Articles

United States Dallas Fed Manufacturing Business Index came in at -20, above forecasts (-26.3) in July

331173 July 31, 2023 22:33 FXStreet Market News

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Full Article

GBP is likely to run into headwinds later this year – Rabobank

331172 July 31, 2023 22:12 FXStreet Market News

Cable has retreated from its recent high, but the Pound remains the best-performing G10 currency in the year to date. Economists at Rabobank analyze GBP outlook.

GBP/USD seen at 1.26 on a three-month view

The most optimal outlook for GBP bulls from this week’s BoE policy meeting would be a hawkish outlook combined with UK growth forecasts that avoid recession.

While we are not expecting the Bank to forecast a recession at this point, it is likely that estimates for UK economic activity in 2024-25 will be downgraded. This scenario should allow the Pound to side-step any strong sell-off in the near term. That said, interest rate hikes take time to impact and a 25 bps rate hike this week will take Bank rate to a 15-year high. As the BoE grapples to bring inflation under control, UK recession remains our base case scenario. On this view, GBP is likely to run into headwinds later this year.

Full ArticleWe are forecasting a move lower in Cable back to GBP/USD 1.26 on a three-month view.

1540 | +0.026% | USDCAD

330568 July 31, 2023 22:03 SwingFish Trading Room Journal USDCAD

Today’s risk: 0.18% (more…)

Full ArticleGermany’s warning of five tough years could be a backbreaker for the euro

331171 July 31, 2023 21:56 Forexlive Latest News Market News

Sometimes politicians say the quiet things out loud.

That happened this weekend with German Economy Minister Robert Habeck, who warned that Germany faces five difficult years due to deindustrialization from high energy prices.

Germany is already in a recession and its centered on industrial companies, that are wilting and cutting production.

“We have a major transformational period ahead of us until 2030,” during which time Germany would move from a traditional, fossil fuel-dependent industrial base to green energies like hydrogen, Habeck said.

He called for more energy subsidies.

The problem for that is budgetary. Eurozone countries are bound to deficits of less than 3% of GDP and Germany was been the major policeman of that policy in the 2010s, drawing the wrath of Spaniards, Italians and Greeks, among others. Now those ecconomies are doing relatively well and Germany is struggling.

The deficit rules are currently suspended because of covid and that will probably continue through 2024 but at some point, they need to end. How hard the periphery countries want to push at that point, will determine what comes next for Germany and the eurozone economy. Germany’s political situation is also tough with deficit hawks still holding huge sway in a fragmented system.

Habeck put it bluntly:

“The question is: Do we borrow money or do we no longer have industry?”

Either options is a negative for the euro, just on different timelines. I suspect the subsidies will flow, which should also help to boost safe havens like gold.

USD/MXN: Below 16.40, next potential objectives situated at 16.10 and 15.90 – SocGen

331170 July 31, 2023 21:56 FXStreet Market News

The Mexican Peso is on track for a 7th successive higher monthly close, matching the run of 2008. Economists at Société Générale analyze USD/MXN outlook.

Break above 17.15 essential to denote a short-term uptrend

USD/MXN decline has gradually accelerated after it gave up the 50-DMA in March. The pair is not far from a multi-month descending trend line near 16.60/16.40. The move is a bit overstretched however signals of a meaningful rebound are not yet visible.

A break above the MA near 17.15 would be essential to denote a short-term uptrend.

Full ArticleBelow 16.40, next potential objectives are situated at projections of 16.10 and 15.90.

EUR/USD Price Analysis: Immediately to the upside comes 1.1150

331168 July 31, 2023 21:49 FXStreet Market News

- EUR/USD looks to add to Friday’s advance north of 1.1000.

- Extra upside faces the next barrier at the weekly top around 1.1150.

EUR/USD climbs further and revisits the 1.1040 region, or daily highs, at the beginning of the week.

In light of the recent price action, the pair could see its selling pressure somewhat mitigated on a breakout of the weekly low of 1.1149 (July 27). Once this level is cleared, spot could the attempt a challenge of the 2023 top at 1.1275 (July 18).

Looking at the longer run, the positive view remains unchanged while above the 200-day SMA, today at 1.0723.

EUR/USD daily chart

Full ArticleUnited States Chicago Purchasing Managers’ Index below forecasts (43) in July: Actual (42.8)

331167 July 31, 2023 21:49 FXStreet Market News

USD Index Price Analysis: Immediate barrier emerges just above 102.00

331165 July 31, 2023 21:35 FXStreet Market News

- DXY gathers further upside traction and retests 101.80/85.

- Further upside targets the weekly high past 102.00.

DXY maintains the optimism well in place and advances for the third session in a row at the beginning of the week.

