Articles

USD/TRY targets 7.70 as lira remains bid

91929 November 30, 2020 22:12 FXStreet Market News

- USD/TRY extends the downside and approaches 7.70.

- Turkey’s GDP surprised to the upside in the third quarter.

- Turkeys trade deficit shrunk to around $2.40 billion in October.

The buying bias around the Turkish currency stays well and sound for another session on Monday and drags USD/TRY to multi-day lows near 7.70.

USD/TRY weaker on USD-selling, data

The lira gains extra ground at the beginning of the week after Turkey’s GDP figures showed the economy expanded at an annualized 6.7% during the July-September period (from a 9.9% contraction), well above initial estimates.

Extra data noted the Turkish trade deficit shrunk to 42.37 billion during October (from a nearly $5 billion deficit).

In the meantime, the pair recedes for the fourth session in a row in response to the broad-based weakness hitting the greenback, while investors’ sentiment still supports the lira following the recent orthodox turn from both the Turkish central bank (CBRT) and the Erdogan’s administration.

USD/TRY key levels

At the moment the pair is losing 0.14% at 7.7886 and a drop below 7.5657 (100-day SMA) would expose 7.5119 (monthly low Nov.20) and then 7.3970 (horizontal support line off August’s top). On the other direction, the next hurdle emerges at 8.0423 (weekly high Nov.24) followed by 8.5777 (all-time high Nov.6) and finally 9.0000 (psychological hurdle).

Full ArticleCanada set to keep the money flowing in today’s fiscal update

91927 November 30, 2020 21:56 Forexlive Latest News Market News

First fiscal package from new finance minister Freeland

The Canadian dollar is riding high today and one of the big reasons is that Trudeau’s government has spent more than nearly every other nation to support the economy during the pandemic.

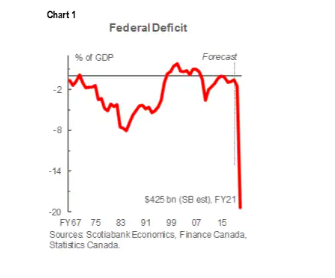

Today, that trend will continue as new finance minister Freeland is set to deliver the fall fiscal update. An update in July pegged the deficit at $343B but Scotia now says it could reach as high as $425B — around 20% of GDP.

The update itself is unlikely to spark much reaction in markets because the government has already announced or hinted at the larger programs that are coming. The bond market may move based on longer-term spending and deficit plans that are outlined.

In September the PBO forecasted deficits of $74B and $55B in FY22 and FY23,

respectively, in September based on policy commitments at the time. However Scotia sees them ballooning to $140B and $85B.

The good news is that a generation of fiscal prudence put Canada in a very good spot ahead of the pandemic and debt should stabilize below 60% of GDP in a few years. Even with the insane spending this year, Canada will still have the lowest net debt level in the G7.

The good news is that a generation of fiscal prudence put Canada in a very good spot ahead of the pandemic and debt should stabilize below 60% of GDP in a few years. Even with the insane spending this year, Canada will still have the lowest net debt level in the G7.A risk though in the next few days is that S&P downgrades Canada. However there was little reaction in the loonie from the Fitch downgrade earlier this year.

