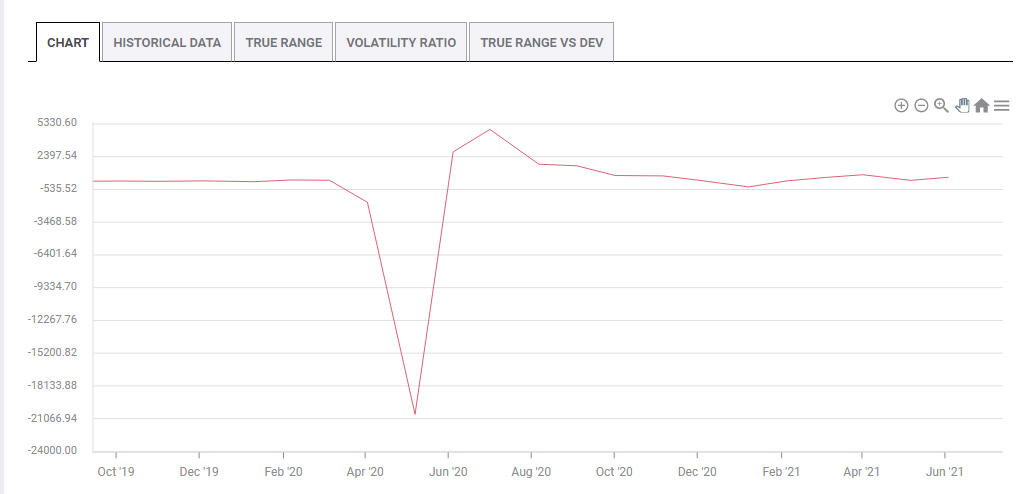

Source: FXStreet

The US gained 559,000 positions in May – extremely high in pre-pandemic times – but falling short of estimates once again. Some blame generous unemployment benefits and stimulus checks, while others mention that the covid crisis is far from over – some fear returning to being in contact.

The skill mismatch mentioned earlier was also compounded by a shortage of raw materials. Have all these issues been resolved between May and June? Probably not, yet expectations remain elevated. The economic calendar is pointing to an increase of some 700,000 jobs in June, substantially above May’s hiring.

All this may lead to a third consecutive disappointment.

2) Powell’s high expectations

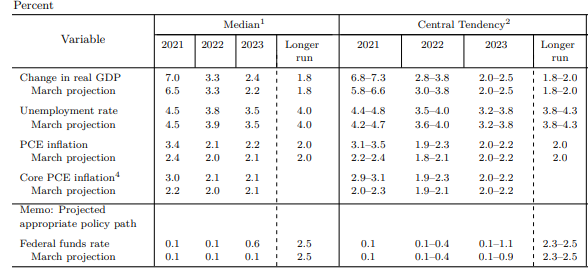

A weaker number than economists estimate would become even worse given elevated expectations created by Federal Reserve Chair Jerome Powell. In his post-rate decision presser, the world’s most powerful central banker declared that job growth would accelerate in the coming months.

Moreover, by basing the Fed’s hawkish turn on this outlook rather than on outcomes, he raised the bar. Therefore, even a satisfactory figure would serve as a reminder that restoring some 7.6 million jobs lost in the pandemic will take a long time. That could weigh on the dollar.

Fed projections, June vs. March:

Source: Federal Reserve

3) Wages could downplay inflation expectations

The central bank’s second mandate is keeping price stability. After sticking to the script that rising inflation is only transitory, Powell and his colleagues acknowledged there is a chance that higher costs are here to stay. They upgraded their forecasts.

