Articles

United States Baker Hughes US Oil Rig Count down to 385 from previous 387

157915 July 31, 2021 01:26 FXStreet Market News

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Baker Hughes oil rig count -2 at 385

157914 July 31, 2021 01:12 Forexlive Latest News Market News

The weekly Baker Hughes rig count data.

- Oil rigs come in at 385 vs 387 last week

- Gas rigs 103 vs 104 last week

- Total rigs 488 vs 491 last week.

The US rig count data is well the pre-pandemic levels that were just above the 800 level. Despite the rise in oil prices from pandemic lows and the supply/demand imbalance on global re-opening, the US oil producers are reluctant to invest the capital in new oil rigs.

Full ArticleUS 1 trillion infrastructure package gets enough votes up for debate to open

157913 July 31, 2021 01:02 Forexlive Latest News Market News

A step forward in the $1T infrastructure package

The bipartisan $1 trillion infrastructure package has received enough votes up for debate to open in the US Senate. To move forward it only needed a 50 vote majority. The Senate last advanced the proposal by a 67-32 margin in a Wednesday test vote. Advancing was expected.

The measure would put $550 billion in new funds into transportation, power, water and broadband.

Full ArticleNZDUSD returns to hourly MA levels today

157911 July 31, 2021 00:56 Forexlive Latest News Market News

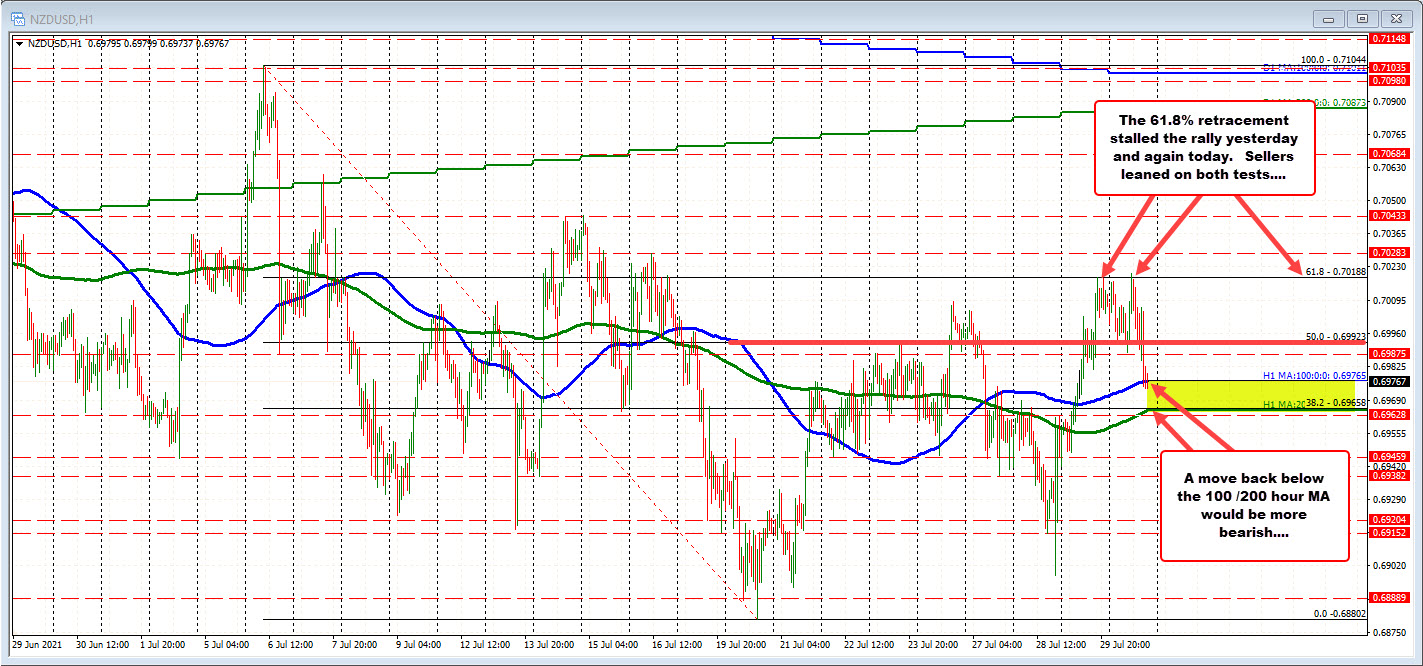

100/200 hour MAs in play

The NZDUSD has moved lower today and in the process returned back toward the 100/200 hour MAs.