Full Article

EUR/USD Forecast: Aiming for higher highs for the year

91925 November 30, 2020 21:56 FXStreet Market News

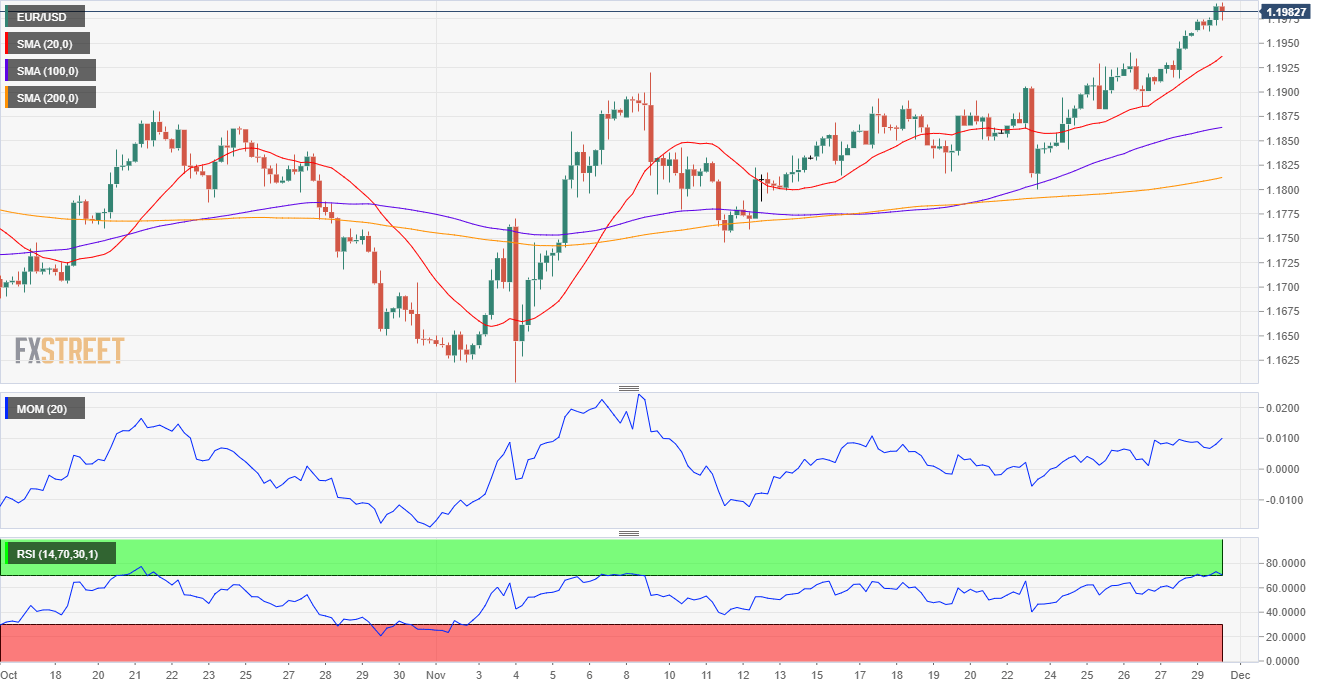

EUR/USD Current Price: 1.1982

- Equities struggle to post gains as investors wait for fresh clues.

- German inflation contracted by more than anticipated in November.

- EUR/USD is bullish in the near term, needs to break above 1.2011.

The EUR/USD pair advanced this Monday to 1.1991, its highest since September 1, when the pair established the year’s high at 1.2011. Speculative interest keeps selling the greenback while equities struggle to post some gains. Investors are cautious ahead of several first-tier events scheduled for this week, starting on Tuesday with a speech from the Federal Reserve’s head, Jerome Powell.

Germany published the preliminary estimate of November inflation, which came in worse than anticipated, falling by 0.3% YoY. The dismal announcement put a cap to EUR/USD advance. The US calendar includes October Pending Home Sales, the November Chicago Purchasing Managers’ Index, and the Dallas Fed Manufacturing Business Index for the same month.

EUR/USD short-term technical outlook

The EUR/USD pair is trading near the mentioned daily high, consolidating gains and maintaining its bullish stance. The 4-hour chart shows that it further advanced beyond bullish moving averages, while technical indicators are neutral but within overbought readings. The European Central Bank has drawn a line in the sand on 1.2000 and is yet to be seen if the market will dare to challenge it. Meanwhile, and from a technical point of view, a steeper advance is to be expected on a break above 1.2011, this year´s high.

Support levels: 1.1960 1.1920 1.1880

Resistance levels: 1.2010 1.2050 1.2090

View Live Chart for the EUR/USD

Full ArticleCanada Building Permits (MoM) came in at -14.6% below forecasts (-5%) in October

91924 November 30, 2020 21:45 FXStreet Market News

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer.

Trading foreign exchange on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial advisor if you have any doubts.

