Articles

NZD/USD retreats from 29-month highs, stays in the positive territory near 0.7030

91914 November 30, 2020 21:26 FXStreet Market News

- NZD/USD lost its traction after rising above 0.7050.

- US Dollar Index stages modest rebound in early American session.

- Wall Street looks to start the day in the negative territory.

The NZD/USD started the new week on a firm footing and climbed to its highest level since June 2018 at 0.7052. With the greenback starting to find some demand ahead of the American session, the pair lost its bullish momentum and was last seen gaining 0.18% on the day at 0.7035.

DXY recovers modestly

The broad-based USD weakness allowed NZD/USD to push higher on Monday. In the absence of significant fundamental drivers, the US Dollar Index (DXY) extended last week’s slide and touched its lowest level in 32 months at 91.55.

However, renewed concerns over the EU and the UK failing to reach a trade deal helped the greenback gather strength against its rivals and forced NZD/USD to reverse its direction. At the moment, the DXY is down 0.13% on the day at 91.65.

Later in the session, the ISM Chicago’s PMI, the Federal Reserve Bank of Dallas’ Manufacturing Business Index and Pending Home Sales data from the US will be looked upon for fresh impetus. There won’t be any macroeconomic data releases from New Zealand on Tuesday.

Meanwhile, the S&P 500 Futures are down 0.25% on the day. Month-end flows could cause major equity indexes to fall sharply and help the USD gather additional strength in the second half of the day.

Technical levels to watch for

Full ArticleAudio recap: Curtains close on November

91913 November 30, 2020 21:21 Forexlive Latest News Market News

What’s moving the market today

We’re back to fuller

form in markets on Monday, with the US returning from the Thanksgiving break.

As things stand, the US Dollar is under pressure, while stocks have been bid.

We are seeing some signs of risk reversal on Monday, though dealers have been

talking a lot about month end US dollar selling.

Full Article

Coming up: OPEC meeting, month end

91912 November 30, 2020 21:12 Forexlive Latest News Market News

What’s coming up

Markets are back a full-strength today after a US long weekend. That takes us right into month-end so flows are going to be a big part of trading today, especially given some of the huge moves throughout financial markets in November.

The main event early in the week is the OPEC meeting. The decision is due tomorrow but expect the usual chatter and leaks today. The market is pricing in a 3-month delay in the taper but there were all kinds of reports about internal disagreements on the weekend.

Full Article

Germany Consumer Price Index (MoM) came in at -0.8%, below expectations (-0.7%) in November

91911 November 30, 2020 21:12 FXStreet Market News

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer.

Trading foreign exchange on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial advisor if you have any doubts.

Opinions expressed at FXStreet are those of the individual authors and do not necessarily represent the opinion of FXStreet or its management. FXStreet has not verified the accuracy or basis-in-fact of any claim or statement made by any independent author: errors and Omissions may occur.Any opinions, news, research, analyses, prices or other information contained on this website, by FXStreet, its employees, partners or contributors, is provided as general market commentary and does not constitute investment advice. FXStreet will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