Yesterday, the price trended higher and reached the 61.8% of the July trading range at 0.70188. Sellers leaned against the area.

The corrective move lower in the Asian session saw the price moved toward the 50% midpoint. One final retest of the 61.8% saw the target broken, but only by a few pips before heading back down. The 50% midpoint has been broken with the retest of the 100 hour MA, the next target at 0.69765. The 200 hour MA is at 0.69658. Move below both, would tilt the technical bias more in favor of the sellers (once again).

Full Article

US: Nonfarm Payrolls probably surged again in July – TDS

157910 July 31, 2021 00:49 FXStreet Market News

Previewing next week’s key macroeconomic data releases from the US, TD Securities analysts said they expect Nonfarm Payrolls to surge again in July, “with the pace up a bit from the +850k in June.”

Key quotes

“Some acceleration in the private sector is suggested by the Homebase data, while government payrolls probably benefited from favorable seasonal adjustments. We forecast another 0.3% m/m rise in average hourly earnings. The 12-month change is likely to rise again to 3.8% from 3.6% in June.”

“Mixed but slightly positive signals from regional data suggest improvement relative to June for the ISM surveys. At around 60, the June readings were still consistent with strong growth, although both came off of recent highs (the 64.0 reading for services in May was an all-time high). The boosts to growth from “reopening” and fiscal stimulus have probably peaked.”

Full ArticleUSD/CAD rebounds above 1.2470, looks to snap two-day losing streak

157909 July 31, 2021 00:45 FXStreet Market News

- USD/CAD gained traction in the American trading hours on Friday.

- Canadian economy contracted by 0.3% in May as expected.

- US annual Core PCE inflation edged higher to 3.5% in June.

The USD/CAD pair dropped to a daily low of 1.2420 in the early American session on Friday but managed to stage a decisive rebound. As of writing, the pair was up 0.25% on the day at 1.2475 and was on track to snap a two-day losing streak. Despite the recent recovery, the pair looks to end the week in the negative territory.

DXY reclaims 92.00 ahead of the weekend

The renewed USD strength helped USD/CAD gain traction in the second half of the day. The data from the US showed on Friday that the Core Personal Consumption Expenditures (PCE) Price Index, the Fed’s preferred gauge of inflation, edged higher to 3.5% on a yearly basis in June. This reading, however, came in lower than the market expectation of 3.7% and failed to trigger a significant market reaction.

Nevertheless, St. Louis Fed President James Bullard’s hawkish remarks and the poor performance of Wall Street’s main indexes provided a boost to the USD.

Bullard argued that the Fed should start tapering asset purchases this fall and noted that he expects to see the initial rate hike in the last quarter of 2022. The US Dollar Index, which dropped to a monthly low of 91.78, is currently rising 0.26% on a daily basis at 92.12.

On the other hand, Statistics Canada announced that the Real Gross Domestic Product contracted by 0.3% in May, as expected.

In the meantime, the barrel of West Texas Intermediate (WTI) is rising 0.75% near $74 on Friday, limiting USD/CAD’s upside ahead of the weekend.

Technical levels to watch for

Full ArticleEUR/GBP: Downside to accelerate below 0.8472 – MUFG

157908 July 31, 2021 00:09 FXStreet Market News

Analysts at MUFG Bank, see a trade idea in shorting the EUR/GBP cross with a target at 0.8350 and a stop-loss at 0.8670. They point out the positive evolution of COVID-19 cases reinforces the bullish outlook for the pound.