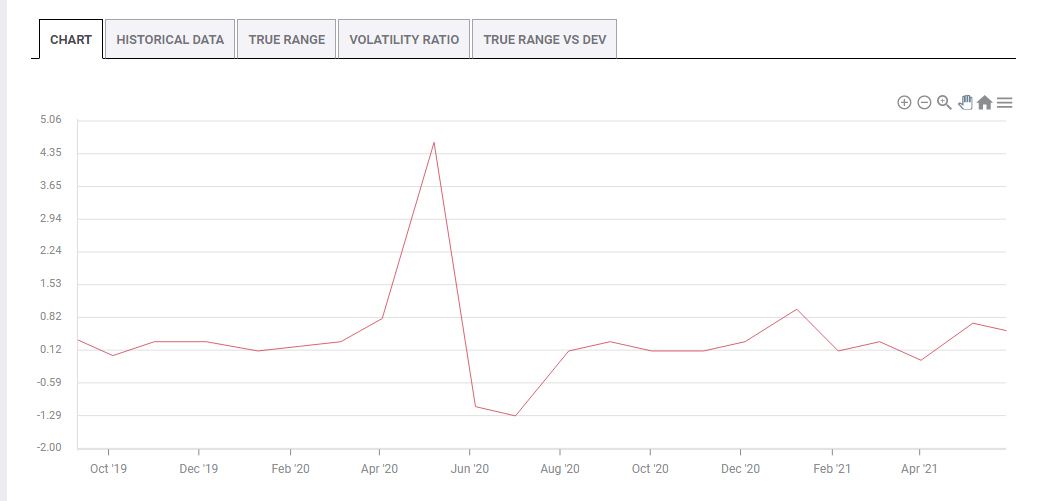

Nevertheless, jumps in lumber prices and also computer chips have begun unwinding. The theory that temporary bottlenecks – not a structural change – are behind most of the gains may receive more impetus if wage growth cools down.

Average Hourly Earnings rose by 0.5% in May and 0.7%, both elevated levels and beating expectations. Similar to weak job gains, another upside surprise in salaries could repeat itself for the third time. However, wages are more likely to decelerate as job growth remains weak, rather than beat expectations.

Source: FXStreet

If Americans have marginally less money in their pockets, that could ease inflation pressures and push the dollar down as well.

4) NFP as a reversal trigger

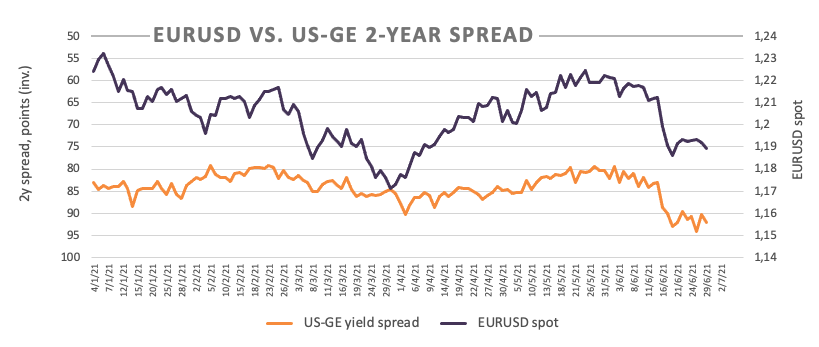

Money managers adjust their portfolios at the end of the month, and this usually results in some unwinding of the trends seen earlier in the month. Not this time. June saw the dollar gaining – mostly as a result of the Fed’s hawkish tilt – and concluding the month has not resulted in any dollar downfall.

Investors seem to be keeping their powder dry ahead of the all-important NFP. It might take only a marginal miss – or even the jobs report merely meeting estimates – to trigger a move in the other direction. That means the greenback giving some ground.