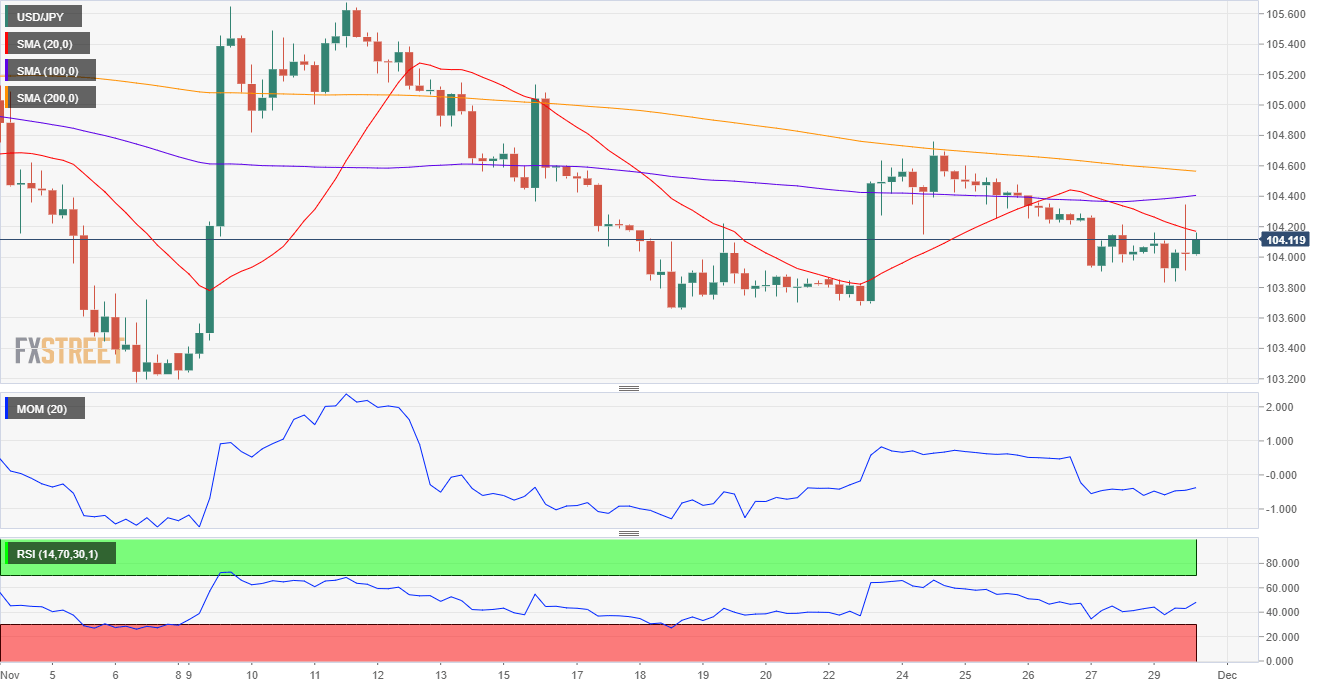

Full ArticleUSD/JPY Forecast: Struggling to advance beyond 104.00, bearish

91909 November 30, 2020 21:12 FXStreet Market News

USD/JPY Current price: 104.11

- Japan Industrial Production beat expectations in October, according to preliminary estimates.

- The market sentiment is sour, with the greenback still the worst performer.

- USD/JPY is technically bearish and poised to extend its decline towards 103.50.

The USD/JPY pair is trading around 104.10, pretty much unchanged from its Friday’s close, although it has fallen to 103.82 during Asian trading hours and peaked at 104.36 early in the European session. The broad dollar’s weakness prevails, with the American currency down against all of its major rivals. The market sentiment is sour, with Asian equities in the red and European indexes struggling around their opening levels.

Japan published the preliminary October Industrial Production estimates. It was up 3.8% MoM, slightly below expected, and down by 3.2% YoY, much better than anticipated. October Retail Trade surged by 6.4% against the expected -7.7%. The country also published October Housing Starts, which declined 8.3% YoY, slightly better than expected.

The US will publish today, October Pending Home Sales, the November Chicago Purchasing Managers’ Index, and the Dallas Fed Manufacturing Business Index for the same month.

USD/JPY short-term technical outlook

The USD/JPY pair is technically bearish, with no signs of an upcoming advance in the near-term. The 4-hour chart shows that a bearish 20 SMA keeps limiting the upside as technical indicators consolidate within negative levels. The longer moving averages head south well above the shorter one, supporting a bearish extension towards the 103.50 price zone.

Support levels: 103.85 103.50 103.15

Resistance levels: 104.35 104.65 105.00

View Live Chart for the USD/JPY

Full ArticleGermany: Annual HICP declines to -0.7% (preliminary) in November vs. -0.5% expected

91908 November 30, 2020 21:09 FXStreet Market News

- Annual HICP in Germany fell sharply in November.

- EUR/USD pulls away from highs after the data.

Inflation in Germany, as measured by the Consumer Price Index (CPI), was -0.8% November, Destatis reported in its flash estimate on Monday. This reading followed the 0.1% increase seen in October and missed the market expectation of -0.7%.

Additionally, the Harmonized Index of Consumer Prices (HICP), the European Central Bank’s (ECB) preferred gauge of inflation, slumped to -0.7% on a yearly basis and came in lower than analysts’ estimate of -0.5%.

Market reaction

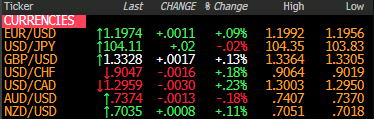

The EUR/USD pair edged lower after this report and was last seen trading at 1.1974, where it was up only 0.1% on a daily basis.

Full ArticleGermany Harmonized Index of Consumer Prices (YoY) below expectations (-0.5%) in November: Actual (-0.7%)

91907 November 30, 2020 21:09 FXStreet Market News

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer.

Trading foreign exchange on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial advisor if you have any doubts.