Key Quotes:

“We have been encouraged by recent positive COVID data from the UK suggesting that the risk of further pandemic related disruption to the UK economic recovery has diminished. The vaccine roll out and number of people who have already caught COVID should help dampen the severity of the current and any future COVID waves allowing the government to refrain from re-imposing significant restrictions. A strengthening economic recovery and building upside risks to their inflation target should keep pressure on the BoE to tighten exceptionally loose policy.”

“The policy divergence between the BoE and ECB should continue to widen as the ECB has signalled strongly it does not plan to raise rates even as the euro-zone economy is recovering more strongly and inflation is set to rise above target.”

“We expect GBP gains to accelerate against the EUR once the year to date low at 0.8472 is taken out.”

“The main risks to the trade idea include: i) a more intensified period of risk off trading hitting the GBP, ii) BoE provides dovish policy surprise, and iii) UK COVID cases pick up sharply again in response to recent re-opening measures. If the BoE sets a much lower threshold for starting quantitative tightening would dampen future rate hikes expectations.”

Full ArticleGBP/USD drops further to 1.3890, but secures weekly gains

157907 July 31, 2021 00:02 FXStreet Market News

- Dollar gains momentum late on Friday and trims weekly losses.

- Cable heads for biggest weekly gain since May.

- Next week’s key events: NFP and Bank of England meeting.

The GBP/USD failed to hold to gains on Friday and tumbled to 1.3890, reaching the lowest levels since Wednesday. Despite the decline, cable is about to post the biggest weekly gain since early May, boosted by a weaker US dollar across the board.

The greenback gained momentum late on Friday, into the London fix and trimmed weekly losses. The dollar rose even as US yields dropped. Economic data from the US did not surprise market participants. The relevant report was the PCE Core index that rose 0.4% in June, below the 0.6% of market consensus.

GBP/USD is hovering around 1.3900/10, at the same level of the 20-week simple moving average. The failure to break above and hold could show signs of some exhaustion on the upside, favoring a correction. The 1.3730 area emerges again as a relevant support. A firm break above 1.4000 next week, should clear the way to more gains.

From the Fed to BoE and NFP

The US dollar did not benefit from FOMC events. From Wednesday until late on Friday, it fell across the board. Next week, the key report will be the Nonfarm Payroll report. “Payrolls probably surged again in July, with the pace up a bit from the +850k in June. Some acceleration in the private sector is suggested by the Homebase data, while government payrolls probably benefited from favorable seasonal adjustments. We forecast another 0.3% m/m rise in average hourly earnings. The 12-month change is likely to rise again to 3.8% from 3.6% in June”, wrote analysts at TD Securities.

In the UK, attention continues to be on COVID-19 developments. If cases accelerate, it could hurt market optimism on the economic recovery. Next week, the Bank of England will meet. No change in monetary policy is expected. “We have become more confident in our bullish GBP outlook. While there is a risk that the BoE could disappoint hawkish expectations next week, any GBP weakness should be temporary”, mentioned MUFG Bank analysts.

Technical levels

Full ArticleUSD/JPY Weekly Forecast: View ahead is the same as the view behind

157906 July 31, 2021 00:02 FXStreet Market News

- Prospect of higher US interest rates fade on weak data, Fed dovishness.

- USD/JPY loses 110.00 on Tuesday, stays below on Friday.

- Technical considerations dominate near-term USD/JPY action, bias weakly lower.

- FXStreet Forecast Poll expects a near term decline.

Prospects for higher US interest rates faded further as poor economic data reinforced the Fed’s cautious view and confirmed the retreat of Treasury yields since the June 16 meeting.

The USD/JPY lost altitude on the week, but trading easily remained within the range of the last two months. With weak US statistics and stationary monetary policy, there was no compelling reason to buy the pair and with positive Japanese input absent. There was no substantial logic for selling either.

Comments from Japanese Prime Minister Yoshihide Suga on Friday that the Delta variant of the coronavirus is spreading quickly among the elderly struck a cautionary note on the country’s immediate economic future.

