Articles

Atlanta Fed kicks of Q3 GDP tracker with a 6.1% estimate

157898 July 30, 2021 23:41 Forexlive Latest News Market News

The Atlanta Fed did a good job of forecasting Q2

This week’s Q2 GDP was below the consensus estimate but at 6.5% it was virtually in line with the Atlanta Fed tracker at 6.4%.

That number will be revised many times in the coming months but the details of the report indicated that inventory builds and bottlenecks will stretch out the US recovery over a longer horizon.

The model forecasts 6.1% GDP growth annualized in Q3, which keeps up the impressive recovery pace. That’s on the lower side of the consensus, which is around 7.2%. Obviously, it’s early and the numbers will shift significantly based on incoming data.

Full Article

EUR/USD Weekly Forecast: Could the Nonfarm Payroll report be a game-changer?

157894 July 30, 2021 23:40 FXStreet Market News

- The US Federal Reserve disappointed markets by showing no rush to taper.

- The US economy is expected to have added roughly 1 million jobs in July.

- EUR/USD has recovered nicely, but a course change has not been confirmed.

The EUR/USD pair reached fresh July highs on the last trading day of the month, settling just below the 1.1900 level. The pair has advanced ever since the week started but gained momentum on Wednesday after the US Federal Reserve smashed the dollar.

No time for tapering

The US central bank left its monetary policy unchanged, as expected, and noted that the economy has continued to progress but noted that “substantial further progress” toward the Fed’s goal of stable prices and maximum employment has not yet been achieved. “We are not there yet,” said Chairman Jerome Powell in the Q&A that followed his speech. Market participants were hoping for some clues on how and when the US central bank will start to reduce its bond-buying programs launched to support the economy through the pandemic.

One thing the Fed actually did was establishing Standing Repo Facilities for banks to exchange bonds for cash. Powell announced they would conduct separate domestic and international facilities. “These facilities will serve as backstops in money markets to support the effective implementation of monetary policy and smooth market functioning,” the statement read.

The American currency fell in the Fed’s aftermath as stocks rallied on relief. US indexes held around all-time highs, as the US central bank is in no rush to retrieve financial support.

US economic growth in a plateau

Worse than anticipated data in the US added to USD weakness. The country published the preliminary estimate of the second quarter´s Gross Domestic Product, which showed that the economy grew at an annualized pace of 6.5%, below the expected 8.5%. Q1 GDP was downwardly revised to 6.3%. Durable Goods Orders were up a modest 0.8% in June vs the 2.1% expected, while the core reading came in at 0.3%. Initial Jobless Claims for the week ended July 23 printed at 400K, while the previous weekly figure was upwardly revised to 424K. The US economic comeback reached a plateau. Data confirmed it, and the Fed knew beforehand.

On the other hand, the EU is in the middle of its recovery process. Germany published the preliminary estimate of July inflation, with the Consumer Price Index surging 3.8% YoY. Growth in the country was tepid, as the second quarter GDP came in at 1.5%, missing the expected 2% but below the previous -2.1%. For the whole Union, GDP in the same period improved from -0.3% in Q1 to 2% QoQ. Also, the EU Unemployment Rate contracted to 7.7% in June from 8% in the previous month. Finally, the Economic Sentiment Indicator in the EU improved to 119.0 in July, surpassing the expected 118.5.

Meanwhile, the number of new coronavirus contagions is on the rise in Europe and the US due to the rapid spread of the Delta variant. Vaccination has slowed in the US, while it continues in the EU. Both economies have immunized roughly 50% of their population with at least two shots. If the situation continues, it will pose a risk to the economic comeback at both shores of the Atlantic.

What’s next in the calendar?