Opinions expressed at FXStreet are those of the individual authors and do not necessarily represent the opinion of FXStreet or its management. FXStreet has not verified the accuracy or basis-in-fact of any claim or statement made by any independent author: errors and Omissions may occur.Any opinions, news, research, analyses, prices or other information contained on this website, by FXStreet, its employees, partners or contributors, is provided as general market commentary and does not constitute investment advice. FXStreet will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Full ArticleGermany Harmonized Index of Consumer Prices (MoM) registered at -1%, below expectations (-0.8%) in November

91906 November 30, 2020 21:09 FXStreet Market News

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer.

Trading foreign exchange on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial advisor if you have any doubts.

Opinions expressed at FXStreet are those of the individual authors and do not necessarily represent the opinion of FXStreet or its management. FXStreet has not verified the accuracy or basis-in-fact of any claim or statement made by any independent author: errors and Omissions may occur.Any opinions, news, research, analyses, prices or other information contained on this website, by FXStreet, its employees, partners or contributors, is provided as general market commentary and does not constitute investment advice. FXStreet will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Full ArticleGermany Consumer Price Index (YoY) below expectations (-0.1%) in November: Actual (-0.3%)

91905 November 30, 2020 21:09 FXStreet Market News

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer.

Trading foreign exchange on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial advisor if you have any doubts.

Opinions expressed at FXStreet are those of the individual authors and do not necessarily represent the opinion of FXStreet or its management. FXStreet has not verified the accuracy or basis-in-fact of any claim or statement made by any independent author: errors and Omissions may occur.Any opinions, news, research, analyses, prices or other information contained on this website, by FXStreet, its employees, partners or contributors, is provided as general market commentary and does not constitute investment advice. FXStreet will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Full ArticleForexLive European FX news wrap: Dollar uninspired as month-end approaches

91903 November 30, 2020 21:05 Forexlive Latest News Market News

Forex news from the European trading session – 30 November 2020

Headlines:

Markets:

- CAD leads, AUD lags on the day

- European equities mixed; E-minis flat

- US 10-year yields up 1.6 bps to 0.854%

- Gold down 1.1% to $1,768.91

- WTI down 0.9% to $45.11

- Bitcoin up 10.6% to $18,815

It was mostly a quiet session with a few data points to move thing along, as well as Brexit headlines reaffirming that negotiations are still ongoing in London.

Risk appetite was mostly tepid but equities have recovered from a bit of a pullback earlier in the day, with US futures keeping closer to flat levels with Nasdaq futures holding slight gains while European equities are more mixed now after a softer start.

The dollar was uninspired as it trades a little lower with month-end in focus today, as EUR/USD holds slightly higher and nudging towards a test of 1.2000.

GBP/USD was more choppy, bouncing in between its key hourly moving averages as the pound consolidates between 1.3300 and 1.3400 awaiting more Brexit clues.

Elsewhere, the loonie also gained some slight ground as oil pared some of its earlier losses on the session having been down by 2% earlier to $44.50 only to recover towards $45.11 currently as we look towards the start of the OPEC ministerial meeting.

The aussie keeps softer as 0.7400 remains an elusive target for buyers so far today.

Meanwhile, gold continues to be pressured upon a break below $1,800 and its 200-day moving average at the end of last week as the yellow metal is down another 1%.

Full ArticleGermany November preliminary CPI -0.3% vs -0.2% y/y expected

91900 November 30, 2020 21:02 Forexlive Latest News Market News

HIGH RISK WARNING: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives, experience level, and risk tolerance. You could lose some or all of your initial investment; do not invest money that you cannot afford to lose. Educate yourself on the risks associated with foreign exchange trading, and seek advice from an independent financial or tax advisor if you have any questions.

ADVISORY WARNING: FOREXLIVE™ provides references and links to selected blogs and other sources of economic and market information as an educational service to its clients and prospects and does not endorse the opinions or recommendations of the blogs or other sources of information. Clients and prospects are advised to carefully consider the opinions and analysis offered in the blogs or other information sources in the context of the client or prospect’s individual analysis and decision making. None of the blogs or other sources of information is to be considered as constituting a track record. Past performance is no guarantee of future results and FOREXLIVE™ specifically advises clients and prospects to carefully review all claims and representations made by advisors, bloggers, money managers and system vendors before investing any funds or opening an account with any Forex dealer. Any news, opinions, research, data, or other information contained within this website is provided as general market commentary and does not constitute investment or trading advice. FOREXLIVE™ expressly disclaims any liability for any lost principal or profits without limitation which may arise directly or indirectly from the use of or reliance on such information. As with all such advisory services, past results are never a guarantee of future results.

Full Article