The statement from the Federal Open Market Committee (FOMC) issued with the Wednesday decision noted that “progress” had been made toward the bank’s goals but provided no guidance on the timing of a much anticipated reduction in the bond purchase program.

Chair Jerome Powell was equally recitient, leaving markets largely without policy directive until the next Fed meeting on September 21-22.

In his press conference, Mr. Powell said that the withdrawal of monetary support has become an active topic among the governors. He noted the US job market still had “some ground to cover” before the bank would begin the reduction of the $120-billion-a-month in purchases of Treasury and mortgage-backed securities.

Treasury yields were essentially unchanged on the week, reflecting the lack of a counter view in the credit market to moderating US growth and the still active pandemic induced labor market and supply chain problems..

However, in the comparison of the Japanese and American economies, the US retains a strong advantage and that is the dollar’s main support.

In US economic information, Durable Goods Orders in June were weaker than forecast though the impact was mitigated by substantial positive revision in May. Second quarter GDP came in at 6.5%, well below the 8.5% forecast. The Core PCE reading for June was lower than predicted, but as the Fed has disavowed any policy impact it made no print on the market.

Japanese data saw some improvement with Industrial Production in June bouncing back from May’s loss. Aside from that, Japan seems trapped in a slow moving recovery, unable to shake the COVID sand from its economic gears. The sparsely attended Summer Olympics in Tokyo will likely join the lengthening list of Japanese disappointments.

USD/JPY outlook

There is no present case for buying and only a weak case for selling the USD/JPY.

Relative to its position in late June and early July when the idea of a reduction in the Fed’s bond program seemed probable, the USD/JPY has already lost two figures.

The loss of motivation for pursuing the USD/JPY above 111.00 is not a trend lower. Recent selling in the pair is a reaction to US economic and rate developments. It is not a reflection of yen strength or of a burgeoning Japanese recovery.

Statistics in the coming week will not change the positions of the two economies.

Overall Japanese Household Spending for June should continue the healthy rebound that started in March, but Japan’s economy is driven by exports not domestic consumption. Tokyo CPI, an indicator for national inflation trends, may return from eight months of deflation, but that would hardly convince markets that the Bank of Japan has succeeded in its goal of ending price declines.

Nonfarm Payrolls for July on Friday, August 6, will order US markets with a strong result capable of giving the dollar a boost. Purchasing Managers Indexes for the service and manufacturing sectors in July could, if better than expected, revive some of the economic optimism lost to GDP.

Technical considerations are balanced, with equal representation of support and resistance lines. The loss of the 100-day moving average (MA) on Thursday leaves only the 200-day MA for support, albeit more than two figures below the market.

The drop to 109.50 on Thursday and slight recovery gives a slight downward cast to trading. Expect movement down to be impeded by support lines, which, as they are tested will negate any serious move lower.