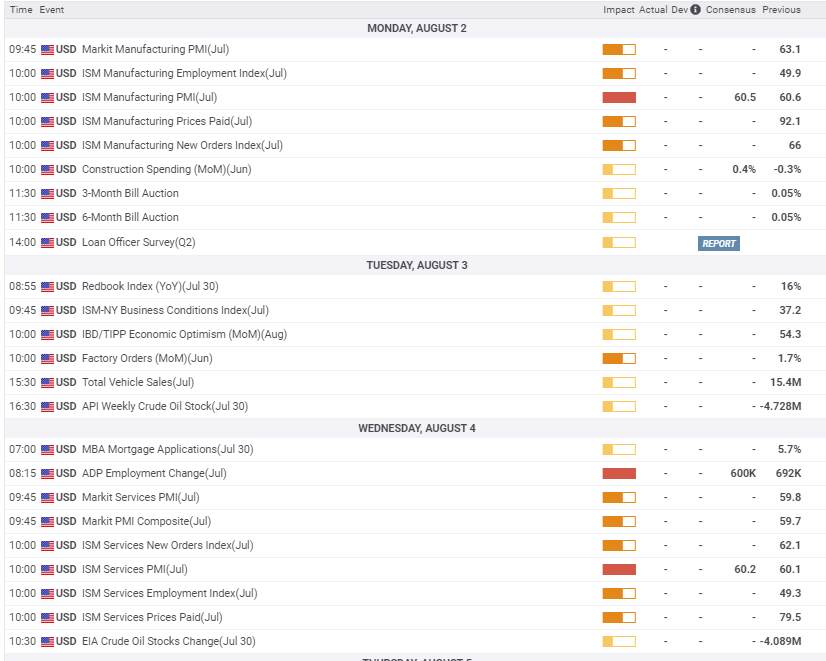

The upcoming week is a busy one, with the focus on US employment data. The country will publish on Wednesday the ADP survey on private jobs creation, foreseen at 600K. On Thursday, the country will release weekly Initial Jobless Claims and Challenger Job Cuts ahead of the Nonfarm Payroll report, out on Friday. At the time being, analysts foresee that 926K new jobs were added in July. The monthly employment report could be a game-changer if the number surpasses the 1 million threshold.

Beyond employment figures, the US will also publish the official July ISM indexes on manufacturing and services output, while Markit will release the final versions of its July PMIs.

Germany will publish June Retail Sales on Monday, while the EU will do it on Wednesday. EU’s Markit PMIs for July will be out on Monday and Wednesday. By the end of the week, Germany will release June Factory Orders and Industrial Production for the same month.

EUR/USD technical outlook

Technically, the weekly recovery seems a mere correction in the wider perspective. The pair keeps developing below the 61.8% retracement of the March/May rally at 1.1920. In the weekly chart, the 20 SMA maintains its bearish slope around the 50% retracement of the same rally at 1.1985. Technical indicators stand within negative levels, with the Momentum modestly recovering but the RSI still flat.

The pair offers a mildly positive stance in the daily chart, as it is advancing above a flat 20 SMA, currently providing dynamic support at around 1.1820. The longer moving averages remain directionless around the 1.2000 area, while technical indicators recovered ground but lost momentum just above their midlines.

For the days ahead, resistance levels are the mentioned Fibonacci figures at 1.1920 and 1.1985. On the other hand, support levels come at 1.1840, the monthly low at 1.1751. and finally, 1.1703, where it bottomed in March.

EUR/USD sentiment poll

According to the FXStreet Forecast Poll, the EUR/USD pair would consolidate in the near-term, as the number of bulls equals that of bears. The pair is seen on average trading just ahead of the 1.1900 level. The number of bears overlaps that of bulls in the monthly perspective, but those going long are looking for higher targets, lifting the average to 1.1917. The pair is bullish in the monthly perspective, as bears decrease to 27%, with the pair seen near 1.2000.

According to the Overview chart, it seems that bulls are slowly coming back. The moving averages turned higher, with different degrees of strength. The weekly moving average is the one showing the strongest momentum, with the long-term media still showing a limited bullish potential.

Related Forecasts:

USD/JPY Weekly Forecast: The view ahead is the same as the view behind

GBP/USD Weekly Forecast: Will the Bank of England step out?

Full ArticleECB to ease further in December even as economy improves – Wells Fargo

157893 July 30, 2021 23:40 FXStreet Market News

Recent data showed the Eurozone economy performed above expectations during the second quarter. Analysts at Wells Fargo explained data the latest report showed the positive momentum continued at the beginning of the third quarter. Still, they expect the European Central Bank (ECB) to maintain its accommodative monetary policy and, indeed, ease policy further in December by announcing a further increase in its bond purchase program.

Key Quotes:

“Eurozone Q2 GDP grew a stronger-than-expected 2.0% quarter-over-quarter, with particularly strong gains reported for Italy and Spain. July inflation remained contained overall, as the headline CPI quickened only slightly to 2.2% year-over-year.”