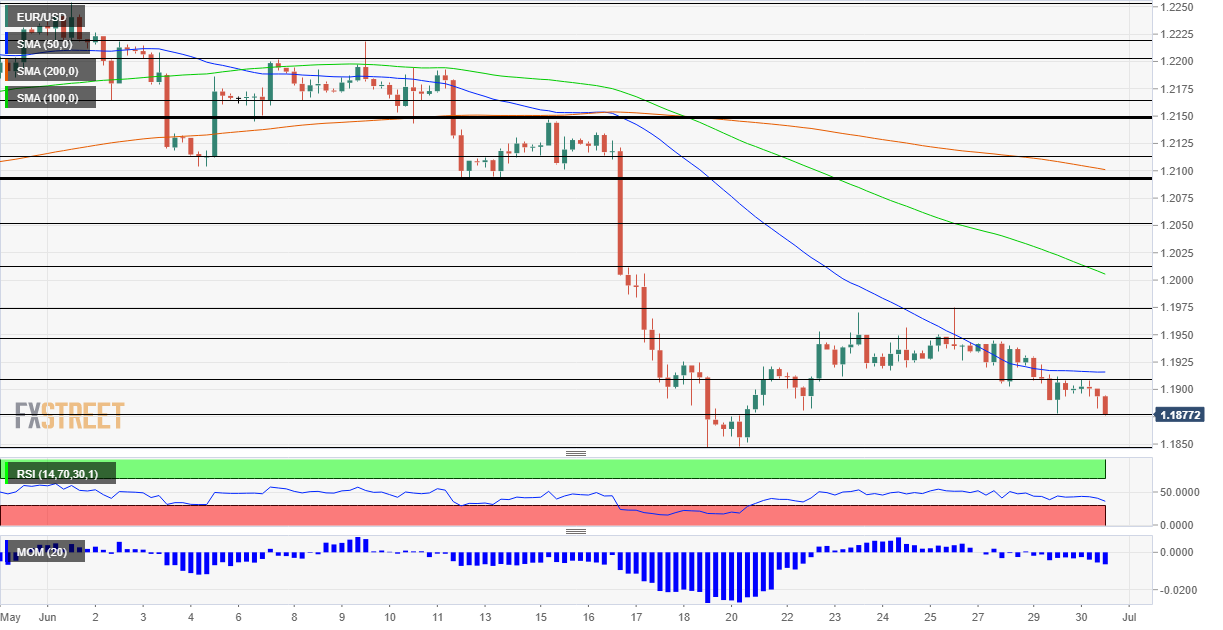

EUR/USD monthly chart, showing June resulted in a fall of over 300 pips:

Conclusion

The dollar has room to fall in response to June’s Nonfarm Payrolls report due to elevated expectations, undoing of existing positions and more.

Full ArticleUS: Pending Home Sales increase by 8% in May vs. -0.8% expected

150687 June 30, 2021 22:09 FXStreet Market News

- Pending Home Sales in the US rose sharply in May.

- US Dollar Index stays in the positive territory around 92.20.

Pending Home Sales in the US rose by 8% on a monthly basis in May following April’s contraction of 4.4%, the data published by the US National Association of Realtors showed on Wednesday. This reading beat analysts’ estimate for a decrease of 0.8% by a wide margin.

Further details of the publication revealed that Pending Home Sales were up 13.1% on a yearly basis, compared to the market expectation of 49.2%.

Market reaction

The US Dollar Index showed no immediate reaction to this report and was last seen gaining 0.17% on the day at 92.22.

Full ArticleSafeMoon Price Prediction: SAFEMOON prepares for 26% advance

150685 June 30, 2021 22:05 FXStreet Market News

- SafeMoon price is attempting to slice through a resistance barrier at $0.00000338 for the second time.

- A rejection here is likely and will lead to a minor pullback that retests the support level at $0.00000295.

- If SAFEMOON breaks down the range low at $0.00000257, it will invalidate the bullish thesis.

SafeMoon price has climbed after a brutal sell-off that ended on June 22. The ascent has sliced through a critical resistance level but is struggling to breach the next barrier. Therefore, SAFEMOON is likely to pull back to the immediate support floor.

SafeMoon price corrects after a brief upswing

SafeMoon price is currently trying to slice through the resistance level at $0.00000338 after a recent failed attempt. Judging by the present state of the crypto market, the latest jab at flipping the ceiling is unlikely. Therefore, investors can expect SAFEMOON to pull back.

The immediate support barrier at $0.00000295 could harbor this correction and serve as a foothold for reversal.

A potential spike in buy pressure from investors scooping up the altcoin at a discount might trigger a rally that could propel SafeMoon price to take another jab at $0.00000338.

If the bulls push through this barrier and flip it into a support, the advance will likely continue to the subsequent ceiling at $0.00000374, a 26% climb from $0.00000295.

In a highly bullish case, SAFEMOON might even retest $0.00000412.

SAFEMOON/USDT 4-hour chart

On the flip side, if the selling pressure continues to build at $0.00000295, SAFEMOON might slice through it and tag the range low at $0.00000257. This move would put a dent in the upswing narrative.

However, a breakdown of $0.00000257 will invalidate the bullish thesis and might trigger a 23% sell-off to $0.00000198.

Full ArticleUS pending home sales for May 2021 +8.0% versus -0.8% estimate

150684 June 30, 2021 22:02 Forexlive Latest News Market News

HIGH RISK WARNING: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives, experience level, and risk tolerance. You could lose some or all of your initial investment; do not invest money that you cannot afford to lose. Educate yourself on the risks associated with foreign exchange trading, and seek advice from an independent financial or tax advisor if you have any questions.