The index appears poised to extend the ongoing multi-session recovery for the time being. Against that, the surpass of the weekly top of 102.04 (July 28) should prompt the index to embark on a probable visit to the transitory 100-day and 55-day SMAs at 102.40 and 102.56, respectively.

Once this region is cleared, it should alleviate the downside bias in the dollar and allow for extra gains.

Looking at the broader picture, while below the 200-day SMA at 103.73 the outlook for the index is expected to remain negative.

DXY daily chart

Full ArticleEuro clings to gains above 1.1000, Dollar remains side-lined

331163 July 31, 2023 21:33 FXStreet Market News

- Euro extends the upside to the vicinity of 1.1040 against the US Dollar.

- Stocks in Europe reverse the initial optimism on Monday.

- EUR/USD looks to consolidate the breakout of the 1.1000 mark.

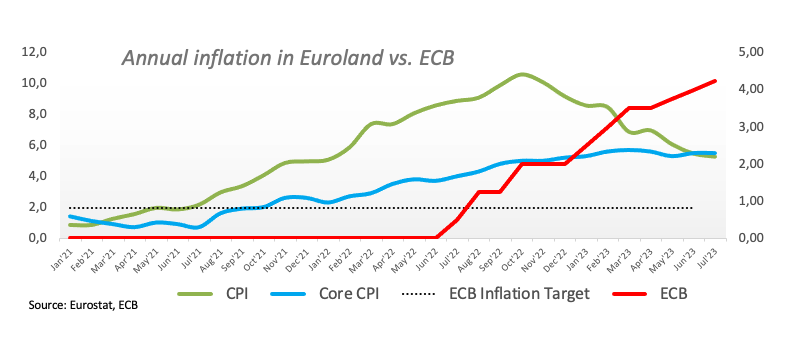

- EMU Flash headline Inflation Rate extends its downward trend in July.

- Germany’s Retail Sales contract 1.6% YoY in June.

The Euro (EUR) is continuing to maintain its recovery against the US Dollar (USD) that began on Friday, which is causing EUR/USD to extend its upward trend after breaking through the important 1.1000 level at the start of the week.

The pair regained momentum after hitting a low of around 1.0940 on Friday as the Greenback was undergoing a corrective move.

Currently, both US and European yields are trading with uncertainty as investors continue digesting last week’s interest rate decisions by the Federal Reserve and the European Central Bank (ECB).

Regarding the ECB, President Christine Lagarde has indicated that the central bank is keeping an “open-minded” approach to the upcoming September meeting and emphasized that the future rate decisions will depend on economic data. Similarly, Fed Chair Jerome Powell has reiterated multiple times that the Fed’s decisions on rates will be data-dependent at the FOMC event on July 26.

In terms of speculative positioning, the net longs in EUR have remained relatively unchanged in the week ending July 25, according to CFTC, which was prior to the FOMC and ECB gatherings. During this time, spot had retreated from yearly highs around 1.1275 (July 18) to the low 1.1000s.

In the Eurozone, Germany’s Retail Sales declined by 1.6% YoY in June, and the Italian Q2 GDP Growth Rate was lower than expected, with a QoQ contraction of 0.3% and YoY expansion of 0.6%. Additionally, preliminary inflation figures in the Euro area show that the Core CPI rose more than anticipated – by 5.5% YoY in July and 5.3% YoY for headline CPI. Finally, the flash Q2 GDP Growth Rate for the bloc shows that the economy expanded by 0.3% QoQ and 0.6% YoY.

There are no significant data releases scheduled in the US docket for Monday.

Daily digest market movers: Euro poised to some consolidation near term

- The EUR picks up pace above the 1.1000 mark vs. the USD.

- The USD Index treads water around 101.70 on Monday.

- EMU flash GDP figures surprise to the upside in Q2.

- Core inflation in the euro area remains sticky.

- US, German yields trade without direction across all maturities.

- The Italian economy is expected to have contracted slightly in Q2.

- Markets’ attention is expected to be on the US labour market this week.

Technical Analysis: Euro looks supported near 1.0940

EUR/USD manages to gather some impulse and extend the bounce off recent lows north of the 1.1000 hurdle so far on Monday.

If bears regain the upper hand, EUR/USD should put the weekly low of 1.0943 (July 28) to the test ahead of a probable move to the transitory 55-day and 100-day SMAs at 1.0908 and 1.0906, respectively. The loss of this region could open the door to a potential visit to the July low of 1.0833 (July 6) ahead of the key 200-day SMA at 1.0723 and the May low of 1.0635 (May 31). South from here emerges the March low of 1.0516 (March 15) before the 2023 low of 1.0481 (January 6).