“The ECB will certainly welcome the improvement in growth, while the moderate inflation trends means there is no need for the central bank to move to less accommodative monetary policy any time soon. That is reinforced by recent changes by the ECB to its policy strategy that included a shift to a symmetric 2% inflation target, and the dovish policy guidance from the ECB following its July monetary policy meeting. Indeed, given the latest COVID developments have added some element of near-term uncertainty, we now expect the ECB to refrain from tapering its bond purchases in September, and instead signal that Q4 buying for the Pandemic Emergency Purchase Program (PEPP) will continue to be conducted at a significantly higher pace than during the early months of this year.”

“If recent COVID developments do eventually have some influence on confidence and activity, and more importantly should underlying inflation trends fail to move meaningfully higher, we expect the ECB to announce a further increase in bond purchases. Our base case for the European Central Bank’s December monetary policy announcement is for the central bank to announce a further €500 billion increase in PEPP purchases, taking the size of that program to €2.350 trillion, with purchases under the PEPP program to continue until at least September 2022.”

Full ArticleCanada: GDP rebound in June, after falling again in May – CIBC

157892 July 30, 2021 23:33 FXStreet Market News

Data released on Friday showed the Canadian economy contracted further in May. Analysts at CIBC point out containment measures necessary to curb the third wave of COVID-19 took a further toll on the economy in May, but the relaxation of those restrictions saw activity rebound sharply in June.

Key Quotes:

“With virus cases generally low across the country, the economy has some open road to recover even more ground this summer. However, the Bank of Canada won’t be in any rush to pull forward the expected timing of rate hikes with challenges remaining, most notably in the form of variants of the virus which are already slowing the healing process in other developed economies.”

“The Canadian economy already began that process with a comeback in June coinciding with falling new Covid cases and the relaxation of restrictions. The flash estimate, which pointed to 0.7% growth, was roughly in line with what we had penciled in and puts the quarterly growth rate bang on our forecast of 2.5% annualized, a touch hotter than the Bank of Canada’s 2.0% forecast.”

“A solid handoff to the third quarter from the strong rebound in June leaves the economy in a position to post a lofty growth rate during the period, so long as momentum doesn’t tail off too much in the coming months. While we do see growth slowing later in the year, the rest of the summer should see the economy make solid progress, given the low numbers of new infections and the ongoing reduction of public health measures.”

Full ArticleGBP/USD Weekly Forecast: Will the Bank of England step out?

157891 July 30, 2021 23:26 FXStreet Market News

- Improving COVID and strengthening economy encourage sterling.

- Bank of England meeting next week brings rate hike speculation.

- The contrast between Federal Reserve and BOE policies benefits sterling.

The rapidly improving coronavirus situation in the UK, a strengthening economy and rising inflation helped propel the sterling to its best close against the US dollar in a month. The GBP/USD rose 1.5% on the week, is up 2.3% since its low of 1.3628 eight sessions ago and is just shy of the 61.8% Fibonacci retracement of the May 31 to July 20 4.1% decline.

Expectations for a positive economic assessment out of the Bank of England (BOE) and perhaps hints at the timing and conditions for a reduction in the Asset Purchase Facility were an undercurrent for the week’s gains.

Until the BOE meeting on Thursday the comparison to the dovish rate pronouncements from the Federal Reserve will continue to aid the sterling.

The Federal Open Market Committee (FOMC) statement issued with the status quo Wednesday rate decision noted that “progress” had been made toward the bank’s goals but provided no guidance on the timing of a much anticipated reduction in the bond purchase program.

Chair Jerome Powell was equally recitient, leaving markets largely without policy directive until the next Fed meeting on September 21-22.

In his press conference, Mr. Powell said that the withdrawal of monetary support has become an active topic among the governors. He noted the US job market still had “some ground to cover” before the bank would begin the reduction of the $120- billion-a-month purchases of Treasury and mortgage-backed securities.

Treasury yields in the US were essentially unchanged on the week, reflecting the lack of a counter view in the credit market to moderating US growth and the still active pandemic- induced labor market and supply chain problems..

British economic information was limited with Housing Prices in July not quite as buoyant as expected, but that comes after the very strong gains of the past year.

Inflation remains a key ingredient for the BOE. The Consumer Price Index (CPI, y/y) has jumped from 0.7% in January to 2.5% in June. Unlike the Federal Reserve with its adoption of inflation-averaging, the BOE has not tried to insulate rate policy from its responsibility for inflation control.