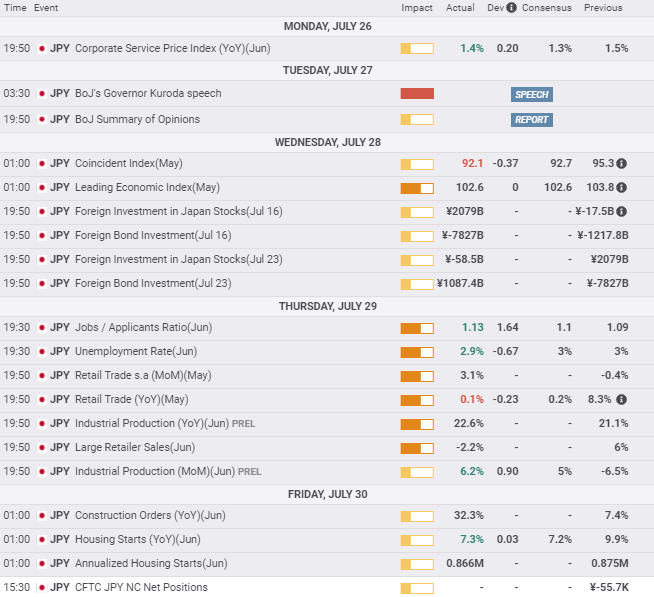

Japan statistics July 26–July 30

US statistics July 26–July 30

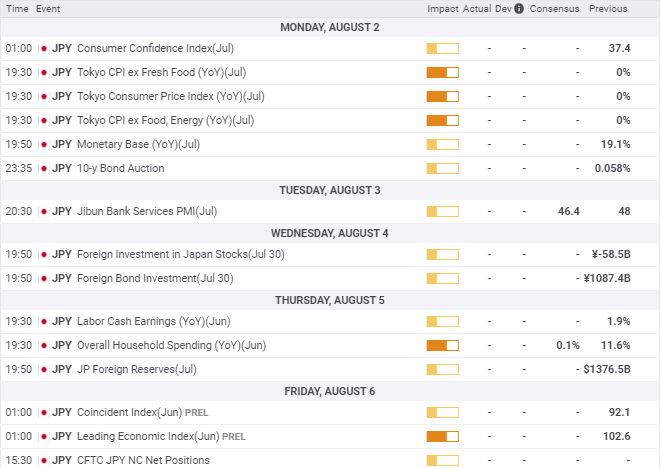

Japan statistics August 2–August 6

Overall Household Spending and Consumer Confidence will give an update on Japanese domestic consumption, Tokyo CPI on inflation. None of these statistics will move markets.

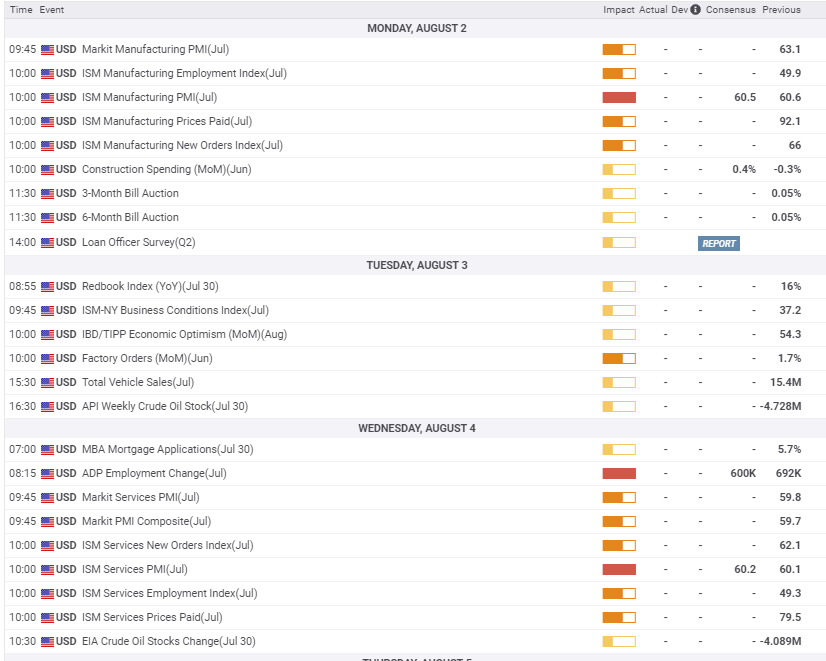

US statistics August 2–August 6

Nonfarm Payrolls provide market focus. Almost one million hires are expected and if the number surpasses the forecast it could restore some luster to the US economy and the dollar. Purchasing Managers’ Indexes will give indications about how much the continuing labor and supply shortages are affecting business optimism.

USD/JPY technical outlook

Overall bias is lower but it is weak and the result of topside failure rather than a substantive argument for selling.

Momentum indicators have moved to the negative. The MACD is a modest sale. The Relative Strength Index (RSI) shows weak selling motion and True Range is slightly more emphatic. The upward trend lines had become ever steeper over the past three months. The last and longest was broken on Monday and it is now resistance at 110.50.