On the other hand, occasional bullish attempts could motivate the pair to initially dispute the weekly top at 1.1149 (July 27). Above this level the downside pressure could mitigate somewhat and encourage the pair to test the 2023 high at 1.1275 (July 18). Once this level is cleared, there are no resistance levels of significance until the 2022 peak of 1.1495 (February 10), which is closely followed by the round level of 1.1500.

Furthermore, the constructive view of EUR/USD appears unchanged as long as the pair trades above the key 200-day SMA.

German economy FAQs

The German economy has a significant impact on the Euro due to its status as the largest economy within the Eurozone. Germany’s economic performance, its GDP, employment, and inflation, can greatly influence the overall stability and confidence in the Euro. As Germany’s economy strengthens, it can bolster the Euro’s value, while the opposite is true if it weakens. Overall, the German economy plays a crucial role in shaping the Euro’s strength and perception in global markets.

Germany is the largest economy in the Eurozone and therefore an influential actor in the region. During the Eurozone sovereign debt crisis in 2009-12, Germany was pivotal in setting up various stability funds to bail out debtor countries. It took a leadership role in the implementation of the ‘Fiscal Compact’ following the crisis – a set of more stringent rules to manage member states’ finances and punish ‘debt sinners’. Germany spearheaded a culture of ‘Financial Stability’ and the German economic model has been widely used as a blueprint for economic growth by fellow Eurozone members.

Bunds are bonds issued by the German government. Like all bonds they pay holders a regular interest payment, or coupon, followed by the full value of the loan, or principal, at maturity. Because Germany has the largest economy in the Eurozone, Bunds are used as a benchmark for other European government bonds. Long-term Bunds are viewed as a solid, risk-free investment as they are backed by the full faith and credit of the German nation. For this reason they are treated as a safe-haven by investors – gaining in value in times of crisis, whilst falling during periods of prosperity.

German Bund Yields measure the annual return an investor can expect from holding German government bonds, or Bunds. Like other bonds, Bunds pay holders interest at regular intervals, called the ‘coupon’, followed by the full value of the bond at maturity. Whilst the coupon is fixed, the Yield varies as it takes into account changes in the bond’s price, and it is therefore considered a more accurate reflection of return. A decline in the bund’s price raises the coupon as a percentage of the loan, resulting in a higher Yield and vice versa for a rise. This explains why Bund Yields move inversely to prices.

The Bundesbank is the central bank of Germany. It plays a key role in implementing monetary policy within Germany, and central banks in the region more broadly. Its goal is price stability, or keeping inflation low and predictable. It is responsible for ensuring the smooth operation of payment systems in Germany and participates in the oversight of financial institutions. The Bundesbank has a reputation for being conservative, prioritizing the fight against inflation over economic growth. It has been influential in the setup and policy of the European Central Bank (ECB).

EUR/GBP to remain close to recent ranges – Rabobank

331162 July 31, 2023 21:29 FXStreet Market News

Economists at Rabobank analyze EUR and GBP outlook.

UK recession risks to undermine long GBP positions into the final months of the year

We currently see risks to both GBP and the EUR as being well-balanced.

Despite concerns about the stickiness of core inflation in the Eurozone, we see risk that ECB rates have already peaked. By contrast, we expect the BoE to follow an anticipated 25 bps rate hike this week with another in September. While interest rate differentials would appear to favour the Pound, we expect UK recession risks to undermine long GBP positions into the final months of the year.

Full ArticleWe expect both GBP and the EUR to give back some ground vs. the USD in the coming months and for EUR/GBP to remain close to recent ranges.

US: Economy looks healthy… and resilient – UOB

331161 July 31, 2023 21:26 FXStreet Market News

Senior Economist at UOB Group Alvin Liew reviews the latest advanced GDP figures in the US economy for the April-June period.

Key Takeaways

The advance estimate of the 2Q 2023 GDP surprised on the upside with a 2.4% q/q SAAR expansion thanks to resilient consumption and a strong boost of business spending (vs Bloomberg est 1.8% q/q SAAR and UOB est 1.6%, but was exactly in line with Atlanta Fed’s GDPNow estimate), accelerating from 2.0% in 1Q. Compared to one year ago, the US GDP grew by 2.6% y/y in 2Q, from 1.8% in 1Q.

The flipside of the still hot US economy is that it should keep the Fed thinking about further tightening to keep inflation at bay. That said, according to trading in futures data compiled by Bloomberg (WIRP) (as of 28 Jul), the probability of a 25-bps rate hike in Sep FOMC stayed at a low 20% (unchanged from 27 Jul, and a tad lower from 21.5% on 26 Jul before the GDP release).