In the US, Durable Goods Orders in June were weaker than forecast though the impact was mitigated by substantial positive revision in May. Second quarter GDP came in at 6.5%, well below the 8.5% forecast. The Core PCE reading for June wasslightly lower than predicted, but as the Fed has disavowed any policy impact it made no print on the market.

GBP/USD outlook

Bias in the GBP/USD is higher with an emphasis on the stronger economic situation in the UK. The rapid recent improvement in the sterling leaves some room for profit-taking, especially if the BOE is more cautious than expected

The contrast between the Fed and the BOE approach to inflation is a fundamental benefit for sterling. Even if the BOE governors do not begin the countdown to a policy reversal this week, they are not constrained from acting on inflation if they judge it appropriate.

The Fed has deliberately removed inflation from consideration, asserting the steep rise this year is temporary, something that the governors cannot know and on which their own record of prognostication is poor.

In his comments on Wednesday, Chair Powell admitted that the price increases are likely to be higher and longer than they had anticipated.

British data is sparse this week and no competition for the BOE meeting.

Nonfarm Payrolls in the US for July will be issued this Friday, August 6. A strong result is capable of giving the dollar a boost and relieving some of the disappointment from the second quarter GDP miss at 6.5%. Purchasing Managers Indexes for the service and manufacturing sectors in July could, if better than expected, revive some of the economic optimism lost to GDP.

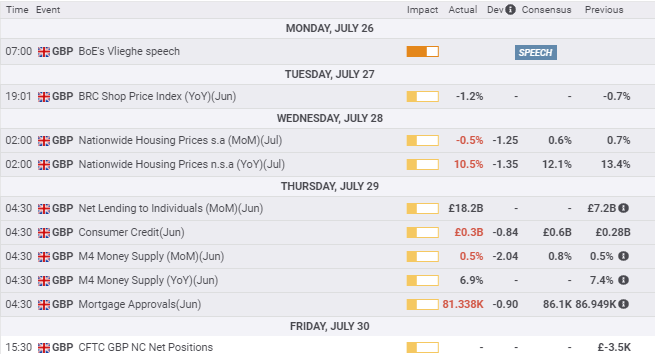

United Kingdom statistics July 26–July 30

US statistics July 26–July 30

FXStreet

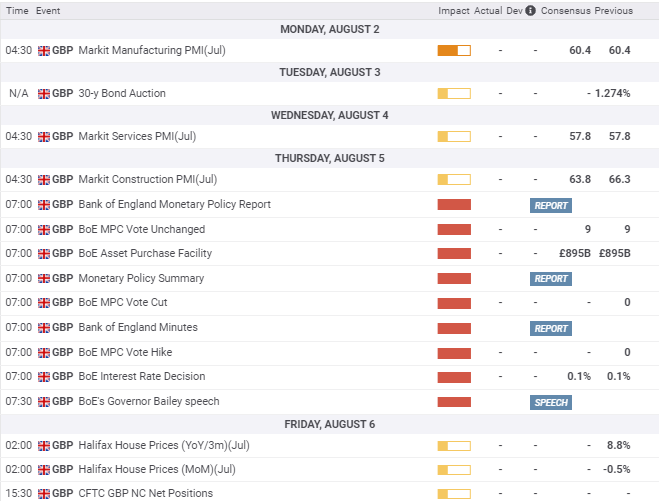

United Kingdom statistics August 2–August 6

FXStreet

US statistics August 2–August 6

GBP/USD technical outlook

The Friday reversal before the 61.8% Fibonacci level (1.3987) of the June 1 to July 20 gain is logical given the steep ascent since that bottom. The finish at 1.3900, just below the 50% Fibonacci line at 1.3917 and at the trend line, likely heralds further increases next week.

Momentum tailed off on Friday as the GBP/USD reversed into profit-taking. The MACD closed the week as a buy, though a bit less so than at the peak on Thursday.

The month-long sojourn above 1.4050 is the current goal but the area between 1.3980 and 1.4050 saw almost no trading and could be passed in a rush if 1.4000 is breached.

The 100-day moving average (MA) at 1.3924 joins resistance at 1.3920 and the 50% fibbonacci at 1.3917 in a moderate band of resistance just above Friday’s close. Were it at a further distance from the market is would be substanital. The 50-day MA at 1.3947 is one with resisance at 1.3950.