The 21-day and 50-day moving averages (MA), 110.16 and 110.08, join with resistance at 110.15 for a strong band just over 110.00. The 100-day MA at 110.60 is mild support, having been crossed in both directions on Friday. Support and resistance lines are well balanced and equally traded, given the lack of strong fundamental momentum they should control the action.

Resistance: 109.85, 110.15, 110.35, 110.70, 111.00

Support: 109.50, 109.20, 109.00, 108.75, 108.35

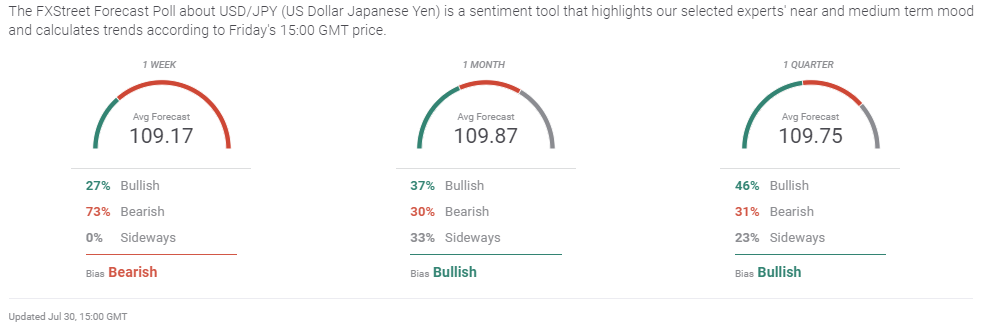

FXStreet Forecast Poll

The FXStreet Forecast Poll reflects the immediate technical weakness of the USD/JPY even as the pair retains positive long-term prospects.

Full ArticleUS: Atlanta Fed’s GDPNow stands at 6.1% for Q3 after latest US data

157905 July 30, 2021 23:51 FXStreet Market News

The real gross domestic product (GDP) in the United States is expected to grow by 6.1% in the third quarter of 2021, the Federal Reserve Bank of Atlanta’s latest GDPNow report showed on Friday.

“The initial estimate of second-quarter real GDP growth released by the US Bureau of Economic Analysis on July 29 was 6.5%, 0.1 percentage point above the final GDPNow model nowcast released on July 28,” Atlanta Fed noted in its publication.

Market reaction

Market participants showed no reaction to this report and the US Dollar Index was last seen gaining 0.25% on the day at 92.10.

Full ArticleUS: NY Fed’s GDP Nowcast rises to 4.2% for Q3 after this week’s data

157904 July 30, 2021 23:49 FXStreet Market News

The US economy is expected to grow by 4.2% in the third quarter of 2021, the Federal Reserve Bank of New York’s latest Nowcasting Report showed on Friday.

“News from this week’s data releases increased the nowcast for 2021:Q3 by 0.1 percentage point,” the NY Fed noted in its publication. “Positive surprises from merchant wholesale inventory data drove the increase.”

Market reaction

This report was largely ignored by market participants and the US Dollar Index was last seen rising 0.27% on a daily basis at 92.12.

Full ArticleAUD/USD Weekly Forecast: Bears are on pause but retain control

157900 July 30, 2021 23:45 FXStreet Market News

- The Fed smashed the greenback but the aussie could not take advantage of it.

- The Reserve Bank of Australia will announce its decision on monetary policy on Tuesday.

- AUD/USD maintains a bearish stance amid concerns about the Australian economy.

The broad dollar’s weakness fell short of helping AUD/USD. The pair ended the week pretty much unchanged, trading below the 0.7400 level. The Australian could not advance with the usual catalysts but retreated rapidly with those that weigh on the aussie, reflecting the absence of interest for the commodity-linked currency.

Coronavirus spooking aussie buyers

The main reason is still linked to the pandemic. Australia passed 2020 without much economic pain, as the island country quickly closed its borders. However, such a strategy could not be applied eternally, and the country opened borders with neighbour New Zealand after a year. The virus entered the country, and since early June, multiple regional lockdowns have been in place, although the coronavirus keeps spreading.