Opinions expressed at FXStreet are those of the individual authors and do not necessarily represent the opinion of FXStreet or its management. FXStreet has not verified the accuracy or basis-in-fact of any claim or statement made by any independent author: errors and Omissions may occur.Any opinions, news, research, analyses, prices or other information contained on this website, by FXStreet, its employees, partners or contributors, is provided as general market commentary and does not constitute investment advice. FXStreet will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Full ArticleCanada Current Account above forecasts (-9.1B) in 3Q: Actual (-7.53B)

91923 November 30, 2020 21:40 FXStreet Market News

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer.

Trading foreign exchange on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial advisor if you have any doubts.

Opinions expressed at FXStreet are those of the individual authors and do not necessarily represent the opinion of FXStreet or its management. FXStreet has not verified the accuracy or basis-in-fact of any claim or statement made by any independent author: errors and Omissions may occur.Any opinions, news, research, analyses, prices or other information contained on this website, by FXStreet, its employees, partners or contributors, is provided as general market commentary and does not constitute investment advice. FXStreet will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Full ArticleCanada Current Account above expectations (-9.1B) in 3Q: Actual (-7.5B)

91922 November 30, 2020 21:40 FXStreet Market News

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer.

Trading foreign exchange on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial advisor if you have any doubts.

Opinions expressed at FXStreet are those of the individual authors and do not necessarily represent the opinion of FXStreet or its management. FXStreet has not verified the accuracy or basis-in-fact of any claim or statement made by any independent author: errors and Omissions may occur.Any opinions, news, research, analyses, prices or other information contained on this website, by FXStreet, its employees, partners or contributors, is provided as general market commentary and does not constitute investment advice. FXStreet will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Full ArticleCanada Industrial Product Price (MoM) came in at -0.4% below forecasts (0.1%) in October

91921 November 30, 2020 21:40 FXStreet Market News

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer.

Trading foreign exchange on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial advisor if you have any doubts.

Opinions expressed at FXStreet are those of the individual authors and do not necessarily represent the opinion of FXStreet or its management. FXStreet has not verified the accuracy or basis-in-fact of any claim or statement made by any independent author: errors and Omissions may occur.Any opinions, news, research, analyses, prices or other information contained on this website, by FXStreet, its employees, partners or contributors, is provided as general market commentary and does not constitute investment advice. FXStreet will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Full ArticleCanada Raw Material Price Index rose from previous -2.2% to 0.5% in October

91920 November 30, 2020 21:40 FXStreet Market News

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer.

Trading foreign exchange on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial advisor if you have any doubts.

Opinions expressed at FXStreet are those of the individual authors and do not necessarily represent the opinion of FXStreet or its management. FXStreet has not verified the accuracy or basis-in-fact of any claim or statement made by any independent author: errors and Omissions may occur.Any opinions, news, research, analyses, prices or other information contained on this website, by FXStreet, its employees, partners or contributors, is provided as general market commentary and does not constitute investment advice. FXStreet will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Full ArticleCanada October building permits -14.6% m/m vs -3.9% expected

91919 November 30, 2020 21:33 Forexlive Latest News Market News

Canada October 2020 building permit data

- Prior was +17.0% (revised to +18.6%)

- Value of non-residential permits fell 29.5% to $2.5 billion in October,

after there were several large permits issued the prior month - Residential permits -5.9%

- Full report

September’s peak was the second highest value on record, with October’s results more in line with recent months.

Full Article

Canada Q3 current account balance -$7.5B vs -$9.0B expected

91918 November 30, 2020 21:33 Forexlive Latest News Market News

HIGH RISK WARNING: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives, experience level, and risk tolerance. You could lose some or all of your initial investment; do not invest money that you cannot afford to lose. Educate yourself on the risks associated with foreign exchange trading, and seek advice from an independent financial or tax advisor if you have any questions.