Full ArticleUS GDP Outlook – US 1H GDP expansion has exceeded our projections, and as we alluded to our previous reports, while we continue to factor in a downward shift in US growth trajectory, we are no longer factoring an outright US GDP contraction and instead we are projecting a US growth slowdown in 2H 2023 (amounting to a soft landing). We still expect the lagged effects of US monetary policy tightening and tighter financial/credit conditions to slow the US economy but we are shifting our 2023 US GDP growth forecast higher to 1.2% (from 0.8% previously) to account for the stronger 1H growth outturn and shallower 2H trajectory, which is a reflection of our overestimation of the monetary policy’s drag on near-term growth and underestimation of the resilience of the US labour market. That said, we are lowering our 2024 GDP growth forecast further to 1.0% (from 1.2% previously) to account for the lagged effect of US monetary policy.

US Dollar stabilizes ahead of this week’s key employment-related data

331160 July 31, 2023 21:21 FXStreet Market News

- The US Dollar holds steady against its major rivals to begin the week.

- The US Dollar Index stays above 101.50 after posting gains last week.

- US jobs report and other high-tier data releases this week could drive USD performance.

The US Dollar remains resilient on Monday after posting strong gains against major rivals last week. The USD Index – which tracks the USD’s valuation against a basket of six major currencies – has stayed within a narrow consolidation channel above 101.50.

The USD gathered strength in the second half of last week as data from the US revealed that the economy continued to grow at a healthy rate in the second quarter, while labor market conditions remained tight. As the US Bureau of Economic Analysis’ monthly report showed that the Personal Consumption Expenditures (PCE) Price Index rose at a softer pace than anticipated, the USD rally lost steam ahead of the weekend.

The US economic docket will feature important labor market-related data releases this week, which could drive the USD’s valuation. On Tuesday, the US Bureau of Labor Statistics will publish JOLTS Job Openings figures ahead of the ADP private sector employment on Wednesday and Nonfarm Payrolls on Friday. The ISM Manufacturing and Services PMI surveys will also be watched closely by investors this week.

Daily digest market movers: US Dollar stays calm ahead of key data

- Inflation in the US, as measured by the change in Personal Consumption Expenditures (PCE) Price Index, fell to 3% on a yearly basis in June from 3.8% in May, the US Bureau of Economic Analysis reported on Friday. This reading came in below the market expectation of 3.1%.

- Core PCE Price Index, the Federal Reserve’s preferred gauge of inflation, arrived at 4.1% on a yearly basis, down from 4.6% in May and below the market forecast of 4.2%. Further details of the publication revealed that Personal Income and Personal Spending increased 0.3% and 0.5% on a monthly basis, respectively.

- The real Gross Domestic Product (GDP) of the US expanded at an annualized rate of 2.4% in the second quarter, the US Bureau of Economic Analysis’ (BEA) first estimate showed on Thursday. This reading followed the 2% growth recorded in the first quarter and surpassed the market expectation of 1.8% by a wide margin.

- According to the CME Group FedWatch Tool, markets are pricing in a 20% probability of a 25-basis-point Federal Reserve (Fed) rate hike in September.

- The benchmark 10-year US Treasury bond yields stays in positive territory at around 4% on Monday.

- US stock index futures trade mixed following the risk rally seen on Friday.

- In an interview with CBS over the weekend, Minneapolis Federal Reserve Bank President Neel Kashkari said that he was not sure whether the Fed was done raising rates. Commenting on the jobs markets, Kashkari noted that it would not surprise him to see the unemployment rate tick up slightly.

- The Fed raised its policy rate by 25 basis points (bps) to the range of 5.25%-5.5% following the July policy meeting as expected. In the post-meeting press conference, Fed Chairman Jerome Powell refrained from confirming another rate hike this year and said that every policy meeting will be live. “If we see inflation coming down credibly, we can move down to a neutral level and then below neutral at some point,” Powell told reporters, noting that the policy was already restrictive.

Technical analysis: US Dollar Index turns neutral above important support

The US Dollar Index (DXY) closed above the 20-day Simple Moving Average (SMA), currently located at 101.30, on Friday after testing that level in the early American session. In the meantime, the Relative Strength Index (RSI) indicator on the daily chart stays near 50 on Monday, reflecting a lack of directional momentum

On the upside, 102.00 (static level, psychological level) aligns as initial resistance before 102.50 (50-day SMA, 100-day SMA). A daily close above the latter could attract buyers and pave the way for an extended uptrend toward 103.00 (psychological level, static level).

Looking south, 101.30 (20-day SMA) stays intact as key support level. If DXY drops below that level and starts using it as resistance, 101.00 (psychological level, static level) could be seen as interim support ahead of 100.50 (static level) and 100.00 (psychological level).

US Dollar FAQs

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022.

Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates.

When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system.

It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.