Resistance: 1.3920, 1.3950, 1.3980, 1.4000, 1.4050

Support: 1.3900, 1.3880, 1.3830, 1.3800, 1.3770

AUD/USD extends correction, hits fresh lows under 0.7350

157890 July 30, 2021 23:17 FXStreet Market News

- US dollar rises across the board into the London fix.

- Greenback trims weekly losses late on Friday.

- AUD/USD back to negative for the week, drops toward 0.7350.

The AUD/USD broke under 0.7365 during the American session and fell to 0.7343, reaching a fresh two-day low. The key driver has been a strong US dollar across the board. The greenback gained momentum into the London fix.

The DXY eared losses and is up by 0.30% at 92.15, even as US yields move further to the downside. The 10-year yield stands at 1.22%, about to test the weekly low. The key economic report of the US was the core PCE deflator, considered a critical inflation number for the Federal Reserve. It rose 0.4% in June, against expectations of a 0.6% increase.

From the Fed to the RBA

After the Fed, now the focus turns to the Reserve Bank of Australia (RBA) that next week will have its monetary policy meeting. “We think policymakers in Sydney (a city that is about to spend the whole month of August in lockdown) will not make any amendment to the current policy stance after the adjustments announced in early July. The jump in inflation to 3.8% in 2Q should be dismissed as transitory, and the Bank will likely wait for more indications from the labour market before reacting on the policy side”, wrote analysts at ING. They add that the recent spread of the Delta Variant is likely another reason “why the RBA should revert from sounding more hawkish or upbeat on the recovery at this meeting.”

The Aussie is about to end the week as the worst performer across the G10 space, hit by monetary policy divergence. AUD/USD failed to hold to gains and on Friday to remain above 0.7400; it is on its way to the fifth consecutive negative weekly result. AUD/NZD heads for the lowest weekly close since November of last year.

Technical levels

Full ArticleCanada extends pandemic wage and rent subsidies until Oct 23

157888 July 30, 2021 23:09 Forexlive Latest News Market News

There will be an election before then

Canadian finance minister Freeland says the government will extend wage and rent subsidies until October 23.

“These subsidies have been a lifeline” for thousands of businesses and workers, she said.

The Canada recovery benefits (CRB) are also extended until Oct 23 at current rates.

The Liberals are gearing up to call an election at any moment and they don’t want these benefits to expire during the campaign.

In terms of markets, this should be a tailwind that extends until then, though it could add more wage inflation as it keeps workers out of the workforce.

Full Article

Fed’s Bullard: Seeing initial rate increase in Q4 of 2022

157887 July 30, 2021 23:09 FXStreet Market News

St. Louis Fed President James Bullard said on Friday that he expects the initial rate increase in the fourth quarter of 2022 but argued that the Fed should be in a position to move sooner if needed, as reported by Reuters.

Additional takeaways

“Inflation expectations generally consistent with Fed’s new flexible average inflation targeting framework.”

“Risky to wait too long to taper, Fed could be left behind curve given inflation risk, ongoing job growth.”

“Risk is Fed would have to really scramble in raising rates if inflation breaks out and that tends to end in recession.”

“Preference would be to decide on taper plan at September Fed meeting, start tapering after that.”

“Plenty of risk still from coronavirus but Fed policy is tilted too much to the dovish side.”

“Indifferent on tapering in larger increments each month versus taking more time, as long as purchases end Q1 2022.”

“Nervous over incipient housing bubble, Fed should not feed into that with ongoing asset purchases.”

Market reaction

The US Dollar Index continues to edge higher in the American session and was last seen gaining 0.3% on the day at 92.15.

Full ArticleHere is why USD/JPY will struggle to climb higher from here – MUFG

157885 July 30, 2021 22:56 Forexlive Latest News Market News

What to look for in USD/JPY

MUFG Research discusses USD/JPY outlook and sees a limited scope for the pair to trend higher in the near-term.

“The swing in July was certainly extreme and unlikely to be replicated but it does highlight one of the fundamental factors limiting the scope for the yen to depreciate on any kind of a sustained basis at levels over 110.00. At the lower bound with investors holding little confidence in the BoJ’s ability to lift inflation, real yields are likely to remain relatively attractive,” MUFG notes.