ADVISORY WARNING: FOREXLIVE™ provides references and links to selected blogs and other sources of economic and market information as an educational service to its clients and prospects and does not endorse the opinions or recommendations of the blogs or other sources of information. Clients and prospects are advised to carefully consider the opinions and analysis offered in the blogs or other information sources in the context of the client or prospect’s individual analysis and decision making. None of the blogs or other sources of information is to be considered as constituting a track record. Past performance is no guarantee of future results and FOREXLIVE™ specifically advises clients and prospects to carefully review all claims and representations made by advisors, bloggers, money managers and system vendors before investing any funds or opening an account with any Forex dealer. Any news, opinions, research, data, or other information contained within this website is provided as general market commentary and does not constitute investment or trading advice. FOREXLIVE™ expressly disclaims any liability for any lost principal or profits without limitation which may arise directly or indirectly from the use of or reliance on such information. As with all such advisory services, past results are never a guarantee of future results.

Full Article

United States Pending Home Sales (YoY) registered at 13.1%, below expectations (49.2%) in May

150683 June 30, 2021 22:02 FXStreet Market News

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

United States Pending Home Sales (MoM) came in at 8%, above forecasts (-0.8%) in May

150682 June 30, 2021 22:02 FXStreet Market News

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

EUR/USD tumbles to new lows… on its way to 1.1850?

150681 June 30, 2021 21:56 FXStreet Market News

- EUR/USD loses further momentum in the 1.1870/65 band.

- EMU’s flash CPI showed inflation pressure lost traction in June.

- US ADP report came it stronger at 692K during last month.

Sellers remain in control of the sentiment around the European currency and now force EUR/USD to slip back to the 1.1870 region, or new multi-day lows.

EUR/USD weaker, dollar stays bid

EUR/USD intensifies the leg lower and records new weekly lows near 1.1870 as the demand for the greenback remains solid on the back of the rebound in yields in the shorter end of the curve.

In addition, better-than-forecast ADP results lend extra legs to the buck after the US private sector added 692K jobs in June (vs. 600K exp.). These results add to the prevailing optimism ahead of the more relevant Nonfarm Payrolls due in the second half of the week.

Earlier in the session, advanced June inflation figures in the broader euro area showed headline consumer prices rising 1.9% over the last twelve months, and core prices gaining 0.9% YoY, both prints easing some upside traction vs. the previous month.

Additional data saw the Chicago PMI at 66.1 (vs. 70.0 exp.) ahead of Pending Home Sales and the weekly report on the US crude oil supplies by the EIA.

What to look for around EUR

Sellers seem to have regained the upper hand and drag EUR/USD back to the area below the 1.1900 key support. In the meantime, price action in spot is expected to monitor the dollar dynamics, particularly following the latest FOMC gathering, prospects of higher inflation and potential tapering before anticipated. Further out, support for the European currency comes in the form of auspicious results from fundamentals in the bloc coupled with higher morale, prospects of a strong rebound in the economic activity and the investors’ appetite for riskier assets.

Key events in the euro area this week: German Retail Sales, Final Manufacturing PMIs in the euro area, EMU Unemployment Rate, ECB’s Lagarde.

Eminent issues on the back boiler: Asymmetric economic recovery in the region. Sustainability of the pick-up in inflation figures. Progress of the vaccine rollout. Probable political effervescence around the EU Recovery Fund. German elections. Investors’ shift to European equities.

EUR/USD levels to watch

So far, spot is losing 0.20% at 1.1871 and a break below 1.1847 (monthly low Jun.18) would target 1.1835 (low Mar.9) and route to 1.1704 (2021 low Mar.31). On the other hand, the next resistance emerges at 1.1976 (50% Fibo of the November-January rally) followed by 1.1995 (200-day SMA) and finally 1.2000 (psychological level).

Full ArticleS&P 500 Index opens modestly lower, tech shares underperform

150679 June 30, 2021 21:56 FXStreet Market News

- Wall Street’s main indexes opened in the negative territory.

- Tech stocks underperform after the opening bell on Tuesday.

- Energy shares push higher ahead of Thursday’s OPEC meeting.

Major equity indexes in the US opened modestly lower on Thursday as investors seem to be staying on the sidelines on the last day of the second quarter. As of writing, the Dow Jones Industrial Average was down 0.17% on the day at 34,325, the S&P 500 was losing 0.2% at 4,283 and the Nasdaq Composite was falling 0.15% at 14,551.