ADVISORY WARNING: FOREXLIVE™ provides references and links to selected blogs and other sources of economic and market information as an educational service to its clients and prospects and does not endorse the opinions or recommendations of the blogs or other sources of information. Clients and prospects are advised to carefully consider the opinions and analysis offered in the blogs or other information sources in the context of the client or prospect’s individual analysis and decision making. None of the blogs or other sources of information is to be considered as constituting a track record. Past performance is no guarantee of future results and FOREXLIVE™ specifically advises clients and prospects to carefully review all claims and representations made by advisors, bloggers, money managers and system vendors before investing any funds or opening an account with any Forex dealer. Any news, opinions, research, data, or other information contained within this website is provided as general market commentary and does not constitute investment or trading advice. FOREXLIVE™ expressly disclaims any liability for any lost principal or profits without limitation which may arise directly or indirectly from the use of or reliance on such information. As with all such advisory services, past results are never a guarantee of future results.

Full Article

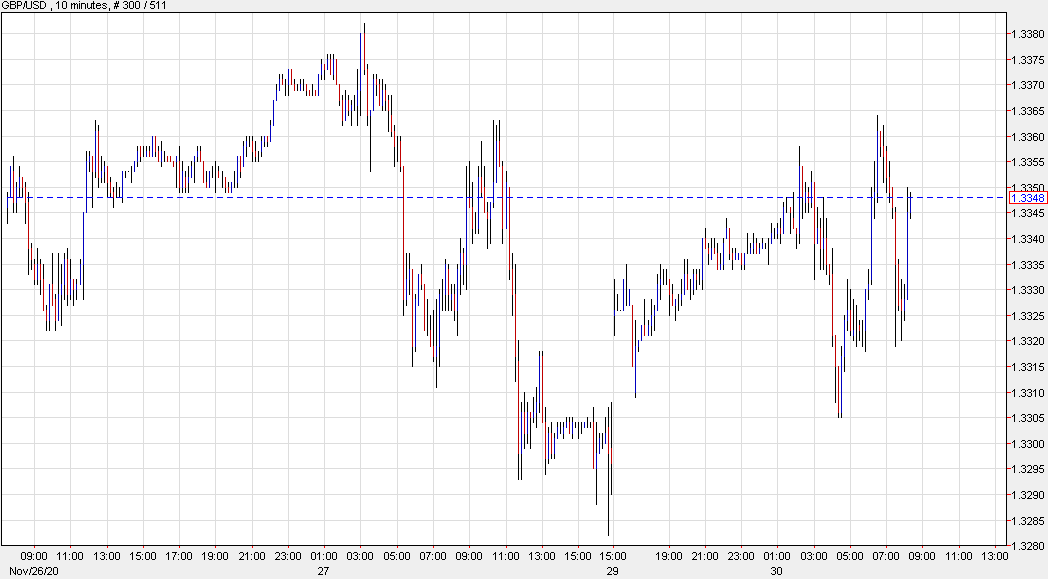

Sterling continues to bounce around on Brexit speculation

91916 November 30, 2020 21:26 Forexlive Latest News Market News

The latest from ITV’s Robert Peston

Here’s a tough one for the market to sort out:

My UK government sources (multiple) say they can see a political solution to the impasse in EU free trade talks that relates to level playing field conditions, state aid and enforcement conditions, but that the EU offer on fishing rights in UK waters is wholly unacceptable. By contrast, Brussels sources say the precise and diametric opposite, that fishing looks sortable whereas the gap on level playing field/state aid/enforcement is still yawning. Although confusing, this probably reflects the differing priorities on each side, and paradoxically it is grounds for optimism that a compromise is within reach.

We’ll have to take his word for it. Cable is whipping around today but reports like this show just how murky the entire situation is.

Full Article

Germany’s Merkel: Economic consequences of pandemic to stay with us for years

91915 November 30, 2020 21:26 FXStreet Market News

The economic consequences of the coronavirus pandemic will be felt for years to come, German Chancellor Angela Merkel said on Monday, as reported by Reuters.

“I hope we can find a solution to ensure the passing of the recovery fund and the EU budget,” Merkel added and noted that the next EU summit will be crucial in this respect.

Market reaction

These remarks don’t seem to be having a significant impact on market sentiment. As of writing, Germany’s DAX 30 Index was up 0.55% on the day at 13,408.

Full Article