“Add to this a structurally stable current account surplus over 3% of GDP and a currency that on many metrics is about 10% undervalued,

the prospect of USD/JPY trending higher from here looks limited. Yes, a

rebound in US nominal yields can play a role in lifting USD/JPY as

correlations show but the correlations weaken at higher levels over

110.00 and over a medium term timeframe, valuation, external positions

and real yields suggest downside risks,” MUFG adds.

For bank trade ideas, check out eFX Plus.

Full Article

US: Transition to discretionary spending underway – Wells Fargo

157884 July 30, 2021 22:51 FXStreet Market News

The personal income and spending report showed a larger than expected number, while the inflation indicator came in below market consensus. Analysts at Wells Fargo see a transition to discretionary spending clearly underway. They point out the days of stimulus checks and buying stuff are gone.

Key Quotes:

“Personal income increased 0.1% in June and spending increased 1.0%; both numbers exceeded consensus expectations. Some of the fanfare of today’s better-than-expected outturn was uncorked in yesterday’s initial estimate for GDP growth.”

“For the third consecutive month, every major category of services spending moved higher. We also reached a milestone on the road to recovery as June marked the first month that services spending finally crested above its pre-pandemic level; in fact services spending is half a percentage point higher today than it was before the pandemic.”

“Last March and April, discretionary spending plummeted 54%, and has been clawing its way out on trend ever since. The transition to stronger spending here was evident in June as discretionary services rose 3.2% compared to a 0.5% gain in non-discretionary categories. That puts the peak-to-current figure at just 7.2% below their pre-pandemic level.”

“Personal income growth would have been stronger if it were not for dwindling stimulus. While overall personal income only rose 0.1% in June, if excluding transfer payments, income rose a stronger 0.7% over the month.”

“Still the overall trajectory of income growth will likely be flat to slightly down over the next four months or so. The confluence of factors from the expiration of all enhanced unemployment benefits in early September and PPP loans rolling out of proprietors income will more than offset upward momentum from employee compensation and the enhanced child tax credit being sent to many households. But, once stimulus rolls out of the income calculations, we expect income growth to settle on a more normal upward trajectory.”

Full ArticleBoE meeting unlikely to provide a strong direction for GBP – TDS

157883 July 30, 2021 22:29 FXStreet Market News

Next week, the Bank of England (BoE) will have its monetary policy meeting. No change is expected. According to analysts from TD Securities, the outcome should not offer a strong directional cue for the pound. They expect the currency to remain in familiar ranges.

Key Quotes:

“We look for the MPC to keep policy unchanged at this meeting, despite recent hawkish sentiment from two members. While wage and inflation dynamics remain strong, there are early signs of a slowdown in demand. The QE decision will likely not be unanimous.”

“We do not expect the August MPC meeting to provide a strong directional cue for GBP, particularly as FX markets have been content to shrug off stronger policy signals elsewhere. GBP’s sensitivity to risk appetite is high and spot is close to near-term FV (fair value) on our dashboard. This should see GBP anchored to familiar ranges as summer trading conditions prevail.”

“Duration remains vulnerable to the pace of BoE buybacks in the coming months. We prefer going into the meeting with a steepening bias for the front-end and curve.

Full ArticleEurozone: Recovery will continue, despite Delta variant – Rabobank

157882 July 30, 2021 22:26 FXStreet Market News

The Eurozone registered a GDP growth of 2% during the second quarter after two quarters of contraction. The reopening of Eurozone economies since end Q1/early Q2 has spurred economic activity, point out Rabobank analysts. They see the main risk to the short-term outlook steming from the highly contagious Delta variant.

Key Quotes:

“The recovery in the services sector should be sustained in the coming quarters, on the back of rising vaccination rates and the accompanying gradual return to normal (58% of the EU population has had at least one shot and 48% is fully vaccinated). In addition, uninterrupted strong order books in the manufacturing sector, improving global trade and the Next Generation EU support the outlook. Furthermore, the ECB Bank Lending Survey suggests that demand for business loans in the Euro area is starting to be more driven by investment intentions again, rather than building liquidity buffers, after this was disrupted by the pandemic.”

“The main risk to the short-term outlook stems from the highly contagious Delta variant which has been slowing the phasing out of lockdown measures and has already even caused governments to rollback relaxations and tighten international travel restrictions.”

“Yet, so far the overall macro-impact of the Delta variant seems to be limited still in most countries.”

Full Article