Earlier in the day, the data published by the Automatic Data Processing (ADP) Research Institute revealed that private sector employment increased by 692,000 in June. This reading followed May’s print of 886,000 (revised from 978,000) and came in better than the market expectation of 600,000.

Among the 11 major S&P 500 sectors, the Communication Services and the Technology indexes are both down around 0.2% after the opening bell. On the other hand, the Energy Index is rising as investors are waiting for OPEC+ to announce its output strategy following Thursday’s meeting.

S&P 500 chart (daily)

Full ArticleUSD/CHF climbs to the highest level since April 13, around mid-0.9200s

150678 June 30, 2021 21:49 FXStreet Market News

- USD/CHF gained traction for the third straight day amid sustained USD buying interest.

- Hawkish Fed expectations, upbeat ADP report continued acting as a tailwind for the USD.

- The prevalent risk-on mood undermined the safe-haven CHF and remained supportive.

The USD buying picked up pace during the early North American session and pushed the USD/CHF pair to two-and-half-month tops, around mid-0.9200s in the last hour.

The pair built on this week’s positive move and gained some follow-through traction for the third consecutive session amid a broad-based US dollar strength. Despite mixed signals on the US inflation, investors have been speculating about the prospects for an earlier policy tightening by the Fed.

The already stronger greenback got an additional boost following the release of the ADP report, which showed that private-sector employers added 692K jobs in June. The reading was well below the previous month’s blowout reading of nearly one million but was still better than market expectations for 600K.

On the other hand, a generally positive tone around the equity markets acted as a headwind for traditional safe-haven currencies, including the Swiss franc. This, in turn, helped offset the ongoing sharp decline in the US Treasury bond yields and provided an additional boost to the USD/CHF pair.

From a technical perspective, a move beyond the previous monthly swing highs, around the 0.9230-40 zone, might have already set the stage for a further near-term appreciating move. It, however, remains to be seen if bulls are able to capitalize on the move as the focus remains on Friday’s NFP report.

The closely watched US monthly jobs data could influence the Fed’s monetary policy outlook and play a key role in influencing the USD price dynamics in the near term. This would eventually assist investors to determine the next leg of a directional move for the USD/CHF pair.

Technical levels to watch

Full ArticleUnited States Chicago Purchasing Managers’ Index below expectations (70) in June: Actual (66.1)

150677 June 30, 2021 21:49 FXStreet Market News

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

EUR/USD Forecast: Euro rejected at resistance, bears eye 1.1850 after US data boost

150676 June 30, 2021 21:17 FXStreet Market News

- EUR/USD has been drifting lower after eurozone inflation dropped.

- The dollar has received a boost from ADP’s upbeat US job figures.

- Wednesday’s four-hour chart is painting a bearish picture.

One-two punch – EUR/USD has received a blow from mediocre eurozone data and from upbeat US figures and may extend its downfall.

Consumer prices rose by 1.9% YoY in June, according to the preliminary read, below 2% recorded in May. Underlying prices are at a meager 0.9%, also one-tenth of a percent lower. While these outcomes only met estimates rather than falling short, they will likely encourage the European Central Bank to maintain its dovish policy.

Moreover, the Delta variant is beginning to spread across the old continent, potentially wreaking havoc. It has yet to reach America’s shores.

Over in the US, ADP’s private-sector jobs report showed a gain of 692,000 positions, better than 600,000 estimates and with only a minor downward revision from last month. Back in May, the payroll firm overestimated American hiring in comparison to the official numbers, and by sticking to a high level, it raises expectations for Friday’s Nonfarm Payrolls.

Moreover, expectations for an end-of-month dollar downfall have proven wrong. The greenback gained substantial ground in June, and portfolio managers seem to be in no rush to unwind these positions.

Overall, fundamentals are pointing to additional falls for the currency pair.

EUR/USD Technical Analysis

Euro/dollar has been rejected at 1.1905, a level that has been capping in in the past few sessions. Downside momentum on the four-hour chart has intensified and that failure to break resistance also leaves the 50 Simple Moving Average as a cap on top of the currency pair.

Critical support awaits at June’s low of 1.1850, followed by 1.18 and 1.1760.

Resistance is at 1.1905, followed by 1.1950 and 1.1975.

Full Article