The number of daily cases is above 200, quite low compared to other major economies, but the Australian government did not act in a timely manner on immunization. Only 14.5% of the population is fully vaccinated, while only 17.7% has received just one shot. Lockdowns have been extended, and the economy keeps feeling the pain. The Reserve Bank of Australia has adopted a cautious stance that will likely be maintained in the next months.

Disappointing Fed and US data

The US Federal Reserve met on Wednesday, and its announcement was disappointing, the only factor that prevented AUD/USD from falling further. The US central bank has left its monetary policy unchanged as widely anticipated. At the same time, policymakers agreed to maintain the current financial support, while Chairman Jerome Powell dodged questions related to the timing of tapering. “We are not there yet,” said Chairman Jerome Powell in the Q&A that followed his speech. Market participants were hoping for some clues on how and when the US central bank will start to reduce its bond-buying programs launched to support the economy through the pandemic.

The US published the preliminary estimate of the second quarter´s Gross Domestic Product, which showed that the economy grew at an annualized pace of 6.5%, below the expected 8.5%. Q1 GDP was downwardly revised to 6.3%. Durable Goods Orders were up a modest 0.8% in June vs the 2.1% expected, while the core reading came in at 0.3%. Initial Jobless Claims for the week ended July 23 printed at 400K, while the previous weekly figure was upwardly revised to 424K.

The Australian macroeconomic calendar included the Q2 Consumer Price Index, which improved from 1.1% to 3.8% YoY. The RBA Trimmed Mean CPI in the same period came in at 1.6% as expected. In the same quarter, the Export Price Index surged 13.2%, while the Import Price Index rose 1.9%.

Focus shifts to US employment

In the upcoming days, the US will publish on Wednesday the ADP survey on private jobs creation, foreseen at 600K. On Thursday, the country will release weekly Initial Jobless Claims and Challenger Job Cuts ahead of the Nonfarm Payroll report, out on Friday. At the time being, analysts foresee that 926K new jobs were added in July. The monthly employment report could be a game-changer if the number surpasses the 1 million threshold. Additionally, the country will publish the official July ISM indexes on manufacturing and services output, while Markit will release the final versions of its July PMIs.

Australia will kick-start the week publishing July manufacturing PMIs and July TD Securities inflation. On Tuesday, the Reserve Bank of Australia will announce its decision on monetary policy, yet as said, no changes to the dovish stance are expected. Through the week, the country will release June Retail Sales and Trade Balance figures.

AUD/USD technical outlook

The AUD/USD pair is bearish, according to the weekly chart. It keeps developing well below a mildly bearish 20 SMA while approaching directionless 100 and 200 SMAs. In the meantime, technical indicators hold within negative levels, lacking directional strength.

The risk is skewed to the downside also in the daily chart, as advances attracted sellers around a firmly bearish 20 SMA, which accelerates lower far below the longer ones. Technical indicators are in retreat mode after a failed attempt to surpass their midlines.

The immediate support level is 0.7290, followed by 0.7220. A break below this last could see the pair approaching the 0.7100 figure. Resistance levels are located at 0.7440 and the 0.7500 threshold.

AUD/USD sentiment poll

The FXStreet Forecast Poll indicates that market participants are willing to keep selling the pair in the near-term, as 71% of the polled experts bet for a slide, leaving the average price at around 0.7335. However, bulls become an overwhelming majority in the monthly and quarterly perspectives, while the number of those looking for lower lows decreases below 20%.

In the Overview chart, the weekly and monthly moving averages retain their strong bearish momentum, somehow suggesting there’s room on the downside. The quarterly moving average, on the other hand, maintains its neutral stance amid a wide range of possible targets.

Related Forecasts:

EUR/USD Weekly Forecast: Could the Nonfarm Payroll report be a game-changer?

USD/JPY Weekly Forecast: The view ahead is the same as the view behind

GBP/USD Weekly Forecast: Will the Bank of England step out?

Full Article